In my last technical analysis report, I discussed briefly the importance of using the logarithmic scale as opposed to sole reliance on the arithmetic scale. This distinction is especially critical for achieving the proper context in cryptocurrency analysis due to the fact that digital currencies make pronounced leaps in valuation.

(Last article here -- https://steemit.com/steem/@bullishmoney/don-t-buy-the-bearish-hype-steem-is-far-from-over)

Additionally, the logarithmic scale can also help us understand "real-time" value as opposed to historical value. Many investors, irrespective of their asset(s) of choice, will determine investment valuation based on past historical data. Typically, this means an earnings-based performance metric. I will show, however, that such metrics are poor indicators of true, or present value.

The Past is the Past

When watching any mainstream business news network, we are inundated with assertions that Apple stock is "undervalued." We are told this is the case because of its price-earnings, or P/E ratio. That is, for each share of Apple stock, it contributes more dollars to the bottom line than do other companies' shares.

It sounds quite reasonable, doesn't it? But then you have to ask yourself why investors are actually leaving Apple stock en masse. The long-term volume trend, whether you approach it arithmetically or logarithmically, is negative. If the consumer tech giant is so undervalued, why aren't astute investors picking it up, and encouraging others to do the same?

But more importantly, past performance doesn't establish future guidance. We see the same mistake in sports broadcasting. Because so-and-so player ran for so-and-so yards, we assume that they will put up similar figures next season. That may or may not be true. To get a better idea, I'd like to know how old the player is. Then, I'd like to see some injury reports, and the conditions in which that player will go up against.

These are much more valuable data than a mere rehashing of past statistics.

Out with the Old, In with the New

Before we can begin to derive true valuation of an investment, we must first understand that in science and mathematics, a "relationship" is linear. To use industry lexicon, statistically strong correlations are always linear, or exhibit linear patterns.

Let's use a simplified example. If you pick up a 10-pound barbell, you would exert a certain amount of force to pick it up. If you see a 20-pound barbell, you would assume that twice as much force is necessary to lift up that barbell. Thus, we have a linear relationship -- the heavier the barbell, the greater the force required to lift it.

A non-linear relationship is similar to the above scenario, except that you have no clue what the weight of the barbells are. In other words, you could pick up a 20-pound barbell, but it could really weigh two pounds. This would be a non-linear relationship, where no correlation is evident between the stated weight of the barbell and how much force is necessary to lift it.

As you can surmise, non-linear relationships don't give us a great read on predicting the future (ie. picking up a 30-pound barbell will require three times the force of a 10-pounder).

An Eye-Opening Evaluation

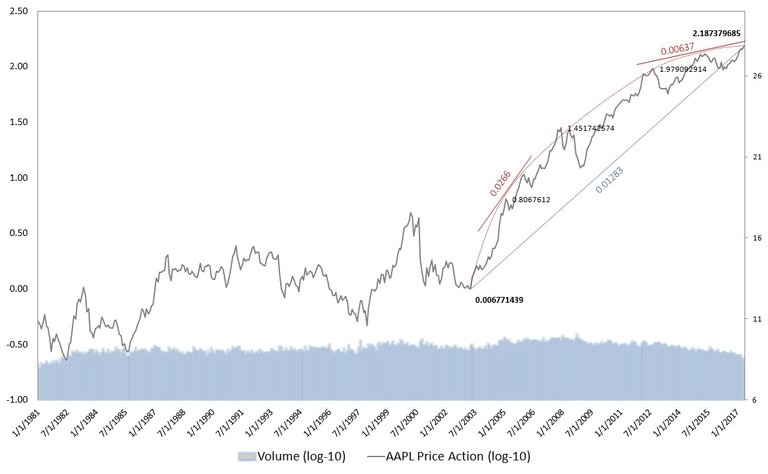

This is the primary reason why so many "traditional" or mainstream analysts are fooled by Apple stock when it comes to its real valuation. Since the spring of 2003 until now, the Apple share price -- on both an arithmetic and log basis -- does not exhibit a linear relationship. For our purposes, we will examine Apple's price action through the monthly logarithmic base since we are interested in magnitude movements, not unit movements.

