Evolution of Social Media and the Birth of BLOCKCHAIN

In order to see what lies ahead we have to look at where we have come from.

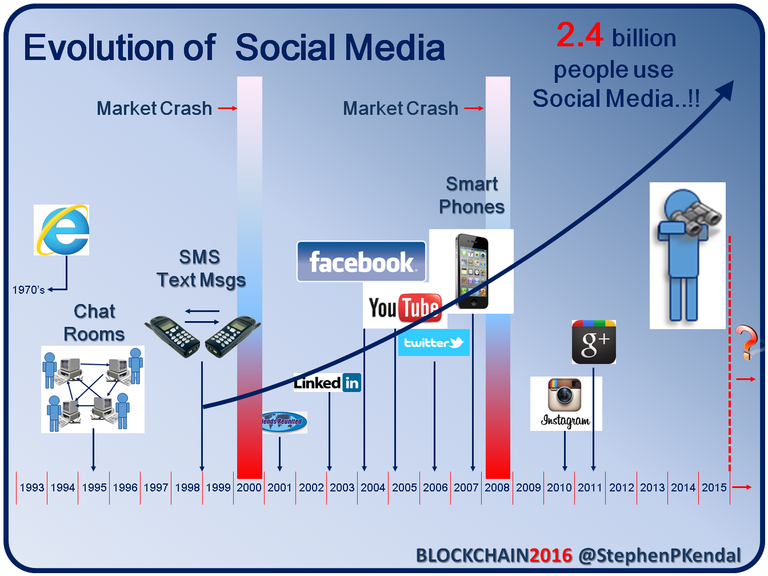

Recent history tells us that a Financial Crash occurs prior to a Major Technology Shift. It's The Markets way of playing catch-up with speculation and allows it to prepare itself for the next leg up.

You do not have to go far back to realise that this is true.

16 years ago (2000) saw The Market reacting to SMS texting. This was in essence the early stages of Social Media. Mobile Telephones sharing of instant messaging not reliant on Main Stream News to share events.

8 years later (2008) saw The Market react to Smart Phones. Facebook, Youtube & Twitter shared the catalysts with Sub-Prime Mortgages for this Crash.

We are now in 2016 and history is about to replay itself with the advent of BLOCKCHAIN as the catalyst.

BLOCKCHAIN and the Distributed Ledger Technology is set to revolutionise the Internet creating what is in essence The Internet of Value.

The imminent Market Crash is nothing more than The Market aligning itself with the effect this Technology will have on Asset Prices, particular in reference to the adoption of BLOCKCHAIN to the Unregulated OTC DERIVATIVES Market.

Steemit is at the forefront of this revolution as it is one of the first platforms that has fused together Social Media with the BLOCKCHAIN.

Expect more Social Media Platforms, both new and existing to migrate to this form of sharing and rewarding as value of Social Media Content takes hold.

Please share and comment, I appreciate it.

Stephen

Thanks for the reply. Thought it was interesting to share on Twitter at stephenpkendal. Thanks again. Stephen

Shared on Twitter, thanks for posting.

Thanks I appreciate it. Stephen

Shared on twitter

Thanks. I appreciate it. Stephen

Last week saw a potentially momentous move by a European regulator – the Belgian market authority banned the distribution of some OTC derivatives to retail counterparties. The move is likely not to stay isolated. ESMA, the pan-european regulator has recently issued yet another warning. The regulatory radar has firmly focused on the sector – with trends in the US pointing in a similar direction.

In effect, Belgian’s move might be a first in a movement to gradually ban OTC trading of binary options, spot forex contracts and CFDs (Contracts for differences). We have received a lot of customer questions asking how this affects Darwinex. This blog post outlines why we think it was about time that regulators stepped in, and why it validates many of the structural choices we’ve made in servicing the independent trader movement.

http://blog.darwinex.com/retail-forex-trading-to-be-banned-in-europe/

Will we see the Belgians joining the blockchain now?

Why did you flag my financial post about silver? I put some good time into that one. Please advise.

Because I agree with you. Silver is way undervalued and bullish. Thought it was a great post. Stephen.

But you flagged my post. You didn't upvote it. That counts negative. Look for yourself.

https://steemit.com/money/@tee-em/get-rich-during-crisis-how-to-arbitrage-bitcoin-silver-gold-and-other-assets-to-maximize-profits-during-collapse-part-1

I appologise sincerely. I don't know how that has happened. Stephen.