I made small research about trading of steem in past few days. I would like to share result of my analysis. Many things have been mentioned before in discussion but now I would like to share general overview and close this topic for ever. It is very frustrated to see how money are drained out of the steemit without any valid reason. So I want to leave this topic keep my focus on more important things.

The reason why I did this small analysis is as follows. I do trade on the crypto-currency market. I am a liquidity provider and my trading volume is serious. (daily transaction volume around 30-50 mil USD). Base on this experience let's assume that I understand my job a bit. I thought that my company can support whole project as a market-maker. Don't get me wrong, please . The participation on the altcoin currency market is pure charity for market-makers. I didn't know anything about rewards for market-makers before I joined. My participation was decision based on my certitude that steemit will grow. (market-making rewards have been canceled before I joined due huge market manipulation). I changed my mind. Let me share fundamental reasons why is steemit not ready to attract market-makers.

Reason why

If you want to join to this type of business you have to be sure of few basic things.

- the market structure has solid technology solutions.

- the matching engine is clear (with no hidden features for some of your competitors )

- the all competitors should have same trading conditions

- the solid benchmark currency is necessary

- market has to be built as pure competitive trading environment for anyone who wants to join (price-time priority is mostly used for young markets)

Internal market

I couldn't find documentation below the internal market site? Anything as Websocket, Rest or FIX protocol APIs ? I don't see even basic data-feeds full trade of history or stats about traded volume. No orderbook or trade UX for clients. Those things were not implemented so far. I know there is some possibility to find very basic API somewhere but those things should be visible because nobody want to spend time by searching for something what maybe don't even exists. Even for charity. Time is money.

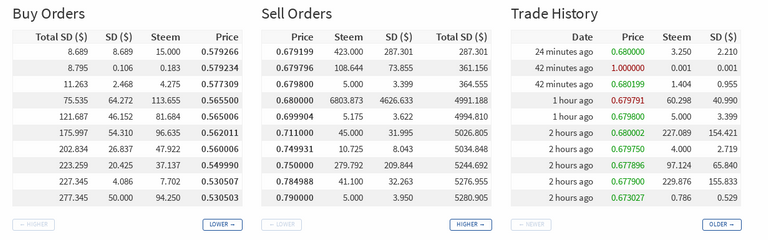

This is one nice part. If someone tells me that matching engine is clear, I wouldn't believe. What I see is there is something like hidden market. Most probably for newcomers. I don't know. This is at least curious because this could be a bug as well. let's look at the pictures below. Most ridiculous thing is that I can see only 30 trade history. Please check the second row of first image. There is a sell order executed at market price with volume of 0.001 at price 1.000. I don't know guys whats going on here but this is strange because there is plenty of sell orders on lower prices than 1.000 and this small order is printed in trade history. This price was not traded on the internal market for sure. If you take time you can find many of those small selling orders during the day.

I couldn't find documentation below the internal market site? Anything as Websocket, Rest or FIX protocol APIs ? I don't see even basic data-feeds full trade of history or stats about traded volume. No orderbook or trade UX for clients. Those things were not implemented so far. I know there is some possibility to find very basic API somewhere but those things should be visible because nobody want to spend time by searching for something what maybe don't even exists. Even for charity. Time is money.

This is one nice part. If someone tells me that matching engine is clear, I wouldn't believe. What I see is there is something like hidden market. Most probably for newcomers. I don't know. This is at least curious because this could be a bug as well. let's look at the pictures below. Most ridiculous thing is that I can see only 30 trade history. Please check the second row of first image. There is a sell order executed at market price with volume of 0.001 at price 1.000. I don't know guys whats going on here but this is strange because there is plenty of sell orders on lower prices than 1.000 and this small order is printed in trade history. This price was not traded on the internal market for sure. If you take time you can find many of those small selling orders during the day.

