Hello EDS'ers. Today is the day we issue the EDS weekly report to keep all your guys up to date and let you know how things are going.

What are EDS tokens?

EDS tokens are HIVE income tokens that pays out weekly dividends every Monday based on 12% of the total power up the balance of the @eddie-earner account. This is currently paying out an APY to token holders of over 22%.

(Example of how the HIVE income pool is worked out)

- EDS is pegged to 1 HIVE per token

- 12% of over 113,000 HIVE POWER pays out (113,000*12/52.18) 259.86 per week

- EDS in circulation each yield (260/54000) 0.0048 HIVE per week

- 0.0048 each week for 1 year (52.18) equals 0.25 HIVE

- 1 EDS pays out a HIVE income of roughly 22% per year

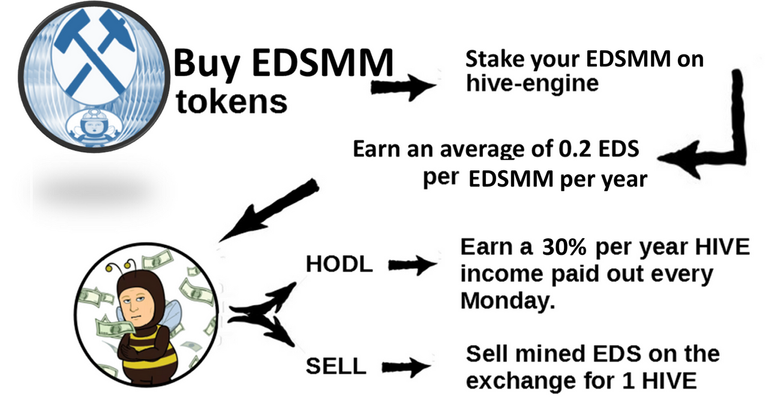

EDS tokens launched with a hardcap of 500,000 and a public sale of 20,000 tokens each issued for 1 HIVE each. There are 2 ways to mint new EDS tokens. 1 is by owning and staking either EDS miners (EDSM) are EDS mini miners (EDSMM) tokens and 2 is delegations HIVE POWER to @eds-vote. EDS Miners yield roughly 20% per year and EDS-vote yields around 4-5%.

EDS converts all earnings, airdrops, tribe tokens into HIVE. This account is 100% focused on powering up as much HIVE as possible. It's just that single-minded. This projects weekly saving club content is run by @shanibeer and wallet by @silverstackeruk both on behalf of SPinvest. This is a long term project and should be viewed as a token to stack up and HODL. Buy some miners, let them mint you some EDS tokens, build a pile and collect weekly HIVE dividends. In other words, buy some EDSM miners and forget about it. Add a few every week/month and watch your EDS pile grow. You can also buy EDS directly from the market, if you add a buy order for any amount at 1 HIVE each, it'll get filled. It might take a few days but it'll get filled as some miners like to sell their mining rewards right away to lock in them profits.

