How SBD could replace BTC: an Unconventional yet Possible Scenario

While (almost) the entire Steemit community is mostly focused on theorizing potential pricing and market capitalization of the Steem token, and the SBD (Steem Backed Dollar) is mostly seen as an "IOU" (I owe You) and "frowned upon" by some as an reasonable investment option, I hereby want to present to you a scenario that, while being unconventional, might be plausible due to -a- a high-implication Steem blockchain rewards mechanism, -b- outsider market valuation perception, -c- technical & commercial innovations expanding the E-Commerce possibilities of the Steem Ecosystem.

SBD background

SBD intended to be a stable currency and fiat replacement

Initially the Steem Backed Dollar (SBD) was meant to provide the "CryptoSphere" with a stable currency. While crypto volatility is very interesting for active crypto traders, - for it enables them to grow their crypto capital's worth by "hopping" from one crypto asset to another -, the volatility is negatively affecting the widespread adoption of retailer crypto acceptation as a means to pay for regular goods and services. After all, suppose you're a smartphone retailer and you purchase "smartphone X" for an amount of $300,- USD, if you're selling it for 0.05 BTC as a retailer you can make a big loss when BTC price drops heavily, and in case BTC goes up to $15,000.- then nobody will buy the phone at 0.05 BTC.

So as a consequence, the retailers that do accept crypto as a payment option constantly change their crypto pricing, because they are still "accounting" in terms of fiat instead of crypto.

So, as an attempt to change that "fiat-minded perspective" the SBD was intended to be worth 1 USD worth of Steem, for being backed by Steem. Maybe the idea was also to get that retailer to price its "smartphone X" at 500 SBD, being the equivalent of $500,- USD, enabling a more "crypto-minded accounting perception" among both retailers and consumers.

Steem/SBD conversions as a mechanism to burn SBD and keep its circulating supply under control

As an implementation mechanism, there was (is!) an "SBD to Steem" conversion option: 1 SBD would then get "burned" to a $1,- USD value worth of Steem, and that 1 SBD would literally disappear from existance after the conversion. To make that conversion and "SBD-burning" work, the blockchain needs to produce as much Steem as needed for that conversion to happen. If Steem is priced at exactly $1,00 USD then 1 Steem is needed to burn 1 SBD. If Steem is worth $10.00 USD, then only 0.1 Steem is needed for that conversion. But in case 1 Steem is worth $0.10 then 10 Steems are needed for the same conversion.

But, the higher the price of Steem, the more SBDs are rewarded ("printed"), meaning that if (for example) Steem is priced at $5.- USD and the blockchain in a certain amount of time rewards 100,000 SBD, and then Steem falls to $1.- USD then the blockchain needs to repay 5 times that amount in terms of Steem, which causes a fluctuating rate of inflation in terms of generated / circulation Steem token supply.

Having said this, in case due to (external) market demands SBD price goes up (a lot) above a $1.- USD value,- which is and has been the case since November / December 2017, then why should anybody holding SBD want to use that Steem/SBD conversion option? A few Steemit rookies made the mistake before to unintentionally convert SBD for Steem at a $1.00 USD price worth of Steem when SBD was worth a lot more. So, as a protective measure, Steemit Inc. decided to (temporarily) remove that conversion option from the Steemit.com user interface. (You can still convert and burn SBDs via the CLI wallet though.) So as a consequence, (almost?) nobody converts anymore, zero SBDs are getting burned at the moment, and the SBD circulating token supply is growing, and growing and growing: while writing this, there are 12,901,785 SBDs in circulation.

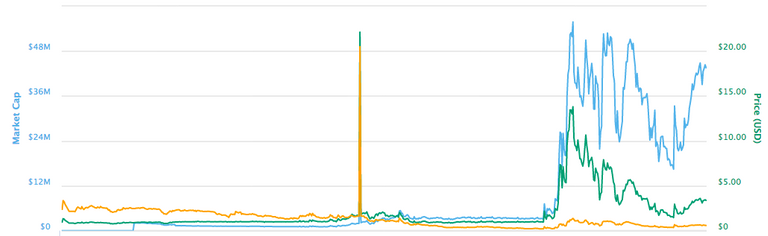

If you take a brief look at https://coinmarketcap.com/currencies/steem-dollars/ you can see that on December 21, 2017, the SBD market cap was around ~$ 55 million USD being priced at $13.81 USD per SBD, while at January 21, 2018 the SBD market cap was above $52 million USD but SBD price at $7.90: in the same period Steem price was relatively high as well, causing the printing of lots of SBDs, which caused a relatively stable SBD market capitalization where prices almost halved. And at April 29, 2018, SBD market cap was still just under $45 million USD while being priced at $3.59 USD.

