At the moment of writing, STEEM was trading at a mere $2.75 while Bitcoin plummeted back below $10,000. There are at least 3 potential causes for this.

I'll take them one at a time, based on their relevance (and impact).

1. Mt Gox Trustee Sold around $400 Million Worth Of Bitcoin In The Last Few Months

According to Coindesk, the MtGox trustee sold between December last year and February 2017 around $400 million worth of Bitcoin and Bitcoin Cash. The trustee acts in the name of those suing MtGox and his main task is to recover lost funds. So he's only doing his job,

But obviously, when you dump almost half a billion dollars worth of Bitcoin, the price will drop like a rock.

In my opinion, this is the main reason of the bearish market we're seeing for about 3 months now. There is a certain impact of regulatory news (as we will see below) but the main problem comes from the market itself. Dumping crashes price. Always.

2. SEC Says All Exchanges Must Be Regulated

According to Bloomberg SEC just issued a statement in which all exchanges must undergo regulation.

“If a platform offers trading of digital assets that are securities and operates as an ‘exchange,’ as defined by the federal securities laws, then the platform must register with the SEC as a national securities exchange or be exempt from registration,” the SEC said in the statement Wednesday.

This is not something new and many of us saw this coming. Yet it still seems to affect market to a certain extent.

3. Rumors About Binance Being Hacked Surfaced Earlier Today

According to Business Insider Binance halted withdrawal today, after investigating some "unauthorized market operations".

A few users reported that their alts have been sold at market price and now they have only Bitcoin. The first statements from Binance point to the fact that the victims all had API keys for automated trading or bots, limiting the circle of potential causes.

All In All, A Really Bloody Wednesday

The cumulated effect of these news is literally crashing the markets. The highest magnitude event is by far the selloff of MtGox, which is still "mtgoxxing" us years after it happened.

If we make abstraction of the emotional toll this event puts on all crypto enthusiasts out there, I would say we're in the middle of a major healing event.

But of course, like in any healing, it will first hurt.

Big time.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

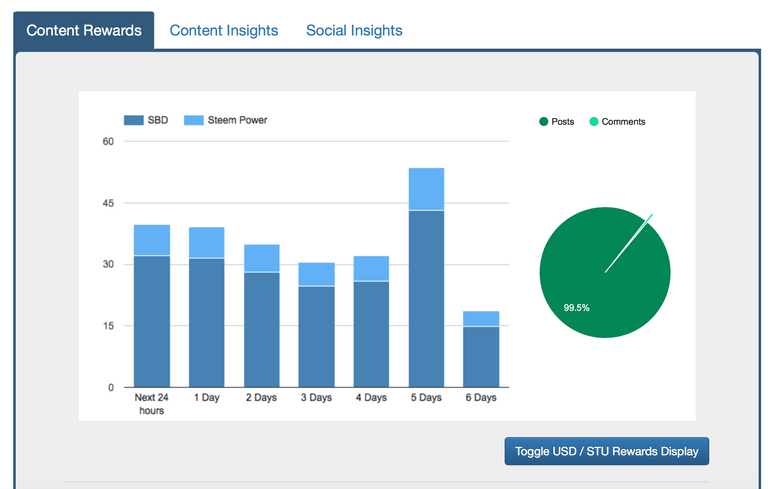

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |

I think it was a forgone conclusion that the regulators would eventually come after the exchanges, but the MtGox news seems very bullish to me.

The sell pressure from the MtGox liquidation will subside, or has subsided already, so it's more likely that we'll be headed into another bull market in the near future.

That's what I meant by "healing". There's still an amount almost 4 times bigger than what has been already sold yet to hit the markets, so we may still expect some waves...

Everyone wants to sell or tak it one way or another what about the rest of us

Thanks for the analysis... upvoted/resteemed

And what they mean by "regulation" is that they want their cut.

Weapons tech ain't cheap!

I disagree. Instead of building faster, bigger jet fighters.

Invest in a bunch of flying bricks. Anyone trying to invade our airspace runs into a cinder block at mach speeds, ripping it to shreds. And all you have to do is put a bunch of these in their way.

Century-long, embezzlement or culmination of a series of neglect, the disappearance of 650,000 bitcoins continues to be a mystery.

The story had started badly. When he bought Mtgox in February 2011, Mark Karpel was notified by the seller, Jed McCaleb, that he was already missing 80,000 bitcoins. The main stock exchange where to buy and sell bitcoins would run after those missing "chips" for years, without ever finding them. Worse, the mass of missing bitcoins on the call would grow and reach the astronomical figure of 850,000 at the time of bankruptcy in 2014, a figure reduced to 650,000. Mark Karpelès, "The Wolf of Bitcoin Street", is currently on trial for embezzlement. He was ambitious however to "clean the planet bitcoin"

Now, we know that MtGox sold about $400 million worth of bitcoin. Do we know how much they still hold and plan to sell again? Except we know that, I don't think we can still say the market is healing. My opinion though.

