Part 1 - Law of Supply and Demand Definition and Explanation OR Why the @sbdpotato experiment just won't work

So this article got really big, because i tried to detail all the mechanisms behind the SBD peg, because this is an essential knowledge to understand what @sbdpotato is trying to achieve.

If you already know or don't want to know about what make the SBD peg work, jump straight to the TL;DR or to the conclusion sections at the end.

But if you like the economy aspects of the Steem blockchain, enjoy yourself reading this big wall of text!

Fiat Currencies peg

Let's start this talk with the basic idea of pegging a currency to another. If you want to dive deeper on this subject, this article is a great start.

When a government decides (for whatever reason) that it's country currency must be pegged to another, they start to implement some economic mechanisms to make sure that this become true.

For example, when Brazilian Real (BRL) was implemented it was pegged with the US dollar (USD).

As you can see above, between 1994 and 1998, the brazilian government was actively working on the markets to hold the USDBRL rate at 1.

Some of the economic mechanisms used by the government were:

- Selling USD from it's reserves on the market to put downward pressure on the price (or buying, if the opposite direction were needed)

- Limit the amount of USD that could be negotiated by other entities each day.

This peg was intended to be temporary until there were enough internal economic stability, like a lower inflation. After 1998, the peg was revoked.

How cryptocurrency peg work (the stablecoins)

There is a lot of different models, and here is a good introduction on the subject.

The article above even talk about SBD, with an interesting quote:

Each SBD is backed by exactly one US dollar worth of Steem. The details behind how all of this works are rather mysterious and many who have analyzed the white paper still don’t understand it.

"Many who have analyzed the whitepaper still don't understand it." I can't disagree with that....

But let's talk about the most famous of the crypto stablecoins: Tether USDT, and the basic model for almost every other stablecoins that exists today.

Tether holds a reserve of USD that is equivalent 1:1 of the amount of USDT in circulation. Here is how it works:

- You deposit 1000 USD on the Tether company account

- You recieve back 1000 USDT

- You can use the USDT as you will

- When you want you money back, you send the USDT to the Tether company, they pay you the same amount in USD

Simple and effective. In the case of USDT the problem here is that it isn't exactly decentralized/trustless, so you have to trust that the Tether company won't disappear overnight with the funds they are holding.

But if you check how other stablecoins that are gaining traction, you will see the same models, except some are using smart-contracts to hold the funds.

What about SBD peg?

This is where things start to get interesting.

As written in the genesis whitepaper SBD uses an economic model that is based on Supply and Demand, with the Steem blockchain (and the witnesses acting as the "government", adjusting the rates (economic policy) at wich more SBD (and STEEM) is printed (increasing supply) and how much return anyone can recieve for buying and holding/converting SBD (increasing demand).

Important to note that the keyword here is increase. As i wrote on the article about the Law of Supply and Demand:

In the end, artificially decreasing supply on the market won't have any long term effect, because the majority of people in the world won't see a good reason to spend money on SBD, and will be more willing to spend it on other similar asset that have more actual value.

Less things to sell doesn't make that thing more expensive if there are no buyers.

The blockchain is programmed to increase printing (increase supply and inflation, reducing the value of the SBD) or stimulate people to buy SBD on the market (increase demand, creating a upward force on the price).

It is like a real world government, setting the ecnomic rules/policies about money printing (STEEM and SBD) and base interest rates.

In essence, the SBD peg isn't a fixed peg like USDT, but the blockchain (through the witnesses) is programmed to adjust its economic parameters in order to create market forces trying to push the SBD price in on direction or another:

There are three economic tools used to push SBD price in one direction or another:

- Conversion (debt payment)

- Debt-to-ownership ratio

- Interest paid for holding SBD

(edit: while writing this article, i made some wrong assumptions about how the debt ratio is calculated, using the external market value wich isn't how it works, but thanks to a talk @timcliff, i understood it better, and i am made some corrections on this part)

Conversion rate (or why everyone should understand how the conversion function works)

First, we need to understand what each of the Steem tokens represent:

- STEEM represents you ownership of the blockchain.

- If you have 1 STEEM, it means you own (1/TOTAL STEEM SUPPLY) percent of the right to use the blockchain

- SBD is described in the white paper as Debt. But i think it would be better described as a Bond, wich is a financial instrument that give it's owner the right to recieve a Debt.

- If you have 1 SBD, it means that you are entitled to recieve 1 USD worth of STEEM from the blockchain

Each SBD pinted/issued is a "promisse" that the blockchain will pay you 1 USD woth of STEEM

Since the printed/issued STEEM in circulation isn't owned by the blockhain, the debt can only be paid is the blockchain print/issue more steem.

If you got a bit confused, imagine this:

Each SBD is like a government bond, and whoever holds it, have the right to claim a payment form the government at any time.

But in this case, the government doesn't have a money reserve, so every time someone claim the debt to be paid, the government have to print more money to pay the bond owner.

The debt payment can only happen if someone "ask" the blockchain for the debt to be paid using the conversion function.

But what is a Conversion?

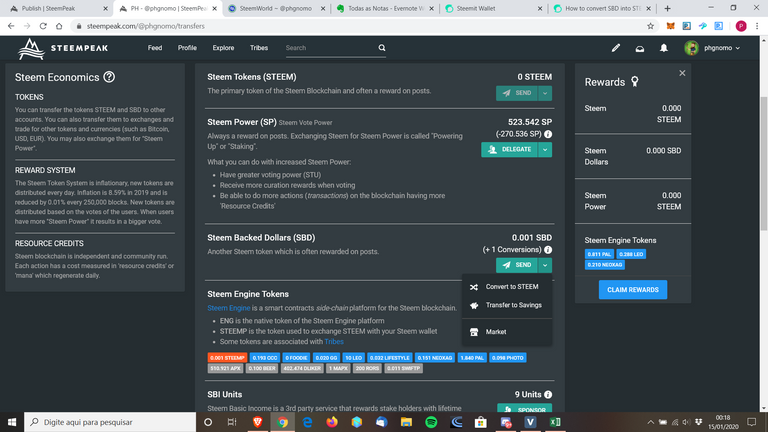

You won't see this function on steemitwallet.com, but there is others front-ends (like Steempeak) where you can use it:

What happens when you use the Convert to STEEM button is that instead of STEEM/SBD exchanging hands between 2 people (wich is what happens when you trade it on a market), you are sending your SBD direct to the blockchain, and when transaction is validated, the blockchain will destroy the SBD and 3.5 days later it was supposed to send you 1 USD worth of STEEM.

