Could Be The End

This could be then end of the ever-present, infamous, derivatives bubble...

These images are from Reuters, published on Yahoo Finance a few days after the story broke. Above was screenshotted today and the below is from my hard disk and I have been saving it for reference

for today's post.

Six months ago Today...

The original charges came under RICO statutes which carry a fine of three times the amount taken in the crime. JP Morgan took out about 1.2 billion ounces of silver, and if they are fined under the original RICO charge, they would need to pay about 3.6 billion ounces of silver in fines to the U.S. government. Nobody knows what that silver is really worth today because of the crime they committed in manipulating those prices but the fine is in silver. Every day that goes by while this is litigated, the dollar amount of that fine will increase with the price of silver.

3.6 billion ounces of sliver at today's prices is $89,900,000,000

As a Result of this Information

We should be buying silver because it now has a chance to reach its real trading price. I have always held silver but never saw any real gain in price even though the dollar has become way less valuable. But now...

I have been buying up silver as the price rises. I had planned to buy gold to replace what I spent while crypto was in a slump using higher priced crypto --> cash --> gold

That makes my gold stash cheaper than what I had paid for the gold ten years ago because I am using dollars from the sale of peak BTC sales. The gold I buy today would actually be several times cheaper, per ounce, than the gold I bought ten years ago. Think about that and you will see it is true...

That plan was put on hold for now because of the story I am talking about today. Thus, I have been stocking up on silver (which has not gone up recently due to this very crime) which will not be free to rise in price as it should. Below is a photo of four kilos of pure silver purchased in the past week.

I choose plastic jars to hold this stuff because glass jars, if they were to break, would be impossible to separate from the grains of silver. It comes in plastic bags from the dealer. I like to check the weight and put it in a durable container. Each one of these has two kilos of silver in it. They will soon join the other plastic containers in a safe.

Back to JP Morgan

A few years ago, they were ordered to pay nearly a billion dollars, for propping up the worthless paper that is our Federal Reserve Note (FRN). In other words, they made silver and gold look less valuable than they really are. The FRN is just a note like any other note. If you have a mortgage, then your bank is holding a note saying you own them. They can collect the debt that you owe by presenting that note to a court of law based on the terms you signed on said note. The asset is the house!

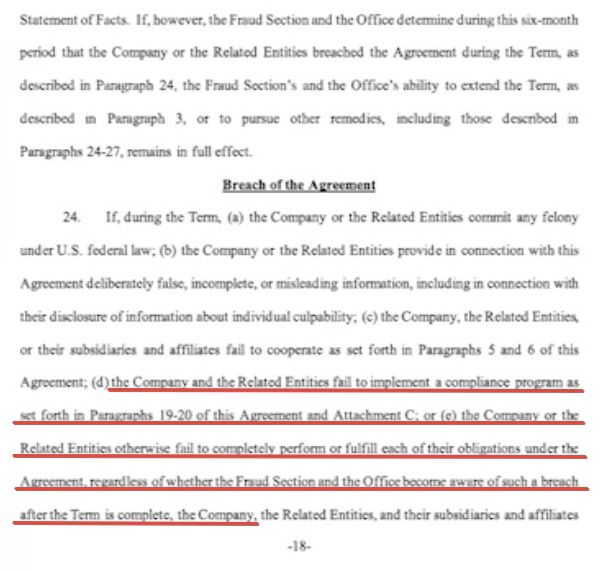

Silver is an asset. Dollars used to be worth the same as silver (silver certificates) and the paper money was like noted on the actual asset (silver). Now the dollars are just paper. Silver has value but the value of it has been manipulated by JP Morgan. They could have been prosecuted for their crime, but they signed a deferred prosecution agreement SIX MONTHS AGO TODAY. I was waiting to see if they would comply with that agreement or not. If so, they would skate and if not then they could be charged on RICO charges as I stated in the title of this post.

As of this morning, they are in "Breach of the Agreement" due to their failure to "implement a compliance program" and that could cause the case to be reopened as a RICO proceeding, dealt with by the Fraud Section of the D.O.J.. My hope is that the Fraud Department is actually prosecuting all cases, not just the ones relating to people they don't like.

I did not do any panic buying in 2020 because the price of silver and gold had not moved for years and had not begun to move until recently. This case, if brought, could cause JP Morgan and their 54 trillion in derivative holdings to come down like a stack of Argentine 1,000 peso bills. Except the fact that it would be the end of all banking as we know it, something that has been kicked down the road for many decades.

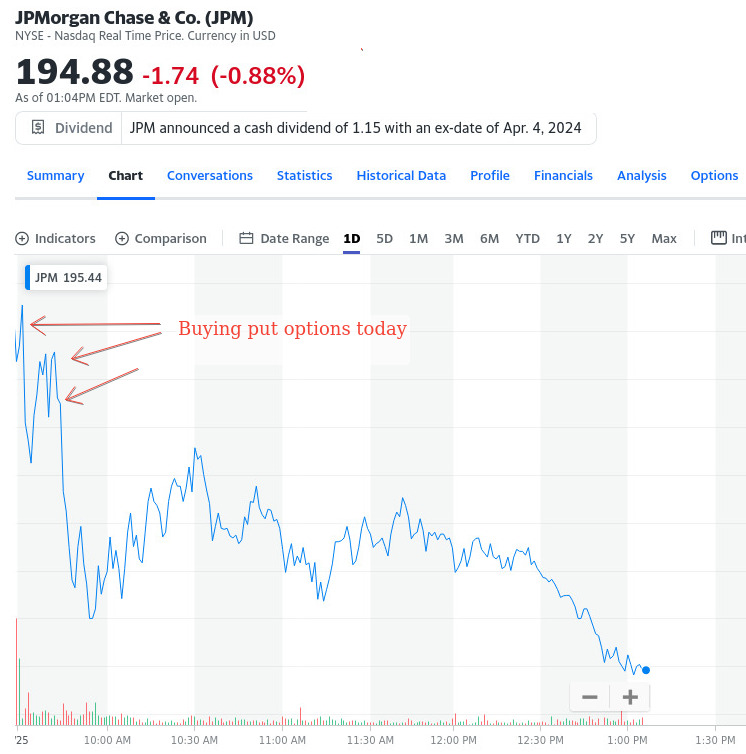

I have been shorting JPM as of the opening bell this morning and here is a view of their price as of right now.

screen shot from yahoo finance.

I am not into trading of companies, but when a clear signal of a major move comes around, I will dabble.

The resolution of this one case could be the start of the fall of the the "paper currency" system and a return to the gold based system. If you are not in gold and / or silver, you should not wait to change some of that worthless paper into a real asset. If not, what would you use to purchase things if the entire electronic and bank based commerce system were shut off?

When the metals correct, the dollar is done, for better or for worse. Remember when nickel shot up like a rocket in 2022?

3.5 Billion oz? That's about 4 years of world production of silver world wide.

Good call. Thanks for the tip. Here's my day so far...

I am holding this one for a bit and see what pans out.

It is great to see you on the site. i was wondering what happened to your metals. You are still buying I see.

Congratulations @goldbuyer! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: