800000 dollar worth of BitShares marketcap are floating......... they float.... they all float.....

As coinmarketcap is one of the most visited sites in the world, one can only assume that BitShares as the number 31 show on the list is being looked at over and over again. But most people watching the show, seem to leave the theatre, clearly dazed and confused. It is a complex performance for sure.

“They float, they all float... and when you're down here with me, fat boy, you'll float too.”

Once worth over 1 billion $ in terms of marketcap, what happened to all that money that was once part of BitShares?

Somehow over 800000$ that once touched upon one of the best acts in the world: BitShares, is now floating somewhere.

Don’t blame Pennywise though, the usual suspect.

Trying to solve this mystery and like any good detective, he will start by collecting evidence.

There must be something else going on, @oudekaas has been on the case for a while now, trying to unravel this complex issue.

Other clowns

First suspects would be the other top 31 coins around. So what acts are they performing? Could the missing 800K $ accidentally have landed in the wrong hands?

A detective must be trustworthy

I must try to be unbiased, keeping an open mind. For I have seen the act of BitShares and the other acts, therefore I can’t understand why this top performer is now dealing with reduced interest, whilst it’s act is just getting better every day.

Top performers

Some of the better well-known performing acts in terms of marketcap are: Bitcoin, Bitcoin Cash, Litecoin, Ethereum and Ethereum Classic.

Most of us know their act, but I also have to research all top 30 clowns to understand what their performance and act is like.

Concluding with an overall comparison between clowns in the same field versus unique operators. Perhaps the truth can be unraveled through this investigati

Coming clean

“Allright, stop the malarkey @oudekaas, the only one floating is you, we all know you are invested in BitShares and want to become rich!”

Darn, you bursting my balloon here. But hold on a minute, let me explain where I am coming from.

I have done a lot of research and right now based on the information available to me, I can only conclude BitShares has the biggest long term growth potential of all acts around. In the meantime I can’t sit still and just assume I am right, I will need to keep myself up to date to all investment opportunities available to us.

In order to feel better about my decision to go for BitShares, my ultimate plan is to give a full overview of the top 30- coins explained what they stand for and what relation they have.

Eventually trying to give each crypto a number in terms of longterm/ shortterm potential based on facts, properties, graphs, usage the whole shebang. Let’s see where this takes us.

So I started out with an initial layout of the first top coins, explaining what they do and what their differences are.

Hopefully building on it.

Ultimately I want to create a page that explains crypto and covers a coin in the minimal amount of words/ sentences without selling itself short. Covering the most important aspects and reasons for shortterm/ longterm growth.

A steemportal that any new investor can study and make it easier to choose, which coins are best to invest in based on facts

Ultimately trying to prove that there are better investment opportunities then BitShares as this is my current number 1.

For those new to crypto, I will endeavour to make links [blue words] to every difficult concept, so you can study whilst reading through it.

Slowly I will try to make the text more readable updating all coins and asking the devs to provide latest news updates.

So let’s start!

Ripple

Ripple works with banks, payment providers, digital assets exchanges and corporates.

It provides a clever way of transferring anything but mainly not-perishable, fungible goods (cash is good, gold is OK, as are cryptocurrencies, but can also be extended to beer and flowers, if the gateways want to deal in them.)

Rather then moving physical gold or actual money between gateways, IOU’s are tracked on the electronic ledger.

It is a clever clown which uses ripple to create shortest trust routes between gateways in order to move different currencies/ assets IOU’s between gateways. Trust is a major factor in transferring wealth between gateways, through using XRP (ripple) an optimal route between trusted gateways is used. Allowing for almost instantenous transfers.

Transactions dealt with per day: around 200K to 600K now but goes up to 2.8MM 6 months

Transaction fees: very low less than a cent.

Transactions per second: ripple's consensus ledger (RCL) can support up to 1500 txps.

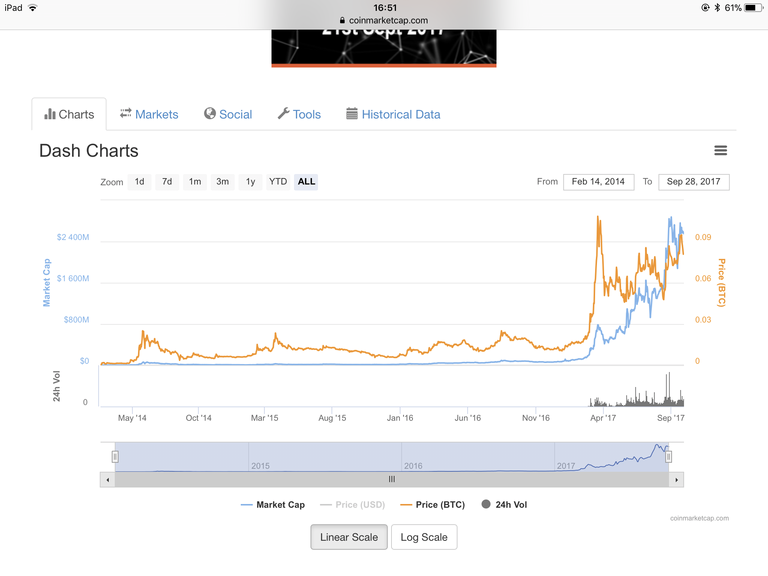

Dash

Dash is very much like Bitcoin.

Bitcoin is a decentralized, peer to peer distributed system. In order to get a grip on how decentralised crypto systems work it is worth having a basic understanding of The Byzantine Generals’ Problem (BGP) .

Which is a classic problem faced by any distributed computer system network.

The biggest difference between Dash and Bitcoin is their governance model. Dash is governed by masternode owner/s, while bitcoin is governed through consensus on the blockchain.

The community members who own a masternode can vote in favour or against proposals that help build the Dash Ecosystem.

Transactions dealt with per day: around 8000.

Transaction fees: today approx. 0.18$

Transactions per second: Dash Evolution should allow for 1500 tps, old data shows 13 tx per second.

whitepaper

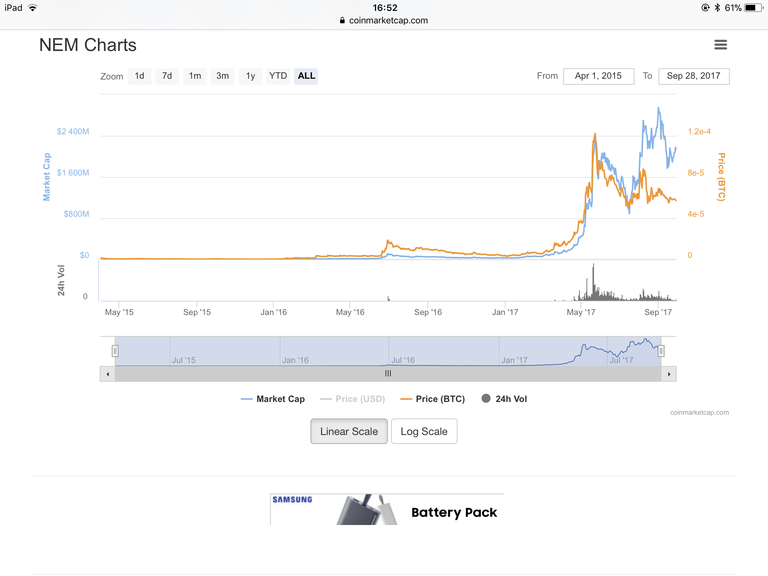

Nem

Fueled by a theme known as the “New Economy Movement” the Singapore-based non-profit organization NEM Foundation started in 2014 inspired by the cryptocurrency Nxt and wanted to enhance it.

NEM is the engine behind the cryptocurrency known as XEM, it also functions as a peer-to-peer solutions platform that delivers services like payments, messaging, asset making, and naming systems.

It does this by using smart assets.

Smart asset system

The NEM Smart Asset System allows you to totally customize how you use the NEM blockchain. First, your Namespace defines your home on the blockchain where you can name your own Mosaics, provide easy-to-remember names to user addresses, and more.

Mosaics then are the basic building blocks of Smart Assets that you can use to represent lots of simple things: it could be a coin, a signature, a status update or more.