Why supposed? The price to be paid for this conversion is determined by 2 rules:

- 3.5 days median of the witnesses price feed

- the "haircut" rule

Every witness must set a price feed when they are processing the blockchain transactions, and the median of this price feed of all witnessess in the last 3.5 days is what will define the price that will be paid for the conversion.

This price feed is independent of the external market prices, and the witnessess can set whatever price they want. This is another economic tool to put pressure on the SBD price.

But how much should be this price feed?

Let's take a look at SBD and STEEM Market Prices:

1 SBD = $0,597249

1 STEEM = $0,124522

1 USD / 0,124522 = 8.030709 STEEM

But if you sell 1 SBD to buy STEEM:

1 SBD = 0,597249 USD

0,597249 USD = 4.79633 STEEM

1 SBD = 4.79633 STEEM or

1 STEEM = 0.208492 SBD

This is the external market SBD/STEEM rate.

Now let's look at the witness price feeds:

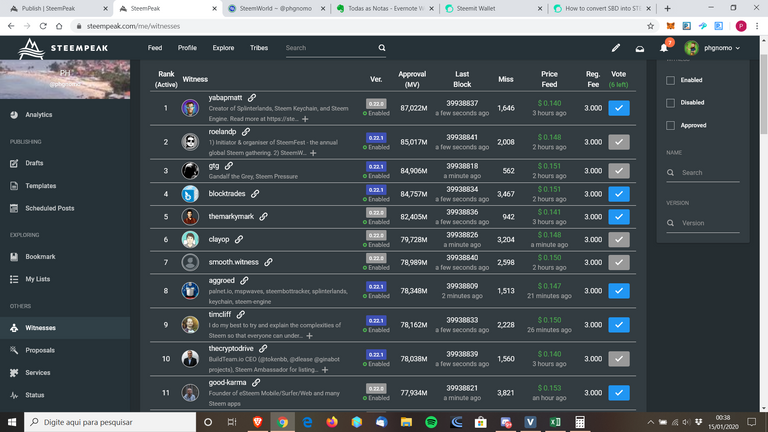

As you can see on the Price Feed column, @yabapmatt is telling the blockchain that he thinks the conversion rate (price that the blockchain must pay for each SBD converted) should be 0.140, or:

1 STEEM = 0.140 SBD

At this rate:

1 SBD = 7.142 STEEM

A lot closer to 1 SBD = 1 USD

As i said before, the witnesses can set the price rate at whatever value they want, but the actual economic policy consensus among the witness is that the price feed must be set as if 1 SBD = 1 USD.

This way, the witness are creating a situation where it becomes profitable to buy SBD on the external markets and use the conversion function, instead of buying STEEM on the external markets.

And this is another toll the blockchain have to create an upward pressure on the SBD price: Incentivize people to buy SBD and convert it, therefore pushing price up, and reducing SBD supply.

But can you see the problem here? If the conversion rate is 0.140, the conversion is highly profitable, and it could create a massive increase of conversion requests, which in turn, would print a lot of STEEM, increase inflation, and devaluate STEEM even more.

That is why there is a STEEM price protection in this system, called the "haircut" rule.

The "haircut" rule, or how the blockchain prioritize protection of STEEM price and not the SBD peg

As we can see above, the consensus among witness right now is that the price feed (aka blockchain conversion rate) should be set at a value that 1 SBD would be converted to 1 USD worth of STEEM.

But, if you try to do it right now, this won't happen, because there is a protection system in place that will override the conversion price to avoid a massive increase of new STEEM printed, wich would create a massive inflation, weakening the economy even more.

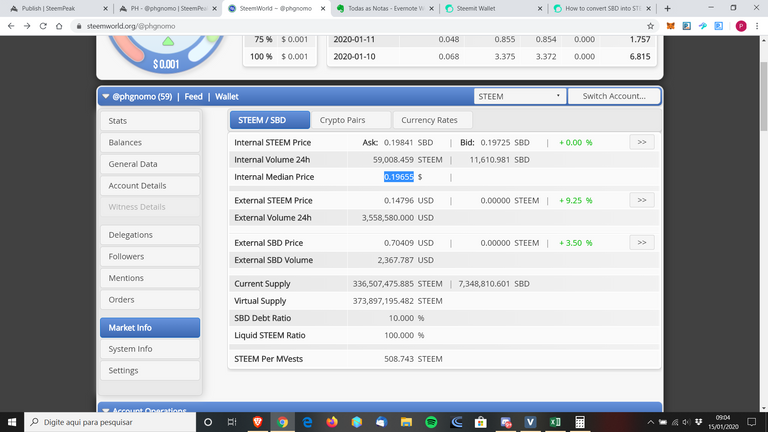

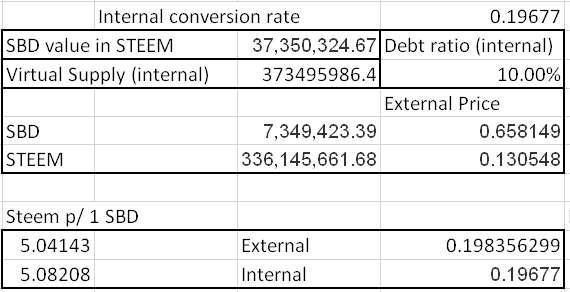

The witnesses are setting a conversion price of 0.140, but if you check steemworld.org market info tab, you will see this information:

The conversion price at this moment is 0.19655, wich is way higher than the price witnessess are setting on their price feed. That happens because of the "haircut" rule:

If the amount of SBD debt ever exceeds 10% of the total STEEM market cap, the blockchain will automatically reduce the amount of STEEM generated through conversions to a maximum of 10% of the market cap. This ensures that the blockchain will never have higher than a 10% debt-to-ownership ratio.

But what is the debt ratio?

Debt-to-ownership ratio is a bit tricky to explain, but let me try

The debt-to-ownership ratio tell us how much the STEEM supply would increase (generating inflation) if all the debt is paid.

(Here, at first, i made the wrong assumption that the external market value could be used to calculate the debt ratio, wich isn't true.)

When a transaction happens on the external market, there is no debt being paid, but only an exchange of the right to recieve the debt payment.

The debt is only paid when the conversion function is used.

To understand how this works, first lets use as a conversion price (how much is paid by the blockchain to convert SBD/pay the circulating debt) the price feed set by the witnessess above:

Conversion rate: 0.140 SBD/STEEM

Actual STEEM Supply: 336,507,475.885 STEEM

Actual SBD Supply: 7,348,810.601 SBD

If we convert the toal supply of SBD into STEEM:

New STEEM created: (7,348,810.601 / 0.140) = 52,491,504.292 STEEM

New Total SBD Supply: 0 SBD

New Total STEEM Supply: 388,998,980.177 STEEM

Debt-to-ownership ratio: (52,491,504.292 / 388,998,980.177) = 13.49%

So, what is the matter? Paying debts is a good thing right?

