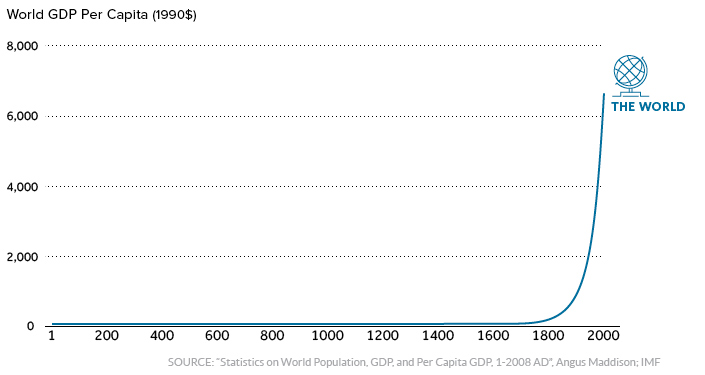

We live in an era of transcendental growth.

It is a privilege of our time to know that our trajectory is that of rapid social and technological evolution. Investing in new technology that enables social connectivity and the broad expression of value seems to be an obvious choice.

The question is, how can a newcomer to crypto-investing catch the wave? If you ask me, the answer is to divorce yourself now from the value of the fiat currency you invest and concentrate on steadily increasing your stake in the crypto-economy.

The Basic Strategy: Dollar Cost Averaging

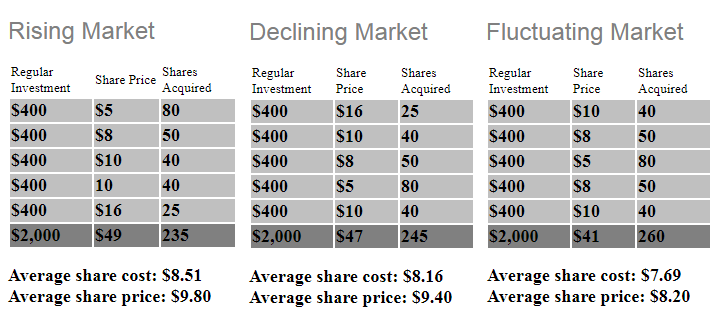

Dollar cost averaging is a simple strategy that is effective in new, volatile markets so long as the market has solid long-term viability.

Simply put, you never sell. You choose an amount of fiat currency to invest every month, and just keep it up no matter what the market is doing.

You could commit to something like, "I will buy $50 USD each of STEEM, BTC, LTC, and ETH on the 1st of the month, every month."

In this case, when prices drop you will buy more of each coin, and when prices are high you will buy less of each coin. The investment of $50 USD in each coin is the same every time. The net effect is that the price you're averaged in at stays below the long-term average price of the coin.

The exception to this is in times of steep corrections like we saw recently. In that case, your strategy remains the same but now you are buying the "crash." Your $50 a month is now going further to increase your stake in that coin.

Once you've become comfortable with the way your chosen markets move, you can add another layer to your strategy by trading your coins against each other.

The Next Layer: Systematic Trading

As a basic example, if your exchange supports the STEEM/BTC pair, you can choose conditions under which you will trade one for the other. Pick a day of the week, let's say Tuesday.

Each Tuesday that STEEM/BTC opens at more than 5% below the 13-day moving average, sell 10% of your STEEM for BTC. Or, if STEEM/BTC opens at 5% or more above the 13-day moving average, buy STEEM using 10% of your BTC.

This is, of course, just an example. I'm nobody's financial advisor, but the idea is that simple, systematic approaches to investing are all a beginner really needs. It is important to grow a portfolio and to develop a feel for the market for a while before you start trading sentiment.

Catching those big impulsive moves and buying into strong uptrends is a risky prospect. My preference is to leave my emotions out and focus on growing my stake in cryptocurrency over time. In my view, blockchain technology represents the next evolutionary step in free market principles, and being tuned in now is a great advantage.

In closing, I'll leave you with the words of a wise man:

Thanks for reading, I'll look forward to your feedback.

You got a 13.71% upvote from @upmewhale courtesy of @worstcritic!

This post has received a 1.74 % upvote from @boomerang thanks to: @worstcritic

You got a 15.78% upvote from @minnowvotes courtesy of @worstcritic!

You just rose by 21.2486% upvote from @therising courtesy of @worstcritic. Earn 43.8% APR by delegating SP to therising. For more details visit: https://steemit.com/budget/@therising/auto-daily-payout-of-43-8-apr-for-steem-power-delegations-starting-from-500-sp-only-limited-period-offer.

You got a 8.40% upvote from @whalebuilder courtesy of @worstcritic. Join @whalebuilder family at our Discord Channel. Don't let your precious stake(SP) go stale...Make it do more so you have to do less. Deligate it to @whalebuilder by clicking on one of the ready to delegate links: 50SP | 100SP | 250SP | 500SP | 1000SP | 5000SP | custom amount.