To create truly Smart Assets however, NEM allows you to create Addresses that act as containers for Mosaics that can be connected with Multisig rules. An address can simply represent a user, such as an account holder. But it can also represent an individual unique asset such as a document, or a song, or a package. You can then update that asset through configurable Transactions.

Check out the “example use cases” to see how Smart Assets can be used to create a wide variety of blockchain solutions, quickly and reliably.

NEM is currently regarded as one of the best funded and sustained blockchain projects in the cryptocurrency industry with its technology currently used by a variety of financial institutions and industries, including the Japanese company Hitachi with its 150 million customer base.

NEM possesses both a standard public blockchain and a permissioned or private blockchain.

It utilizes a tiered architectural structure common to the Internet but unusual in the blockchain world.

As a result, running a node in order to utilize the ecosystem is not a requirement. Therefore NEM has the ability to facilitate web, mobile and other thin clients without leading to a costly footprint on devices.

Lon Wong (President NEM foundation) says that he is confident that NEM is one of the few blockchain projects in the market that has a production quality solution.

Nem has a strategic alliance with Blockchain Global, one of Australia’s leading blockchain companies providing international auditing and network infrastructure services.

Later this year, NEM plans to work with Blockchain Global to develop a cryptocurrency exchange for the NEM ecosystem. Blockchain Global previously built ACX.io, Australia’s largest Bitcoin exchange by

NEM is built from scratch as a powerful and streamlined platform for application developers of all kinds, not just as a digital currency. Using NEM in your application is as simple as making RESTful JSON API calls allowing you to configure your own "Smart Assets" and make use of NEM’s powerful blockchain platform as your fast, secure and scalable.

Configured for your use, NEM is suitable for an amazing variety of solution classes, such as direct public transactions via streamlined smartphone app, efficient cloud services that connect client or web applications, or a high-performance permissioned enterprise back-end for business-critical record keeping.

Transactions dealt with on a daily basis:

Transactions per second:

Transaction fees: After the latest fork on 3rd aug 2017 not more than approx 1 XEM (today 0.22$)

Iota

IOTA is not a Blockchain, it is based on a directed acyclic graph (DAG) aka the Tangle, not a Blockchain.

IOTA is an innovative new distributed ledger technology to function as the backbone of the Internet of Things.

Born in 2014, it is the only technology of its kind that is able to function as the lightweight distributed ledger with scalability, quantum resistance and decentralization for all IoT devices.

It is far more advanced then the block chain and is recognized in the innovation-press like Forbes, Techcrunch, International Business Times and Huffington Post.

IOTA has no mining, no blocks, no difficulty, no transaction fees.

IOTA scales almost infinitely, unlike Blockchains

IOTA is not solely made as a currency but as an interoperability protocol that solves the problems of the IoT

IOTA wants to enable the machine economy

many articles about how IOTA will be used

Its field of application is set in the Internet of Things as the technology for data integrity and industrial appliances. Furthermore pay on demand, micro-payments, and machine to machine communication like sensor technology, smart cities, adaptive systems etc.

It is quite evident, that Bitcoin and nearly all other cryptocurrencies weren’t made to function as such. Considering hundreds of thousands of nano-payments each day in the near future, these Blockchains would generate an enormous amount of fees, just for conducting transactions, while costs of these nano-payments oftentimes undermatch the fees.

Therefore, it is indispensable to use a secure, fee-free system, which IOTA is. This technology, therefore, is a novum.

The underlying technology, the Tangle, is a third-generation Blockchain-technology, based on a directed acyclic graph, made for the problems of tomorrow.

Beyond that, the Winternitz one-time signature scheme enables quantum resistance, which makes it perfectly equipped for the future.

