Hello Steemit!

passive fail-save investment strategy from Harry Brown.After more than 15 years stock trading including two bankrupties and massive winning steaks I finally discovered the fascinating world of #CryptoCurrencies for myself. In the first years I tried various #trading strategies with the aim to live #independently as #daytrader but this ended up in two #bankrupties in 2001 (#crash of the #dotcom #bubble) and 2009 (shorting the #bull market with to much #leverage).

By the time I became a #follower of the

I had the „luck“ to participate in the Ethereum ICO and got nice gains out of it, but in parallel the #fear growth to miss the next big thing behind #Bitcoin and #Ethereum. So I developed my own passive investment #approach I will present to the Steem #community in this post.

A #Lamborghini - #dream of most crypto #investors.

Image from Damian Morys from New York City, published under Creative Commons Attribution 2.0 Generic

My theses regarding Crypto-Currencies

Over the years I formulated the following theses

- It is not predictable which cryptocurrency will survice at long sight. Remember, only 5 months ago Ethereum was the shooting star and handled as potential #Bitcoin-Killer, and then came #TheDAO with the #DAOHack and now we have this #Ethereum vs #EthereumClassic mess.

- I observed that every new Coin / Currency / Cryptotechnology is starting „small“ in terms of market capitalization. For instance STEEM’s market capitalization was below $3 million in April before skyrocketing. The same applies for #Ether and other successful #ICO.

- Long-term only one or a few out of thousands coins will come to the top and survive.

My conclusions

Based on these assumptions leads to the following conclusions

- The future is uncertain, so I have to be invested in each major coin.

- I focus solely on coins with a market capitalization greater than $ 10 million.Since my #financial #resources are limited,

- It’s assumed that in the long term the most coins will die, so a gradual exit strategy is needed. This #exit strategy should keep a portion of the coins for the unlikely case that a coin reaches a market capitalization greater than one #trillion dollar, but as most coins will not reach this target, early sales are necessary.

The Entry - when to buy

Once a coin exceeds a market capitalization of $ 10 million, I invest $ 1,000 and buy one ten-thousandth of the coins supply. If an ICO achieves more than $ 10 million, then I buy also a ten-thousandth of the supply, as long I can afford it.

The Exit - when to sell

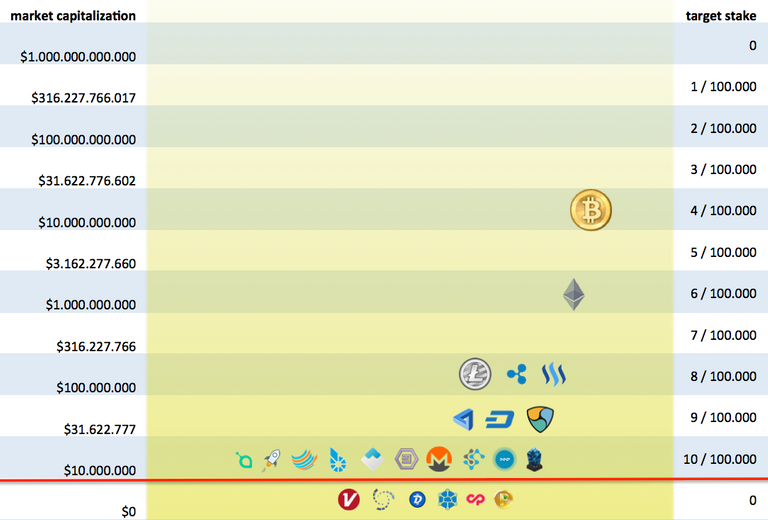

My #exit strategy has 10 exit levels, where I sell one-tenth of my original share. The last exit level is placed at a market capitalization of one trillion US dollars. The other exits between the entry level at $ 10 million and the last exit at $ 1 trillion are not linearly distributed, instead I use an #exponential function. The following chart shows all exit levels (as you might have noticed, the distance between the exit levels is always the factor 3.162 (= square root of 10).

The scale on the left side of the chart shows the market capitalization values where the exit levels are located. As soon as a market capitalization is reached, I sell 1/10th of my original stake.

The right scale shows my share in the currency supply I try to hold according to the current market capitalization of the coin. For instance STEEM has currently a market cap of arround $300,000,000. As 300,000,000 is between 316,227,766 and 100,000,000, I currently try to hold 8/100,000th of all STEEM.

In the middle of the chart the current top coins are placed according to their market capitalizations. The red line marks the entry level for the initial buy. As soon as small coins are located below this line, I don't buy them. Due to the inflation of coins I rebalance at the exit-levels to reach my target-stake.

Optimizations

In case that a coins market capitalization is falling dramatically, I rebuy some coins. For instance if STEEM would fall below $ 100 million, I would rebuy to reach a target stake of 8/100,000th of all STEEM. If afterwards STEEM is rising, I would sell STEEM at $ 316 million to hold 7/100,000th.

The chart shows the history of STEEM which launched with a market capitalization below $ 10 million. As STEEM jumped over the red line (the $ 10 million market cap), the entry happend. After that 3 sales of each 10% of my stake followed. Now it depends of the direction of the market, if next action is a sell (in case $ 1 billion market cap is reached) or a re-buy (in case of $ 100 million market cap is reached).

As even #King Bitcoin is far away from $ 1 trillion market cap and perhaps this target will never met, I feel free to trade with 20% of my stake according to shortterm setups based on #ElliottWave or other strategies.

Adaption of my strategy to the STEEM universe

As STEEM POWER is locked for 2 years and STEEM DOLLAR is pegged to the US-Dollar, I only concentrate on the STEEM token. In case of coins with high #inflation like STEEM I only focus on the market capitalization for the initial entry into the coin. As soon as I bought my initial stake, I concentrate on the US-Dollar price per coin instead of the market cap. STEEM jumped over the $ 10 million on friday 13th of may 2016.

At this day the 26,655,539 STEEM had a market capitalization of $ 11,524,262 due to the price of $ 0.432936 per STEEM. So the entry was to buy 2,665.539 STEEM (= 1/10,000th of STEEM supply) for $ 1,152.42 (1/10,000th of market cap). Based on this entry price the following exit-levels are defined:

So if for example STEEM would rise above $ 43.29, the accumulated profit of all sales of 266 STEEM (10% of my STAKE) at $ 1.37 , $ 4.33 , $ 13.69 and $ 43.29 is around $ 16,700 and I would still hold around 1,600 STEEM at this level (worth around another $ 70,000).

Downsides

The main downside of my strategy is that if a coin is pumped over $ 10 million market capitalization and I buy in and then the coin dumps hard, I will stay as #bagholder of this coin. But I must accept this risk because I want the garantuee to be invested in the big winning coins in the long run.

The main upside of the strategy is that it is time-saving. A quick glance at http://coinmarketcap.com per day is completely sufficient to determine whether action is needed or not.

I hope I could give you some #inspiration for your own investments.

Thank you for reading!

Best regards,

twinner

Disclaimer

This post is no financial advice. The author is currently invested in Bitcoin, Ethereum, Ethereum Classic, Steem, MaidSafeCoin, BitShares, Factom, Stellar, Monero, NewEconomicMovement, Emercoin, Storjcoin X, Radium, Lisk, Qora, Synereo, Counterparty, Waves, Next and Siacoin.

Thanks for starting this thread. Really appreciate you bring this to our attention. Be prepared for a fluctuating crypto market. We do need to look better at the insights of every coin. What team is behind it, is there any management. How strong is the product, is there any product at all? Does anyone know about: https://www.coincheckup.com They give great insights in the team, the product, advisors, community, the business and the business model and other techincal insights. Check: https://www.coincheckup.com/coins/Steem#analysis For the Steem Investment research report.

Nice exit strategies!

Hi drako,

please check out my new idea ...

https://steemit.com/money/@twinner/financial-freedom-lifelong-with-minimal-effort-introducing-the-permacryptofolio-system-a-public-trading-experiment-using-real

Best regards,

twinner

Two important points that you made I think are worth repeating:

The first one is important if you want to avoid bankruptcies. The second basically means you are a buy-and-hold investor. Short term trading is either arbitrage or gambling. (and Arbitrage = zero risk, in other words, a guaranteed gain. A lot of people think they are in an arbitrage situation but they are not)

Hi keypiedoll,

please check out my new idea ...

https://steemit.com/money/@twinner/financial-freedom-lifelong-with-minimal-effort-introducing-the-permacryptofolio-system-a-public-trading-experiment-using-real

Best regards,

twinner

Great strategy. I was thinking of buying and selling some btc, eth and xmr as well. But I don't have a concrete strategy in place. I just know on top of my head that the price within a month is falling, then I would buy. If it shoots up, I would sell. Clearly I am not really a trader and rely only on my gut feeling. Thanks for sharing your strategy. I now have a clear view on how would I do it if I proceed with my plan. Of course I only have micro account on those currencies but it's a good learning experience.

Hi kentdenns,

please check our my new idea.

https://steemit.com/money/@twinner/financial-freedom-lifelong-with-minimal-effort-introducing-the-permacryptofolio-system-a-public-trading-experiment-using-real

Best regards,

twinner

You seem to #love all these #tags sprinkled #randomly within your #post..

Wow, fantastic read. This completely opened my eyes to the possibilities of crypto currencies. As the stock market has been bad to me lately, I am going to do more research on crypto currency investments. thank you

Hi rdigh,

please check out my new idea ...

https://steemit.com/money/@twinner/financial-freedom-lifelong-with-minimal-effort-introducing-the-permacryptofolio-system-a-public-trading-experiment-using-real

Best regards,

twinner

Great post, even if it's not the best strategy.

Did you invest in STEEM though when it crossed $10M? I see that you don't have any added STEEM power to your account.

As I mentioned, I dont like that STEEM Power is locked 2 years. In this time I cannot sell.

Hi justbc,

please check out my new idea ...

https://steemit.com/money/@twinner/financial-freedom-lifelong-with-minimal-effort-introducing-the-permacryptofolio-system-a-public-trading-experiment-using-real

Best regards,

twinner

Great article, thanks for sharing your knowledge.

That's a damn fine strategy! Yet another day I learned somthing on Steem

Yes, active trading is to nerve consuming and often external events like the DAO-Hack or other whale interests kill any technical analysis based trading.

Hi financialfreedom,

please check out my new idea ...

https://steemit.com/money/@twinner/financial-freedom-lifelong-with-minimal-effort-introducing-the-permacryptofolio-system-a-public-trading-experiment-using-real

Best regards,

twinner

Thanks for sharing.

Hi ap2002,

please check out my new idea ...

https://steemit.com/money/@twinner/financial-freedom-lifelong-with-minimal-effort-introducing-the-permacryptofolio-system-a-public-trading-experiment-using-real

Best regards,

twinner

Thanks for your interesting post!

Nice article. Nice to see I'm not the only one who thinks like this. The trustworthiness of the crypto is based on: A solid team, product, advisors, preferably VC investors, etc. Sell all cryptos that don't have this solid background. It's a waiste of money. An interesting website I found: https://www.coincheckup.com. It's a great site that gives in depth research on every tradable cryto in the market.