We can clearly see, that because (almost) nobody is nowadays using the Steem/SBD conversion option, more and more SBDs are being printed, causing a relatively stable SBD market cap in a 3-month (Jan-Mar 2018) SBD price downtrend (which has now been reversed) causing a bigger "debt position" for Steem.

A complicating blockchain debt safety measure

As we have experienced last month when Steem price was relatively low and the circulating supply of SBDs was (and still is) relatively high, something interesting happened, which is caused by a blockchain mechanism which is intended as a debt safety measure. Because, in order to keep the debt-equity ratio of SBD/Steem from getting disproportional, there exists a mechanism built into the Steem blockchain. Regard the following formula:

Steem Debt Ratio = SBD Circulating Supply / Steem Market Cap

This formula does take into account the Steem Market Cap, but it does not take into account the SBD price or its market cap; only the amount of circulating SBDs.

And there exist the following rules:

- when the Steem Debt Ratio is below 2%, blockchain rewards (50-50 setting) are being paid as SP and liquid SBD;

- when the Steem Debt Ratio is between 2% and 5%, rewards are paid as a mixture of SP, liquid Steem and liquid SBD (the higher the Steem Debt Ratio, the less SBDs will be rewarded);

- in case the Steem Debt Ratio goes above 5%, rewards will be paid as SP and liquid Steem only, meaning no more SBDs will be printed!;

- and when the Steem Debt Ratio goes above 10% then the rule "1 SBD is worth 1 USD worth of Steem" won't be honored anymore.

SBD: inflationary or extremely scarce????

The 2-5% Steem Debt Ratio rule did already get applied, briefly and very recently: for example, on April 1st 2018, the Steem market cap was about $378 million USD, and at the same date the SBD market cap was at about $17.5 million USD while priced at $1.56, meaning there was an SBD circulating supply of about 11.2 million tokens. 11.2 / 378 = ~3%, and as we've experienced parts of the rewards were then paid out as a combination of SP, liquid Steem and liquid SBD. Since then Steem price has gone up considerably, leading to more SBDs being printed in a short span of time, and since today there are 12,901,785 SBDs in circulation already that's a 15% increase of the amount of SBDs circulating (+ 1.7M / 11.2M) in just one month!

Also, regarding that last rule (>10% debt ratio)... that's all good and well IF SBD price is <= $1.00 USD, but in situations SBD is (way) above $1.00 USD absolutely nobody wants to use the conversion option: not at a $1.00 USD rate let alone at a lower rate than $1.00 USD.

So these debt-limiting mechanisms have an unforeseen effect. And that effect is:

SBDs will be scarce as gold.

First more SBDs will be printed, up until the point the Steem Debt Ratio is above 5%, and then suddenly zero new SBDs will be printed meaning the circulating supply of SBDs is scarce, and fixed even, at a zero inflation rate or even deflationary.

Scarcity as a key value driver

And what usually happens, in terms of valuation, to any asset that's become scarce?

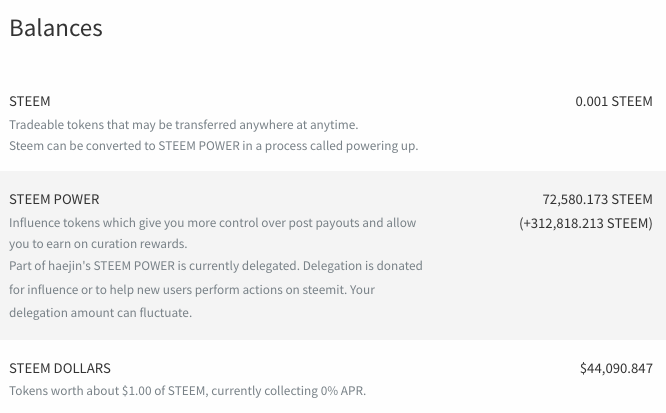

Some believe in @haejin being a "crypto oracle", while others are of the opinion he's a scammer, a self-centered egoist, and a reward pool thief (to avoid a different wording). Anybody is entitled to form his or her opinion regarding @haejin, as far as I'm concerned, but have a look at this SBD price prediction post of his, which was presented from a price-technical point of view (as always), and now regard it from the perspective that I just presented. And ask yourself, no matter what you think about him personally: "Is that SBD price projection unrealistic, or might it be under-valued even?"