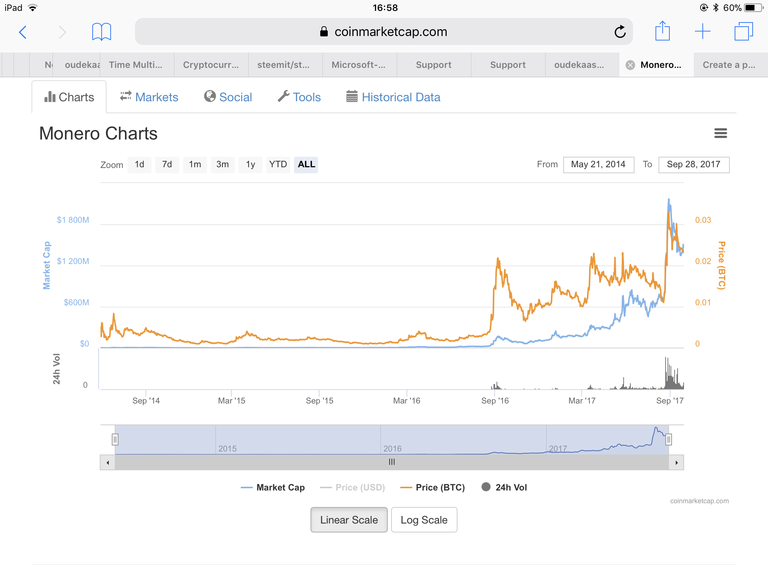

Monero

Monero is created from the ground up to deliver genuine privacy and anonymity.

Every transaction, is confidential, which means every user’s activity enhances the privacy of other users.

Transaction amounts are encrypted to prevent them from being traced by the amount sent.

Dynamic blocksize allows for fast transactions and at low fees.

Fungibility: no fear of couns being tainted, by association with the activity of previous owners.

The funds you own will not be associated with your public address, like they would with Bitcoin. This means if you tell someone your public address, they can’t see how rich you are.

When you send funds to someone’s public address, what happens is that you actually send the funds to a randomly created brand new one-time destination address. This means that the public record does not contain any mention that funds were received to the recipient’s public address.

For the same reason, the funds that you are sending were not associated with your own public address either in the public record. Therefore, when you send these funds, the public record will not show that the funds originated from your public address and will not show that the funds were sent to the recipient’s public address.

In Monero, your public address will never appear in the public record of transactions. Instead, a 'stealth address' is recorded in a way that only you, the receipient, can recognize the incoming funds.

When the recipient checks for funds, they need to scan the Monero blockchain (the public record of all transactions) to see if any transactions are destined for them. The recipient has a secret view key which is used to check each transaction to see if it was addressed to them. Because the recipient is the only one that knows the secret view key, only the recipient can see that funds have been sent to them.

This is why, if you launch your Monero wallet, you will see it ‘scanning’ the blockchain. This is done to check if any transactions have occurred that have you as the recipient. Note that you can give your ‘secret view key’ to others so that they can also see what funds you have received. They will only be able to view the transactions and not make any transactions on your behalf.

So far, we’ve discussed the concept of ‘unlinkability’. This means that received transactions are associated with a one-time address that is not linked to your public address. It also means that two transactions sent to your public address cannot be associated as having the same recipient.

We don't want the sender of a transaction to notice when the recipient of the transaction then spends the funds in a new transaction. Monero solves this problem through the use of ‘ring signatures’.

Ring signatures enable ‘transaction mixing’ to occur. Transaction mixing means that when funds are sent, the sender randomly chooses several other users’ funds to also appear in the transaction as a possible source of the funds being sent. The cryptographical nature of the ring signature means that no one can tell which of the funds were really the source of the transaction – not even the person that gave the funds to the sender in the first place. A system of ‘key images’ associated with each ring signature ensures that although no one can tell the true source of the funds, it can be easily detected if the sender attempts to anonymously send their funds twice.

The number of people that are added to the list of possible senders in a transaction is often referred to as the ‘mixin’ level. Because using a larger mixin level increases the size of the transaction for the Monero network to process, there is a slightly larger fee associated with your transaction if you increase the mixin level. Note that because you may be often included as a possible source of funds every time any transaction is made on the Monero network, no one can tell if you are or are not spending any funds that they sent you. It will look like you’re very busy continuously transacting with people everywhere at all hours of the day and night, even if you’re doing nothing at all!

