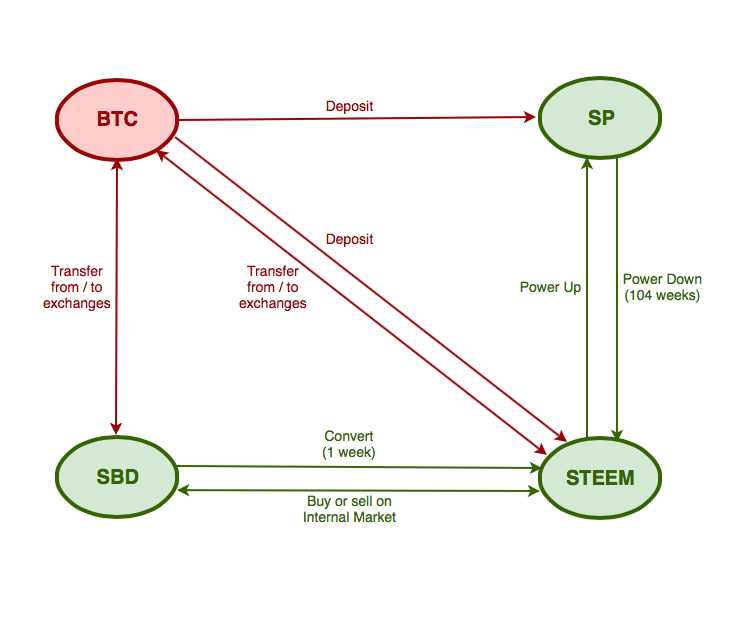

This is a guide to better understand the three types of assets in Steem and how they can be converted each other.

Steem is the cryptocurrency Steemit social network where users can earn through publishing content.

There are three classes of assets in Steem:

STEEM:

- Liquid swappable exchanges (Bittrex, Poloniex, and OpenLedger of BitShares)

- It can be transferred from one exchange to the portfolio of the user who uses your account name and the address (how easy compared with Bitcoin!)

- You. Can convert bitcoins directly to Steem. Use the option to deposit portfolio Steemit.

- It can be transferred from one user to another. Use the transfer option in the portfolio of Steemit.

- 100% is inflated annually

- Given the high inflation rate is not convenient to save it and it is preferable to keep it for a short time

- Every 3.3 years a reverse split is 10: 1

- STEEM is as effective in a hyper-inflation economy and can be used to buy SP and SBD

Steem Power (SP):

- It is not liquid, implies a long-term commitment to the Steemit network.

- The more SP has the user, the greater your rewards for curing content.

- All new STEEM that is created, 90% goes to those with SP, and 10% content authors and curators of content.

- Making it acquired "Power Up STEEM" or a direct deposit of the Steemit Bitcoin wallet.

- 104 takes weeks to be turned back to STEEM. You. Use the "Power Down" function in the portfolio.

- SP is like the actions of a company. The Steem network distributes profits among the owners of SP in proportion to the size of their savings.

Backed Steem Dollars (SBD or SMD):

- Liquids, interchangeable exchanges and in the domestic market Steemit.

- Designed to have a stable value of about USD $ 1. The current values are listed here (see "Feed" column)

- The owners get 10% annual interest.

- They can be converted to STEEM directly in the portfolio. The conversion takes a week, and the price is the median price of that week.

- They can be transferred to other users. Use the Transfer option in the portfolio of Steemit.

- SBDs are as bonds. If you save 1 SDB you are effectively paying the $ 1 Steem network, and get paid a reward in return, but not as much as if you had SP. But on the other hand you have the benefit of liquidity and you can sell your SDB at any time, not every SP 104 weeks.

I upvote U

I am new to steem.... informative post....

Pretty good, unfortunately i can't upvote it because the voting systems are terrible right now.