If you take a sneak peak at https://steemit.com/@haejin/transfers/ and take a look at his liquid positions... then surely you cannot deny that @haejin is practising what he preaches, at least in this case, for he's clearly preparing himself for an SBD mooning very soon.

Let's say at some point Steemit Inc. wants to put a stop to the ever-expanding increase of SBD supply, therewith controlling the debt-equity ratio, by "burning" a bunch of SBDs with their self-owned Steem. While being very costly on the one hand, such an operation would be pointless on the other as well. What happened in December 2017 when SBD price had mooned causing a 0.2 SBD/Steem price ratio? On the internal market everybody quickly converted their hard-earned SBDs for Steem: trade 1 SBD in exchange for 5 Steem, that was a pretty good deal! So as an effect, SBD price slowly fell, but Steem price got driven up: high-SBD lead the way to a higher price of Steem. So in case Steemit Inc. would choose to mass-convert SBDs to Steem by burning them, then at first the amount of SBDs will be even more scarce, causing the price of SBD to moon once again, which will again lead to a price increase of Steem, which leads to more SBDs being printed, until the same high debt/equity ratio is a reality once again.

Also ask yourself: who else than Steemit Inc. could or even want to burn SBDs just in order to sanitize the debt-equity ratio?

Concluding on this, and as I've reasoned about that has nothing to do with technical but with fundamental financial analysis, and please feel free to share with me aspects I didn't consider that might prove me wrong, if things continue unchanged in the way they do now, I see no other possibility than that SBD price and market capitalization will go up by several factors in a few weeks or months.

SBD vs Steem vs BTC: which one could or should be more valuable?

Circulating supply SBD vs BTC: same ballpark

What drives market capitalization of any asset? I'd say it's "utility" (what can it be used for?) and "popularity", or "volume" (how many people want to use it?). BTC is of course the first mover in the crypto sphere and because of that, since 2009, it has steadily acquired a powerful market position in terms of market awareness, and price per token and market capitalization as an asset class of its own. Out of the maximum supply of 21 million BTC tokens, currently a little over 17 million tokens are circulating.

When looking at SBD, with a current circulating supply shy under 13 million tokens, wouldn't you say that both BTC and SBD are in the same ballpark, in terms of circulating tokens? Suppose we're at a point where 100 million SBD tokens are circulating, then they're still in the same ballpark, but in order to let the ">5 % Steem Debt Ratio" take effect, then the market cap of Steem needs to remain under $2 billion USD (that's double the value it has today).

However, the current market cap of SBD (~$ 44 million USD) isn't in the same ballpark as BTC's market cap currently is (~ $ 165 billion USD) at all.

SBD vs Steem vs BTC Comparison SWOT

Apart from it's first mover advantage, which strong points does BTC have? Its underlying blockchain technology isn't very fast in terms of transaction speed, especially when being compared to the Steem blockchain which dances circles around BTC's blockchain tech. BTC's mining mechanics are very inefficient, yet lots of hardware capital (ASICs that can only be used for one specific task) is involved in the mining of BTC meaning the miners have their hardware investment at stake as an incentive to keep on backing BTC. But there's one very strong plus in favor of BTC, namely it being the current gateway between fiat and crypto: if somebody wants to invest in crypto or cash out to fiat, BTC is the gateway. And if somebody wants to exchange altcoins X for Y on crypto markets, then they're obliged to do so via BTC (and/or ETH) mostly as direct exchange pairs.

By design, anybody can follow and inspect transactions of a certain BTC wallet, where the wallet's address is anonymous (well, to a certain extent at least it is). People mostly prefer not to talk to others about the amount of BTC they own, for various reasons, meaning a scenario where BTC-users would "interconnect socially", like is being done on Steemit, is highly unlikely. And as such, I don't see any potential for BTC to be more than a storage facility and exchange mechanism for holding and exchanging crypto value.

Now as I've argued above, Steem and SBD behave like Siamese Twins (intended originally, or not, doesn't matter: the correlation is happening regardless). A mechanism where high-Steem leads to a faster creation rate of SBDs, and low-Steem leads to a zero creation rate of SBDs, eventually an equilibrium state will occur where the circulating supply of SBD is finite and fixed by market demand, not by design. Therefore I foresee a situation where Steem will be mostly occur, and be used dominantly, in the form of Steem Power as a means to have a say over the distribution of newly rewarded Steem. The (then) liquid Steem rewards will either be powered up to SP or traded for SBD for its scarcity and value.

