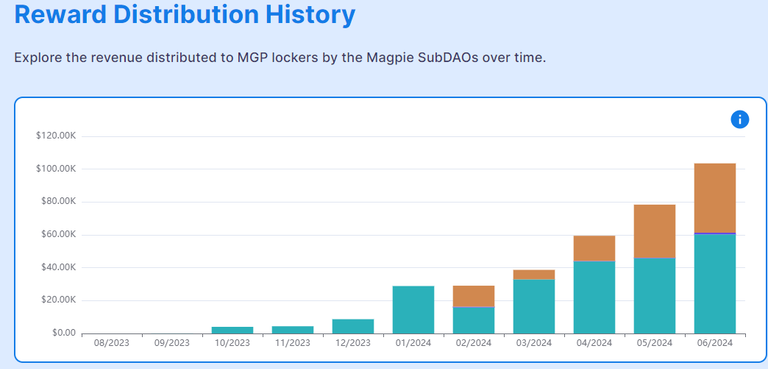

Magpie is a DAO that is made up of various sub daos focusing on providing liquidity for protocals that require locking of assets for say a year or so like Radient to get the highest yields in fees and required a lock of 1 year for both airdrops, first arb, then now a current drop of RDNT as well as other incentives in ARB and airdrop points. Radpie allows you to get the yield from RDNT while not locking up your RDNT for a year and having a shorter vesting time for RDNT earned and penpie for Pendle does something similar as does Cakepie for Pancakeswap. These sub daos have allocations that are given to MagPie DAO the master DAO and it basically receives passive income from the subdaos under management in the form of the subdao units as well as the treasury retains some units as well to grow. There are also 3 new listings for popular defi platforms coming soon and after that likely more listings if the other three go as well as the first three are going as you can see by the recent revenue growth in staking rewards from locking up MGP for 60 days at a time. I will also be opening a LP position in MGP on pancake swap on Arbitrum to get fees in MGP and ETH as well as Merkel arb airdrop rewards and cake staking rewards for staking the lp position in the Cake earning section. Both the Merkel arb dao units and cake dao units will be distributed at the same time so you want to make sure to stake as well so you can claim both. You may need to goto merkles website to claim some pools but its a good idea to check that anyway to make sure you have no pending fees to be collected. May also use camelot depending on the grail farm rewards as well as Merkle and the variety of advanced management strategies available. If there are no strategies I will use DEFI Edge to make my own ALO rebalancing strategy to auto adjust when the lp needs to be rebalanced. I also may use Steer as well to create vaults for different strategies that are better in certain market conditions etc and add a mgmt fee in case any others decide to deposit in the vault after my performance with the strategy has been documented for long enough. If my LP strategies perform well on pairs like DEC-USDC then a vault will be created like the steer vault for SPS but with a different strategy for usdc-dec and take a smaller performance fee as well as gas fees will be deducted and there will be a option to receive rewards on HIVE and if the dec or sps is used on my land or staked to a account in my guild then there will be no fees. There are some interesting platforms that allow you to make markets more efficiently and employ strategies over dexs that traditionally do not have any automation or auto rebalance etc. These pools can perform with a lot less management as the constant rebalances are triggered based on criteria set algorithmically. You can also have ranges of liquidity and fee tiers so that you can place liquidity in the tier based on market conditions and adjust weighting etc as they change.

Sort: Trending

[-]

hive-178951 (48) 9 months ago

[-]

splinterboost (60) 9 months ago