Yes, but since there is no new USD entering the system (buying SBD or STEEM), the value of the supply doesn't change, causing a massive inflation:

Market STEEM price: $0,124522

Total STEEM Market Value: (336,507,475.885 x 0,124522) = $41.902.583,912

New total of circulating STEEM Supply (aka Virtual Supply): 388,998,980.177

New Expected STEEM price: ($41.902.583,912 / 388,998,980.177 ) = 0,107719

% of expected price decrease: 13.49%

So, overnight, STEEM would lose 13.49% of it's market value if all SBD were converted at the same time.

This wouldn't exactly happen overnight, but this new supply of STEEM could be expected to be sold on the market, creating a downward force that evetually would hit the expected lower price.

That is why the debt ratio must be as low as possible, as a high debt ratio indicates a bad financial health of the system and a higher potential inflation.

When the debt ratio reaches 10%, the blockchain stops printing SBD to avoid increasing the debt even more.

Since the debt ratio using the witnesses price feed would be higher than 10%, the haircut rule kicks in, and override the conversion price with one that keep the debt ratio from going above 10%

Here is how it's calculated:

Current Supply:

STEEM: 336,507,475.885

SBD: 7,348,810.601

Current conversion price set by the haircut rule:

0.19655

New STEEM that would enter the system if all SBD in circulation would be converted:

7,348,810.601 / 0.19655 = 37,389,013.487 STEEM

Total new STEEM supply after conversion (aka Virtual Supply):

336,507,475.885 + 37,389,013.487 = 373,897,195.482

As you can see, the conversion price is defined in a way that as the SBD value converted to STEEM will never be over 10% ( 37,389,013.487 / 373,897,195.485 = 10%).

But what about the peg?

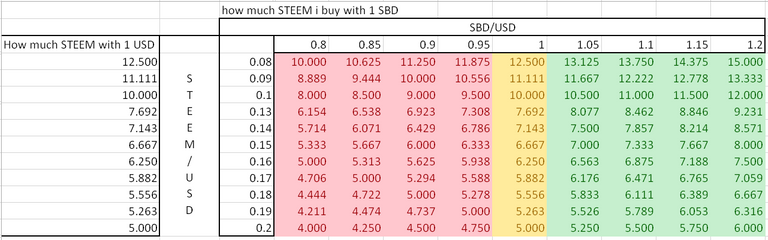

Let's see how this works in a pratical situation, using the actual market prices of STEEM and SBD.

At the moment of this writing, the prices are:

1 SBD = $0,597249

1 STEEM = $0,124522

First, how much STEEM can i buy with one dollar?

1 USD / 0,124522 = 8.030709 STEEM

This means that, for the system to work as intended, with 1 SBD i must be able to buy 8.090709 STEEM

But since there is no SBD/STEEM listed in any market, we must go through some hops:

With 1 SBD i will recieve 0.597249 USD

Then, 0.597249 USD allow me to recieve 4.79633 STEEM (0.597249 / 0.124522).

So, on the external market,

1 SBD = 4.79633 STEEM, or

1 STEEM = 0.208492 SBD

(this the external SBD/STEEM rate. Remember it, because it will be very important later!)

At the moment the SBD is 40.27% below it's target price.

But what must be changed here for 1 SBD = 8.030709?

There is two sides on this equation that can change: SBD price and STEEM price. Let's check out what happens in 2 scenarios:

SBD price goes up to $1,00 and STEEM price stays the same

if

1 SBD = $1.00

1 STEEM = $0.124522

then

1 USD buy 8.030709 STEEM

1 SBD buy 1 USD

1 USD buy 8.030709 STEEM (1/0.124522)

In this case, the target is achieve and 1 SBD can buy the same amount of STEEM as 1 USD can.

But what if there is a change on the STEEM price?

Now this is where the magic happens. Just check the table below:

As you can see, the only way that 1 SBD can buy 1 USD worth of STEEM is when 1 SBD = 1 USD (the yellow column).

And here is where peg model start to work: If the SBD price goes above 1, if someone is looking to buy STEEM, it will be profitable to Sell any SBD that person holds and then buying STEEM, instead of using USD to buy STEEM. This creates a downward force on the SBD price.

Interest? What interest?

As described on the white paper:

SBD pays holders interest. The interest rate is set by the same people who publish the price feed so that itcan adapt to changing market conditions. All debt carries risk to the lender. Someone who holds SBD without redeeming it is effectively lending the community the value of a dollar. They are trusting that at some point in the future someone will be willing to buy the SBD from them for a dollar or that there will be speculators and investors willing to buy the STEEM they convert it into.

On the "real world", when a debt is created, the value that can be claimed will increase over time, because there is usually an interest that must be paid along with the original value.

And since SBD is an instrument to recieve a debt payment, it's holders are entitled to recieve an interest.

The interest rate to be paid to SBD owners is defined by the witnesses and is also another tool to create a downward force if SBD price is trading above 1 USD:

The primary concern of Steem feed producers is to maintain a stable one-to-one conversion between SBD and the U.S. Dollar (USD). Any time SBD is consistently trading above $1.00 USD interest payments must be stopped.

This make the SBD interest another tool to create a downward force when it's price is trading above 1 USD: If there is no interest being paid, it's more profitable to sell SBD instead of holding it.

But this also works the other way around. If the price is below 1 USD, interest must start to be paid again, and then, it will become profitable to buy SBD and hold it, creating an upward force on the price.

And now you may ask: "SBD is trading below 1 USD, why is the interest rate is still 0%"

The answer: Debt ratio above 10%

Every new SBD entering the system increase the debt, then if interest were paid in this situation, it would increase debt even more, making the Steem economy even worse.

TL;DR

If you didn't bothered/wanted to read all the detailed explanation about how the SBD peg actually works, here is a resume:

- SBD isn't a true USD peg, because there is no funds that will pay 1 USD for 1 SBD, therefore, SBD price will never be fixed at 1 USD;

- The SBD peg isn't 1 SBD = 1 USD. It's 1 SBD must be worth 1 USD of STEEM. Looks like the same thing, but this defines how the peg mechanics works;

- SBD peg is achieved with a set of economic rules and policies, some automated, some defined by the witnessess, to create market forces:

- Rules/policies that creates downward (when SBD is over 1 USD):

- You will get more STEEM per SBD if you sell the SBD for USD and buy STEEM with the USD;

- No interest should be paid (parameter defined by the witnessess), therefore making it less interesting to hold SBD.

- Rules/policies that creates upward forces (when SBD is below 1 USD):

- Interest should be paid (parameter defined by the witnessess), therefore making it interesting to buy and hold SBD;

- The blockchain conversion price (based on the median of the 3.5 witnessess price feed) must be defined at a point that pays more STEEM per SBD than the external market, therefore creating a incentive (profit) to buy SBD on the external market, and converting it to STEEM inside the blockchain.

- There is some protections in place, to avoid that the forces created by the above policies have a bad influence on the economy:

- The higher the debt-to-ownership ratio is, less SBD will be printed by the blockchain to avoid increasing the debt (and potential inflation created through conversions). If the debt ratio goes above 10%, no more SBD will be printed.

- If the debt ratio is above 10%, and the SBD price is below 1 USD, the system will set a conversion rate that is different from the witnessess price feed, making sure that the internal debt ratio never go over 10%

- Rules/policies that creates downward (when SBD is over 1 USD):

As stated on the white paper:

It is our belief that these rules will give market participants confidence that they are unlikely lose money by holding SBD purchased at a price of $1.00. We fully expect there to be a narrow trading range between $0.95 and $1.05 for SBD under normal market conditions.

Under normal market conditions

So, if you are thinking that the SBD peg isn't working, you are wrong. The system is working as intended.

We are at a point where SBD is below 1 USD, and the external debt ratio is over 10%, therefore there is no new SBD being printed, no interest being paid, and the conversion rate is set to a price where the internal debt ratio will never go above 10%.

And this happens to avoid a high inflation, wich would cause a devaluation of the STEEM token.

The moment the debt ratio goes below 10%, the mechanics described above (interest and better conversion price) will start to work again, and a upward pressure on SBD price will start to appear.

Debt ratio will get lower if:

- STEEM price increase

- STEEM supply increase

- SBD price decrease

- SBD supply decrease

What this have to do with @sbdpotato (Conclusion)

(edit: i adjusted some of the conclusions after discussing some aspects with @smooth, as you can see on the comments)

After researching a lot about how the Steem economy system works, i reached some more concrete conclusions about the effects of the @sbdpotato experiment:

- The logic they are using as a base for the experiment is right, and go as this:

- Recieve reward from the posts in STEEM

- Trade STEEM for SBD on the internal market every 10 minutes (decreasing the internal market SBD/STEEM rate, increasing SBD price and decreasing STEEM price)

- Convert SBD to STEEM through the blockchain conversion function (reducing SBD supply, and increasing STEEM supply);

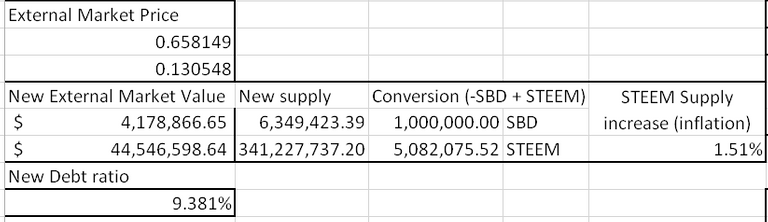

Here is a small simulation of how this affect the economic parameters if they convert 1 million SBD:

Below is a snapshot of the real Steem economy at a point of time

Now, if we convert 1 million SBD in STEEM, these are the results:

As you can see above @sbdpotato project is doing 2 things:

- Decreasing the Debt ratio (wich is good)

- Increasing STEEM suply/creating inflation (wich is bad, can't be avoided)

But the is one thing @sbdpotato experiment isn't doing:

It isn't affecting SBD external market price because it isn't buying SBD from the external market!

The counter-argument presented is that the external market would adjust to internal market due to arbitrage operations executed by bots and humans. While this is true, i think that this have an impact over the external market price mostly because of the low liquidity on the exchanges. The arbitrage operation is short-term and work on both directions, and for it to be profitable it can't have a impact on the price, or it would reduce the profitability of an operation on the other direction.

So, the better way to actually impact the price is to bring the proposed process to the outside markets.

As i wrote on the first article about this subject, the SBD price will only rise if there is an actual demand on the external market.

This could only be achieved by the @sbdpotato experiment if they sold the STEEM for USD on an external market, use that USD to buy SBD and then convert it back to STEEM inside the blockchain. That way, they would create a real demand and would reduce SBD supply at the same time.

A secondary problem: @sbdpotato interaction with @burnpost experiment

Now things get a bit more tricky. As you may also know, there is a @burnpost experiment going on, that burn all STEEM it recieve as a reward, sending it to @null account.

While the idea is to reduce the STEEM supply (therefore lowering inflation), and (in theory) increasing STEEM price, @burnpost (and any other actions sending STEEM to @null) is actually slowing down the resolution of the debt ratio problem, making the recovery of the STEEM economy happen at a slower pace.

Since decreasing supply doesn't have an effect on the price increase (only demand does), burning STEEM isn't helping in increasing the STEEM market price, but only helping to slow down the price decrease.

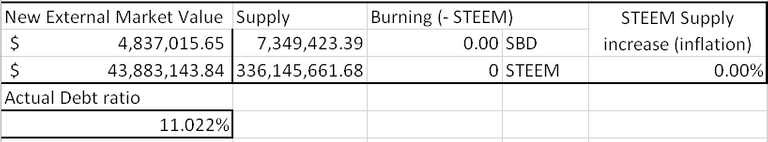

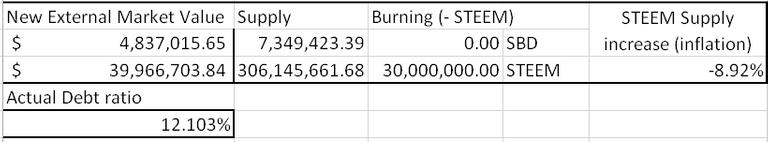

Here is what happens when the STEEM supply decreases:

Before the burning:

After the burning:

(this is just an example to show what happens when STEEM supply is reduced. @burnpost don't burn the already circulating supply, only reduce how much the STEEM supply increase)

So, yes, burning STEEM creates a deflation, but also increase the Debt ratio, wich makes the Steem economy even more fragile, and what is happening here with both experiments running is:

- @sbdpotato is decreasing the debt ratio

- @burnpost is slowing down the debt ratio decrease

Since both experiments are happening at the same time, they are creating a situation where they are pushing the debt ratio in different directions, causing the target balance (lower debt ratio) to be reach at a much slower pace.

