Everyone wants to find that magic formula that will predict the price of Crypto in the future. An awesome algorithm that finds hidden patterns in trading prices, volumes and profits. With the move in big data and advancements in machine learning is all this becoming a reality?

I was analysing the price of STEEM, obviously with the hope of hitting the jackpot. Sure why else would I spend hours pouring over market data. Unfortuanlly I did not find that magic formula, however I did find a correlation in the data.

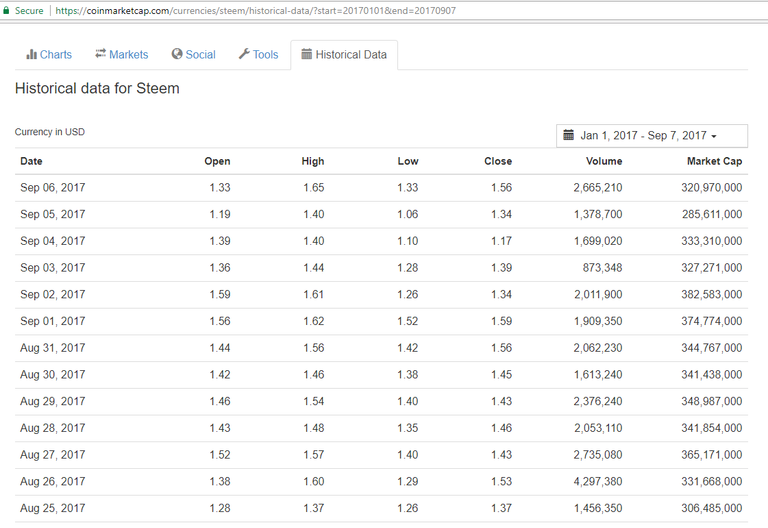

To carry out this analysis I used Power BI to connect to CoinMarketCap.com and I imported the historic data.

To the model of data I added the following calculations using DAX (Data Analysis eXpressions)