The most important part of the market is benchmark currency. In the internal market you can see only STEEM/STEEM DOLLAR . There is no any benchmark currency like BTC (BTC/STEEM , BTC/SMD). This is very important. Nobody says that BTC should be implemented to the steemit as a currency.The thing I am saying is that internal market has no chance to grow before this feature is applied.

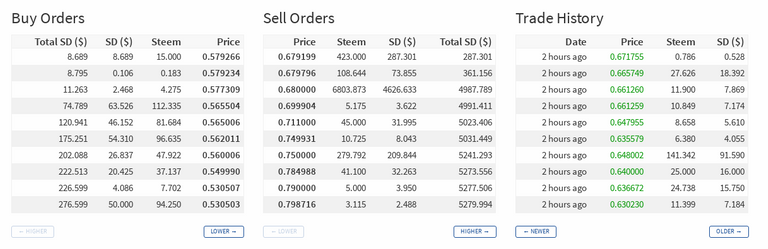

I think there is a price-time priority matching algorithm but regarding trade history algorithm seems different. Other thing is that if you place order to price 0.7600 it is not exactly 0.7600. I know this could be a recalculation of volume but this type of quotation is not an industry standard. This may seems like hidden fee.

The result ?No market-maker is involved because no one will accept this market conditions even for charity.

Uneducated clients may lose at least 5% of their money at any transaction on the internal market

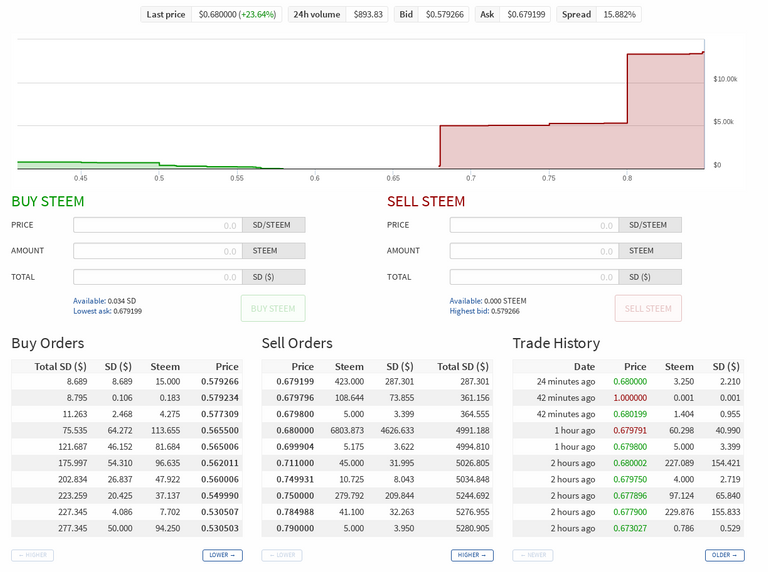

Just look at the picture above. Is this how the healthy market looks like?

