Don't invest your life savings, invest in saving for life.

In this article I explain the way I am diversifying savings with STEEM Power for a future retirement income stream.

First the Disclaimer:

I am not a financial advisor or planner. I am an engineer planning for retirement. In this post I am not providing advice on what you should do. There is risk in any investment. Each person needs to consider carefully for themselves before pursueing any investment strategy. The information in this erticle is my opinion and an investment strategy I am pursueing and sharing with you.

In my previous article, Everlasting STEEM Power; Why you should Power Up!, I examined the power of compounding STEEM Power. In this article I want to discuss using the STEEM Power balance like an annuity type of instrument and a supplemental income for retirement or saving.

Short Introductory to STEEM Terms Used

STEEM

Steem is similar to publicly traded company shares. The amount of Steem doubles each year so there is signficant dilution for those that hold Steem, however like many fast growing startups a rapid increase in value may outpace the dilution. Just like company shares (ie. stocks) these digital assets have value as more people use and contribute to the ecosystem. The estimated value of the total outstanding Steem assets is currently about $20 million on Coinmarketcap.com.

STEEM Power (SP)

Steem Power is similar to private restricted company shares and have disadvantages and advantages. One disadvantage is that holders can't sell Steem Power immediately; hence they are illiquid.

STEEM Power: These are network influence tokens, rather like a longer term investment in Steemit. The more SP you have, the more weight is given to your voting. Generally, it is beneficial to accumulate more SP for building up higher passive and active rewards. You may also liquidate SP to acquire Steem Dollars. SP is locked up for a period of time. So if you wish to cash out some of your SP, you can do so by Powering Down. It will pay out over a period of two years, split into 104 weekly payments.

For More Information About STEEM and STEEM Power

The following post reference 5 by @steemitguide is a must read for new SteemIt users and newbies who want to learn more about this incredible platform and crypto-currency.

SteemEducationProgram ; STEEM POWER Guide and Infographics that Every Steemit User needs to Read!

For a complete tutorial reference 10 provides a good place to get started.

Everything you Need to Get Started Fast with Steemit, Social Media that Pays [Complete Tutorial with Screencast]

Update on the Weekly Compounding Rate of STEEM Power

STEEM Power compounds in your wallet minute by minute. The recently observed weekly rate of return is 4.3% for my accumulated STEEM Power of about 545 units. The weekly rate of 4.3% will be in the calculations for this article.

Powering Down STEEM Power to Power Up Your Savings/Retirement

As long as the weekly compounding rate of STEEM Power (4.3%) is greater than the simple powering down rate (100%/104 = 0.9615%) then powering down will not exhaust your STEEM Power. In fact, if the 4.3% weekly compounding rate of STEEM Power over the two year powering down period, then your STEEM Power will be far greater than when you started powering down.

Assumptions for the Purposes of Simple Calculations

- The compounding rate of STEEM Power (4.3%) remains constant over the two year powering down period.

- During the two year period you will be able to stop and restart your powering down of STEEM Power at any time.

- Additional STEEM Power (from posting, curation, or other activities) is not added to your balance during the two year powering down period.

- One STEEM unit is produced when one STEEM Power unit is powered down.

Powering Down Over Two Years

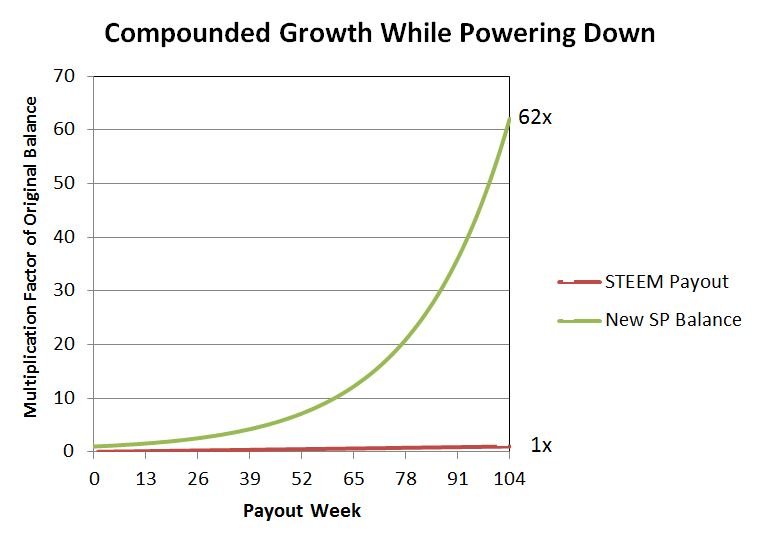

In this first calculation the powering down process is started and left alone over the two year period.

