J.P. Morgan

Former JP Morgan trader pleads guilty to manipulating US metals markets for years.

https://www.cnbc.com/2018/11/06/ex-jp-morgan-trader-pleads-guilty-to-manipulating-metals-markets.html

After reading that article, one should ask themselves about its true meaning. For that, we need a little context.

A Brief History of Gold and Silver

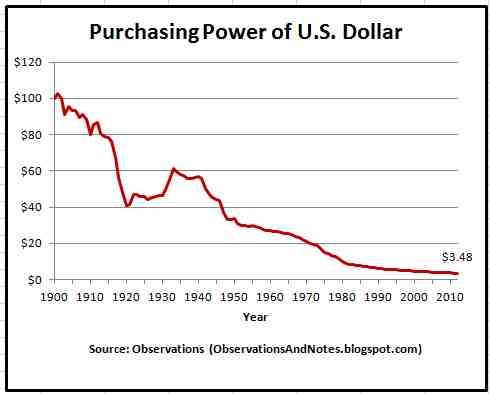

Gold and silver have been used as money for millennia, until Nixon abolished the gold standard in 1971 and opened the floodgates for fiat currencies, where the dollar was given the opportunity to reign supreme. It's no coincidence that since the Federal Reserve (which is a private bank, NOT a government entity) was founded in 1913, the dollar has been on a steady decline, where today it had lost over 96% of its purchasing power.

Because of their limited supply, gold and silver provided economic stability for centuries and allowed civilizations to flourish. Why? Because it kept governments in check and prevented them from indulging in deficit spending (spending exceeding the revenue). However, history is full of examples where gold and silver were gradually debased to fund wars and build social structures. Debasement was achieved by re-minting the pure gold or silver coins with other cheap metals like copper, therefore increasing the money supply. In our modern world, debasement is simply printing more fiat currencies. Such deficit spending always led to hyperinflation and ultimately the demise of century-old power houses, like the Roman empire.

Starting with Nero in AD 64, the Romans continuously debased their silver coins until, by the end of the 3rd century, hardly any silver was left.

(https://en.wikipedia.org/wiki/Debasement)

If you want to know what hyperinflation looks like in the 21st century, look no further: Venezuela and Zimbabwe.

So, during the last 47 years, what happened when the rest of the world (sheeplings) went along with Nixon's criminal plan to ditch the gold standard? Well, since there's nothing to keep governments in check, the bankers took over, since they are the ones who controlled the printing of currencies. Thus, there's no limit whatsoever to how much they can print, something they couldn't do with gold and silver. So here we are, trusting in worthless pieces of paper that are continuously being debased and devalued. History shows that over 6,000 currencies simply ceased to exist. Lesson: all fiat currencies end up in the trash, while gold and silver are still around.

Furthermore, government deregulation allowed banks to increase their fraudulent and criminal activities to rob the people of their assets. How? I'll give you the example of silver, which is the topic of this post's title.

Back to 2008, while the banksters were dreading deflation, several rounds of quantitative easing (QE) where unleashed to bail out the banks because they were too big to fail. By the way, quantitative easing is a fancy word for printing more currency.

https://ritholtz.com/2010/05/too-pig-to-fail/

Following each QE, investors rushed into buying... gold and silver, which sent the prices skyrocketing. No matter what the "experts" tell you, precious metals are and have always been a hedge against inflation and deflation. Publicly, the economists on TV bash precious metals, but in the background, it's clear what they're doing: keep the population away from precious metals so they can hoard it themselves. I'll get to that in a minute. So with the rising prices of gold and silver, JP Morgan (and other fraudsters like George Soros), systematically shorted their positions and dumped their paper gold and silver (e.g. ETF's and futures contracts) to suppress the prices. The price manipulation was outrageously clear back then, and here we are 10 years later with proof that JP Morgan did manipulate the silver price, to say the least. And that's not all. Before 2011, JP Morgan held ZERO physical ounces of silver. When silver peaked at almost $50 in 2011, JP Morgan opened their vault in New York! After the big short started, they began filling their vault with physical silver! This stockpiling is still ongoing and its timing was no coincidence. These guys know exactly what they're doing. They know silver is going to go big, otherwise they wouldn't be stockpiling it. Currently, they are holding over 150 million ounces of silver in registered COMEX warehouses, and possibly an additional 500 million ounces in Switzerland.

https://silverprice.org/silver-price-history.html

What Happens Next?

Consider the following:

- USA's debt went from to $880 billion to $22 trillion in 10 years, (i.e. deficit spending)

https://tradingeconomics.com/united-states/government-debt - Three rounds of QE's (printing currency, debasement and devaluation)

- USA trade wars with China and other super powers

- Unending global wars, proxy wars and political tensions worldwide

- JP Morgan manipulated and shorted silver, made a ton of money, then bought physical silver cheaply, thereby robbing wealth from the people.