In addition to providing that no one can tell whom they have received funds from, an extension to the system of ring transactions has been developed known as RingCT. RingCT (Ring Confidential Transactions) went live on 10th January 2017. It hides not only the source of funds being sent, but also hides the amounts of the funds being sent from being visible on the blockchain. This is achieved by applying a mathematical function to all funds such that public observers can see that the transactions are legitmate, but only the sender and receiver can know the actual amounts. This prevents theoretical attacks through blockchain analysis that could otherwise be possible if the real amounts of transactions taking place were a matter of public record.

Finally, project Kovri, which is currently in development, will hide your internet traffic so that passive network monitoring cannot reveal that you are using Monero at all. This is achieved by encrypting all of your Monero traffic and routing it through I2P (Invisible Internet Project) nodes. These nodes pass your messages along and have no visibility over what is in them. They do also not know whether the destination they’re sending your messages to is the final destination or just a waypoint which will further forward your message. Passive listeners can tell you are using I2P, but cannot tell what you are using it for or what destinations you are interacting with.

Monero can even withstand the attack scenario where every exchange is leaking details about your identity and the funds that you own, and where every vendor has a severe security breach that exposes their wallet. If you need the absolute highest levels of privacy and are dealing with exchanges that know your identity, you can perform a 'churn' immediately after withdrawing Monero from an exchange and immediately prior to depositing your received Monero into an exchange. A 'churn' means sending all of your funds to yourself 12 times over. Since Monero will automatically assign 5 possible sources of funds for every transaction, your funds will be hidden within a theoretical 5^12 = 244 million other transaction funds, which at the time of writing is more than 10x the number in existence. It will look like almost every customer of the compromised exchange could have been transacting with each exposed vendor. This gives you extreme privacy on the blockchain.

In summary: Monero ensures no one can tell where funds came from. No one can tell when they are then spent or whether they have been spent at all. No one can see the amounts of the transactions of others, or even that others are using Monero at all. Everyone appears to be repeatedly transacting with almost everyone else almost all of the time.

versus Bitcoin fees (XMR/BTC) Txn fee USD

Monero (lowest) 0.004000 $ 0.3919

Bitcoin (lowest) 0.000800 $ 3.3098

Monero (median) 0.014000 $ 1.3716

Bitcoin (median) 0.001000 $ 4.1373

Monero (highest) 0.661000 $ 64.7608

Bitcoin (highest) 0.005036 $ 20.8354

Transaction speed between 1 and 10 minutes.

Transactions per second 1700 TPS

Neo

Best way to understand what Neo encompasses is by making a comparison to Ethereum.

Neo is often called the Chinese competitor of Neo.

backing

NEO is backed by the Chinese government. This has become the most important factor for NEO’s popularity in China, making it China’s first open-source public blockchain project. NEO is also backed by WINGS, Alibaba, and various Microsoft-like giants.

Ethereum is not backed by any nation’s government, but it is supported by the EEA-Enterprise Ethereum Alliance. This speaks volumes about its popularity and potential success on the world’s stage.

consensus mechanism

NEO uses a delegated Byzantine Fault Tolerant (aka dBFT) consensus mechanism, which is an improved form of proof-of-stake.

Ethereum uses a proof-of-work mechanism.

dBFT is believed to be more energy efficient than proof-of-work, as POW is a very energy-intensive and expensive. But I don’t see this as a big advantage for NEO because we can eventually expect Ethereum to move to an efficient proof-of-stake mechanism.

Divisibiliy

The native crypto-fuel of NEO’s blockchain is not divisible. It only exists in whole numbers (1,2,50,1000, etc.).

The native crypto-fuel of Ethereum is divisible. It can be divided (3.4352, 283.399403, etc.)

Fueling the blockchain

NEO produces a special crypto asset called NeoGAS (or GAS)which is used as a crypto-fuel for NEO’s blockchain.

In Ethereum, small units of Ether are used as “gas” to fuel the network.

Language

NEO’s smart contracts and DApps can be written and compiled in C# and Java. In the future, developers will also be able to write smart contracts in Python and Go. This will drastically reduce the entry barrier for all developers around the world.

Currently, if you want to write smart contracts and DApps on Ethereum, then you have to learn a new programming language called Solidity. Very few people know this language.

Direction

NEO is focused on making a smart economy by digitizing traditional real world assets via digital identity, along with running smart contracts and DApps.