This week's numbers

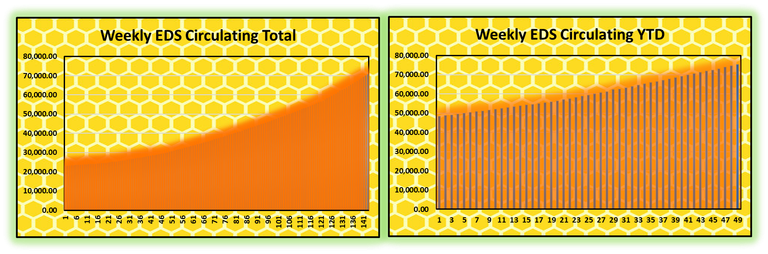

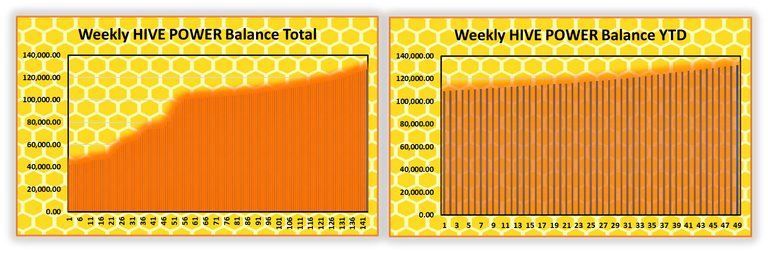

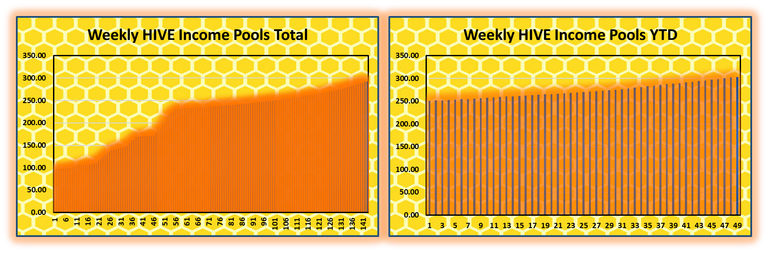

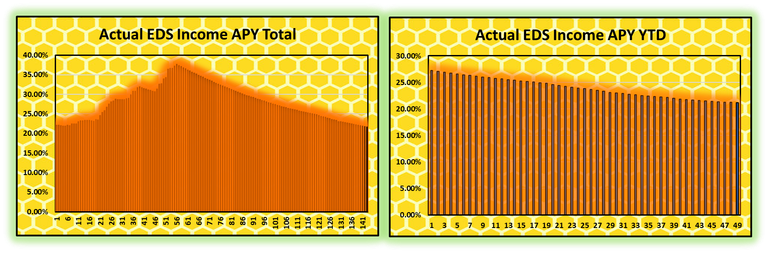

Here you can see the progress of EDS from Jan 2022 to date.

| Week | Eds Circulating | EDS minted | HIVE POWER | Income pool | EDS APY |

|---|---|---|---|---|---|

| 1 | 23,024.00 | 88.38 | 42,453.00 | 97.63 | 22.13% |

| 5 | 23,406.78 | 96.60 | 42,666.41 | 98.12 | 21.87% |

| 10 | 23,777.86 | 92.00 | 44,567.00 | 102.49 | 22.49% |

| 15 | 24,115.46 | 97.46 | 46,968.00 | 108.02 | 23.37% |

| 20 | 24,593.86 | 92.00 | 48,205.00 | 110.86 | 23.52% |

| 25 | 25,276.00 | 196.00 | 57,895.00 | 133.15 | 27.49% |

| 30 | 26,164.00 | 190.94 | 62,567.00 | 143.89 | 28.70% |

| 35 | 27,156.86 | 203.20 | 67,552.00 | 155.36 | 29.85% |

| 40 | 28,138.66 | 197.40 | 74,350.00 | 170.99 | 31.71% |

| 45 | 29,125.66 | 192.20 | 74,809.52 | 172.05 | 30.82% |

| 50 | 30,473.06 | 462.00 | 86,169.46 | 198.17 | 33.93% |

| 55 | 32897.36 | 297.10 | 98,853.25 | 227.34 | 37.19% |

| 60 | 33,382.46 | 298.20 | 101,628.19 | 233.72 | 36.53% |

| 65 | 34,893.46 | 294.60 | 102,223.83 | 235.09 | 35.16% |

| 70 | 36,469.58 | 319.61 | 102,880.59 | 236.60 | 33.85% |

| 75 | 38,136.80 | 318.28 | 103,552.48 | 238.15 | 32.58% |

| 80 | 39,872.92 | 349.80 | 104,470.72 | 240.26 | 31.44% |

| 85 | 41,665.69 | 379.12 | 105,319.93 | 242.21 | 30.33% |

| 90 | 43,569.61 | 359.68 | 106,530.84 | 245.00 | 29.34% |

| 95 | 45,418.31 | 377.02 | 107,710.30 | 247.71 | 28.46% |

| 100 | 47,471.89 | 405.79 | 109,011.43 | 250.70 | 27.56% |

| 105 | 49,495.27 | 403.14 | 110,351.05 | 253.78 | 26.75% |

| 110 | 51,631.75 | 428.51 | 112,015.90 | 257.61 | 26.03% |

| 115 | 53,758.19 | 423.18 | 113,875.81 | 261.89 | 25.42% |

| 120 | 55,950.65 | 437.50 | 115,655.63 | 265.98 | 24.81% |

| 125 | 58,808.16 | 577.37 | 117,399.05 | 269.99 | 23.96% |

| 130 | 62,604.81 | 288.57 | 120,122.91 | 276.26 | 23.02% |

| 135 | 65,271.83 | 693.53 | 122,622.45 | 282.01 | 22.54% |

| 140 | 68,630.93 | 686.46 | 125,916.99 | 289.58 | 22.02% |

| 145 | 71,916.73 | 569.41 | 129,029.41 | 296.74 | 21.53% |

| 150 | 75,158.00 | 682.92 | 132,340.94 | 304.36 | 21.13% |

| Week | Eds Circulating | EDS minted | HIVE POWER | Income pool | EDS APY |

Let's get a look at the charts this week

This week's mintage was fairly high with 682.92 being issued. This puts the total in circulation at 75,158.00. As I said a few months back, I think we're fairly stable at minting 600-700 EDS per week for the foreseeable future as I dont see eds-vote seeing much more growth. Its already out performing expectations.

There was 676.93 HIVE powered up this week to the eddie-earner wallet. This puts the total HP balance at 132,340.94. There's nothing wrong with growing by 650-750 a week. Remember the EDS weekly income HIVE payout is based on a set % of the HP balance. The higher the balance the higher the payout pool.

