we compare all these..

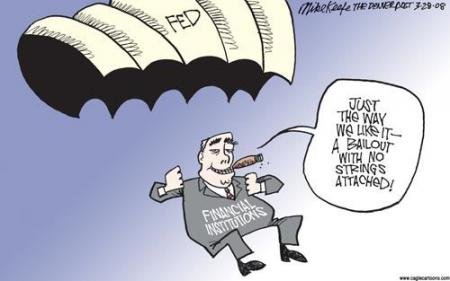

2008 crisis: The Genesis block of bitcoin mentioned the bank bailouts of 2008-2009. There is a belief that bitcoin was born out of anger against govt using taxpayers money to bailout the banks. Banks who took lot of risk with all these bad mortgage based securities and other trading instruments. They were bailed out by a central entity thereby promoting moral hazard in some way.

DAO refund: Fast forward we land up in the DAO hack incident resulting in a hard fork and ether being refunded to participants. Participants got bailed out after the hack by ethereum developers while some claim vitalik is solely responsible for decision. A centralized decision and thus promoting a moral hazard among participants.

Gdax bailout: Now we have GDAX paying back all those who lost money due to the 300000 ether flash crash. Margin trading is risky and they are involved in trading a token that is still in development and an exchange that is unregulated, but they are made up for their losses by a bailout by centralized decision making process which encourages a moral hazard for more margin trading.

If I am a victim I would like to be bailed out. That is a frank statement. So centralization is sometimes sweet and good right?

That is truly a slippery slope..if my margin account with robinhood got wiped, i just get a margin call..don't be dumb and trade more than u have..i think i used margin once and sold quick to get out

Followed you hop u follow back and visit my blog @kishan