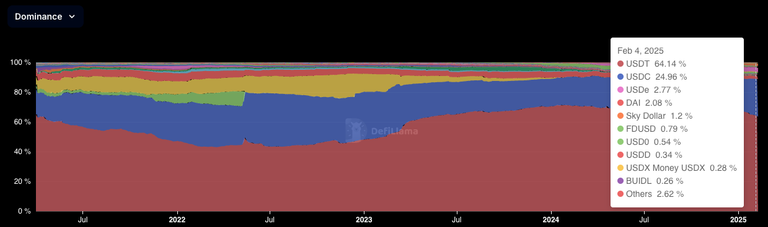

Many traders refer to USDT Dominance as a major indicator to see the middle and long-term crypto market direction.

This USDT dominance has been used for several years as USDT has been solely the most dominant stable coin and USDT has been tied to Binance closely.

Now it is time to consider the possibility that USDT dominance is a less reliable indicator as the relevant landscape is changing. This shift in the stablecoin landscape reflects possible changes in the crypto, where new players and technologies are challenging legacy rules and players.

USDC dominance is growing again after the FTX collapse. And this growth seems to be very organic as many institutions have cooperated with the issuer of USDC, Circle, and USDC has had the reputation as the most reliable and transparent stable coin backed by real USD.

And USDC has had a close relationship with the Solana chain, with recent USDC dominance on Solana chain accounting for 79.55%.

And Solana is rising as a reliable, transparent and absolutely high-performance chain, not just as an "Ethereum Killer". Most Solana users and developers do not care about the call-sign "Ethereum Killer".

Solana has boosted many sectors like DEX, easy-to-make memecoins, fast-changing and high-yield CLMM pools that shared much profit with users, and all this development and revolution has been along with stablecoin USDC.

Until 2~3 years ago, Ethereum was the sole strong leader of DeFi and liquidity hub. But now it doesn't have that sort of unrivaled strength.

In the Ethereum chain, USDT has 55% of Dominance. As Solana and other chains grow organically with reliable development and smart users and investors, USDT also doesn't have the overwhelming leader position in Stablecoin.