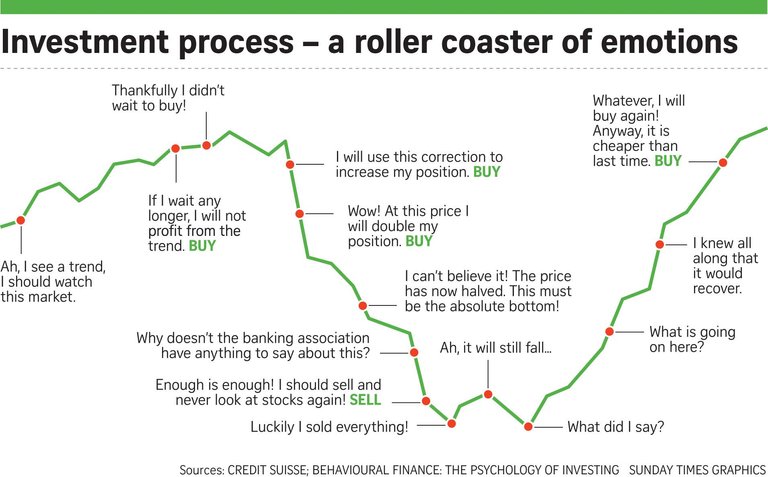

No matter the market, fear and greed are the two key psychological indicators that help drive markets to the highest of highs and lowest of lows. This has been on display in the crypto-market recently and many of you may want to learn how this affects markets as well as you personally. What are your thresholds? Do you get nervous about losing value from an investment that you bought near the highs. How do you know that they are at their highs? Does the chart resemble your psychological profile?

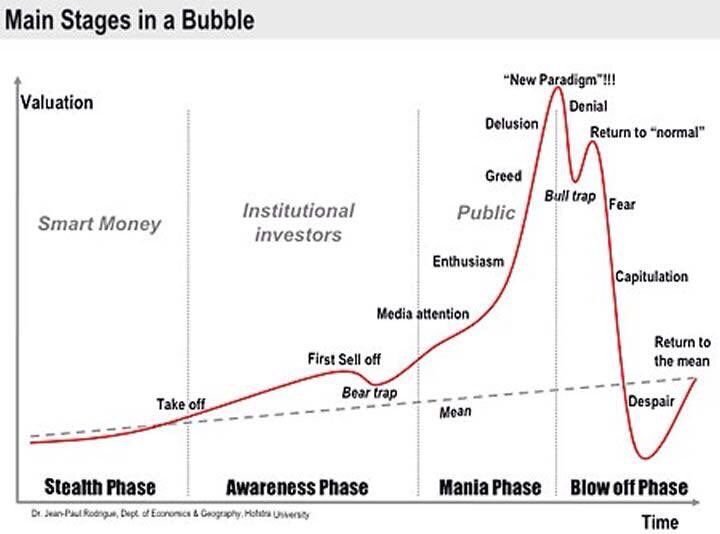

What does a bubble look like?

The recent bubble in bitcoin and the crypto space in general recently popped. That is actually a good thing since it ran up dramatically over the past year and especially over the last two months of the year. If you bought into the market in the last two months, you've taken a hit, no doubt. But if you believe in your investment, did your due diligence, and project that it will go higher from your entry point and feel confident about it then you should hold. You might even want to add to your positions if they have dropped by half or more to bring your cost basis down, if you've got the sack to do so. There are a ton of ways to play the game, but don't let fear, nor greed be the primary driver! That's a no win situation. Does this chart look familiar?

What is the 'Prospect Theory'

Prospect theory assumes that losses and gains are valued differently, and thus individuals make decisions based on perceived gains instead of perceived losses. Also known as "loss-aversion" theory, the general concept is that if two choices are put before an individual, both equal, with one presented in terms of potential gains and the other in terms of possible losses, the former option will be chosen.

In short, depending on how information is presented to someone makes a difference in their decision-making. Someone could be offered the same investment, one showing overall positive results, and one showing high gains and losses, but it's the same investment. Therefore, most likely that individual will choose the first investment of overall positive results.

I am not an expert in this field, nor am I giving any financial advice to anyone about anything. Remember, you should never invest more that you can lose! I am just here to provide some information (a little at a time) to those who are truly interested in this topic. Since most people on steemit are obviously interested in the crypto-space in one form or fashion, you should understand some of the psychology that is driving these wild swings. Especially if you are investing and trying to trade cryptos. And if you are, you really need to know your on psychological thresholds and how to manage those to make wise decisions and to not panic buy or sell, which may cost dearly!

You may also want to check out behavioral finance with the link I provided below. Knowledge is your power. Don't squander the ability to gain knowledge whenever you can.

Sources: https://www.investopedia.com/terms/p/prospecttheory.asp

https://www.investopedia.com/university/behavioral_finance/

Image Sources: https://static.straitstimes.com.sg

https://upload.wikimedia.org

Great post! People (including myself) always underestimate their own irrationality and the irrationality of people and entities around them, such as markets. Our emotions can make life worth living, but they also suck when they lead you to losing 50% of your net worth in a market correction lol