Steem Dollars Are Not $1, And We Can Thank The Bots

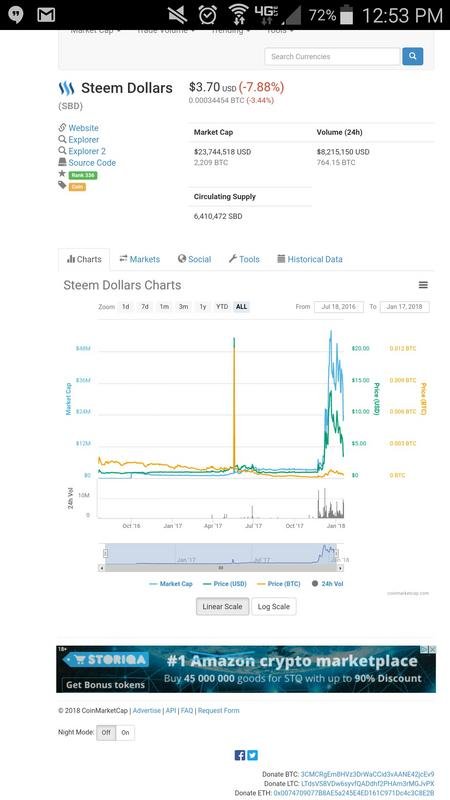

After weeks of trying to identify why Steem Dollars (SBD) diverged from their $1 USD course, I am going to go out on a limb and assert that it was much in part to do with the rise of bots on Steemit.

By design and intent, SBD was intended to be pegged to the US Dollar, having only their conversion value to Steem as a means of backed intrinsic value. Yet as the rise of bid bots have surged in recent weeks, SBD has become a rejuvenated internal currency within Steemit armed with increasing utility.

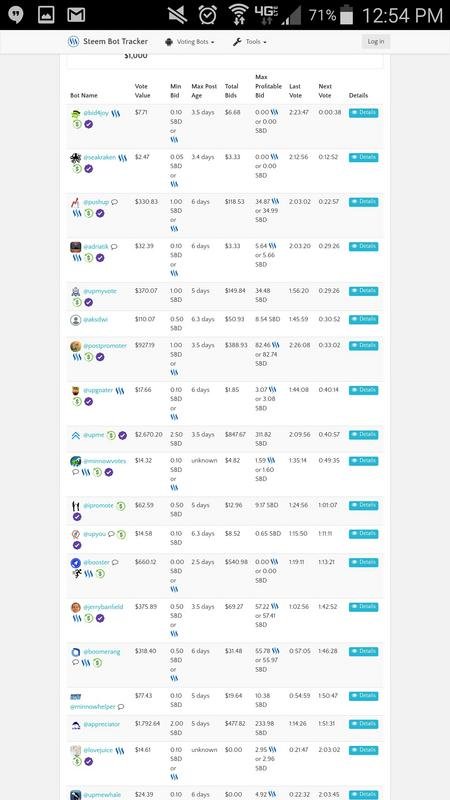

SBD currently serves as the base currency for the bid bots. Until recently, bidders were largely required to utilize SBD to bid on upvotes. STEEM bids are slowly enterring as an alternative payment form, however, but even now SBD payments remain the norm. Those curious about the prevalence of bots need only to look here:

https://steembottracker.com

By finding an alternative functionality, this has helped to extend the lifecycle of SBD from being immediately sold for STEEM. If SBD was largely considered as being akin to US Treasury note, imagine if the bid bot was a payday loan service that paid you the double digit interest return in exchange for your US Treasury notes as a fee. This is essentially what was taking place as upvotes often saw double-digit return on investment returns and payments on posts were advanced up to the 6th day.

Eventually equilibrium between supply and demand would be met, and this has now occurred. Limited steem power delegation to the bots and an abundance of new SBD (from higher payouts due to a rising Steem price, which is in part due to a higher SBD price due to higher income rewards) has resulted in most bid bots returning a negative ROI. Demand for bidding services has exceeded the supply of it.

Where we go from here is unclear. But if I had to guess, what is most likely to occur is an inflation of SBD supply which could return the SBD value back down to its $1 peg in due time. This can be offset however. An increase in steem power delegation to the bid bots could keep the cycle going for a bit longer. Doing so could help to increase the price of Steem by locking up more supply and taking it out of circulation (provided that this is new steem being locked into steem power exclusively for this passive income).

Whether you believe that a broken SBD peg is good or bad for the ecosystem as a whole, I would imagine few would doubt that it has positively influenced the current price of Steem. I would argue that increasing bid bot delegation can help make Steem more valuable in the long run. But what is for sure is that as long as bid bots continue to exhibit maxed-out votes or negative ROI on bids, those who delegate are likely the greatest recipients of the wealth transfer.

That is a very precise and in depth analysis! Thank you!

...also the best description of SBD there is - if I get asked what it is in the future, I simply can say "This is an internal currency to pay for bot upvotes!" - doesn´t get any clearer than that! ;)

I'm not sure I completely follow. Are you saying that the increased utility in SBD drove up the demand of SBD so it now trades at a price above the intended peg?

Yes, I agree with the author and believe that this is what he is saying. Multiple reasons though. Initially it may have just been greater returns in the roi enticing SBD demand. Now its likely just increased circulation extending out the SBD lifecycle thereby reducing circulation supply (its not just hitting the mkt upon receipt). Additionally, new class of passive income delegators are unlikely selling their SBD daily returns the second they get them, which leads to increased attrition in SBD supply circulation (active bidders to less active and more passive investors and then delay before selling). I also believe were now reaching a point of excessive supply due to this large run up in the steem price which results in more and more SBD being issued. I think thats what the author was getting at.

Thanks for answering. Definitely some interesting ideas here that could probably be verified with some blockchain analysis!

Excellent reply and I fully agree! This response articulates what i am suggesting. To build on that point about more stagnant and passive investors .... consider @freedom who is delegating almost 7 mil steem to various parties and has almost 2% of the entire SBD supply just sitting there.

I firmly believe that supply and demand is the way to go with this new age where in.

The hustle for good content has still be attach.

Im not sure what the context of this is about. If we are talking about delegating sp to a bid bot, then the delegator is paid out in terms of the bids submitted by those requesting upvoting service and therefore has nothing to do with how the vote affects a post. That said, the bidder maximizes his value in hoping the bid pool does not exceed the value of the vote (if it does, results in negative roi for bidders and even greater gains for delegators)

If the bid pool is getting bigger than the vote value, the bidders are just losing out collectively since the vote value is determined by the amount of delegated steem power to the bid bot. The bid pool is just how much bidders are willing to pay for that vote.... it has nothing to do with what the upvote's value will be. This is why the delegators to the bidbot prosper even more when there is negative ROI to the bidders.

Got a new follower🏃🏃

Thank you for your information. this is solved by the most beautiful trial-and-error method. I'm going to try it with a bot now. my return when it comes back.

I have transitioned most of my steem power over to delegation and have not regretted it. There may come a day in which SBD valuation decline makes this not as valuable, but we are not there yet.

I need to show someone more knowledgeable this to assist with its interpretation for me.

A really useful post which I am referencing in my blog today - will be following from here on.