How to make the @sbdpotato have a real effect on the peg

First of all, @sbdpotato and @burnpost experiments can't co-exist. The effect one creates on the Steem economy nullifies the other, and they are creating a situation where the debt ratio will recover at a much slower rate.

If @burnpost stops and @sbdpotato continues this would help lower the debt ratio, and over time, the economy mechanics needed to push the SBD price up (Interest and better conversion rate) would be activated, and incentives to buy/hold/convert SBD would start to happen, wich could eventually bring the SBD price to 1 USD.

But the only way for @sbptotato to actively have an effect on the SBD price is to use the STEEM rewards to buy SBD on the external markets, and convert it inside the blockchain.

If @sbdpotato stops and @burnpost continues, this would reduce the STEEM supply increase, wich would slow down the debt ratio recovery, and the SBD peg would still be on "hold" (No incentives would be created to buy/hold/convert SBD as long as the debt ratio is above 10%).

It could maybe increase the STEEM price, bringing the debt ratio down but it's very unlikely, because again, changing the supply doesn't move the price.

A possible solution to this situation (as discussed with @smooth in the comments) is that, while the debt ratio is above 10% no STEEM would be sent to @null, allowing the debt ratio to recover at a normal pace. The burning could start again once the debt ratio is back to accepable levels.

So, my final conclusion, after all this research is: @sbdpotato could work, but only if 2 conditions are met:

- @burnpost experiment stops or change the burning policy (pushing debt ratio down and increasing incentives to buy/hold/convert SBD);

- Use the rewards to buy SBD on the external markets (pushing the SBD price up).

Besides that, here is a few possible solution to help with the SBD peg:

- Make the "convert SBD" visible again on the steemitwallet front-end;

- Also, make it visible wich is the actual convertion price while also explaining what are the risks of using this tool (like the 3.5 days delay that will have another convertion price), so everyone can decide for themselves if it is worth to use the SBD conversion;

- Witnesses should increase awareness about the convertion function, and what it is used for.

- Basically, keeping as many people as possible informed when it might be profitable to use the conversion function (but also informing about the risks of this operation)

But there is still a bit more to talk about!

Next article, i will write about another aspect that makes the @sbdpotato experiment not worth it: price vs value and The outsiders perspective.

That's all i have for now, and thank you for you attention! Please, feel free to keep the conversation going by adding some comments!

This post contains a great deal of confusion, misunderstand, and frankly nonsense.

For example (and notably presented in bold with an exclamation despite being completely wrong):

In reality there are numerous active arbitrage bots which trade between the internal and external markets. In fact it does not matter which market is used to buy SBD, because any demand pressure added to one market will be transmitted to the others via arbitrage. As an example of how this works, a bot will, or in some cases a human could, sell SBD on the internal market to satisfy the demand from @sbdpotato, and then buy SBD on an external market to replace the SBD just sold.

Another misunderstanding is the nature of @burnpost. @burnpost does not under current conditions, take existing STEEM and destroy it, it takes newly created STEEM and destroys it instead of selling it. This does in any circumstance reduce the market cap of STEEM, it results in the market cap of STEEM being unchanged. But that's not all. @burnpost only receives 50% of its rewards in liquid STEEM. The other 50% is received as SP and is committed to eventual burning, but is only powered down slowly (25% per 13 week cycle). The effect of this is increased supply of STEEM (in the form of SP) and no potential selling pressure on markets, therefore an increased market cap and reduced debt ratio, the exact opposite of what the post claims.

In short, the author of this post has a very, very poor understanding of economics, how stable-value cryptocurrencies work (there are numerous errors in that part too, which I have chosen not to take the time to address here) and is trying to profit by writing long, elaborate posts which could be helpful if accurate, but in fact are just misleading people and causing harm. It will be for that reason that I will be downvoting these posts.

It is fair to be wrong and learn from the experience, and that is even admirable, but no one should be paid to be wrong.

While I agree with many parts of your evaluation, I gotta say that justifying burnpost and sbdpotato doesn't really help, either. If the supply of any given good is pre-determined (and both these experiments have a tiny effect on the overall supply of STEEM / SBD), then demand will be the driving force behind the market price.

Clearly, price of STEEM has been going down not only due to the increasing supply, but more so because the demand hasn't kept up. How can the community foster demand? Clearly not by promoting frequent spam posts to be visible. And surely also not by taking a chunk of the rewards which have been meant to reward good content. In that respect, this article deserves more payout than any of those "experiments".

What bothers me most, though, is that sbdpotato / burnpost take up significant portions of the community's attention. Instead of discussing and building solutions to make Steem a better platform / community, we're caught up talking about promoted spambots. This is sad, as it's like trying to close a volcano crater with a chewing gum.

Posted using Partiko Android

Neither is tiny (therefore the supply is not per-determined)

@burnpost, last I saw, was the largest single recipient of rewards and about 8% of all rewards. I don't consider that insignificant. But really the goal of the project isn't to be a particular size, that is up to voters. The goal is to give voters the option to direct rewards to burning, which it does. If voters vote a small amount, or a large amount, or a medium amount, then so be it.

As for @sbdpotato, it is already reducing the supply of SBD by more (about 500 SBD per day) than the amount being introduced into circulation (about 285 SBD per day), and that rate is growing by about 50 SBD per day. Over time this is very much not insignificant. (Since the SPS proposal is now funded, the rate of increase will be much greater.)

Or to put it another way, if these were really insignificant, they would not show up on Trending and we probably wouldn't be having this discussion. Clearly voters have seen fit to allocate significant rewards to these efforts.

No, it is absolutely both. To claim otherwise is silly. There is an enormous amount of Steem being sent to exchanges and sold every single day and every single week. It absolutely has an effect on the price and has had an effect on the price.

I'm all for increasing demand, but I don't think making a pretty Trending is a signficiant factor in that. We had months and years with all sorts of different Trending pages. The two things that have remained constant are: 1) Everyone is never happy with what is on there. 2) Neither the Trending page itself nor paying rewards as we do to the types of posts we do has demonstrated real effectiveness as a growth driver for Steem, nor a demand driver for STEEM investors.

If you have new ideas how to boost demand (and growth), I'm all ears. In the meantime, I remain firm that giving stakeholder voters the option to vote to reduce supply is a positive and not a negative.

One last thing, for all the 'ugliness' complaints about the visibility of burns and other economic projects on Trending, as an investor, seeing that a good chunk of inflation is going to a burn is more of a positive to me that makes me more likely to want to invest (i.e. increasing demand) than seeing that my investment would be inflated away to pay people for posting a picture of a tree.

Nah, man. They are there to get the curation rewards because big whales will vote on them.