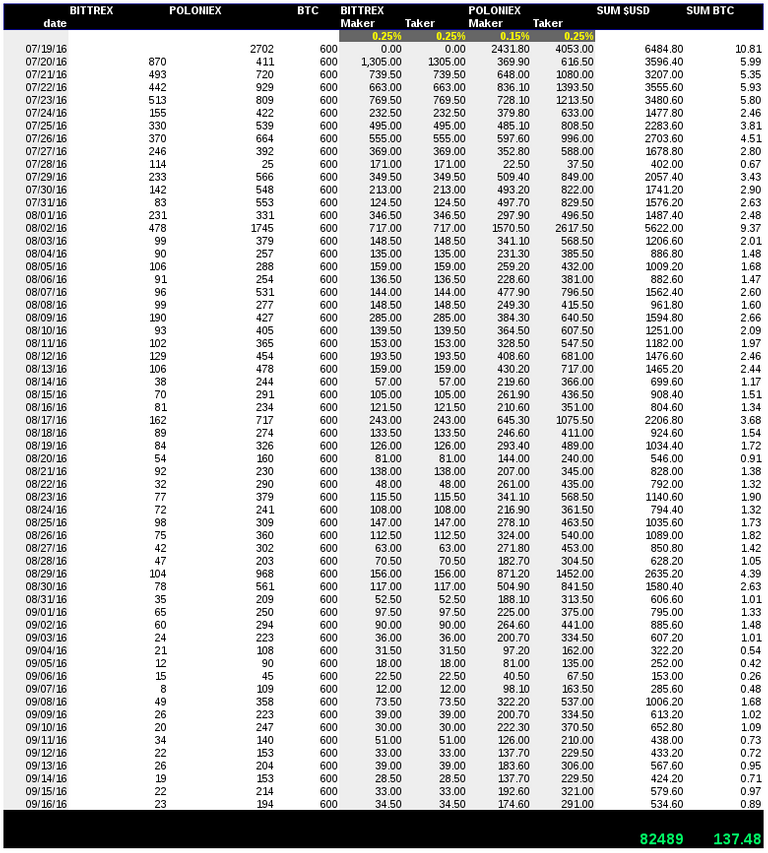

Do you know what the most ridiculous part of this article is? The real market is somewhere else. The real steem market which is under attack of speculators and those who want to cash out rewards is out of the steemit . Bittrex and Poloniex made this market by adding of steem to their offer. Both providers also hold massive amount of liquid steem. I don't care how they get this power. I am just saying that your income from steemit is lower because of fees on the different market.

The numbers

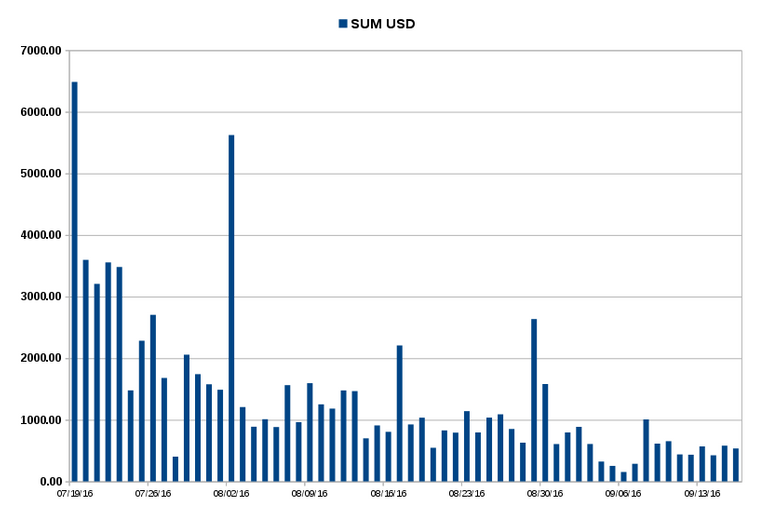

On the picture below you can find table with estimate income of exchange platforms Poloniex and Bittrex. In first two columns you can see volume of trades on daily bases since STEEM was listed on those exchanges. The next four columns are calculations of maker-taker fees. The last two columns are daily income denominated in USD and BTC. Green numbers are collected fees in dollars or bitcoins.

This is the overview of fees collected based on daily basis.

Well, this is the end of the story. My mission was to point out bad decisions from past. I wanted to offer a solution also, but I think is not needed in here. The worst thing is that once I tried to bring solution I was flagged out by one big whale with no reason or explanation.

I wrote this article in pure analytic mode. No ideas , no conclusions. Pure data based on public sources. You can make your own conclusion.

I guess dust orders: https://bitsharestalk.org/index.php/topic,22851.msg296524.html

It's the same engine so maybe http://docs.bitshares.eu/api/ this could fit.

thank you. I will check this links

I don't understand much of how all this works, but you seem to have valid points to make. I hope it gets more recognition to see if things can be done for the internal market, like at least showing the BTC price.. hehe. Good luck. Peace.

thank you . those points are valid because I wrote this article from perspective of market-maker.