- Top governments recalling their gold from overseas vaults (Germany, Russia, China, Venezuela, etc...)

- Top governments hoarding gold and silver (China, Russia, India, etc...)

- Top governments dumping the petro-dollar

I don't know about you, but 1 + 1 = 2. The current system is inflationary by design and is unsustainable. A crisis is brewing, all fiat currencies are on the verge of collapse, not just the dollar, because all the major countries have been printing currencies for a while. Precious metals are set to skyrocket.

How Can We Fight JP Morgan?

There's an adage that goes: if you don't hold it, you don't own it. This is true for gold and silver. Silver spot price is around $14 today, it hasn't been that low since 2008-2009. So, consider this, if JP Morgan has hoarded 150 million ounces of silver so far (COMEX stockpile alone), in today's price that's worth $2.1 billion. That may seem tiny, but when prices explode, they will make a hefty profit. So to fight them, we should buy physical silver too. In fact, to counter JP Morgan and slow down their theft of wealth, it only takes:

- 150 million individuals buying 1 oz of silver ($14) [that's half the American population]

- 1.5 million individuals buying 100 oz of silver ($1,400)

- 150,000 individuals buying 1000 oz of silver ($14,000)

So with a minimal budget, the people can secure a portion of silver (or gold) to protect themselves from a financial crisis and to send a message to the banksters that we are aware of their manipulations and schemes. Don't be caught off-guard by hyperinflation.

once.

once.

The Indian scenario is getting worse. We (?) demonetized (banned our own currency!) & did lot of other stupid things. The growth has plummeted. Now the central government is begging for billions of cash from the Central Bank (RBI). The RBI was one of the best institutions which was headed by economists like https://en.wikipedia.org/wiki/Raghuram_Rajan .

Considering India is one of the hungriest civilization when it comes to the appetite for gold and silver, whatever is shaping up in India could have an impact on the global prices.

More on the recent drama is here : https://www.economist.com/business/2018/11/08/indias-banking-system-is-flirting-with-a-lehman-moment

Raghuram Rajan

Raghuram Govind Rajan (born 3 February 1963) is an Indian economist and an international academician who is the Katherine Dusak Miller Distinguished Service Professor of Finance at the University of Chicago Booth School of Business. He was the 23rd Governor of the Reserve Bank of India between September 2013 and September 2016. Between 2003 and 2006, Rajan was the Chief Economist and Director of Research at the International Monetary Fund. In 2015, during his tenure at the Indian Reserve Bank he also became Vice-Chairman of the Bank for International Settlements.At the Federal Reserve annual Jackson Hole conference in 2005, Rajan warned about the growing risks in the financial system and proposed policies that would reduce such risks.

Definitely India is a major player and their gold/silver hoarding goes beyond investment: jewelry. I'm extremely shocked how India is ruining itself like that. Plus, the Indian government acting against bitcoin is another short-sighted decision. Pakistan may be pointing their finger and laughing at India for this :(

I wish someone in the government and political parties had a similar feeling ...

Well, We don't even like our own Currency that we banned it ! ie, we banned even Indian Rupees. You are talking about that random Satoshi's Bitcoin ? come on. You are barking at the wrong crazy-tree - may be you are barking at a BIG-CANNABIS-TREE :-D

The Pakistan reference is quite funny here - the joke is that, until recently they used to print the notes for India and once they stopped the government is begging the central bank for more money. Earlier, they were allegations that counterfeit Indian notes are printed by Pakistan to "destabilize" India.

On serious notes, The ex Indian Central Bank Governor was an Engineer - IIT + MIT and then he became an economist. He was interested in exploring Bitcoin and Blockchain's in general. What I feel is we need people with knowledge at the decision making positions irrespective of which country it is. Until few years ago, India had the unique case of a Rocket Scientist for its President, An internationally acclaimed economist for it Prime Minister - both of them were not really politicians too. Its not about Education or Phds but those people had "knowledge" and wisdom. I feel this is a lesson for any nation while selecting its rulers. Whether someone is a good "leader" is not should be based on politics but it should be based on track record. What that person did with her/his life should bet he means to elect ones rules and not some ideology. Personally Iam not interested in politics or governance but I feel I have lived to see some of the most governance.

We’re probably screwed. The deficit (deficit, not debt) is now going up $100 billion a month:

https://www.bloomberg.com/news/articles/2018-11-13/u-s-budget-gap-jumps-to-100-billion-at-start-of-fiscal-year

Keep on stacking!