Also, it protects the relative stake level of those voting accounts because the "authors" won't be getting inflation, or so it seems.

How many people actually care about burning? There are literally trillions of USD out there, but that doesn't stop everyone and their dogs cashing out into it.

This is wrong, or at least the people trying to do that are doing it wrong. These posts are too popular and too predictable for curation to be high return. Much of it is pushed into the before-5-minute zone where curation rewards are returned to the pool and the rest has high competition.

But this really begs the question. Why are the whales voting for it? That's of course where most of the rewards are coming from, not the smaller snipers. And the whales aren't getting good curation rewards either, due to all the front running.

Okay, so this reflects lack of confidence that paying to (some) authors is actually a good/effective use of inflating investors funds. You do realize that's where the rewards come from, right?

IMO that is how the system is supposed to work. Stakeholders should vote to pay (some) authors when paying authors generates a positive return in the form of high value to Steem (or at least value that is aligned with rewards; small rewards may not need much value, in absolute terms), not "just because".

@burnpost is the default "none-of-the above" option. Arguably it should be built right into the system, but since it isn't, we provide it as a layer 2 solution.

All about both supply and demand. There is huge demand for USD, so the high supply is tolerable. Other currencies (including, of course, one that starts with S), not so much.

I am a currency trader for a while. The reason USD survives because there is no other game in town. The reason there is huge demand for USD is because even the largest economic enemies of the United States, hold massive amount of USD and USD backed assets. There is a case against USD touted for last 20 years. The fundamental argument in favor of the bear case for USD is solid. Even Buffet shorted USD in the late 2000s and early 2010s, against the EUR. One of the worst trade BRK-A did in their entire history. Now, Buffet has very deep pocket, so he managed his loosing trade much better than a regular individual or a govt., but still he incur massive losses that would have broken almost any other entity.

My point is, as long as Chinese Govt, and Chinese Private equity funds, and rest of the world's private equity funds continue to hold US Govt. Bonds and USD backed assets. There is nothing that is going to happen to USD.

Ask yourself the question: What else would you rather buy? Euro? LOL. That is similar to buying Iraqi Dinar! :)

That. I can agree.

Tiny as compared to the total supply, which it is (at least in terms of STEEM).

I said it's both. But in the design of an economy that increases its monetary supply over time (like all real-world economies), they rely on growth to not have tremendous indvalidation of their currencies. This is exactly what hasn't happened here. Having a supply-increase rate of 7% yearly doesn't matter much, if demand for that currency increases faster. Every successful startup would show growth rates of above 50% yearly, and likewise most of these inflationary cryptoeconomies make such an assumption.

If the economy fails to grow as quickly as hoped / anticipated, price will go down. Obvisouly, STEEM was very hyped (much above its fair value) end of 2017, but there simply aren't enough drivers to motivate people (and I mean real people!) to start buying STEEM at a larger scale.

Seeing empty posts pushed to Trending multiple times a day will discourage anybody from buying STEEM ("This is what the stuff is good for?? Nah, thank you!"). Why not at least use this empty (but valuable) space to promote good Steem / crypto projects, curate great content or whatever. This is why I really don't get the appreciation both these projects receive.

Okay, and such tremendous invalidation is a benefit to no one. It destroys the existing investment and also destroys the resources available within the community to actually build (or even sustain) anything.

If we aren't growing enough to more than offset the cost of 7% inflation (and we clearly aren't, since we aren't really growing at all, and pretty much never have apart from a few short burst secondary to price spikes), then 7% inflation is too high. It makes a lot more sense to preserve capital until such time as we can fix the growth model, rather than waste it.

Indeed, what little of a growth model we have seems dependent on favorable price action. All the more reason to be skeptical of continually flooding the market with new coins.

That's under consideration. It is potentially an added benefit from the use of the space, but there is also very little evidence that "Trending" is a true growth driver (or valuable), despite the claims being made here (your implied claim included). In fact, it is mostly a leaderboard and something that some Steem insiders care about a lot about and the rest of the world not so much. It is perfectly fair for investors to vote to take a gain in lower inflation (burnpost) or a better-functioning stable value coin (sbdpotato, and also sometimes burnpost) over a prettier trending page (and also fair to vote the opposite).

Another excellent bit of market evidence that Trending space is not worth much is that no one has ever been willing to pay (e.g. bidbots) much of a premium to trend. As a thought experiment, if I were to auction off the space in the burnposts, how much do you think I would get? All evidence suggests, to me, that it would not be enough to even be worth the effort.

IMO trending prettiness is just not that important. Feel free to disagree and vote accordingly though.

I can tell that being shown under Trending does indeed generate a lot of clicks, and therefore reads, and thereby is significantly more valuable than not being there. The absolute value of these views / reads is debatable, and overall traffic, no matter where, in the crypto space is generally low.

I can only reiterate what I've been suggesting for hardly anybody could ever live off the payouts at such a low price.

I don't know exactly what such a Steem(it) would look like nowadays, but it would definitely take more example in the existing incumbents of content and media which have attracted a vast audience without any monetary expectations (at least as they were a similar size as Steem is now).

Maybe this would be very disappoining for investors in STEEM, but in the short-term price matters too little. STEEM price will only reach new sustainable ATHs if Steem grows significantly. I would advocate on spending the time and energy on building better clients (e.g. use-case specific, or offer whitelabel discussion platforms that can be curated using Steem Engine tokens or SMTs), or improving the protocol (e.g. work on improved Sybil attack resistance if that is considered a huge problem).

That said, I shall probably stop discussing @sbdpotato and @burnpost now myself and just let everyone do whatever they deem is best for the network, even if I think they're wrong. At least I gotta admit that it's well-intended :-)

Thanks for the input. I will say that people do work on building better clients, etc. and these initiatives in no way take the place of that work. They are parallel efforts to attack the issue of sustainable (and, going forward, more than merely sustainable, but successful) Steem economics from multiple angles.

Great explanation.

I've been saying for a long time now that SBD should just be abandoned entirely. The market mechanics that were built into it do not work well enough to create anything resembling a stablecoin.

SBD has been in the 1 USD range for maybe half of its history. While that is handy for speculation, it's not so good for storing purchasing power.

I think it would be far better for the blockchain to simply allocate newly created STEEM. And then we can all argue about how much STEEM should be created and who should get it.

I would say that SBD is more misunderstood than useless.

A stable asset based in a trustless economic system (Wich is the case) I may actually be more beneficial to the blockchain than a high price STEEM.

A naturally volatile asset like STEEM won't work as a good mean of transaction, but if SBD Target price (between $0.95 and $1.05) is reached, it can have a way bigger positive impact on the blockchain (Wich could drive STEEM prices up).