This is about the biggest dump since December 2017 thereabout.

From the article linked above.

And bitcoin gold

@dragosroua again yet another reason why we need to find a new standard to value the altcoins on as when BTC crashes the whole market does too. This is no way for any market to operate. People would At least like to know there was some stability in a super volatile market pegged to BTC.

Trust, I think it is the key word. Even if "trust" is an ambiguous word...

How it can be done? Sincerely I don't have the answer...

This is the perfect time to sit back and do some more steeming. 2-3 years from now when a lot of coins are 10-100x their current value, everyone will be wishing they had done more to accumulate them at lower prices. I think the btc chart over the last 5 years is a good indication of what we can expect for the overall market

I'll use this to console myself....

Thank you @dragosroua for saving me from unnecessary fear and worry with the above message.

this is like a soap opera huh?

One drama after the next.

Well, it has less than six months to sort itself out so I can get some winnings out and pay the entry fee for a totally epic race.

I has been a roller coaster ride with huge ups and downs. At the first in the month of December and January there was a huge up then it started collapsing and started showing huge downs.

The bright side is that if you have money, now is an even better time to buy!

That's what I was thinking!

Until I tried to buy more STEEM with my credit card account and then received an email from the exchange that the credit card bank had rejected it (not allowing crypto purchases).

So, I went to add another credit card. The exchange then informed me it was no longer taking credit cards at this time.

To get USD from a bank account into a wallet on the exchange takes 7 days. I did that once already by accident and it was not fun.

Besides, in seven days, we could be heading to the moon. Or not. The point is, the $2.70-ish price I was going to buy at an hour ago is already back on it's way up.

Bittrex still isn't taking new accounts. Binance may have been hacked. Poloniex wasn't doing that great before it was bought and wasn't accepting new users, either.

I guess that leaves me open ledger, but unless someone can confirm with absolute certainty that they will take a credit card (or allow some other form of instant buying of a cryptocurrency without it already being a cryptocurrency), I'm sitting this deep dip out. Or better said, I'm sidelined with no viable options.

I'm sure there's more than one person around here who will fault me for not being better prepared. Good news is, I don't answer to any of them.

In the meantime, my wife will be happy I wasn't able to buy any more. Her I do answer to. So there's that. :)

That's a fairly good synopsis of what is going on for a lot of people. I was trying to buy Ethereum last year, but it took me 7 days to get my money there and by that time, the prices had skyrocketed. I didn't end up getting in. That's the way it goes sometimes. Sorry you couldn't get more though. It's always nice to get a bargain. :)

It's been like this for the past few months but we are still in better position than this time last year. STEEM is sitting on $2.50 but it spent most of last year under a dollar. So once this tough patch is over and we find out what regulation will be coming in people can start moving again. I don't think anybody is going to move large money into a market where they won't know it rules and regulations in six months time.

I was wondering why I couldn't transfer my Steem from binance to steemit.

Luckily most of my other coins are in a wallet and not sitting on an exchange!

Thanks for share such a nice post.

According to a lot of users on Binance. "they" bought Viacoin. this is why Viacoin's value increased in around 10k%. to 0.025 btc!

so informative post thanks for sharing

Since the Chicago Stock Market traid Bitcoin only for Banks he fall down. Its the last fight from ouer System Fiat to bet the Cryptocurrency. They are scared because they have to much fiat money

Looks like the market is overheated ;-)

I hope to see a rise in steem sooner than later and then stability. I remember a time when sbd was as high as $4.92 or there about and steem was a little below this figure. I hope that we heal faster than we hurt @dragos

Thanks for the crypto news

Right after reading this news i guessed that the market might have collapsed. $400 Million is not a small number. So i checked the coinmarketcap to see prices and i was right the market indeed collapsed and that to in a worse way.

When bad things start to happens they don't happen one by one, instead they happen in numbers multiple sides.

I am in the red for the year and have been for a while. I am hesitant to put new money in because of days like today. When it goes down, it goes really down. I have holdings that are over 70% down from where I bought them. Really not sure what to do here. Likely hold and ignore but definitely not investing more. Thanks.

The SEC decision is obviously causing some caution, and will continue to do so until a final ruling is made.

I wasn't aware of the $400 million dump of Bitcoin though. Is the selling by this trustee now finished? If not, how much more is still to be sold?

many things happened in a single day exchanges doesn't seem safe at all now

it was hacked literally funds are safe glad to check that out