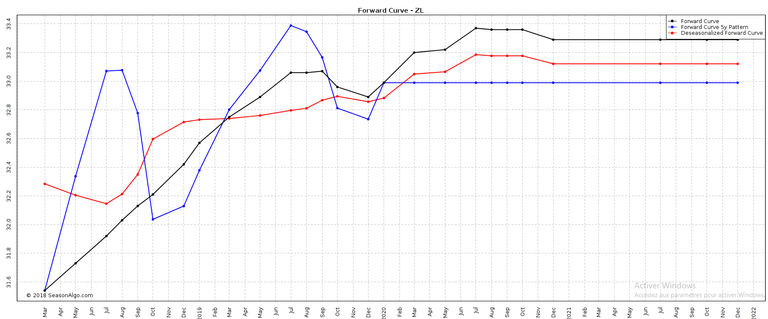

There is a sell opportunity in the ZL soybean oil futures. We can use a calendar spread to reduce our margin requirement & the volatility & $ exposure compared to the outright contract. Plus we can add odds to the trade working in our direction profiting from cost of carry that prices further expiring contracts higher than closer to expiration contracts ZL is in normal backwardation as seen in the forward curve of the product:

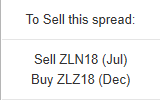

In order to open this spread:

The price action of the spread the 6 last years is quite repetitive & we can expect a repeat this year :

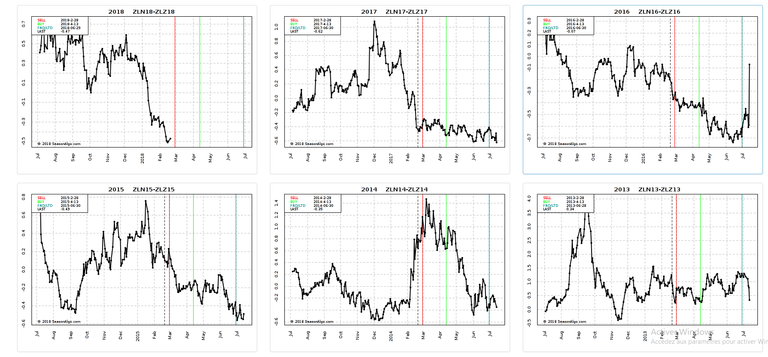

Here the 5 year & the 15 year cycle seasonality, see how they are correlated with each other & with current price which shows a strong seasonal tendency:

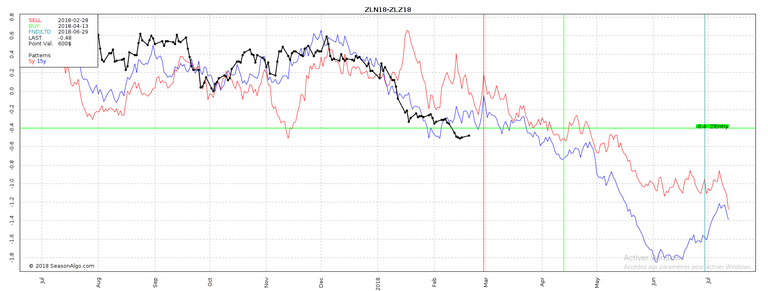

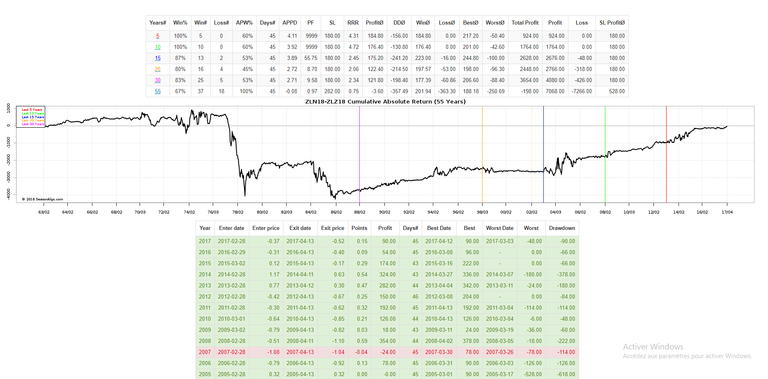

This is the backtest of the trade, it has a high success rate, expected profit per spread is around 200$:

Concerning the price action & volume analysis, we'll use the spot contract as it is very highly correlated to the spread, we can see sell volume imbalances, a bear flag in a downtrend & continued distribution in the cumulative delta:

Lastly the COT analysis shows that commercials & producers are still short despite oversold conditions, we can then expect continuation lower:

Sort: Trending