In this potential example, at the end of the two year powering down period you have 62 times your original STEEM Power balance and 100% of your original balance in STEEM. Simply put, if you start out with 104 STEEM Power units then powering down:

- Pays out 1 STEEM unit each week for 104 weeks.

- Results in a total payout of 104 STEEM units.

- Results in an ending balance of 6,200 STEEM Power units in your account.

Okay, this is where your jaw drops. This is just the power of the 4.3% weekly compounding of STEEM Power.

Resetting the Power Down Every Quarter (13 weeks) Over Two Years

With a little more effort than powering down and forgetting about it, what happens if you reset the power down of STEEM Power every quarter. Every 13 weeks you stop the power down process and restart the power down using your current balance.

This potential example increases the payout in STEEM units and the STEEM Power units still increase.

- Every quarter you increase your weekly payout by 1.73 times over that quarter. For example, if your weekly payout over one quarter is 10 STEEM units then the next quarter after you make the reset your weekly payout will be 17.3 STEEM units per week over that quarter.

- If your original STEEM Power balance is 100 units, then the total payout is 780 STEEM units over two year and the balance at the end of two years will be 3,700 STEEM Power units.

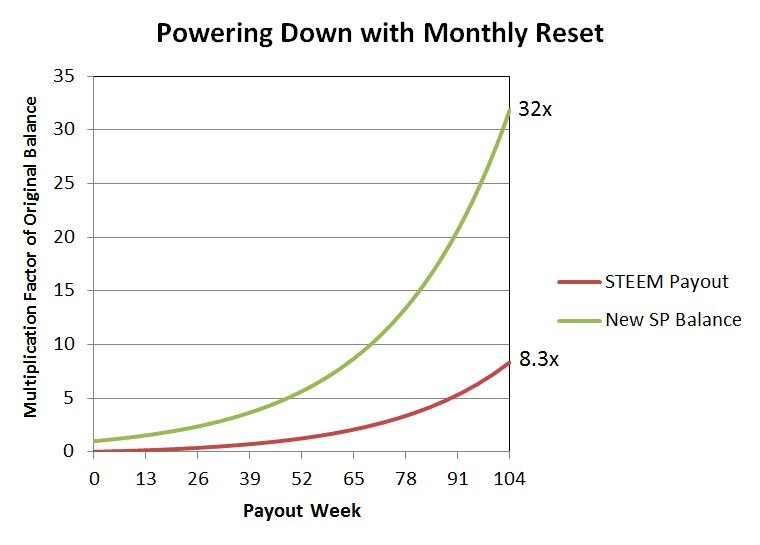

Resetting the Power Down Every Month (4 weeks) Over Two Years

What happens if the power down is reset to the balance every month (4 weeks)? The following graph shows the results over two years.

This potential example further increases the payout in STEEM units and the STEEM Power unit balance has still grown.

- Every month (4 weeks) you increase your weekly payout by 1.18 times over that month. For example, if your weekly payout over one month is 10 STEEM units then the next month after you make the reset the weekly payout will be 11.8 STEEM units per week over that month.

- If your original STEEM Power balance is 100 units, then the total payout is 830 STEEM units over two year and the balance at the end of two years will be 3,200 STEEM Power units.

I like this strategy the best. It provides good returns while not micro-managing the powering down process.

Resetting the Power Down Every Week Over Two Years

In this final potential example, the power down is reset to the balance every week. This is the most labor intensive and results in the highest payout while still increasing the final balance of STEEM Power.

This potential example increases the payout in STEEM units the most while still growing the STEEM Power unit balance.

