What Is The KODAKCoin

Photographers have long suffered since the age of digital photography emerged. With little protection, #photographers’ work is often the victim of illegal usage and underpaid licensing. Eastman Kodak Company (NYSE:KODK) is developing a way to stop this.

Kodak had once been “the” brand in photography, before the 90s when the company failed to keep up with the times, clinging on to its film heritage before eventually being left in the dust. This time, the company plans on not missing out on the digital trend and has decided to switch its primary focus to become a #blockchain business. Yesterday, Kodak announced that it will be launching its own Initial Coin Offering (ICO) and @cryptocurrency starting January 31st, of this year. The coin offering will be available to investors in the U.S, Canada, United Kingdom and other ‘select’ countries. Kodak is the first major NYSE-listed corporation to create and implement a #cryptocurrency.

Kodak Announces ICO and KODAKCoin; Stock Jumps Over 100%

Kodak, one of the most historically renowned companies, has announced a partnership with WENN Digital, in a bid to develop its own @cryptocurrency – KODAKCoin.

According to the statement, KODAKCoin will be a photo-centric cryptocurrency and will be the native token for the KODAKOne image rights @management platform. Aimed at photographers and agencies, the platform will utilize blockchain technology to register, track and license their work for secure distribution and protection of IP rights.

"For many in the tech industry, 'blockchain' and 'cryptocurrency' are hot buzzwords, but for photographers who've long struggled to assert control over their work and how it's used, these buzzwords are the keys to solving what felt like an unsolvable problem," Kodak CEO Jeff Clarke said.

"Kodak has always sought to democratize photography and make licensing fair to artists. These technologies give the @photography community an innovative and easy way to do just that," Clarke said.

Kodak has become just the latest brand name company to jump on the @crypto trend to send its stock soaring.

Riot @blockchain shares have tripled since October when the former biotechnology firm changed its name and said it was revising its business focus to @bitcoins.

Rochester, @New York-based Kodak was founded in 1880 and traces its roots to the early days of film-based photography. The new @services will be launched via an initial coin offering (ICO), which @many @cryptocurrency startups are using to raise funds, on Jan. 31.

Kodak's stock price surged 135 percent to $7.32 in afternoon @trading. The stock has been slumping over the last year, shedding more than 70 percent of its value.

Kodak and others are entering the market as warnings grow over the riskiness of virtual currencies and the potential for a bubble. In December, the Securities and Exchange Commission warned investors to exercise caution before buying cryptocurrencies or participating in ICOs.

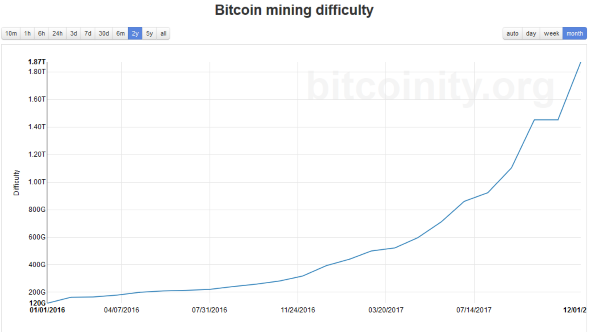

but, wait. There's more. The final piece of Kodak’s blockchain plan is the most peculiar. At CES the company revealed it plans to install rows of Kodak-branded bitcoin mining devices at its headquarters in Rochester, New York. Investors will have the chance to rent a machine for two years, at a cost of $3,400 (£2,500) and will be allowed to keep half of the bitcoin mined, with the other half going back to Kodak. Each machine should generate around $375 (£277) worth of bitcoin every month at current prices, although the cryptocurrency's price is notoriously unstable, with many @analysts speculating that it is heading for a crash.

Kodak isn’t the first company to try and cash in on the blockchain hype despite seemingly having limited expertise in that area. Everyone from burger chains to tea companies have tried to get their own share of the @blockchain magic. Here are a few of the oddest.

Shares in @photo firm Eastman Kodak soared nearly 120% after it revealed plans to mint its own crypto-currency, the KodakCoin.

The US firm said it was teaming up with London-based Wenn Media Group to carry out the initial coin offering (ICO).

It is part of a blockchain-based initiative to help photographers control their image rights.

Kodak also detailed plans to install rows of Bitcoin mining rigs at its headquarters in Rochester, New York.

Details of this second scheme - which is being branded the Kodak KashMiner - were outlined at the CES tech show in Las Vegas

Kodak’s entry into blockchain-based @platforms and cryptocurrency @mining has sparked @new debate on @companies potentially capitalising on the cryptocurrency volatility for pure market gain and little else. Kodak’s stock has increased dramatically since the announcement, quelling the consistent downhill slide the company has been facing indefinitely.

There are many vocal critics of Kodak’s recent crypto obsession, including Bloomsberg’s Matt Levine who says: "This does not strike me as fully baked, or half-baked, or really anything other than a collection of buzzwords prefaced by a frank admission that it is a collection of buzzwords."

Despite this, the fervour surrounding @cryptocurrency has already sold 80 Kodak KashMiners and SpotLite have confirmed they have 300 more arriving shortly to fulfil some of the current backlog. The KodakOne platform, on the other hand, may have some teething issues if and when the platform launches.

cc. @steemitboard