The art of deficit spending. The more they print, the more we stack. In stack we trust.

really well stated and the fact that history keeps repeating itself is frightening... a lot of us assume most markets are manipulated to some degree but when you see filthy rich sociopaths cause effects that result in humanitarian crises something has to give.

picked this post for my upcoming curation post for today

Precisely, history repeats itself and humans never learn. More like, the smart corrupt ones DO learn and ruin the economy on purpose to transfer the wealth into their pockets. I think each person must study history to understand the truth of what's happening and why: cause and effect.

Powerful post, a clear eye-opener. Still not sure what will happen after the financial collapse. Governments might declare the possession of precious metals illegal, as history already has proofed.

Indeed it's a worrying prospect. However, the people have evolved mentally since those days, awareness and communication are a far cry from what they used to be. If governments even dare to confiscate gold and silver, it will be their downfall. Another important thing is that since the gold standard was abolished, governments don't consider gold/silver as money anymore, so they have no reason to confiscate them. If we return to the gold standard, than they might confiscate in another time of crisis, i.e. a future plan to re-abolish it again lol.

Thanks my pirate! I follow you.

It's posts like this that make me really consider taking something of the little bit I have (I'm young and saving yet) and dumping a good chunk into precious metals. But I have now idea how? Where can I buy silver and gold for cash? What are things to watch out for? Etc...

There are plenty of online precious metal stores, APMEX is the largest in USA, Kitco in Canada (they both accept bitcoin too). It depends on your country though. Avoid pawn shops because they'll try to rip you off with premiums, i.e. prices well above the spot price. Also, I recommend you check if the store (online or not) is an authorized and trusted dealer.

Alright sounds like good info to start on. Who "authorizes and trusts" said dealers?

It's also a nice place to find a lot of dealers to choose from.The mints have lists of authorized dealers. For example https://www.mint.ca/store/mint/customer-service/bullion-dna-dealer-locator-10900014

APMEX is listed under US dealers

Kitco -> Canada, US and Asia

Canadian PMX -> Canada

etc...

Also, know that the mints do not sell directly to individuals, but to their authorized dealers, who in turn sell the bullion to individuals. Take your time to shop around, prices vary greatly. For instance, Canadian coins will be cheaper from Canadian dealers, while they're more expensive at American dealers, and vice versa.

What would your recommendations be on rare coins dealers (there is one near me). Are they a good place to start?

I'm not into numismatic coins, only bullion.

Thank you!

The safest option is to evolve consciously such that we no longer allow free will and destiny to be limited by the amount of resources being held. The general capitalist model is one that literally motivates the survival mechanism to be directed towards hoarding and manipulation/exploitation such that 'the market' buys endless stuff it doesn't need. As soon as we stop competing, the remaining competitors gain ground and can do so to such an extent that they start to encroach on our ability to survive. The belief that life is powered by 'survival of the fittest' is flawed unless 'fittest' means 'most loving'. It is love that provides and protects, not the ability to kill and overpower others. When we cease every involvement with that which overpowers others and ourselves, our survival rate will 'go through the roof'.

It should be obvious that working together is superior and more effective to competition, but so many have been trapped by a low self worth that twists their thinking into believing that fighting is the only answer.. and thus we have our current world full of self created traps.

I just watched this video that shows something of the reality of our 'markets'

I have 15% of my assets in physical precious metal so I am fine, but good to spread the idea of owning the metal (rather than silver and gold contracts).

Arrrh! So Captain @drakos when can we hang this man upon the Yardarm?

Jamie Dimon CEO of JP Morgan

I've never been a huge fan of silver. I can see the use case for gold more in the intimidate future as 10kg is put into each satellite . I'm a fan of holding gold. Say you want to carry around 500,000 in silver.. Well that is a big wheel barrel! 500,000usd @ today's gold price is 31.25 pounds. No problems! I told many people back when gold was 500usd/oz to buy it, but they didn't listen. I agree with you about inflation and the price of certain metals rising , I think Gold will have a higher ROI is all.

I've been paying close attention to silver and also bitcoin since 2009. I like silver because historically it is money and it has a lot of industrial uses. It's so undervalued because of the price suppression. Some economists believe that in a decade or two, silver will surpass gold. On another note, I didn't cover bitcoin in this post, but it's another path to freedom because of its decentralized property vs the centralized fiat world. While gold and silver are a safe haven against financial turmoil (proven and tested), I think cryptocurrencies are also worthy for portfolio diversification. There are even a few cryptos backed by silver or gold, which is fantastic.

