The Gold/Silver Ratio is a pair that I used to enjoy trading on Oanda. Especially around 2016-2018. It is pretty much how many ounces of silver are required to purchase one ounce of gold at current market prices. Interestingly enough, there are records of this ratio all the way back to roman times, making it one of the oldest exchange rates in history.

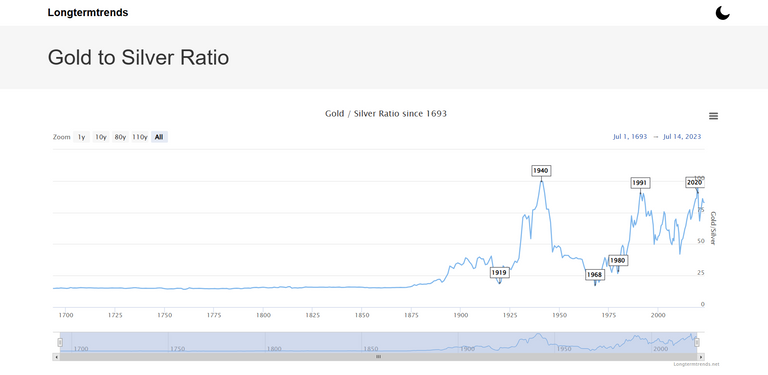

As you'd imagine, there've been some wild fluctuations in the exchange rate over the last 2,000 years or so. For instance, the Roman Empire established the ratio at 12:1. In a similar vein, the United States with the Coinage Act of 1792 set the ratio at 15:1. After the gold standard was abolished in the 1970s, however, the average of the gold/silver ratio has been around 65:1. You can see the movements since the US Coinage Act in the chart above.

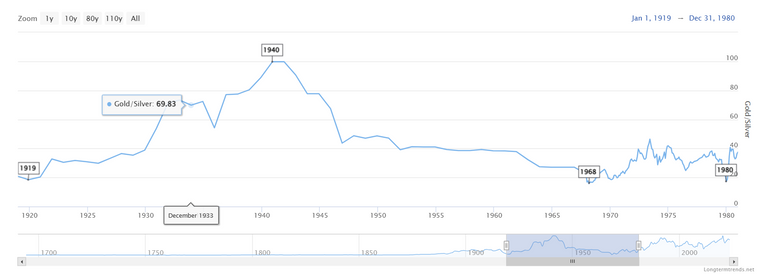

Though its average has been around 65:1, the ratio has seen highs and lows across different periods. For instance, in the history of the US over the past century, gold/silver ratio dipped into the teens on a few occasions - specifically in 1919, 1968, and 1980. Imagine gold being less than 20x the price of Silver. Crazy!

More recently, during the height of the COVID-19 pandemic in March 2020, the gold/silver ratio noticeably spiked to more than 120. Here's a screenshot from my OANDA chart. This was primarily due to the surge in gold demand as it served as a safe-haven asset in uncertain times.

Gold was around $1600 in March of 2020 while Silver was at $17. Since then, Gold moved to a high of $2070 while Silver moved to a high of $30. Comparing the percentages, that's a 29% gain for Gold and a 76% gain for Silver.

Personally, I'm going to be waiting for Gold to drop below the recent average of 60 before looking to pick up more Gold. Again, this is a relative valuation and both Gold and Silver could be undervalued or overvalued at the same time.

As for trading the Gold/Silver ratio, I'll also avoid that unless we get to extreme levels because of the costs involved in trading CFDs. Every day the position is open costs money so timing is key.

I figure the Silver/Gold Ratio will go to 10 to 1 in Phase One of the U.S. Monetary Correction, then it will go to 1 to 1 in Phase Two of the U.S. Monetary Correction, before going to 1/2 to 1 in Phase Three of the U.S. Monetary Correction...

Records are meant to be broken after all. It will definitely ruffle some feathers.

Will take advantage and swap some silver for gold if we have a big ratio change