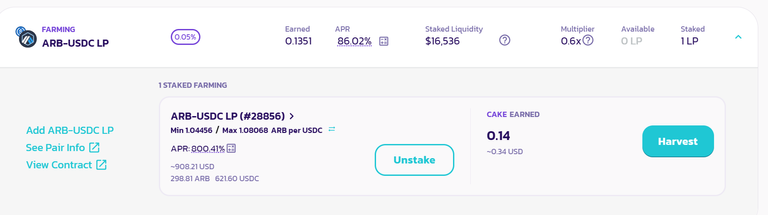

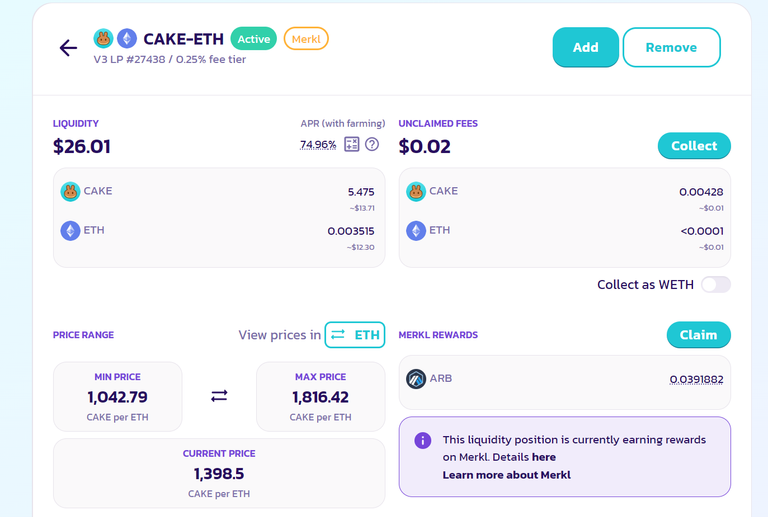

Have been farming CAKE using the ARB/USDC LP pair and using a tighter 1.6% on each side range for the liquidity to be provided as the pair has been stable lately around 1 dollar for Arb with some minor fluctuations. Having concentrated liquidity works well when the pair is not volatile at the moment. I have been borrowing the USDC from my BTC on Compound and putting it in tight range liquidity positions while I am there to keep a eye and adjust the position if necessary and the fees on Arb are very small so it is pretty easy to earn more than it costs to rebalance if you can hold off doing it for a half hour or so. Eventually if I can keep making this type of strategy work well I will be using much more money so that I can have less time exposed to the market and collect more fees in a short period of time reducing my risk of having a move in prices that causes impermanent loss. Also will be adding the CAKE profits accrued which usually is the largest part of the profit in farming on pancake swap and that pair has Arbitrum farming on Merkle if you do not stake it to farm CAKE it Farms ARB on Merkle. All the farming rewards are deposited now in this LP pair with a Wide range strategy getting it a couple hundred percent on the CAKE/ETH LP pair in fees and ARB farming. I just started doing this so do not have a large balance in the CAKE/ETH farm yet but just the profits from the other day doing the same thing and will add any profits I have from managing various positions today depending on the CAKE emissions and multiplier I will choose the one that gives me the highest APR reliably and is not in a volitile time currently. Also will be looking at the stable coin pairs as some of them offer a very high APR for stables and are much safer than many of the LPS on SPL that are much more volitle and since SPS is not very bullish lately it would be killing your returns with impermanent loss. If any pair for SPL use the USDC DEC LP as that offers usually a high APR for a 5-20% range for prices and there is sufficient volume coming though the pair as people use that to cash out there earnings to get it off of hive and into other digital assets and pay the 1% swap fee. Might as well get a piece of that action using my excess land grain to get more and more DEC into the LP as well as add enough to the grain market to cover the volume I sent though daily so I essentially don't pay the fees as my portion would rebate me those fees though the fees earned in the LP. Eventually will only be adding to the lps for DEC as they are much more stable and offer higher ROIs than the SPS LPs. DEC is harder to get in the game than SPS so having a LP that gives you much higher APRs than inflation in the game will end up advancing your account faster than people just staking and getting the minimum inflation. You need to participate in activities that minimize the risks and maximize the ROI so that you are in the top half of players growing there pies as there pies grow when others are losing equally as it is basically a zero sum game you want to just make sure you get enough outsized returns compared to just staking than other players. Bringing a good portion of your earnings and putting them in LPS that produce high APRs for in game assets as well as non SPL pairs like the ARB/USDC pair or ETH/USDC pair offer higher returns than any of the LPs in SPL since they nerfed the rewards so having a lot of SPL liquidity may be risky if its in the SPS pools as SPS would have killed your returns lately and basically all this year as prices have been on a constant decline which would make your impermanent loss way more and the rewards you get constantly worth less than they were lowering the ROI. There will continue to be downward presure on SPS as long as the DAO is not bringing in its own cash flow that can cover its expenses and the market cap will keep dwindling as well unless they start taking more action and increasing reserves in non SPL assets to be able to run as a DAO even without SPL. It would deff take a huge hit in value but with outside assets it could vote to continue to be a DAO and manage those assets for the benefit of the members growing these assets and distribute the cash flow by deploying them in various defi protocols. Since there is a risk of SPL not being able to continue forever it may be prudent to ensure the DAO can change purposes to a investment DAO or something that would live on.

As the 26 dollars in my CAKE position grows to a larger amount as I deposit additional CAKE from farming into the LP it will produce more fees in CAKE and ETH as well as collect its ARB airdrop in larger amounts each time its increased and eventually it will be a significant amount if I can continue to get returns in the 500-1000% range for short periods of time though out the day when I am able to monitor and adjust the position. Depending on how well it goes I will raise the position size up to 10K next and 10X the rewards that I would get in the same time once I am confident in the strategy being manageable profitably over a longer period of time. All earnings will be put in the CAKE/ETH LP for now and the only earnings I will take out are the earnings from the CAKE LP in order to grow the position and cash flow faster.

The income from the non correlated pairs will help fund SPL buys when they are at really low prices like right now without being under pressure from price declines in SPS and will make building stronger bots that can survive in wild and build SB and GLAD decks to put in my guild owned accounts and place scholars on them that are new and don't have access to SB and GLAD decks for a split.

Congratulations @hive-178951! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 50 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: