Since the starting of this month, there has been one coin everyone has been talking about. This coin is RIPPLE, traded as XRP.In the last year alone this coin had given return more than 35000% to his investors. In India, everyone wants to know how to buy ripple in India for 2018

Even in December ripple had given 1300% appreciation on investment, investors were crazy for this coin. But the investor’s crowd who had joined the party later at its peak point has been disappointed right now. After reaching more than 3$ it’s broke down.

I would never advise anyone to invest in anything based on price alone. My reasons for investing in Ripple are based on features of the coin, not just hype based on the profit (although that certainly doesn’t hurt). This coin had hit new all-time highs almost every single day in December and is following the same trajectory that can be seen if you look at the early charts for other successful coins like Bitcoin and Ethereum.

WHAT IS RIPPLE

Ripple is a universal real-time gross settlement (RTGS) payment protocol founded in 2012 to enable the fastest and most cost-effective peer-to-peer payment system for international payments. It aims to make payments as easy and quick as sending an email. Ripple’s protocol is being increasingly adopted as settlement infrastructure technology among various Top 50 global banks, mainly due to the benefits of the distributed ledger (blockchain) technology powering it.

Ripple aims to build a global payment system which can facilitate inter-bank transfers across the world at a low cost, more accurate and in a trackable and transparent manner.

Current global payment infrastructure….

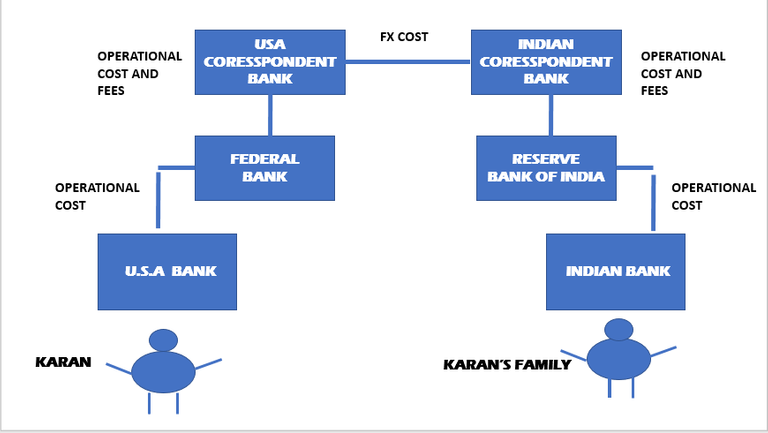

Let’s assume Karan wants to send money from the USA where he is working as Engineer, to his relative in India. He would have to submit payment request from his native bank in the USA which would then send it to Indian bank. Sounds simple, yeah. But this is not as simple as it looks, let’s understand the complete process.

-U.S banks make an ACHor RTGS payment to a local correspondent bank who have partnerships with other similar banks for forex transfers

-U.S correspondent bank holds a Nostro account with an Indian correspondent bank and provides FX (transaction cost) for the transaction

-Indian correspondent bank debits the U.S. correspondent bank’s Nostro account and credits the beneficiary Indian bank via NEFT/RTGS transfer

-This whole mechanism can take anywhere between 1–3 days and more in some cases with very limited visibility to the end user

Ripple can revolutionize the payment mechanism within the bank. In Ripple payment protocol one bank can initiate the transaction from his bank to other banks without involving any third party to facilitate the transfers.

There is no need to manage NOSTRO account in multiple correspondent banks which lead to reduce the operational cost and forex exchange cost.Transactions can happen with the digital asset of ripple protocol i.e. “XRP”, banks can keep a pool of XRP TOKENS with them or can source with the third part exchanges.

-With the Ripple payment network, bank no need to worry about the spread between different currency exchanges in the market

-Less failure points, less manual interventions, no need to require the third party to facilitate the transactions

-Ripple lowers your bank’s back-office costs through an efficient mechanism to process and settle international payments.

-Taken together, Ripple and XRP minimize settlement risk and eliminate the need for banks to collateralize Nostro accounts around the world, resulting in a lower total cost of settlement than ever before.

HOW TO BUY RIPPLE IN INDIA

In INDIA there is only one website which allows you to buy directly XRP(RIPPLE) with INR. In India, we will find more options to buy bitcoin but for Ripple, I found only one where you can directly buy RIPPLE with INR.

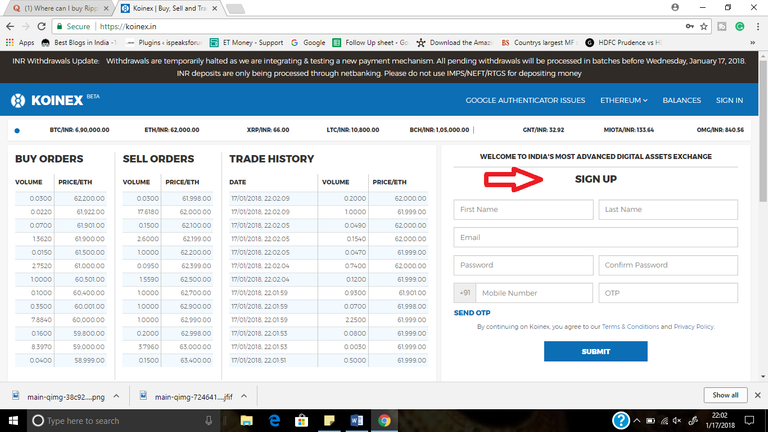

To buy XRP(Ripple) in INDIA you need to register in the INDIAN exchange known as KOINEX.

How to use KOINEX:-

Head over the home page of koinex.

Sign up by filling the details about yourself here.

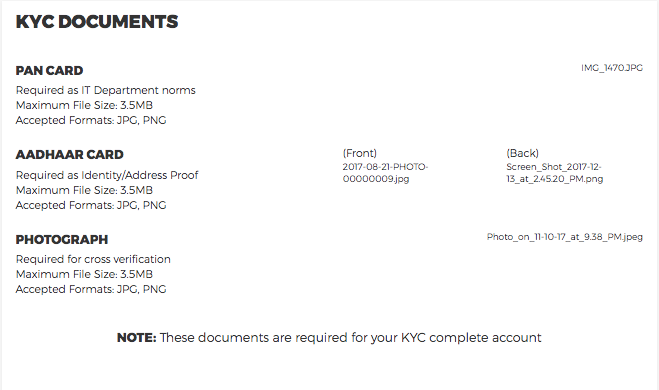

After Registering you have to do the KYC Registration in the profile section

You have to upload a scanned copy of the Aadhaar card and a pan card here:

Now you have to wait for 6–7 days for KYC approval after that you can fund your account using NEFT and Net banking.

Now when everything is done just head over to the coins tab and select Ripple to buy XRP against your funded INR.

from last month koinex has halted new registration but they will start soon

I hope you would have liked the content, if this could help you to understand the technology and objectives behind the ripple then please share it with your friends.