The economic model is well thought, but when the 2017 crypto hype happened, creating a quick price spike followed by a continuous price dropping (and the debt ratio went over 10%), the protection system started to work to avoid pressuring the steem price down even more.

See, the system is working as intended, and with time and the gradual increase of STEEM supply, the economy would eventually return to it's normal state, and to help push sbd price up again to 1 USD, the witnesses would set an interest to be paid to sbd holders.

I agree with all of that. But a system that takes years to work itself out isn't useful as a stable coin.

Right now you can buy SBD on the open market, hold it for a (long) time, and be reasonably confident that you'll make 60% gains. Like I said though, that's speculation, not using it as a stablecoin.

Therefore, buying and holding it to await for the price to rise is actually pushing the price back to 1 USD, so, working as designed.

At this moment, it is working as a speculative asset for basically 2 reasons:

This is not accurate, SBD is still being printed via the SPS (Steem Proposal System) so the failsafe that stops the printing was effectively removed in the last hardfork.

If we want the SPS to keep paying in SBD instead of STEEM then it is my opinion that we need to introduce a blockchain rule that stops the SPS from printing SBD and instead buys it from the internal market if the debt ratio is above a certain threshold.

https://steemit.com/steem/@onthewayout/how-to-fix-the-sbd-peg

That is a good point.

I haven't considered the sps influence on this, and thinking about it, it's kind of worsening the debt ratio even more...

More circulating sbd = more debt.

SBD created to fund the SPS (treasury) doesn't increase debt in any real sense (though it does increase the apparent debt ratio used by the blockchain to calculate the conversion haircut), until stakeholders vote to pay out those SBD in order to fund proposals, since it doesn't circulate, it just sits in the treasury.

If that happens (funding payouts), then one can conclude the stakeholders believe that such an increase is 'worth it'. Indeed funding something like @sbdpotato out of SPS is another way for stakeholders to place controls over the debt ratio (since @sbdpotato will destroy more SBD than the SBD put into circulation to fund it).

For this reason, as well as the funding rate being rather low (less than 1% of market cap per year), it was seen as fine to continue to fund SPS with SBD regardless of the debt ratio.

So the SBD locked is still counted as circulating SBD, it does affect the debt calculation.

And even though the SBD is locked, it makes sense that the debt-ratio increase, because the SBD is printed, and the debt already exists. It can't be claimed, but it exists.

Can't say more than first impressions and thoughts, because i haven't researched how the SPS work yet.

I don't know what 'it exists' means exactly, nor what it means to say it is 'printed'. It is a number in the blockchain code. It can't be spent, it can't be converted, it isn't part of any user's account balance, etc. In fact, regardless of votes, it can't even be paid out to SPS proposals at a rate of more than 1% per day.

IMO it shouldn't even be included in 'supply' until placed into circulation, at which point it can be spend, can be converted, etc. but this is of little practical significance right now since the amount is very low (200K out of 7M), as is the rate of increase.

If it's being accounted for by the blockchain as circulating supply, then it is "printed", and it is added as a debt to be paid.

It might be locked and not moving, but it is accounted for, and it does have an influence on the debt ratio value.

And as you said, it definetly shouldn't be included on the supply until it is unlocked.

And 200k/7M is 2.8%, wich isn't insignificant if you consider that the external market debt ratio is around 0.5%-2% over 10%.

So yeah, the way this is accounted for does have a significant impact on the debt ratio.

The 2% (over cap) is a percentage of the total Steem market cap not of the amount of SBD, so these are different numbers. In fact about 20% of SBD needs to go away to get back to the cap and SPS is only 2.8% of SBD.

This would probably be slightly better but not necessarily worth the added complexity given the current funding of SPS. At the moment, SPS only receives 10% of the roughly 8% inflation or about 0.8% of market cap per year. In other words, if the debt ratio is 10%, then after a full year of SPS printing (assuming no conversions, which is of course unrealistic), the debt ratio would then be 10.8%. Not really a serious concern.

In fact there are times, even under haircut conditions, when conversions reduce the SBD supply faster (sometimes much faster) than SPS creates it so even the 0.8% annual rate is an overestimate.

Eventually I agree there are are merits to the idea of the blockchain sometimes buying and selling on the internal market, but at the moment it seems like a very low priority given the above numbers.

One thing that change that would be an increase in the share of inflation going to SPS.

Ultimately the deciding factor is the price of steem however it still bugs me that we are still printing SBD under the current market conditions. The updside to printing sbd instead of steem is that we have less liquid steem putting pressure on the price. If we could find a way of getting rid of the excess sbd by burning it instead of converting it everything would align.

We do have the promotion page which burns SBD, though the quantity is very limited, probably only a few dollars per day. When SMTs launch it will be possible to pay/burn SBD (amount to be determined) in order to create a new SMT.

Still probably won't add up to much but better than nothing.

Interesting information here! Thanks for sharing.

If you use the https://steempeak.com wallet you can use the convert function.

Yes, like I said above.

The only thing that I think @themarkymark should add there is what is the actual conversion rate, to help people decide if they are willing to take the risk of converting.

Well, I have done some calculations, and I found out how to get some STEEM profits using the conversion function.

It is possible, but there is some risks of losing money but in the end, it should be up to the user to find out if it's worth do the conversion.

And that can only happen if we have all the information available.

I am not part of Steempeak, so I have no say what they add. You could talk to @jarvie or @asgarth though.

Oh, my bad. For some weird reason I thought you were part of the team.

No, but I do chat with them time to time and advocate the use of Steempeak a lot as I like their work a lot.

Maybe that is why. And yes, you are right. I also think that steempeak is the best way to use the blockchain.

Thanks for passing by!

Hey, thanks for the suggestion. We are fully committed on supporting communities at the moment, but I'll evaluate this for a later release ;)

Great post! It certainly puts a lot of meat behind the argument that potato posts and burnposts amount to pissing up a rope. In my opinion, they only serve as a mechanism to abdicate curation of real posts while still appearing virtuous, and to passively collect curation rewards under the guise of creating price appreciation. It is an insidious type of reward pool farming, which to this point has been almost immune to criticism.

An that is actually the third topic I will write about on the next article.

But basically what I think is that these projects won't achieve anything, might even damage the economic system, and worst of all:

It's removing rewards from what can actually create value in the blockchain: good content.

Anyway, I will be more detailed about it soon.

Thanks for joining the discussion.

These projects do not collect significant curation rewards.

