Lesson 9: How To Find The Best Bitcoin Exchange

Thanks to Bitcoin exchange guide, click here to get more info (aweber.com)

In the last lesson, we explained how bitcoin mining works, including how new blocks are added to the bitcoin blockchain. We talked about how miners receive a reward – in the form of bitcoins – for their contributions to the network. Miners use specialized equipment – like advanced computers stored in massive data centers – to mine bitcoin.

Today, we’re focusing on bitcoin exchanges. You’ll learn things like:

The bitcoin network does not need exchanges in order to operate. Bitcoins can be bought and sold on a peer-to-peer basis. If you find someone willing to buy bitcoin, then you can transfer bitcoin to that person with no centralized party – like a bank or an exchange – required.

However, this P2P exchange system isn’t practical in the real world. That’s why we need exchanges.

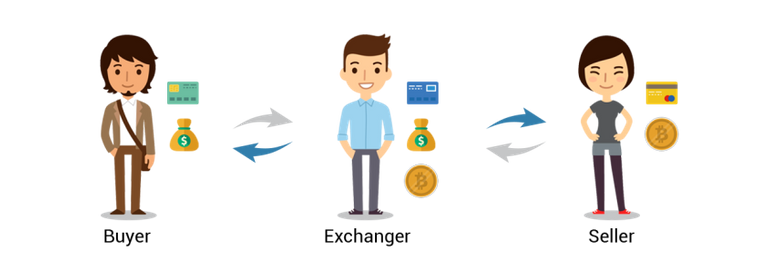

The primary role of a bitcoin exchange is to collect orders from people who wish to buy bitcoin, then match those orders with people wanting to sell bitcoin. This is the “order book” of a bitcoin exchange.

Today’s top exchanges process millions of dollars in bitcoin transactions every day. They match bitcoin buyers with bitcoin sellers. They facilitate price discovery in bitcoin markets, basing the price of bitcoin on whatever the last buyer paid for 1 BTC.

Exchanges play another crucial role: exchanges store your money. You can deposit your bitcoin into an exchange, for example, and leave it there.

As we learned in our discussion on bitcoin wallets, however, it’s rarely a good idea to leave your money in an exchange. Exchanges can be hacked or suffer a glitch. You should only temporarily store your bitcoins in an exchange.

Choosing the perfect bitcoin exchange isn’t as hard as you think. Today, there are hundreds of exchanges from which to choose. Every major cryptocurrency exchange in the world offers one or more bitcoin pairs.

Some exchanges allow you to buy and sell bitcoin in exchange for USD, EUR, GBP, and other major fiat currencies. Other exchanges only allow you to buy or sell bitcoin for Ethereum, Litecoin, or other cryptocurrencies.

In addition, some exchanges ban customers from certain countries, while other exchanges are welcoming to users from all over the world.

Here are some things to consider when shopping for a bitcoin exchange:

Here are the top ten leading bitcoin exchanges based on their consistent position among the highest-volume exchanges:

All of these exchanges are consistently ranked among the highest by trading volume. They each complete well over $100 million in trades every day. Most of the exchanges listed above accept customers worldwide. Some exchanges, like Bithumb and Huobi, target users in specific countries like South Korea.

Ultimately, choosing an exchange isn’t rocket science. It shouldn’t be difficult or frustrating to choose an exchange. You’re not marrying someone. You’re not committing to an exchange for the rest of your life. You can sign up for dozens of exchanges then pick the one with the prettiest UI. Overall, the exchanges listed above will offer a consistently strong user experience when buying bitcoin online.

You’re almost done! Tomorrow is the last lesson in our daily email series. We’ll recap everything you learned during this course – and explain how you can take the next step in cryptocurrency investing.

Congratulations @mitems! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: