introductory post.This is my twenty third day from the 30 days writing challenge I'm doing during January. Basically, I'm writing each day an article on a topic that I'm interested in, or something that I'm just learning. I tag these posts with #challenge30days, if you want to join, all you have to do is to use the same tag. Each day I will also pick 3 articles and give them a full upsteem. For all the details and the motivation, have a look at the

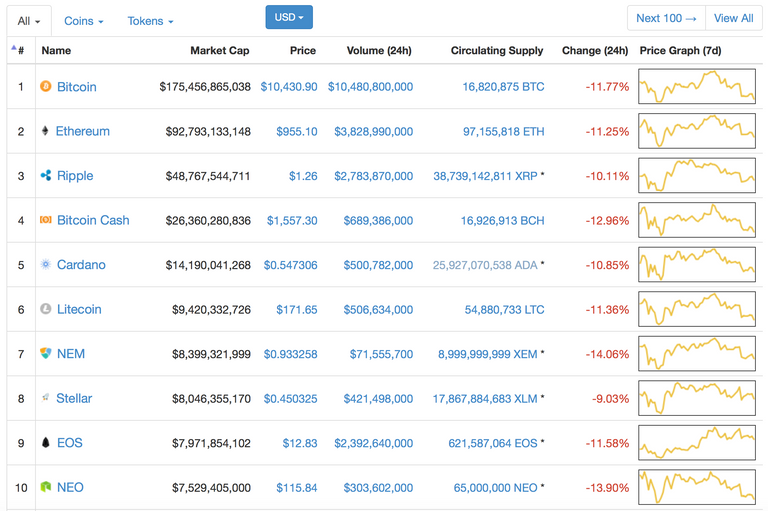

Top 10 Cryptos

At the moment of writing, top 10 cryptos were sharply bearish, with 9 out of 10 assets posting double digit losses.

The dive might be caused by the recent announcement about taxing crypto-currency exchanges in South Korea because all tokens are posting a similar decrease. Looks almost like some big players are liquidating their positions at once.

STEEM And SBD

At the moment of writing, STEEM was trading, on average at $4.15 on Coinmarketcap, significantly down from yesterday. On Bittrex, the 30 minutes chart shows a sideways corridor formed between 38k satoshis and 41k satoshis.

The 1 hour chart shows a smooth downwards trend slowing down slightly.

The 1 day chart shows a very small correcting candle. Given its entire size is smaller than yesterday's candle wick, we can assume a potential stabilization around the corridor mentioned above.

SBD was trading, at the moment of writing, at $6.45 on average,sharply down from yesterday. The 30 minutes chart on Bittrex shows two consecutive sharp corrections followed by a cautious slowdown.

The 1 hour chart displays cautious trading after two major corrections.

The 1 day chart is very similar with the STEEM 1 day chart, in that the correcting candle is smaller than yesterday's candle wick.

Overall opinion: although hit by the news just like the rest of the tokens, SBD and STEEM seem resilient. The cautious retracement may leave room for further improvement, but unless overall crypto sentiment improves significantly, I expect mainly sideways movements.

Previous Posts In The Challenge

- Markets Snapshot - Day One

- Markets Snapshot - Day Two

- Markets Snapshot - Day Three

- Markets Snapshot - Day Four

- Markets Snapshot - Day Five

- Markets Snapshot - Day Six

- Market Snapshot - Day Seven

- Market Snapshot - Day Eight

- Market Snapshot - Day Nine

- Market Snapshot - Day Ten

- Market Snapshot - Day Eleven

- Market Snapshot - Day Twelve

- Market Snapshot - Day Thirteen

- Market Snapshot - Day Fourteen

- Market Snapshot - Day Fifteen

- Market Snapshot - Day Sixteen

- Market Snapshot - Day Seventeen

- Market Snapshot - Day Eighteen

- Market Snapshot - Day Nineteen

- Market Snapshot - Day Twenty

- Market Snapshot - Day Twenty One

- Market Snapshot - Day Twenty Two

Disclaimer: I'm not a trader and this is not trading advice. I'm writing these articles for my own educational purposes and they are not meant as an investment foundation. Please make your own due diligences when investing and never invest more than you can afford to lose.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |

Way to stick with the #challenge30days. Almost at the finish line.

Still a week to go, but thanks for your support :)

I agree with you, STEEM and SBD seems to be less impacted by the correction in terms of downtrend, this is giving confidence to the investors because it means a more stable coin

Seems like at the moment it is pulling out of the well !

Positive to see the green !

SBD is still standing strong and it helped me do some cheap trading. The price for almost ll altcoins is down right now and this is a very good opportunity to buy. BTC price will go up in couple of days and we can expect the same for other altcoins. Thanks for the detailed report on SBD/STEEM @dragosroua.

Steem On!

Steem/sbd is the kind of coin crypto traders invest on a long term without panick of it crashing into the ground someday.

Major pullback alert time to HODL on :)

Could be a rough ride for the near future.

Thanks for this market price of sbd on steem

i want to take this challeng30days

carry on dear....resteemit done

Nice post :)

I really like your post, keep the spirit and be the best. If you wish to upvote back my post, I need a little support from you: @dragosroua

https://steemit.com/aceh/@mahyul/jalan-jalan-ke-waduk-jelekat-lhokseumawe-8edd295ed6fc1

Stop spamming and Try to increase the reputation.

great post bro i really like this type post because this post is very helpful ...wish you best of luck keep posting....

Very useful Market Snapshot. @dragosroua

@ dragosroua it is really good the way you are giving a good message to the world. I love this your update steemit post. upvoted

I checked coin market about 35+ munites ago. Every crypto price dropped too much. After seeing it, I was very disappointed.

Good post @dragosroua, thanks for ur update!!

Once again the market is down with of other countries threatening to ban

Excellent analysis of both steem and sbd and thanks for staying us updated regarding steem and sbd market, it's really helpful for me, Stay blessed

Wow such a wonderful post :)

Thanks for sharing us

@upvote and @resteem

nice .. like the rresearch following

Digital currencies have emerged as one of the most profitable investments of 2017.

You don’t have to take our word for it. Just take a look at the returns:

Ethereum is up 2,000%.

Bitcoin is up 744,233%.

Litecoin is up 750%.

With the digital currency floodgates open, early investors are becoming accustomed to four-digit returns.

But there’s a catch. Many of the currencies listed above have already achieved mainstream investors. They will continue to generate profits (making them valid investments), but you will never be able to buy them for under $1.

Many digital currency investors are hunting for the next big altcoin, hoping to find a new Bitcoin for the right price.

And the best contender is Ripple. In the last year alone, Ripple is up 3,733%.