Practically speaking, you can do the same with SBD as you can with liquid Steem: they both use the very fast Steem blockchain technology allowing for very fast transaction times at a high volume. This means both Steem and SBD can be both used as a transaction mechanism / currency for the exchange of goods and services in a far more practical way as BTC current technology allows for.

Utility-wise, both SBD and Steem have far more possibilities than BTC does. Because of the underlying social interactions (by design!) of the Steem Ecosystem, both SBD and Steem encourage social interaction between users and therefore also "wallets". While BTC wallet owners behave rather "shy" about showing what they've got, the Steem Ecosystem encourages "showing off" your wealth: there's a strong correlation between "amount of SP owned" and "amount of followers". The more SP influence you have, the more eyes following you as well (e.g. people hoping for an upvote from a high-SP account). The Steemit ecosystem encourages people to interact, form alliances, develop and use new things and services, together. None of those things are happening in the BTC Sphere: in there, the "retailer fiat mindset" is still dominantly present.

Steem & SBD E-Commerce Initiatives => SteemCommerce

Currently, the Steem ecosystem is still mostly about "blogging" and "upvoting content". But so much more can be done with both the underlying technology and community! Just imagine what will happen if we create an E-Commerce layer on top of the current Steem ecosystem... The zero-transaction costs of Steem & SBD are very appealing, allowing for micro-payments. And it's possible already to do so in ways currently unseen. Let's give a few examples:

You know hosting company https://www.privex.io/ ? It's founded by my friend Chris (@someguy123), and as a hosting company Privex allows you to use its hosting services paid for in USD but also as Steem and/or SBD. Many Steemians use Privex.io because of that: the acceptance of SBD & Steem allows you to actually spend your Steem & SBD, in fact circumventing the fiat markets with it. Now imagine how useful it would be if Privex.io would deploy a subscription-based payment system: auto-payments I mean, subscription-based, right from your wallet on a predefined date and time. It's possible already technically, using SteemConnect!

@utopian-io already uses a weekly comment-creation and upvoting mechanism for moderators and Community Managers, as a means of payment for being active in those Utopian roles. Again, using SteemConnect authorization, Utopian auto-comments on behalf of moderators / Community Managers, and auto-upvotes each comment based on the value provided by that person in the past week. The interesting tech aspect here lies in the 'auto-commenting on behalf of'. That's another form of a subscription, I argue.

And then there's Steem Dunk, allowing you to pay, via subscriptions, for setting up and deploying an advanced curation trail. While that's still a similar service to "blogging & upvoting", the subscription-based payment mechanism is extremely interesting.

Please consider @neoxian 's financial services. Another very interesting approach to provide new and exciting services, using the Steem blockchain, apart from "blogging". @neoxian is single-handedly taking the Steem blockchain to an entire new level, providing immense value to the entire ever-expanding community.

Many developers are already accepting Steem and SBD as payment for their development services. The same goes for designers providing their services. Another form of "SteemCommerce".

Or how about web shops allowing you to pay with Steem & SBD, right out of your account's wallet, via SteemConnect?

If we only think "Out of the Box" about the Steem Ecosystem, instead of "blogging & upvoting content"-only, and develop new services and infrastructures around it, then we have collectively circumvented the need for a "fiat gateway", which is to my perception the most dominant enabler of BTC's market cap.

Concluding...

I think:

SBD market cap and price has a realistic potential to multiply by a number of factors, because of the debt-equity counter measures built into the blockchain, leading to irreversible SBD scarcity (don't take this as financial advice but don't ignore what I've explained either);

Since I've argued that Steem and SBD are behaving as "Siamese Twins" I don't see why their both market caps couldn't be in the same ballpark;

If we collectively develop a technical infrastructure of SteemCommerce with new and exciting products and services, and take care of growing the Steem user base (which needn't be about blogging-only!) in a healthy way, then we have combined all factors that are needed to make way for a very, very, very bright future of the Steem Ecosystem.

Many tokens are pretty scarce. Not sure if SBD is something special

It is special, because it's -1- backed by Steem, -2- it's strongly correlating to Steem because both are the only ones tradeable against eachother in here, on the internal market (a dedicated exchange used only for 2 coins).

We're discussing a number of things here, let's not confuse them:

the upward price potential of SBD

In nov / dec 2017 SBD mooned, and what happened then is likely to happen again: due to the (now!) low market cap of SBD (as compared to major tokens) its price can be relatively easy pumped by a number of factors. If you look at the volume of open sell orders regarding SBD on - for example - Bittrex, you'll find it only takes a few million USD to make SBD price go toward the $25,- mark by simply buying all current sell orders. As a consequence, many automated trading systems will follow, putting more and more capital into SBD, suddenly causing a high-SBD market cap.

