SolarCoin co-founder Nick Gogerty and advisor Paul Johnson have published a new piece of research explaining the economic model behind SolarCoin and the broader concept of currency. SolarCoin was established in 2014 with a 40 year to goal incentivize global solar energy.

This is assumed feasible if the network value per SolarCoin can steadily remain at $10–30 USD. It is early days in the network and the thesis.

The research is a working paper entitled Network Capital: Value of Currency Protocols Bitcoin & SolarCoin cases in context.

The general thesis is that a currency is a subjective phenomenon that emerges from individuals seeking to optimize their own utility functions. This leads to the use of intermediate trade goods. Eventually these trade goods become used primarily for their level acceptance across a wide spectrum of transactional actors, a transactome.

The best currency paradoxically is the one with the lowest redemption value or traditional utility. This ultimately leads to paper or fiat currency and other information instruments.

Currency as a form of capital has 2 traits as a protocol and a medium of expression. The protocol emerges as the dominant trait with the medium having different utility. Example the USD $ protocol can be expressed in paper, metal or electronic media.

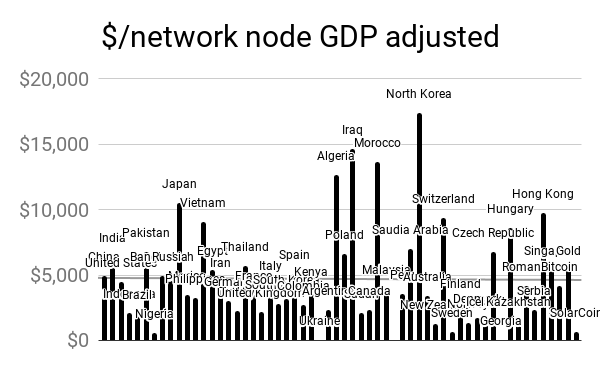

Our findings are that the transactome as measured by the estimated number of accepting participants of a protocol is a useful metric for measuring the effects of currency as an intersubjective phenomenon. Studying $16 trillion of currency assets including 50 fiat currencies, Gold, BTC and SolarCoin leads to a few interesting conclusions.