How are Taxes Imposed

There is a common saying that there is nothing more certain in life than death and taxes. Since cryptocurrency started to gain prominence, the state starts to view such transactions as possible source of revenue and there is no better revenue to the state than the imposition of taxes.

In many countries, the appreciation of an investment which is essentially classified as capital gains are taxable. Currently there are three categories of 'income' that is taxable and it can be classified as follows:

- currency (fiat)

- asset

- asset representing currency (cryptocurrency)

In some countries such as the United States and other jurisdiction, they have classified cryptos such as Bitcoin (BTC) as assets which are taxable. Inland Revenue Services in 2014 declared cryptos as properties.

However, the position of whether cryptos can be taxed and the manner of taxing it is quite unclear. In many cases, appreciation of an investment in the stock market (capital gain) in Japan is taxable and the rate is 20%. However, a different scale applies to cryptocurrencies whereby the earning of the individual is taken into account, hence the more then individual earns the more he can be taxed. Such uncertainty, results in many investors fearing for the worst.

In Japan cryptocurrency is treated as miscellaneous income and therefore it is taxable. Cryptocurrencies are recognised through an act of Parliament called Payment Services Act. So the recognition of a specific category renders such cryptos taxable. However the same cannot be said about countries such as Malaysia.

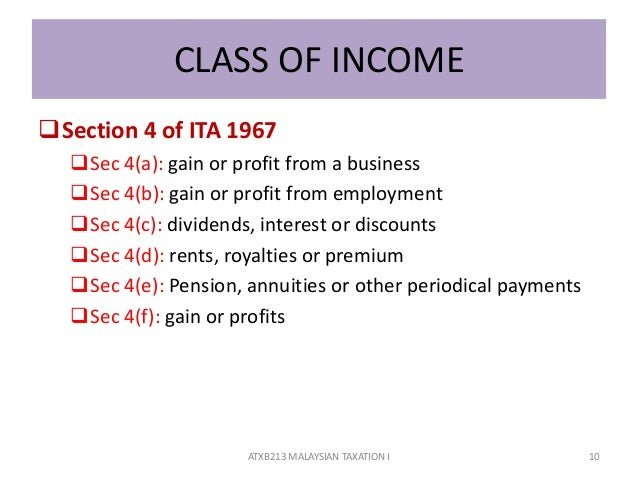

Income Tax Act in Malaysia

One would only be liable if it comes within the purview of income tax act. So taking a cursory view of the Income Tax Act and the class of chargeable income can be seen in section 4 of the Income Tax Act

- Subject to this Act, the income upon which tax is chargeable

under this Act is income in respect of—

(a) gains or profits from a business, for whatever period

of time carried on;

(b) gains or profits from an employment;

(c) dividends, interest or discounts;

(d) rents, royalties or premiums;

(e) pensions, annuities or other periodical payments not

falling under any of the foregoing paragraphs;

(f) gains or profits not falling under any of the foregoing

paragraphs.

The only possible class to categorise a capital appreciation for cryptocurrency must fall under class (f) and it reads,

'gains or profits not falling under any of the foregoing paragraphs'

However this interpretation is dubious because for there to be appreciation, there must be a value attached to the subject.

Malaysia through its central bank has on numerous occasion stressed the cryptos are not legal tender in Malaysia.

“The public is reminded that digital currencies are not legal tender in Malaysia,” the statement added.

Source

If no status as been affixed to the status of cryptos in Malaysia, any increase in its value has no bearing on it. Therefore it cannot be deemed as 'gains' or 'profits' within the context of section 4. So there are two ways to make cryptos fall within the definition of section 4:

i) The case on whether cryptos has value can be determine by court (judge made laws); or

ii) Cryptos can be affixed with a value through legislation just like how many jurisdictions such as South Korea and Japan has done.

There are pros and cons in not having proper legal framework that facilitates imposition of taxes.

- If taxes cannot be imposed, the 'asset' is not recognised. Therefore it is not taken into account in determining the worth and value of the company or individual.

- Companies cannot buy and purchase cryptos because there is no basis of categorising such 'assets'

- If taxes cannot be imposed, parties can continue to accumulate such 'assets' without being made liable to pay anything for it. But there is still the need for disclosure.

But what evidence is there that any of these laws, regulations, acts, and other legislation applies to anyone who doesn't give consent? That's the big question.

Very Interesting. Thanks for sharing. They sure suk-o-matic our living souls in taxes.

Funny comic strip.