Staking cryptocurrency is a fun, easiest, and quite profitable way to grow your cryptocurrency holdings. Staking, normally refers to POS consensus mechanism where a cryptocurrency blockchain, runs by people running nodes with collateral on the line to keep them honest. In layman's terms users lock up coins, for a period of time, and earn interest on those coins. So while you can’t actually “Stake” stablecoins by the proper definition, you can lock them up and earn interest on them in a very low risk high APR way. This article dives into the 2 best protocols for earning interest on your locked up coins. I have been using Crypto Lending platforms for quite some time now, so I wanted to share some I learned. Including the Decentralized Finance (DeFi) platforms as well. If you haven’t heard of Crypto Lending platforms before, it’s basically decentralized bank where you can either borrow cryptocurrencies against collateral or lend them out and earn interest. You never need to apply, or talk with a banker, it’s all done via smart contracts. Cryptocurrencies typically/usually accepted are Bitcoin, Ethereum and even Stable coins. The most profitable platforms and stablecoins I found are Compound finance and Dy/Dx Exchange for DAI and USDC.

Stable Coin Passive Income

If you just started cryptocurrency and you’re still reluctant on really investing in crypto because of the volatility, there are still high yielding ways to get involved and earn passive decentralized income. The best way to go about this is to use Stable Coins on Decentralized Finance (DeFi) applications. It’s quite simple.

- Convert your USD to Stable Coins such as; DAI or USDC (article better explaining these stablecoins) The short summary is that with DAI, it’s an economically incentivized decentralized stablecoin. So its essentially trustless, but you need to trust the smart contract as well as the economics and market makers to keep the system sufficiently collateralized. For USDC, its a trust based system. So if you use USDC you are trusting reputable company Circle that every USDC is backed by a USD in a bank account. USDC is a significant improvement from largest crypto stablecoin USDTStablecoins are pretty simple, the goal is to put dollars on the blockchain. So they are pegged tokens that are suppose to trade 1:1($1 = 1 Stable Coin) with USD, but the demand of the market still fluctuates the price of the coin. Like for example, at the time of writing DAI is currently trading at $0.99 and has been below $1 for quite some time now.

- Deposit your Stable Coins to a Decentralized Finance (DeFi) . For passive income its as easy as just depositing and starting to instantly earn interes. That Is all you have to do. Similar to MakerDAO’s DAI, the system is mostly trustless, but you still need to trust the contract as well as the economics and market makers to keep the system liquid.

Comparing The Platforms

There are a number of platforms where you can trade Stable Coins. Because we’re aiming to determine the best way to earn interest, we will only be comparing the top Decentralized Finance (DeFi) platforms. Namely, Compound.Finance, Dy/Dx Exchange and DDEX

| Compound.Finance | Dy/Dx | |

| Stable Coins Accepted | DAI, USDC | DAI, USDC |

| Major Crypto Accepted | ETH, BAT, REP, ZRX, | DAI, USDC, ETH |

| Interest Rates (As of August 2019) | 0.07 - 7.47% | 0.2%-25% range historic 10% APR |

| Compounding | Daily | Daily |

| Lock In | No | No |

| Decentralized | Yes | Yes |

| Minimum Amt. | No | No |

| Security | Own Wallet | Own Wallet |

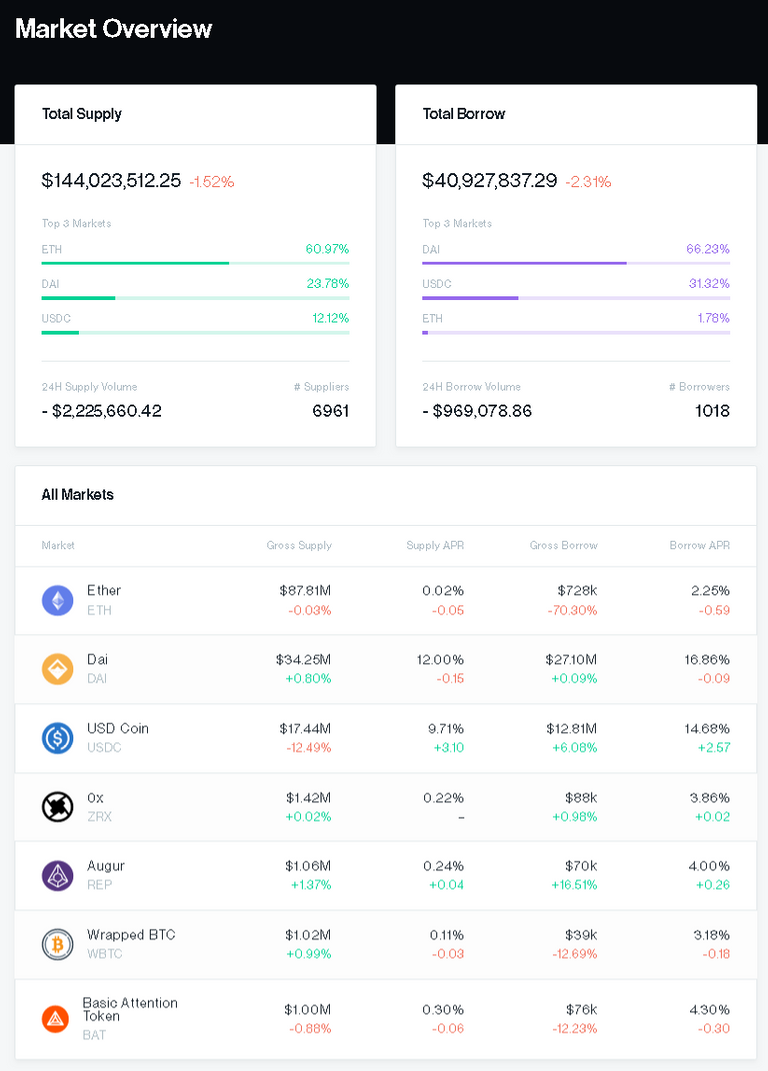

Compound.Finance

Is deployed on the Ethereum network which means that the platform is managed by Smart Contracts. Compound.Finance is considered the most decentralized platform to date. That being the case, it is safe to say that it is arguably the most secure and trustworthy platform. For the risk and liquidity it's definitely one of the best ways to earn interest on your stable coins

Compound currently accepts DAI - Maker Dao as well as USDC as stablecoins for borrowing and lending. You can also use Ethereum and some other quality ERC20 tokens, but the most profitable is by far lending out stablecoins.