SBD price pulling up Steem price

What then happened in dec 2017 / jan 2018, is that - presumably because of the internal Steemit market -, SBD price pulled up Steem price, which is because Steemians favor Steem for its ability to power up to SP. Also on the internal market, trading SBDs for Steems and vice versa is currently the only trading pair on the internal market.

faster SBD printing due to high-Steem price

The higher the price of Steem, the faster new SBDs will be printed, and since nobody converts (as opposed to trades!) SBD for Steem at a $1.- price point anymore, that will only lead to a larger amount of circulating SBDs.

Steem debt protective measures inside blockchain rules

And as I've explained in my article, the situation that more and more SBDs are circulating will eventually lead to the "5% rule" (# circulating SBDs / market cap Steem) which will cause zero new SBDs to be printed. That's the "SBD scarcity effect" I was referring to! How many SBDs needed to (relatively) permanently sustain that situation, is of course dependent on the market cap of Steem.

Prediction: SBD market cap / Steem market cap => 1

And as a consequence, I predict for the mid to long term that the SBD market cap will eventually be equal to the Steem market cap.

PS 1: I probably should have split this article in 2:

part a) about SBD's potential market cap

part b) about SBDs possible ability to replace BTC

PS 2: I'm thinking about doing a follow-up post, in which I'll compare historical Steem & SBD market data, graph that data, and discuss the data.

I get your point. But don't agree wit it competely.

Nov-dec 2017 was the rise of paid upvote bots with SBD as the only paying option. So the transaction demand lifted SBD mcap to 40M approximetely. Then STEEM rose and SBD token mass began to grow significantly. All the time maitaining mcap at 40-50M range, with price steadily declining. Then upbotes get STEEM paying option and SBD mcap fell to 20-30M where it is right now roughly. So the whole story was a simple transactional demand for a scarse token.

My vision is SBD return to 1 usd range. With steem economy transacting mostly in STEEM tokens as in such a condition the whole system is less volatile and any economy tend to reach its less volatile state.

I really don't think the upvote bots have anything to do with it. In any transaction, one party buys what the other sells. Prices go up when demand is higher than supply. That's not caused by people sending SBDs to bid bots, because there's not even a trade involved there, it's rather like a "gift" where wallet X sends SBDs to wallet Y.

What really drives prices up or down, are the external markets. Because the SBD market cap is quite small, and so is its trade volume, any whale is able to pump its price by simply buying all open sell orders on an exchange. If you have a look at the current SBD sell positions of SBD on Bittrex, then you'll find it only takes a few million USD to buy all open sell orders, which will cause a gigantic price lift, which will trigger other bots to further increase its market cap.

And if you would read my article ( https://steemit.com/steemit/@scipio/how-sbd-could-replace-btc-an-unconventional-yet-possible-scenario ) and the comments underneath, you'll get my point on what's really happening in reality, regardless of the original intentions with SBD to be USD pegged.

A stable currency, whether fiat or crypo, is the equivalent of looking for a unicorn or a perpetual motion machine. It is a myth! Even the Swiss national bank could not keep the CHF pegged to the euro.

All assets have to find their valuation on the open market, not be predetermined by some central entity.

One word: bitUSD

Those were three words actually! :P

well.... that's my point exactly, isn't it? :-)

Here is my idea, what do you guys think?

https://steemit.com/steemit/@simonpeter35/sbd-market

SBD can not replace BTC.

BTC's POW blockchain should disappear, but SBD is a highly inflationary asset that is supposed to track the price of another inflationary asset, which inflation rate is not even subject to any rule or regulation.

In addition, Steem and SBD's sustainability is in doubt.

BTC should be replaced, and I believe that it will, but neither Steem or SBD will be its replacement.

Its future is guaranteed demise.

The only question is when.

Both its userbase grows, and the amount of spam per each user grows.

I hope to board its replacement in time.

Have you not read what I wrote? What SBD was "supposed to do" - be pegged to $1.00 USD as a means to provide a stable crypto currency in terms of fiat value -, hasn't exactly been accomplished.

And I've explained what is in fact happening with SBD (and as I said in a reply comment to @bronevik above, I probably should have split this article in 2), in short:

So yes:

I read most of it now, but have to read it all again, repeat it, verify it, think about it and internalize it.

I have a remark about utility:

While BTC may seem useless to some, it and other currencies have an important utility:

dividends/airdrops

In this case, holders of currencies receive other currencies, which may in turn be very useful, like Byteball and Steem.