% Daily Change in Volume

% Daily Change in Market Cap

% Daily Change in Spread

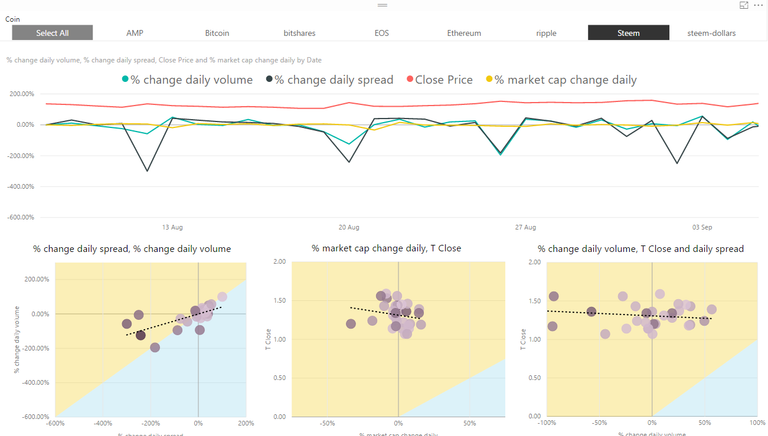

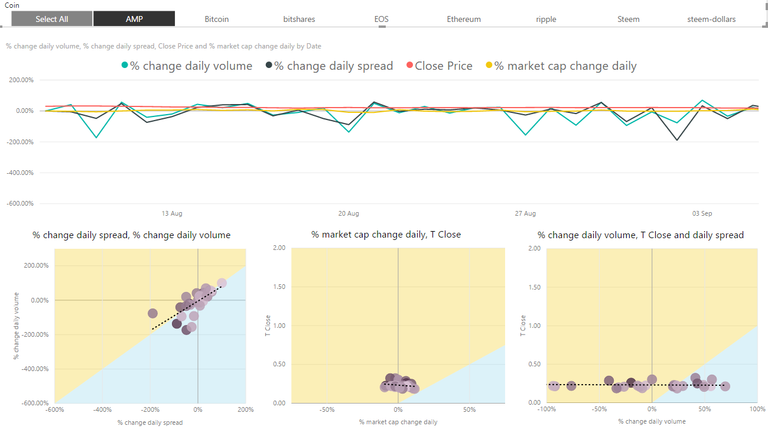

And I then plotted the values to revile the following

The charts above only contain data for the dates 8th Aug to 6th Sept for STEEM. I did carry out the analysis on a much larger date range, but to see the graphs properly I have filtered this to a smaller date set.

What I found interesting is the correlation between the % change in daily volume and the % change in daily spread. As the daily volume decreases the change in spread also decreases and with higher volume the spread increases.

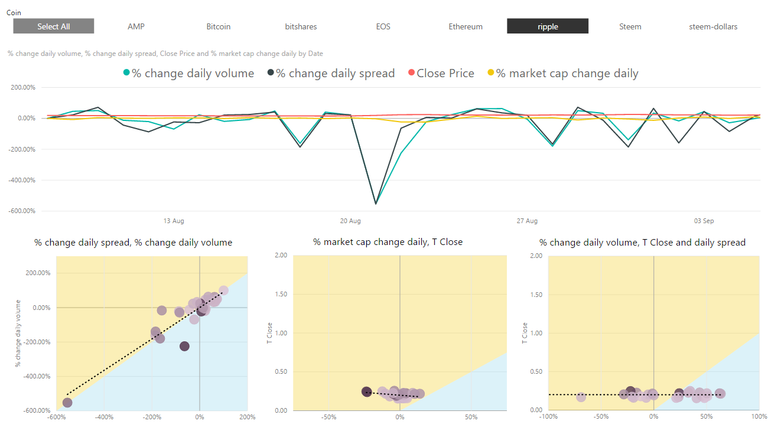

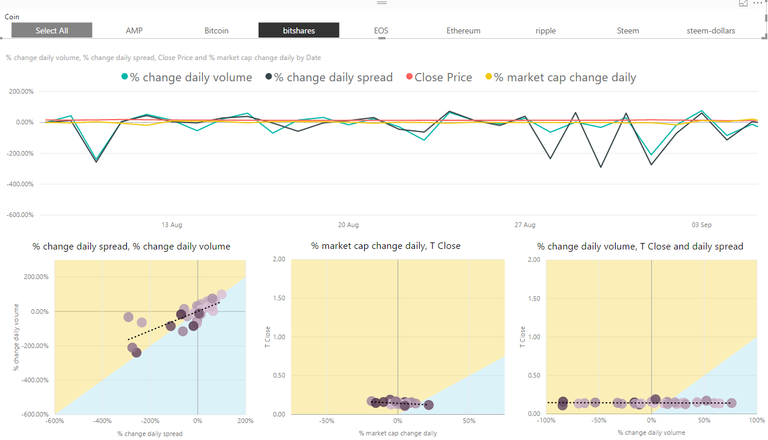

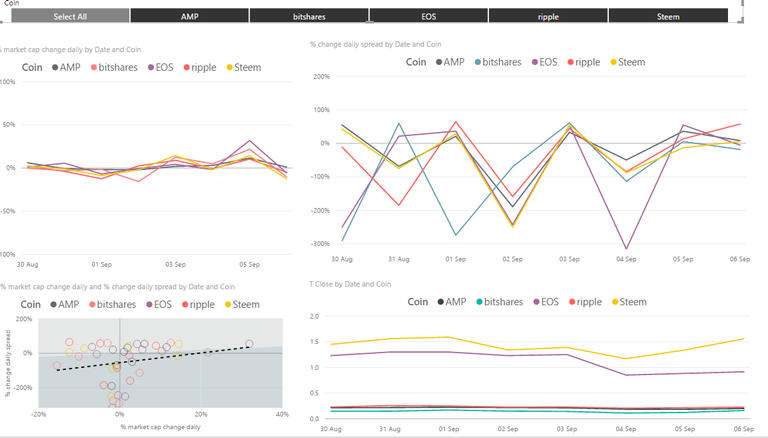

I carried out the same analysis for a number of coins to see if this holds true for them all