The curation system is designed to penalize all "passive" curation (on posts with highly-predictable rewards, whether those are always-popular authors, or 'campaign' posts like these) by: a) paying more curation to the earlier curators, forcing people to vote earlier and earlier; and b) returning an increasing share of curation rewards to the pool for votes earlier than 5 minutes. As the competition described in (a) proceeds, more and more of the votes are forced into the before-5-minute zone where curation rewards are returned to the reward pool instead of paid to the voter.

In the case of @burnpost (and I assume @sbdpotato, though I haven't looked carefully), there are always many votes before 5 minutes, and even several dollars of votes before 2 minutes (meaning >60% of the curation rewards which would be earned by these voters are instead returned to the reward pool).

That is to say, the curation reward system is working as designed, even (or especially) for predictable payouts that don't require a lot of curation effort. It offers voters a choice between low rewards for low effort or higher rewards for higher effort. It probably isn't feasible to have a system that pays no rewards for low effort for two reasons: 1) "low" or even "no" effort is not knowable by the blockchain except by observing votes, and to measure such a thing requires a graduated scale; and 2) reducing curation rewards too much, even for low effort votes, encourages vote-selling, which is far worse for curation overall.

In fact, people voting on @burnpost, @sbdpotato or even other 'passive curation' (such as voting on consistent high-payout authors) could and often would do better by picking some 5+ minute old unvoted content at random.

Good points, appreciate the input.

Every time the debt ratio gets above 10%, the original idea was that blockchain is supposed to stop printing more SBD. That was the beauty or debt resolution on steem.

The majority of community users haven't seen a new SBD reward for their comments and posts in such a long time (August 2019 briefly?). Many people have never experienced the blockchain when it was below 10% debt ratio. I continue to watch account value shrink, and wonder how new steem is ever going to help protect my wallet.

If we can get out of this zone of creating more debt at this level, rather than remain there, then things will get exciting again. Unfortunately, the number of exceptions allowing additional SBD to be printed and paid is making this goal very hard to achieve.

@phgnomo, thank you for sharing about @sbdpotato. This is a confusing aspect (to me) of the blockchain I was not aware of. Would @sbdpotato potentially lose a ton of money if they used the external market as proposed in this article?

What is the specific intended goal of @sbdpotato? How is its success or failure measured?

@smooth already answered most of your questions, but allow me to add a few more insights

The @sbdpotato isn't looking for profit, because it doesn't care about the conversion price. Sometimes it will make profits others it will have losses.

The whole point is to reduce sbd supply and theoretically increase it's price (Wich I don't think it works)

But it's kind of hard to measure it effectiveness, because a lot of other factors are pressuring the sbd price in one direction or another.

For example, the price increase we are seeing now have more to do with BTC price going up (since it pulls all alt coins prices with it) than with actual effect of SBD supply being reduced.

You can certainly measure effectiveness by amount of SBD removed from the supply (which in turn reduces the debt ratio, and therefore the haircut). That is right in the @sbdpotato posts. Currently that's a relatively small number, about 15000 SBD, but it is accelerating over time and should increase much faster now that the SPS funding is adding to the available funds.

When it comes to price, yeah I would agree it is hard to measure since prices (both STEEM and to a lesser extent SBD) move all the time for a variety of reasons. Even if we were to wake up tomorrow and find that SBD had pumped right up to $1, it would be a stretch to say that @sbdpotato was definitely responsible. It could be, but also could not be.

No, as I explained in my top-level comment, it really doesn't matter which market you use. This is among the many misunderstandings and errors in the post.

It is possible that @sbdpotato will lose money, as it is possible for anyone using the conversion function to lose money. Since @sbdpotato is not even trying to make money (it is trying to reduce the debt ratio and haircut, and increase the market price of SBD toward $1), it probably is more likely to lose money than private actors using the conversion function. However this is independent of which market is used.

I am not the operator of @sbdpotato, however as a contributor of some of the ideas I can give you my answer. By reducing the supply of SBD toward zero, the debt ratio is guaranteed to be reduced (assuming STEEM ratain any non-zero value). As this proceeds, the haircut will be reduced and it will become possible to convert SBD into a larger value of STEEM, eventualy into $1 of STEEM. This will eventually result in the market price of SBD returning to approximately $1, because it is impossible for SBD to be worth much less than $1 if you can convert 1 SBD into $1 of STEEM.

Secondarily, both the buying of SBD by @spdpotato and the visibility of @sbdpotato engaging in these efforts may increase confidence in SBD returning to $1 soon and encourage speculators to buy up SBD with that expectation. (If you buy SBD at $0.70 and it returns to $1, your return-on-investment is almost 50%.) If this happens then SBD may return to $1 (or at least closer to $1) sooner.

The second portion is speculative and may or may not happen. The first part is guaranteed to work as long as @sbdpotato removes SBD from the supply faster than it is being created, which is currently a low rate of about 1500 SBD per day (for SPS funding). That depends only on @sbdpotato having adequate funding (from post rewards as well as the SPS proposal) to continue to buy and convert SBD.

In fact, despite @spdpotato by itself not really having enough funding to meet this threshold yet, @sbdpotato plus other people converting has been enough to reduce the supply of SBD over the past few days. So progress is being made. With the SPS funding proposal approved, it should accelerate over the coming days/weeks.

Thank you for clarifying @smooth. If it works as intended then there is some good news for everyone.

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

It must have taken a long time to write this, give you an A for effort but @smooth already answered that most of it doesn't make sense. Firstly you state the debt ratio is 10.x percent, it actually is more like 14.x percent if you look at this api by witness cervantes http://cervantes.one:8081/api/get_debt_ratio

Secondly burnpost and sbdpotato are complimentary, while the blockchain is printing STEEM, @burnpost burns the STEEM while @sbdpotato converts the SBD wrapper back into STEEM, so while one is reducing SBD supply and increasing STEEM supply, the other is mopping up the extra STEEM supply created so they work nicely hand-in-hand.

WHen the blockchain starts printing SBD again @burnpost will burn 50% SP and 50% SBD so will still burn a bit of both and compliment @sbdpotato in any event.

Yes indeed, I realized that I understood the debt ratio calculation wrong, but @timcliff helped me with that.

But this still doesn't change my conclusions so far.

The sbdpotato and burnpost interaction is only complementary when burnpost is burning SBD.

Since there is only STEEM to be burned by them (debt above 10%), they are slowing down the STEEM supply increase, Wich make the debt ratio recover at a lower pace. So it slow down the sbdpotato effect on the debt.

Still, reducing supply won't affect the price up. It might help to avoid it to go lower, but don't push it up.

Hi @phgnomo!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 3.531 which ranks you at #6741 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 115 contributions, your post is ranked at #1. Congratulations!

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server