-

- Pros:

- Decentralized through Smart Contracts

- Dynamic real time changes on interest rate based on supply and demand.

- Daily compounding interest

- Cons:

- Not significant

- Pros:

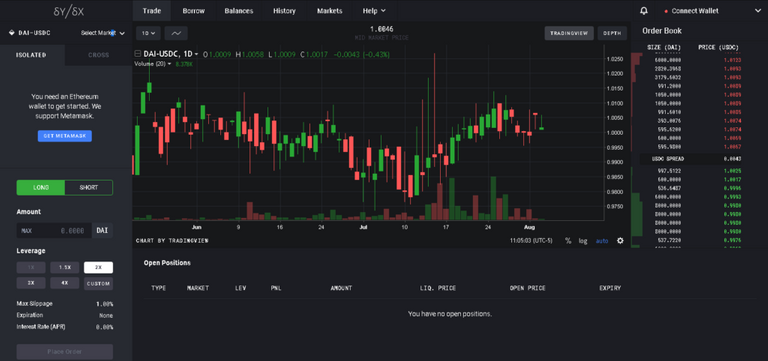

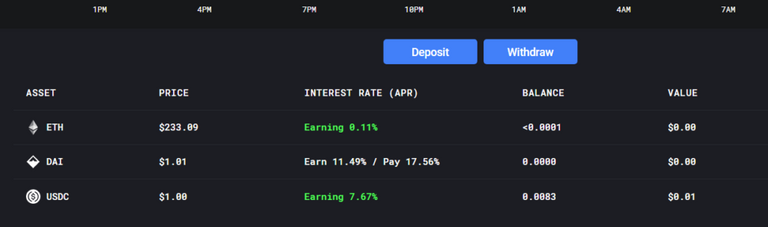

Dy/Dx

Dy/Dx Exchange is also a platform deployed through the Ethereum Network, and powered by open source Smart Contracts. Dy/DX primarily a (DEXs Decentralized Exchange. Dy/Dx differs in that its focused more on advanced trading features for margin trading, leverage, and eventually derivatives. But, in order to support this advanced margin trading capabilities dy/dx also has a money market account very similar to compound.finance. Borrowing and lending is very much the same, deposit and instantly start earning interest.

Why is this important?

Margin trading and derivatives are essential parts of trading, lending and borrowing system that eventually benefit the entire crypto ecosystem.

Current platforms rely heavily on counterparties and intermediaries which was supposed to add another layer of security however paradoxical to the most basic essence of cryptocurrency, which should be removing third parties to increase security, not the other way around. Dy/Dx solved this issue by giving everyone, everywhere access to high quality financial tools directly from their wallet to the blockchain.

-

-

- Pros: Decentralized through open Smart Contracts, Daily compounding

- Cons: Historically lower interest and liquidity than compound.finance

-

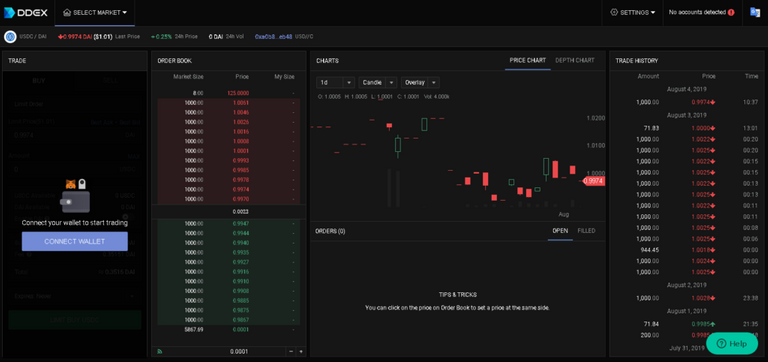

DDEX

We were very excited to hear that DDEX will be launching a margin trading platform on its popular decentralized exchange platform. However, unlike Dy/Dx DDEX plans on pulling from compound.finance for borrowing and lending.

DDEX’s fast Hydro protocol along with using highly liquid compound.finance pool could make for an excellent combination.

Which Is the Winner?

Easy, use whichever one is paying more. Both contracts are highly audited and tested out in the Ethereum network with millions of dollars on the line. The simple fact that they are still working now after being a literal money honeypot for hackers over the last 6 months is a good enough reason to trust that they will continue to be safe in the future. Afterall, if you hold ETH, you are already exposed to these platforms as if 1 gets hacked, the ETH price is going to tank hard so its in everyone's interest to keep these protocols safe and functioning. The potential for DeFi is huge and we are always on the lookout for new and innovative platforms that utilise Smart Contract technology. Can’t wait for the next generation products in this space that offer more than just lending and borrowing!

The Rubik's Cube solver can fix 2x2 cubes and Pyraminx puzzles too. Set the scrambled configuration and let the program find the solution in seconds.

Congratulations @topstaking! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!