From April 2003 to the present time (mid-May 2017), the slope of AAPL's price action is 0.013. However, almost none of the price action fits this slope. Instead, to get a true read on AAPL, we have to use calculus.

For the sake of time, we will use "rough calculus." The average slope between April 2003 and December 2007 is 0.027, nearly a +108% discrepancy against the linear slope. From 2008 onwards, the average slope is 0.006. That is nearly a -54% discrepancy against the linear slope.

In fact, this is the crazy part -- the latter slope at 0.006 is steadily approaching zero, meaning no slope. That means Apple investors right now are paying for a near-zero capital growth. Should something happen to the company, the slope could go negative, and thereby cause a loss of capital.

When viewed from an arithmetic scale, the recent climb in AAPL is quite impressive. From a logarithmic perspective, not so much. What we instead realize that against magnitude, AAPL is slowing quite dramatically. Akin to an aging superstar athlete who is well past his prime, an investor would be foolish to go gung-ho on AAPL stock under the assumption that it's "undervalued."

A Note for Cryptocurrencies

Regardless of asset class, I always encourage my friends, colleagues, and clients to utilize the logarithmic basis. Simple arithmetic, although helpful in some cases, are woefully inadequate in others. It's a good reminder that in the traditional markets, any edge in information helps considerably. Wall Street is run by insiders, so playing that market already puts you behind the eight-ball.

As for cryptocurrencies, a proper analysis cannot be conducted without a logarithmic basis. Lost in the wild swings of digital currencies are contextual shifts in magnitude. Specifically when discussing STEEM, we must consider true value -- that can't be accomplished without an awareness of magnitude and how much "force" each "share" of STEEM is presently exerting.

And do not be fooled by naysayers regarding cryptocurrencies being in a bubble. The reality is quite the opposite. Apple is considered one of the hallmark investments of Wall Street, yet it is very clear that its days as a viable investment are numbered.

STEEM, and other rising digital currencies, are just in their infancy stage. Certainly, we will go through periods of volatility and consolidation. But we have many, many years to go before we have to concern ourselves with upside limitations.

STEEM On!

thanks!

Imagine the future-

I can imagine $4 by year's end! :)

https://steemit.com/steemit/@bullishmoney/steem-s-technical-chart-setting-up-usd4-usd-by-year-s-end

Yeah, with all these alts going super-parabolic since 2017, like NEM with it's +3,000% or RIPPLE with it's nearly 5,000% move (since the beginning of 2017, mind you!), $4 might be a bit too conservative, lol.

That's so true -- plus, if I'm not mistaken, STEEM is the only crypto that's actually levered to something useful: a network that creates immediate value for content creators and content searchers. As another Steemian was saying on the commentary section, once Steemit introduces video and music and other elements, it's game over for the YouTube / Facebook hegemony. When that day arrives, I wouldn't be surprised to see $400 STEEM or higher! :)

I see it, $7

https://steemit.com/steem/@malonmar/price-simulation-of-steem-to-31-dec-2017

Can't complain with that! :)

Apple has serious competition. The great growth of the past won't and can't continue. It is overvalued.

Great article!!!

Thank you!!!

Following and voted! Awesome!

You're very welcome! And you can expect much more to come! :)

Awesome!! Me, too!!! We rule!! hahaha

Great Post! Always jealous of those buying Apple Stocks. Finally I have Steem! Followed

Yeah, it was the investment of the future...now its time is fading :)

Another great analysis; I like the comparison and contrast between arithmetic and logarithmic scales, and it's making more sense to me. Order of magnitude is important, isn't it! Great job, and Steem on!

Absolutely it is...and the mainstream media uses these "math tricks" to make their investments look wonderful, and truly open source investments like STEEM look like speculative crap. But we know better, and I'm just trying to spread the word to get others to see the real deal :)