Investing in gold is one of the most popular types of long-term investments that have proven to be profitable year after year. Investors in gold can purchase gold in its physical form and keep it stored in a bank vault or a personal safe in their home. The Digital Gold platform has taken another approach. They allow their investors to invest in the digital state of gold, stored in the form of a GOLD Token located on the Ethereum blockchain. This is a perfect way of investing in gold for those who don't want to worry about where to store the gold and what to do with it after having purchased it.

Digital Gold - Trade Gold Without Limitations.For more information about the Digital Gold platform, https://gold.storage/en/home, please take a look at my article

If you would like to learn how to trade gold on the Digital Gold platform please take a look at How To Trade Gold On the Digital Gold Marketplace for more information.

In this article, I am going to make a comparison between the possible profits an investor could have made had he/she invested in gold compared to investing in the two most popular cryptocurrencies - Bitcoin and Ethereum in the last 6 and 12 months.

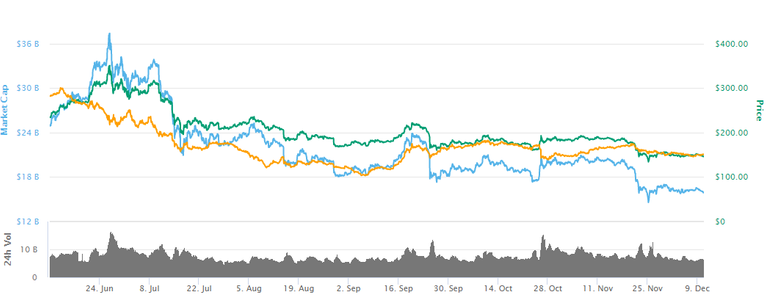

Let us start by taking a look at Ethereum. At this exact moment, the value of Ethereum is $146 according to CoinMarketCap. If an investor had purchased Ethereum exactly one year ago, he would have paid approximately $88 per token. This is a profit of over 65% in one year.

Exactly six months ago, Ethereum was valued at $245. Compared with the current price an investor would have lost 40% of his investment had he purchased ETH six months ago.

Let us now take a look at the movements Bitcoin has made in the same time frame.

On 10 Dec 2018, the value of Bitcoin was $3,415. The current value according to CoinMarketCap is $7,281. An investment in Bitcoin exactly one year ago would have brought the investor a profit of 113%.

If we now focus on the value that was current six months ago, we can see that one bitcoin was valued at $7,969. Such an investment would result in a loss of 8.6% compared to the current value.

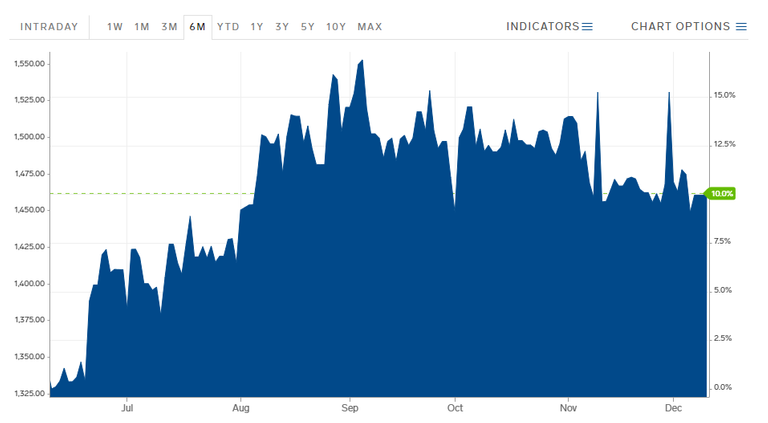

Now it is time to show you how gold performed during the same time frame. According to data shown on MarketsInsider, the current price of gold per 1 ounce is $1,465. An investment in gold one year ago could have resulted in a profit of 17.9% today. That is a profit of $1,790 on a $10,000 initial investment.

Had an investor invested in gold six months ago his portfolio would now show a profit of exactly 10%. That is a $1,000 profit on a $10,000 investment.

Conclusion

The value of Bitcoin has increased by 113% in the last 12 months which makes it the best performer among these three financial instruments that I researched. But an investment in Bitcoin six months ago shows a net loss of 8.6% today. The movements of Ethereum show the following data. One year ago today all investors in Ethereum could have recorded a profit of over 65% but the same investment six months ago could result in an overall negative balance of -40%. This shows how volatile cryptocurrencies are and how significant the price movements can be in the space of just a few months.

Gold, on the other hand, is considered to be a safe haven when it comes to investments. Especially in times of financial uncertainty or political disorder. It is not as volatile as cryptocurrencies are and is more suitable for institutional money. The numbers and the data posted above show that gold can produce solid growth long term and although that growth potential is not as big as with Bitcoin or Ethereum, during the last 12 months, it is also not as volatile as Bitcoin and Ethereum were during the last 6 months. The charts show a 10% increase in the value of gold during a period in which Bitcoin fell by 8.6% and Ethereum by 40%.

"Slow and Steady Wins the Race".

Invest in gold with the Digital Gold Platform and Marketplace.

Website: https://gold.storage/en/home

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2437930

Thanks for sharing this useful information.

I am glad you liked it.You are welcome @joelai.

Thank you!