Yeah I was going to mention crypto but I figured this post was focused into the metal manipulation. I agree bitcoin/freedom based cryptocurrencies are fairly safe as long as you hold the key properly. The same as gold possession/silver possession, key possession mainly determines ownership

If you don’t want to be listed just leave me a comment and I will delete your profile from the website. Thank you very much for reading and I’m looking forward to your feedback!

PS: I’m NOT a bot so… I’m really looking forward to your feedback 😊Hi, congratz, you are now listed on the Steemians directory (https://www.steemiandir.com/) You can read more about this initiative here: https://steemit.com/steemit/@anonyvoter/directory-update-of-november-22-2018 If you like this project it would be great if you could resteem the post to make more people aware of it.

Damn! That’s the way you write a silver post!!!

😎👍

Thanks for connecting on here! There is something magical about silver! My Gift To YOU https://roberthollis.com/mdcty

It is the in depth posts like these that make coming to steemit worthwhile day in and day out. Thank you for taking the time and effort to put this together!

so tis yer pirate side keepin an eye on silver .. Arrr :D

kidding aside, excellent perspective and write up !

Yargh, me silver chest is hidden on a remote island.

(not-so) complex particulars. Thank you for enlightening me. :) Now – if only I had enough of that deceptive paper money to buy up a whooole buncha pure silver.What a wonderfully informative and sobering article, @drakos. I've been hearing whispers about the future of silver for quite some time, but didn't really understand the

Great post!

The Bloody Raven approves of this article.

Awarded the Bloody Raven JPMorgan GIF award.

Scuse as me gonna back up the ship.

We think alike almost at the Same Time Today. Nice J.P. Morgan Picture too by the way......................@drakos

The Bloody Raven approves of this article.

Awarded the Bloody Raven JPMorgan GIF award.

Scuse me gonna back up the ship.

Really awesome post! Essentially if the current fiat system collapse we would go back to the gold standard and the value of gold will reset to much larger than what is trading at now. Don't have the exact calculations but this is the general idea because debt owed cannot all be defaulted.

There has been several debt cancellations in the past (http://www.cadtm.org/The-Long-Tradition-of-Debt), so it's an option. Ideally a gold standard would stabilize the economy, but the return to it won't be an easy transition. All the fiat and credits must take a dive, with perhaps some debt cancellations worldwide (at least the poor countries). One thing for sure, a new monetary system is desperately needed, whether it's a full gold standard or something coupled with it (maybe blockchain technology), no matter what it is, it must be prevent future corruption and allow the people, not the bankers, to prosper like they did through the ages.

Haven't heard of any major economy have debt cancellations, only smaller ones like Argentina, Greece, Jamaica etc... Going straight to a gold standard is unlikely, possibility in transitioning to gold and commodities over the years. I agree with a monetary system coupled with blockchain for security and transparent purposes.

New era, new materials! Gold and Silver might retain their value but, from my point of view, it looks like other rare earth metals (Neodymium, etc) are the future.

Gold and silver have a long history of being used as money.

True that! On the other hand, traditional currencies also have a "long" history and cryptocurrencies are taking over!

From my point of view, if you want or can diversify your portfolio I would include rare earth metals. It will pay in the long run! Just remember the 2010 incident!

Cheers!

Hi @drakos

Excellent post. By far one of the most informed and well laid out ive read on this subject for a long time. It might well be my "go to" reference blog for a while.

Id also like to thank you for your delegation to @ssg-community, it was totally unexpected. THANK YOU.

I'm @welshstacker and if you want to reach out and have a chat on discord you can find me with welshstacker#1176, id love to get you more involved with our community of like minded silver/gold/precious metal stackers here on steemit. Ok, I think ive kept you long enough, hope to catch you soon.

regards

My interest in silver goes back to a decade, I'm considering getting more involved with the Steem silver community and post more about it, since cryptos are on the slow side.

Thank you for the great post!

(Would be great if you take a look of my latest drawings;)

Your post had been curated by the @buildawhale team and mentioned here:

https://steemit.com/curation/@buildawhale/buildawhale-curation-digest-11-16-18

Keep up the good work and original content, everyone appreciates it!

Nice post just voted you as my witness, I saw how supportive you are to steemians. More power.

I really like the article. I just do not agree that the solution is to purchase silver. If those 150 million individuals buy silver the demand for silver would skyrocket and send the price up even more.

That's the point, people are so uneducated about the value of gold and silver that when offered a choice between a chocolate bar and a bar of silver, they choose chocolate. This ignorance is what's helping keep precious metals suppressed, which makes the banksters happy. So yes, let everyone buy silver and prices will surge because of higher demand.

Welcome to #steemsilvergold

Congratulations @drakos! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @drakos! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOP💪

Posted using Partiko Android