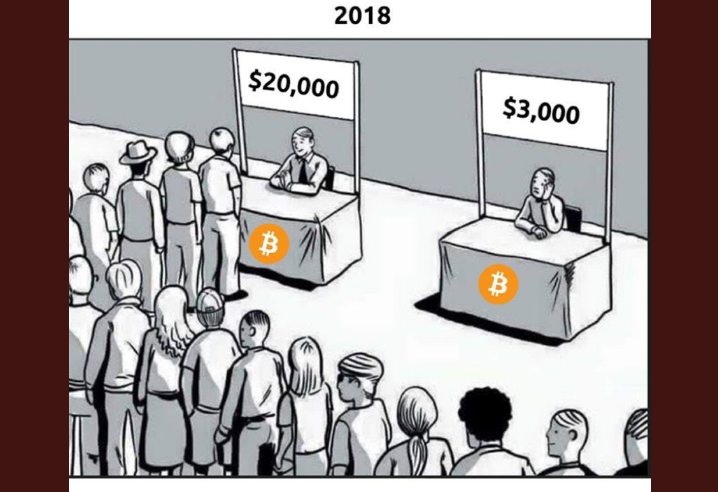

Literally, every cryptocurrencies undergoes this circle.

People don't seems to buy in when price is low but will prefer to all in when price are high.

[image source](https://twitter.com/mcshane_writes/status/1586368122063200256?s=20&t=mhA8Tlj_23VcS0FXyPcd2Q)

True, people follow people..

And the basic rules should be they should buy when it is low and sell when it is high.

Users tend to have a 'perceived value' placed on any type of investment; in stocks/options we can call that the intrensic value. For crypto, users will tend not to buy the lower priced ones for fear that the lower priced one is lower quality - meaning the project is less reliable, or the platform it represents is less meaningful, and will prefer to buy fractional values of the higher priced ones for the opposite reason.

However, the 'value based' mindset when evaluating cryptocurrency is one of the biggest mistakes any one can make. You need to actually DO the research on the actual platform and buy the token when it's low, so that you can hold and profit when the token begins to be used. Otherwise, it's pointless.

Secondly, regardless of what you buy, the token has absoutely no value until switched to fiat currency to begin with. You may 'invest' 20,000 in XYZ token, but until you convert that to something you can use to pay for stuff (like bitcoin, eth or usdc/usd), then you really have NO investment at all. There is no 'money tied up' or 'money in reserve', owning UTILITY tokens means doing a direct donation to the owner of the utility token, in HOPES for a return when the value of the token increases, and you can swap it for something that will give you actual value.

That's the thing that most poeple forget.