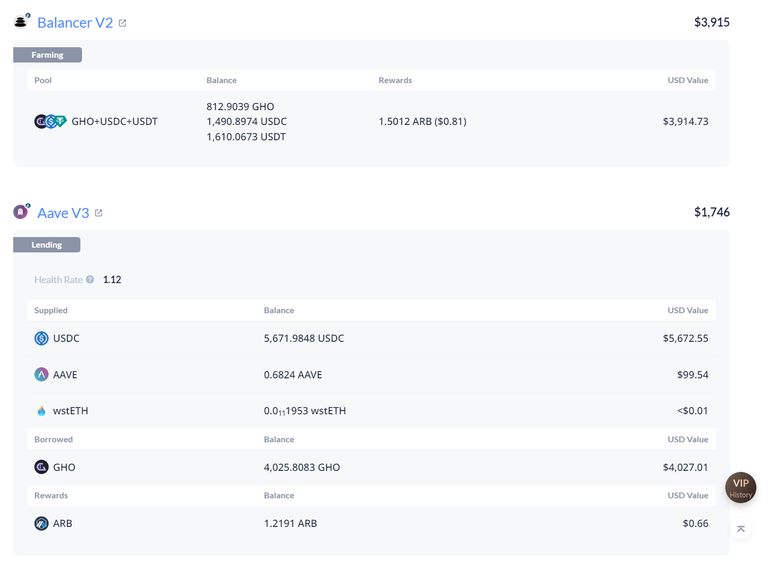

Set up a position where I am farming ARB using AAVE and Balancer as they have a ARB distribution currently if you borrow GHO AAVEs stable coin and then you can take that GHO and deposit it in the GHO/USDC/USDT LP triple pool with the three stables on Balancer and earn about 10% -15% in fees mostly in ARB units and some of the ARB units will need to be sold to cover the interest cost in excess of the deposit interest. With the market uncertainty I have started to build some more market neutral and defensive positions that are farming airdrops and other things like that where I can stack various lending protocols or other defi platforms together to get multiple things at once such as multiple airdrops like I am doing with Scroll Marks. I started depositing and then borrowing eth on scroll on AAVE to start earning marks there then the eth went to RHO finance where I deposited it in to Stakestone ETH on RHO which earns a few different airdrops, then borrowed against the STONE to deposit eth on Stargate at 7-10% which makes up for the extra costs on some of the borrowing platforms where you need to pay a little bit in order to farm the airdrop, just make sure your earnings are covering it.

Right now I have set up a much more stable portfolio outside Splinterlands which will be good if the market takes a tumble and then I can buy back in but also will be fine if it keeps producing cash flow in ARB units as I want to acquire a larger position in ARB. I have added some additional stability to part of my gaming funding portfolio. Hopefully I am right about ARB and it will take off toward all time highs again which would be nice to get around 2 dollars again for ARB. I will have many units from locked up ARB expiring over the next 40 weeks which will become free ARB for me as well as part of Dolomites airdrop for ARB.

My strategy with cash flow, airdrops and Splinterlands. What my strategy has been lately is I sold a bunch of assets a while ago to make a portfolio that would produce passive income not related to SPL assets and I have that now generating enough to either keep reinvesting in that or if its a good time to buy in SPL in a certain asset or token then I would divert some of the cash flow back to SPL. Also I am using some of the cash flow from SPL to fund it and taking out some as well to keep building the outside portfolio as well. So overall my strategy is take more out that I am putting in for now until I recover my cost basis and then once that happens I can slow my withdrawals down to much less. Also will slow down once I get my account to its optimal size.