A balanced investment salary is one that aims at balancing risk and return.

Rebalancing is the process of realigning the weightings of a portfolio of assets. Rebalancing involves periodically buying or selling assets in a portfolio to maintain an original desired level of asset allocation.

In the world of cryptos, how do my experienced investors out there manage the rebalancing effort? As we all have seen, values of cryptocurrencies shift dramatically in hours.

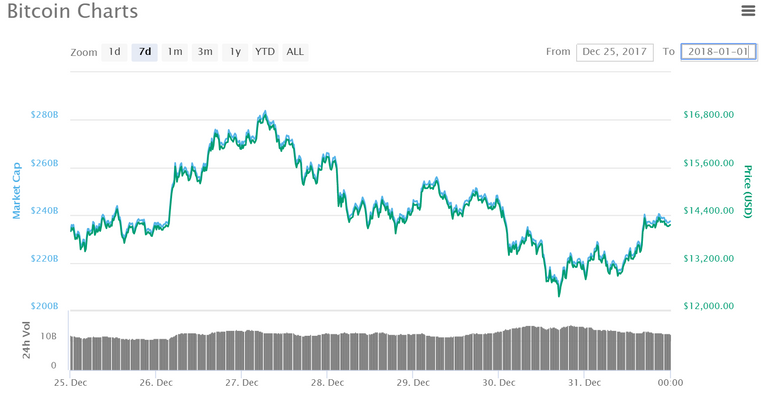

Ripple, for example, exploded over 150% the week between Christmas and New Years, while Bitcoin was flat-to-slightly down.

In this scenario, if I owned just Ripple and Bitcoin at a 50/50 perfectly balanced portfolio on Dec 25, the portfolio would be balanced almost 70/30 after this week.

My question is: should I rebalance the portfolio? Or "let it ride"? Does anyone have expertise in this space?