- Every week the increase in weekly payout is 1.18 times over the previous week. For example, if your weekly payout over one week is 10 STEEM units then the next week after you make the reset the weekly payout will be 10.43 STEEM units per week for the next week.

- If your original STEEM Power balance is 100 units, then the total payout is 850 STEEM units over two years and the balance at the end of two years will be 3,000 STEEM Power units.

Strategy for Supplementing Savings and Retirement

When you start powering down to supplement your savings and retirement is up to each individual. I plan to accumulate more STEEM Power before starting my powering down experiment. Even while powering down I plan to continue to be an active member on SteemIt.

The following 26 minute video on getting more STEEM Power is helpful.

Posting Quality Content to SteemIt

Be mindful of your reputation. You can see how your reputation ranks within the SteemIt community by visiting the STEEM WHALES reputation rankings and searching on your username. Typically the higher your reputation rating the greater exposure your posts will have with the community and potentially the more your post will earn.

Curating Quality Content

View the newly created posts to find quality content to upvote. This strategy gives newbies a better chance of earning curator rewards than voting on those posts at the top of the trending page. The utility steemstats.com is a great way to monitor votes, rewards, and your content. Curator rewards depend on your voting power and the amount of STEEM Power you have too. Curating posts that whales have upvoted may only net you 0.001 STEEM Power units. This is why curating lessor known authors of quality content potentially has greater rewards for the curator.

A good post for curating newbies is Mind Your Votes! An investigation and guide to maximizing your Curation Rewards..

Do Not Upvote Too Often

After 20 votes per day, your voting power goes down. You can monitor your voting power with steemstats.com.

Do Not Upvote Too Early

A 30 minute rule was recently enacted during the last hard fork, reference 8. Upvoting within the 30 minute window reduces the potential reward to the curator.

Conversion of STEEM to...

When powering down STEEM Power units are converted into STEEM units each week. The STEEM units can then be sent to an exchange to convert into another currency vehicle (typically another crypto-currenty like BitCoin). Here is a video describing one way to exchance STEEM Based Dollars (STEEM units can be exchanged in the same way):

Hang In There and Don't Be Discouraged

You may not become an instant success on SteemIt but hang in there, be consistent, and build your reputation and following. Even a little is more than you had without contributing.

A Few of the Risks

- Stability of STEEM value against the market for conversion. As discussed in reference 6 by @dantheman, the STEEM team is taking steps to secure the economic foundation of STEEM.

- STEEM does not become widely accepted. STEEM and the SteemIt community is in the latter stages of the early adopter phase.

Keep an eye on the distribution and engagement of the SteemIt community. - The rules/rewards for authors and curators change.

Please refer to my SteemIt sources for more information and, if you find the information useful, upvote

Reference 1, Everlasting STEEM Power; Why you should Power Up!

Reference 2, Steem Network Asset Classes: Steem, Steem Power and Steem Dollar; Explained in One Chart !

Reference 3, Steem: Where DOES the money come from?

Reference 4, Simply Steemit: Your No-Nonsense Guide to Getting Started

Reference 5, SteemEducationProgram ; STEEM POWER Guide and Infographics that Every Steemit User needs to Read!

Reference 6, Steem Dollar Stability Enhancements

Reference 7, STEEM education program - ideas welcome

Reference 8, Getting the most money out of curation 101 (Part2)

Reference 9, How to Withdraw Your Steem Dollars from Steemit in Less That a Minute by Gabriel Scheare

Reference 10, Everything you Need to Get Started Fast with Steemit, Social Media that Pays [Complete Tutorial with Screencast]

Great article! It's hard to find information on how to split my steem between the three assest types.

Changing between the STEEM asset types (STEEM, STEEM Power, and STEEM Backed Dollars) is accomplished via your SteemIt wallet page.

You can purchase STEEM assets using Bitcoin. If you want to convert other cryptocurrencies into STEEM assets, you should be able to accomplish this through Blocktrades too (although I have not tried it).

I found using Blocktrades to be extremely easy when diversifying STEEM into other cryptocurrencies.

I am very glad you liked this article.

Have a great weekend!