In your scarcity scenario, one of SBD's very few utilities, which is conversion to Steem is disabled.

Regarding gold, it is mined and may be either brought from space, or airdropped (which is how it reached earth) from space.

So gold supply increases and is expected to increase.

OK, good! Love to hear from you when you have re-read it , thought about it and internalized it! ;-)

SBD getting "scarce as gold" is of course just a comparison. I could have (perhaps?) better just said "scarce". And that scarcity is not just a hypothesis but a real effect caused by the way the blockchain prints SBDs.

BTW, I'm not against BTC, in any way. The BTC-replacement scenario part in my article is a possible scenario; unconventional yet possible. Things need to advance, regarding the Steem ecosystem, a lot even, and the "SteemCommerce parts" are quite important for the scenario I talked about (regarding SBD replacing BTC) being able to happen. Having said that, of course in the BTC world, regarding sidechains, also loads of possible advanced mechanisms can be implemented. Like the usage of sidechains. We'll just have to see what's going to happen!

I have another problem.

Even if SBD will cease to be created, it will be temporary, until Steem's inflation will catch up to it,and then its production will be resumed, its so like gold, it will not be a limited resource.

Its inflation rate is and in average will continue to be much higher than gold.

Due to this inflation rate and the unsustainability of Steem's blockchain, it can never replace BTC.

It should be preferred over Tether, which is what you should have compared it with.

Well... no. I gave a quantitative example already in the body of my article above. Suppose there are 100 million SBD tokens circulating. Then in order to let the "5% rule" apply, Steem market cap needs to stay below 2 billion USD (roughly a price of $8.- per Steem). In order to print new SBDs, the Steem price needs to rise to - say - $10.- per Steem. And as an effect, temporarily, lots of new SBDs will be printed. Say there are then at some point 150 million SBDs circulating, then to overcome the "5% rule" Steem needs to have a market cap of at least $ 3 billion USD (roughly priced as $12.- per Steem). If Steem does go above that, new SBDs will be printed even faster.

Do you now get my point? The more SBDs are circulating, the higher the price of Steem is required to overcome the "5% rule". Yet if it does, then the printing of new SBDs will be ever faster. And eventually the Steem market cap simply cannot keep up with the circulating amount of SBDs. And as an effect, SBDs will be scarce for they will not be printed anymore.

@youtake pulls you up ! This vote was sent to you by @stimialiti!

i have not enough sbd

Then produce some good content to earn some! ;-)

You got a 34.63% upvote from @luckyvotes courtesy of @stimialiti!

I read follow, upvote and resteem, vote me!

No, seriously, what is happenig lately? More spam comments everywhere :s Many of my last posts have no comments or spam comments only :( I used to have more quality comments a few weeks before. I don't know if this is general in steemit or it is related that I don't have 6000SP anymore.

With that thought in my mind (and with a lot of help of a programmer, @alpacachino) I created this game: spampig ... BUT not only with that on mind, also with all you said here; I want to help expand the limits of STEEM/SBD to other than just upvoting content; having a store inside this game (and future games), to achieve 2 main things:

I think games, specially 'easy' games, like flappy bird, runner games, etc can go mainstream very quickly and we can use that in advantage for STEEM :D

This will take a while because non of the team is expert in the blockchain, and now steemconnect has been attacked and that has discouraged us from using it u_u But we still have all this great idea in mind!

I have always though SBD has great potential to become a real replacement not only for BTC, but for USD. It only needs to be stable at some point. Exactly for what you said.

I have seen STEEM and SBD have little capability of division, like 9.999 only 3 digits after ".", so SBD price can't go super high or 0.001 could be $100USD and we could only buy super expensive things with it. Maybe I am missing info here, and the blockchain can change to 0.0001, 0.000001 etc when needed. Does it?

This was very interesting to read Scip! If I have more thoughts on this I will come back x)

And yeah I did upvote and resteem xD

Good question! Whether or not Steem & SBD are "Satoshi-divisible" to 1/100.000.000

A question I don't know the answer to regarding its current state ..., but I'm sure that's possible to alter via a Hard Fork if not the case!

They should hardfork tobe able to upvote and resteem after 7 days and have payouts each week. xD

That would be nice, wouldn't it? ;-)

Yeah, it would be.

Currently SBD has 0.001 as its lowest denomination, which I think is good because it limits upwards motion of the price to too high, at which point even trading 0.001 SBD would be quite a lot (say $1 if SBD reaches $1000).