Ethereum is going in the direction of becoming the world’s only supercomputer based on the blockchain by hosting numerous use cases of digital identity, computing, decentralized exchanges, remittances, and KYCs (to name a few).

International audience

There isn’t much information available about NEO for the English-reading audience due to its Chinese roots.

Ethereum is already a global enterprise which fully caters to its international (and English-reading) audience.

Transaction Speed:

At present, NEO can handle 10,000 transactions per second.

Ethereum can handle 15 transactions per second.

Quantum computer-proof

NEO is quantum computer-proof. Quantum computers are believed to have the ability to break into and hack the cryptographic math on which blockchains are based. NEO claims that they have already developed an anti-quantum cryptography mechanism called NeoQS (detailed in their white paper).

Ethereum, and every other cryptocurrency, is not quantum computer-proof.

Transaction fees: tba

Transactions by comparison

Bitcoin is 7tps and Ethereum 15tps. Litecoin has a maximum capacity of 56tx per second.

Be aware this data is probably old, after for instance Segwit implementation the Bitcoin tps increased a bit. Yet in terms of world wide adoption we must really be hoping for a coin to do limitless transaction per second.

Otherwise the monetary system becomes to slow.

Lightning Network

It is a network that is being build to allow scalibility of decentralised coins like Bitcoin, to allow for Billions of transactions per day. One could argue it is a workaround to make a slow system quicker by building a layer to it.

However there are many issues surrounding the implementation of this network one of which is that it will be unlikely that the solution is decentralised potentially making Bitcoin even more centralised then it already is. read more about potential Lightning Network issues

http://www.investopedia.com/news/bitcoin-lightning-network/

Coins to be followed and added to this message in the future:

omisego

bitconnect

quantum

lisk

zcash

tether

stratis

waves

ark

steem

bytecoin

maidsafecoin

tenx

BAT

golem

eos

augur

decred

stellar lumens

Crypto coins have Memory

But I can’t help but think, that those who hold crypto, remember in what coins they invested in, in the past.

That means for me that potentially BitShares could explode back to it’s original glory once people understand BitShares and it gains renewed visibiliy.

No, don’t worry, I am not one of [Dr. Emoto’s] (http://highexistence.com/water-experiment/) crazy labstudents.

It will take time and I am pleading for help from fellow investigators to come to an overall conclusion to what would be the true best longterm act to invest in right now and in the future.

As investors we want to make the decision that has best calculated equity to that decision.

So why not help each other gaining info and discuss latest news and additions to our favourite coins and reevaluate what the best option is here. Based on facts! Proof me that BitShares is not the best investment and by doing so convince yourself you are making the right decision.

This is all informational and hopefully over time factual, so don’t hold anyone responsible but yourself for making an investment decision that popped your balloon.

Check the Benchmark out between Bitshares and BTC.

Why I think a paradigm shift will happen that involves BitShares.

I love these posts, thank you so much for posting!

I like this ranking system better than CMC, BTS is currently No. 19 and it seems much more reasonable than using market cap:

https://www.worldcoinindex.com/

Thx John, I entirely agree, marketcap gives the wrong impression. Once I gather enough info I am planning to make a top 30 based longterm potential and one for shortterm potential.

Looking at short term news, roadmaps active marketing, basically as many factors that can be reasonably obtained and turned into fact rather then blindly following marketcaps or what is being said in the slack.

The amount of money that is being thrown into the 1000+ coins available tells me, people don’t fully understand what is already on the market in terms of technology and therefore are most likely mistakenly speculating on coins that have no future.

It will be interesting to find out how many of these 1000+ actually bring something unique to the table.

That can’t for instance be build on already existing ecosystems that have gained much more trust already.

Will take some time, I will probably run several posts next to eachother one showing a less detailed version in the future.

Quality content!

Can't wait for future posts. :)

thx zeneth :)

Great post :) if u want u can look at my last video:

will check it out emma! thx

nice post

Neo sounds like an awesome project, but how is it supposed to be a currency with nondivisible 50mil coin supply? In freakin China? With population more than a billion people?

Secondly, is there any info on what is done already? Or is it whitepaper only?

Thanks for the good information here... @oudekaas