Ripple

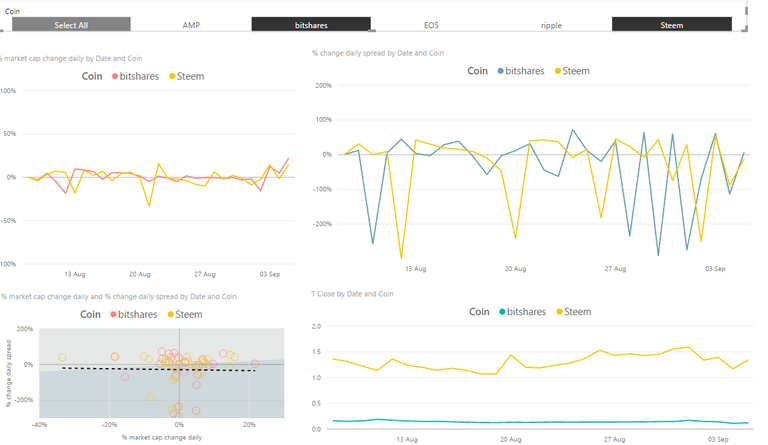

Bitshares

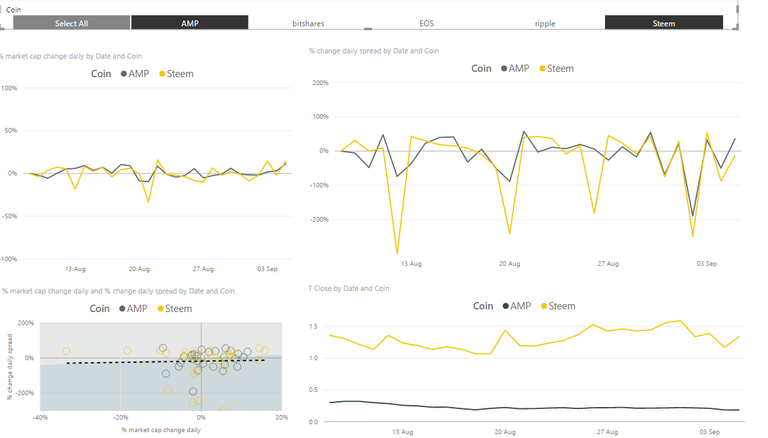

AMP

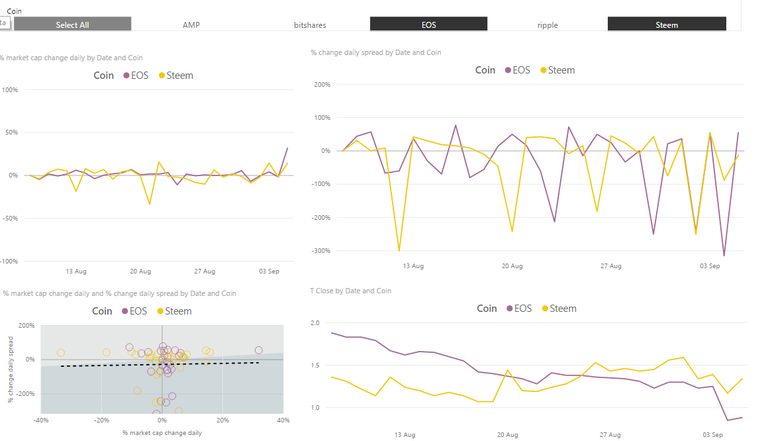

And EOS

For each coin I am finding a positive correlation, so my findings holds true. The next question I asked of the data was ‘Is there a correlation between coins on these metrics?'