You can see in the above chart the HIVE income pool only increases each week and it has done this for the past 150+ weeks, with each week a small increase. This is because the eddie-earner HP balance increases each week. Our HIVE income pool for this week is 304.36 HIVE and it's increasing by roughly 1.70 HIVE per week.

Because of the higher-than-normal mintage, the EDS APY has dropped slightly more than it has been for the past few weeks. The drop this week was -0.09%. This is nothing to worry about and im sure next week will be better.

Anyways, the EDS APY sits at 21.13%.

How do you build a HIVE income that only ever increases over time?

If the EDS project sounds right up your street, there are 2 ways to get your hands on EDS tokens. Building a HIVE income is one of those things when it's better to get started sooner than later. We all put money aside for a pension/old age with the money we earn from jobs, why not do the same with blockchain earnings? If blockchain is the future, why not be playing the game of life 3 steps ahead of everyone else? There's no day like day to start increasing your income and the snowball effect is real when you have patience.

Mine them

The 1st EDS miner (EDSM) is now sold out and can be bought from the hive-engine market by clicking here

The 2nd EDS mini miner (EDSMM) is now sold out and can be bought from the hive-engine market by clicking here

Buy them

Or buy them directly from hive-engine from someone looking to sell out. You can place a buy order for 1 HIVE and just wait, it will get filled. Click HERE

Weekly Roundup

Things are going well for EDS as usual but I've been looking at EDSD lately and thinking it's not growing, not that many use it, it doesn't issue many EDS tokens and it could be time to wrap it up and allocate its EDS to something else. I dont know what I would replace it with but it would be replaced. Miners are not an option sadly so no EDS micro mini miners (EDSMMM)😂

Onwards and upwards always! At least HIVE is starting to turn around.

Thanks for checking out this week's report!! Have a great week!

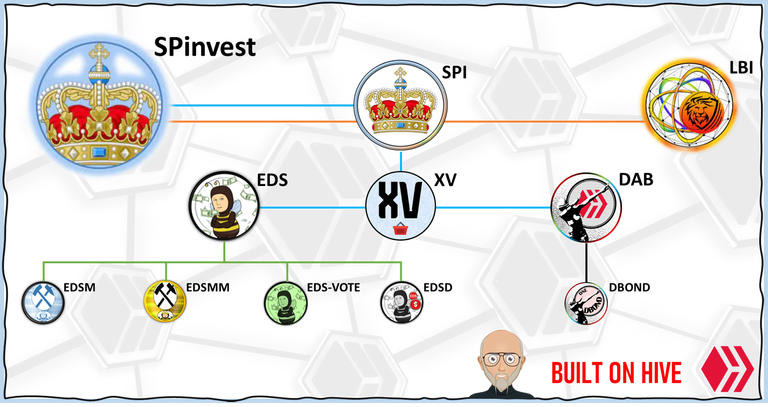

@eddie-earner, its wallets and tokens are managed and backed by SPinvest

EDS Report Subscribers

@siddhartaz, @dkid14, @noctury, @stickupboys, @ericburgoyne, @shanibeer, @riandeuk, @thatcryptodave, @relict, @curatorcat.pal

I think the interest in EDSD will vary according to the price of HIVE. It is a very good deal when HIVE prices are low and especially when there are no miners available on the market.

Its great benefit, whatever HIVE's price is, is that it is liquid - easy in, easy out, with minimal downtime.

We don't especially promote either of those features.

As we go through the bull run, we're going to see accounts with a lot of liquid HBD. EDSD is one option for accounts to stash some of that HBD while they wait for the price of HIVE to come back down and buy back in. As we progress through the cycle, the HIVE:HBD ratio becomes attractive again, and we're back to the low price of HIVE is a good reason to hold EDSD.

There's not many people around right now, but they'll be back as the price rises and we're working on bringing more people to EDS through Saturday Savers. I would be reluctant to see EDSD abandoned when it's not been properly tested yet. I think we've at least got to see it through a cycle before making a judgement about whether it's a good product that provides accounts with a service and another option.

In addition, we're gradually approaching breakeven with EDS and soon after that the APY will start to increase - have we got a timeline for that and how it fits with the BTC/HIVE cycle? As the APY starts to increase, EDS will become very attractive and short-term liquid options like EDSD may be an excellent bridge.

Who knows - as everyone moves to HBD, we might be having a similar conversation about winding up @eds-vote 😂.

Yes, my bad on the release time. Is more of the bear market product than a bear market one.

Releasing early means there's time to test it before there is a lot of demand. Meanwhile, EDSD is adding somewhere between 2k-4k HIVE to the @eddie-earner wallet each year - all helps to reach breakeven.

Dear @eds-vote & @eddie-earner,

I have a question. I am seeing that your eds-vote delegation is giving dividens in EDS and giving (up)votes to some of those who delegate. So, if I will delegate to @eds-vote. Will I get the same?

Thanks for your response in advance