Steem on,

Mike

Good info, something to think about!

Thank you!

Steem on,

Mike

The 20 votes per day figure is incorrect, though it is widely believed. The formulas for voting power are here: https://steemit.com/steem-help/@biophil/the-ultimate-guide-to-voting-power-with-cartoons-formulas-and-code-references

Thanks for this post, one of the best of it's kind that I have read. ^_^

Thank you very much.

Steem on,

Mike

Thanks for sharing this information!

You are welcome!

Steem on,

Mike

Will Powering Down causes Inflation?

I did some Test experiments. On Time, UPVOTES , Curating.

Most of the time , you will waste your UPVOTES on Larger payout. I find the author too greedy n they don't upvote back , don't think they know who Upvoted them .

My surveyed says that.

@etcmike one Rocket coming up ✅

Thank you!

I will continue to explore the many facets of SteemIt do and report what I learn to the community.

There are a lot of good posts and videos now available to help those starting out on SteemIt. Hopefully, the tutorials and videos will help new steemians understand the purpose of voting and stop some from wasting their votes.

Thank you @bullionstackers for what you do to help the SteemIt community.

Steem on,

Mike

Excellent article! This is a topic that I have given some thought to since Steem compounds so frequently and at such a high rate. I think a person could conceivably work hard to accumulate $100,000 in Steem Power and then if that person did nothing else, it would grow to a comfortable retirement if left alone for the next 20-30 years.

Thank you!

I too found the compounding of STEEM Power to be intriguing. When I started calculating the rate of the compounding STEEM Power, I realized the potential for using STEEM Power to supplement my income.

Of course there is risk to this strategy, as there is risk in any investment.

I was thinking that $100 per week from powering down would be a great retirement supplement to start with. At the current market price of STEEM that would mean accumulating (104 * $100/ $0.955) 108,900.524 units of STEEM Power.

Steem on,

Mike

I only have 200 more years at this rate. Thanks for the post.

There is a lot of power in a compounding interest rate. Currently the weekly rate of return on STEEM Power is 4.30%. Let's say you start out with 125 STEEM Power units. If the weekly rate of return remains the same, in one year the STEEM Power compounds to 1,116 STEEM Power units, two years 9,965 STEEM Power units, three years 88,974, and five years 7,093,004 STEEM Power units. Now, how much that equates to depends on the price of STEEM in five years. Even if STEEM is $0.01 USD, in five years that would be $70,930.04.

The rewards of being an early adopter. Now, everyone in the SteemIt community needs to work to make SteemIt and STEEM a success, risk versus reward. Without a bit of risk there is no reward. Taking a risk makes the reward that much sweeter.

At the same time, I do not recommend anyone go all in on STEEM Power. Each person needs to evaluate their own risk to reward tolerance.

Steem on,

Mike

Am I right in thinking you could never take out all your SP if the interest rate keeps topping it up quicker than you can power down? Is that a problem?

As long as the weekly compounding rate is greater than zero, then powering down will not result is a zero balance at the end of the two year powering down period.

Is this a problem? I do not think the 4.3% weekly rate of return will last forever. I fully expect the weekly rate of return to be less one day. At this stage of SteemIt the inflation rate makes sense, but it will likely change over time. Time will tell.

Steem on,

Mike

It may well change in time. I'm not sure if it matters that you cannot take it out as long as you can see some return on your investment (time and/or money)

Cheers for sending me a 'bonus' :)

You are welcome! Thanks for upvoting the post!

Steem on,

Mike

awesome , thx for the bonus - i am still trying to figure this thing out - just noticed it my wallet - now if we just get the FUDders to quit whining about not making a million bucks in one day ;)

You are very welcome. I am grateful to everyone who upvoted this post.

I just wanted to share my success with those who upvoted me but did not earn any curating rewards according to steemstats.com

Steem on,

Mike

This is one way of diversifying your wealth. As the saying goes"Don't put your eggs in one basket"

Completely agree with not putting all your eggs in one basket. Developing multiple streams of income should be everyone's goals.

Steem on,

Mike

Good luck then @etcmike. All the best for your endeavors at steemit