ATM or automated banking machines are machines that you might think are completely safe and secure modern technological marvels right? Wrong.

Not only are ATMs often volnurable to hacking and not to mention other attacks, they can also be physically modified in a manner that can be very difficult for customers to detect.

ATM Skimming

The way that skimming works is that thieves put a card scanner on top of the little slot where you insert your card. These skimmers allow your card to pass right through them into the ATM itself while also scanning your card and stealing your numbers off of it. This happens so discreetly that many victims have no idea something is amiss until they look at their bank statements weeks later.

Because many ATM card slots use similar designs especially machines for major well-known banks, there are many skimmers on the black market that look almost exactly like legitimate card slots making it even harder for customers to realize what’s going on.

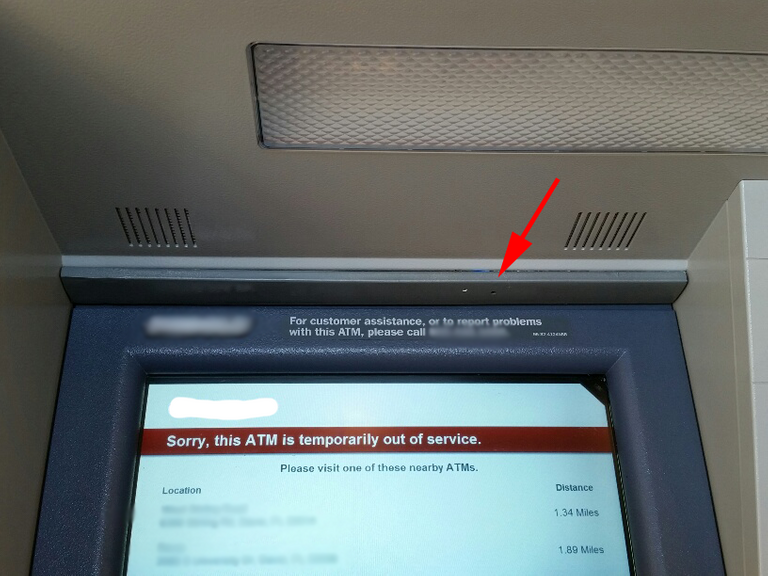

Of course though you typically need a card number and a pin to do anything nefarious so they also install small pinhole cameras in inconspicuous locations on the ATM to capture footage of you punching it in.

Some scammers even buy number pad overlays on the black market to capture pins which can be even less obvious.

How to avoid becoming a victim

Back in the day, it used be very common for scammers to get busted when they came back later to retrieve their skimming equipment, more recent black market gadgets can transmit stolen card information pins wirelessly making it even easier for the bad guys to carry out their schemes without getting caught.

So how can you avoid falling victim to a card scammer? Aha, in many cases you can tell if you look closer.

Before using an ATM or a card reader at some store, before you go sticking your card into it, give the card slot a good wiggle. Does it seem loose? Most legitimate slots are built very sturdy due to the sheer number of people that use them everyday so if it does seem loose then you should be very wary of proceeding.

Also check the top of the ATM, the screen and the area just above the pin pad to see if there are any tiny holes that could be cameras installed by scammers, remember these holes can be very small.

Finally check the pin pad as well, does it wiggle? Do the buttons feel off when you push down on them?

If everything seems fine and you don’t notice anything abnormal, it’s probably safe to proceed but in case you overlooked something and you do get your information stolen, make sure you report it immediately to your bank.

Security measures.

Banks are also very serious about trying to prevent card skimming some newer ATMs are not only outfitted with tamper detection but they can also read the EMV chips on newer cards. These cards are much more difficult to skim as the data on an EMV chip is only good for a single transaction and changes next time you purchase something or withdraw money. Along with this many other security measures are being taken by the banks to make sure our information is kept secure.

thanks for the sharing

Glad you liked it

An upvote will be very much appreciated tho 🙂

Thanks for sharing important information

@originalworks

@OriginalWorks Mention Bot activated by @mariey. The @OriginalWorks bot has determined this post by @taimur to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

For more information, Click Here!

Thanks for the valuable information!

Glad you liked it

An upvote will be very much appreciated 🙂