In general, though, I think SBD shouldn’t go very high, because SBD should be a stablecoin, not digital gold. Right now Steem is built so that STEEM is the main focus, with SBD being paid out as a way for people to recieve instant rewards.

You seem to imply in the post that SBD is only bottom-pegged, but I believe that the witnesses have the ability to tweak the APR on SBD, so that they can manipulate the price down to $1.

Make sure to tell me if there is something I’m missing here.

Great article. If you see the daily increase of steemit users it is amazing. When a lot of people are familiar with this platform, the popularity of steem and SBD will definitely rise. Correctly said, people are using BTC as a media of fiat gaining. Not sure, in future steem and SBD will replace BTC or not but I can bet steem will dominate the blockchain and crypto industry. Thanks for the informative article.

Well... since SBD price has gone up wildly - and because I think it will do so again - thus far the objective of providing a USD-pegged stable currency didn't completely succeed... yet?! ;-)

I just skimmed over (I'm in a hurry right now) but I will read and re-read your post later and try to understand it better ;-)

But let me ask something in advance anyway. And disclaimer, I don't really have good understanding of internal mechanics.

What role in all this play witnesses who can, and do change conditions and are that way pushing SBD price down? I heard many times from them something in this regard: SBD price is too high, adjustments are needed and I'm doing them. How much this affect SBD price and divergence from 1USD (and STEEM price) and what this mean in case of your idea?

That's a good questions, for which I'm hoping one or more witnesses will reply to via the comments!

But as far as I'm concerned, SBD is only bottom-pegged to the USD.

Finally another someone who speak a lot of sense. I've been saying similar things for a some time and so does @ew-and-patterns

Glad to have you followed. 100% upvoted and resteemed.

Hi! Thx for the compliments! ;-)

But what are your thoughts about SBD exactly then?

We have a coin that is 200 times faster than BTC that has Zero Tx fees. SBD can handle several times the Tx capacity of BTC and it cannot fall below 1 USD (unless some extreme scenario happens to STEEM which is unlikely considering SMTs and being technologically superior to 99% of blockchains). BTC on the other hand can hit zero and considering how technologically inferior and that it's already the biggest coin in the market with while being the slowest and most expensive.

@haejin said SBD can hit 6-12 STEEM. I'm around 2.5-4 STEEM and I've seen @ew-and-patterns call for 4 STEEM worth SBD. Either way, unless SBD is worth 10 BTC I'm not going to be surprised by any price increase. I think SBD will be more volatile than STEEM. But I'm with @haejin and @ew-and-patterns for the short term as I too believe SBD will outperform STEEM.

I also think people are too blinded by the "peg" which I actually call a price floor and forget the utility of the coin. I mean only Dash/PIVX InstantSend has better speeds and at the moment no other blockhain can handle more Tx/s.

Dear Sir Scipio,

Thank you so much for posting so beautiful.

SIR was very good for your posting. Because you get many benefits with the right information, so thank you very much for posting so beautiful and helping others by providing such information in the future.

Just a quick heads-up regarding commenting-style, because you're new to Steemit: there exist few accounts holding a lot of Steem Power (SP) (like over 25,000 SP or so), quite some accounts holding quite some Steem Power (in the range of 1,000 - 5,000 SP), and lots of accounts holding close to zero SP (like 10 - 100 SP).

When you're new, like you are, you need to start learning how things work. And trust me on this: if you're looking to get upvoted on your comments from powerful accounts, then commenting "what great info, thanks!") will not get you an upvote. Instead, try to form relationships with people and only comment high-quality stuff. It takes some time and effort to build relationships but it is worth your time.

PS: here's a small upvote from me, just to get you started on Steemit!

Hi @scipio,

Your article exploded my head!

Even taking in consideration the unlikely fact of SBD overtaking BTC (which I see as 'impossible' right now), it's the 'scarcity scenario' what drives me crazy. (Isn't that easy to understand, even if you're familiar with trading as I am).

The point is clear: SBD and STEEM are highly correlated and as evidenced in the past, STEEM grows after SBD mooning.

The key fact is the 5% printing/debt limit (which I wasn't aware of btw).

I struggle and I wonder... What would suddenly happen if there's no 'new' SBD's being printed? Steem mcap will rise to 'balance this situation' which will lead to more SBD being printed... which will lead eventually (again) to reach this 5% limit.

Pretty interesting read mate. Upvoted and resteemed.

Have a nice day!