First I looked at STEEM v’s XRP RIPPLE

Then STEEM and BITSHARES

STEEM and AMP

STEEM and EOS

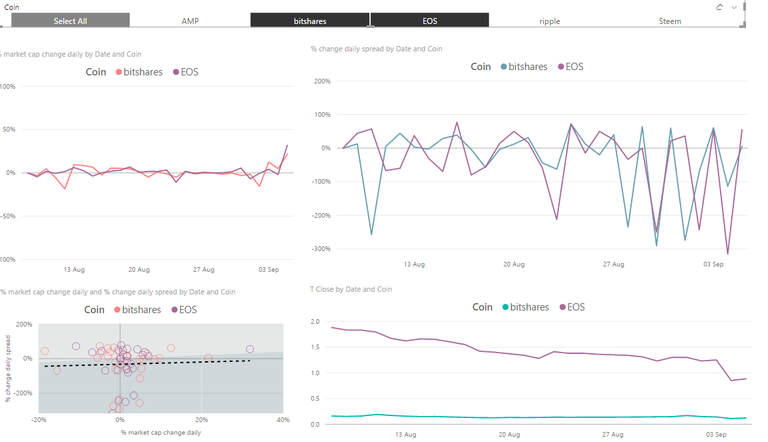

After this I also looked at the other pairs, one of which was EOS and BITSHARES

What looks most interesting in these charts in the % movement from the 1st of Sept, as many of these charts seem to align, except Bitshares which also aligns on the 3rd Sept.

What has happened in the crypto market to make this align up so well?

Which chart did you find of most interest?

What patterns can you spot in the data?

What would be your next step with this data and the analysis?

Please comment below as I would love to hear your thoughts.

The only correlation that I have positively found is the correlation between the % change in daily volume and the % change in daily spread. Have you found any correlations in crypto market data?

I am part of a Steemit Business Intelligence community. We all post under the tag #BIsteemit. If you have an analysis you would like carried out on Steemit data, please do contact me or any of the #bisteemit team and we will do our best to help you...

you can find #bisteemit on discord https://discordapp.com/invite/JN7Yv7j

Very interesting analysis. Didnt know about the BI group on

I think the reason they line up so well is due to fluctuations in the price of BTC. Thousands of traders are shorting BTC. I think those matching dips all correspond BTC either going up or down more than a couple %.

The $ value of crypto must be reassessed against BTC/ALT

I know nearly nothing on the subject but I was told many of the cryptos are traded using BTC (bitcoin) so that the price of BTC and sentiment has large effects on other cryptos. Like many market sectors they all seem to move together more often than not (how's that for high level analysis!)

I would like to see that analysis.

This post has received a 3.59 % upvote from @buildawhale thanks to: @clumsysilverdad. Send 0.100 or more SBD to @buildawhale with a post link in the memo field to bid on the next vote.

Steem WitnessTo support our curation initiative, please vote on my owner, @themarkymark, as a

This pretty good. I think you might be better off doing historical volatility. You will be comparing apples to apple (Sigma). Another thing is that you missed BTC. It's a gateway currency to other cryptos. If you haven't seen this CryptoCompare, you might want to. It shows the percentage of fiat to the crypto. I believe the dislocation from bitshares was caused by this weekends ruling by the Chinese govt. to ban new ICOs. Openledger does a huge trade in Yuan/BTS.

Interesting read, didn't know about this tag. Have been seriously into this 25 years ago, now i am wiser :-)

Very interesting analysis... I didn't even realize there was a common tag for these kinds of analyses; learn something new every day-- thanks!

You are most welcome

Nice analysis. Last week all the coins hit a low due to chinese ICO ban and then rebounded, so the volume and price movements might have been similar. We may need a different time period without a major new affecting the market to see if we get same results.

Very nice analysis. There are all kinds of meanings to be discovered in patterns. Prediction, one of the holy grails. I would be interested in where else you might go with this. Thanks for sharing!