Indeed, there are two things to consider here:

(1) the Steem market cap will indeed "rise to balance the situation" until that will become impossible to achieve in the short term. As I've said, a Steem market cap of about 2 billion USD, so Steem at a price of about $8.-, is plausible to achieve in the short term. For the "5% protective blockchain mechanism" to take place, that would require 100 million circulating SBDs.(0.1B SBDs / 2.0B Steem market cap). Maybe via a few "pumps" temporarily an even higher Steem price is possible, but I don't see it sitting at that price point for months in a row.

(2) in order to grow to a circulating supply of 100 million SBDs will take quite some months; it's hard to closely predict exactly how many months because the inflation rate of SBDs circulating depends on the Steem price. But at the current rate we're talking about 1 to 3 years for that to happen. And that's quite some time from now, almost like "a century" in "crypto time".

A very informative but entertaining post @scipio. I just do not think SBD has the utility that BTC had found.

Does anyone want to buy drugs using a blockchain where you did your introduction post with a photo and all transactions are public and really easily traced to you? Anyone?

Okay, very public stuff. Does anyone want to openly buy files such as e-books, and music files. Go to https://www.steemfiles.com. You can spend with your Steem Dollars. Anyone? Same response as above?

Hi!

In response to your comment:

I don't see that many "regular" webshops allowing you to buy drugs with fiat money either.

But that could be only because I don't do drugs.

In case of buying digital media, such as eBooks, the blockchain can just store an encrypted memo. No need to list all items bought, just the transaction amount, retailer address, and some form of ID. If you buy an eBook at a regular webshop, does it show the book title on your bank receipt?

can you elaborate on why you think SBD doesn't have enough utility? (Of course BTC has a huge market dominance now, and btw - I'm not against BTC at all! - and BTC still has the first mover advantage, lots of users, but I don't see why the Steem Ecosystem should not be able to take that position (as well). )

Once you have a technology in place, it takes a very large improvement to get people to switch. In the case of pre-bitcoin it was Swift and Western Union. There was a incentive to switch based on no fees or very low fees. Today, SBD gives us zero fees, but the merchants that have become disillusioned with bitcoin because of the high fees are unlikely to start accepting Steem. Steem Dollars although intrinsically better in many other aspects is like bitcoin with only blockchain.info for a wallet. How many people would still be able to move their Steem/SBD funds if some government (cough cough USA) entity decided to shutdown Steemit? Nearly everyone. What would happen if this happened to bitcoin.it? Nothing, bitcoin has many wallets.

I would love to sell my Steem and SBD to people here in Argentina but liquidity is very poor. It is always hard to find buyers of crypto to fiat. There are no Steem/SBD gateways. There are Segwit Bitcoin to fiat gateways that make you put your id and everything. So, they are going to store my id on running servers. They say they are going to leave some bitcoin in cold storage but they will not do the same for the id I send them to verify with. Ostensibly the identification documents are for verification of identity, so I fail to see the need to even store them at all, much less online. So now ripio.com is a nice pot of digital scans of documents ripe for mass identity theft by any hacker that can get in. That site and satoshitango.com are the only two sites in this country that do this crypto to fiat exchange.

Neither of these exchanges work with anything but the inefficient, slow, high fee Segwit Bitcoin unfortunately. So, suppose we say yeah fiat sucks and the people are going to buy into bitcoin because they don't know any better or they need to get into bitcoin first even if they do. They use an exchange and defeat the whole point of crypto-currency.

I do think these sites you mentioned give the SBD some acceptance it needs. The first market advantage was squandered by Segwit Bitcoin devs but now users of crypto have thousands of other currencies to choose from.

Good point on the decentralization of Steemit. However Steemit Inc != Steem Blockchain

steem is the main crypto, and other side sbd is steem back doller, steem will be high price and sbd price must be low. am i right sir?

Ehm... you might want to read the entire article before asking things like this...

SBD may getting down today or tomorrow, i realise it from your blog..need a more balanching with STEEM & SBD.

You might want to read before commenting as well...

i was read the background of sbd. then i express, sorry for unnecessary things.

Well good! That's at least 10% of the article! ;-)

Dear Sir @scipio

Thank you so much for posting so beautiful

SIR was very good for your posting. Because you get many benefits with the right information, so thank you very much for posting so beautiful and helping others by providing such information in the future.

Please Stop - @biplob0136

You just said "your post" and in your your last 100 comments you used 50 phrases considered to be spam and you made this exact same comment 1 times. You've received 0 flags and you may see more on comments like these. These comments are the reason why your Steem Sincerity API classification scores are Spam: 63.50% and Bot: 2.30%

Please stop making comments like this and read the ways to avoid @pleasestop and earn the support of the community.