Yesterday, the S&P 500, the DOW and the Nasdaq fell more than 1% due to jitters surrounding the continued US-China trade talks and the US imposing visa bans on Chinese officials for human rights violations against Muslims in Xinjiang. Yesterday marked the 36th 1% down day for the S&P 500 in 2019.

Several days ago, I wrote a post titled,

The iPath S&P 500 VIX Short Term Futures ETN (VXX) is the largest and most liquid in the volatility ETF/ETN universe. The ETN sees average volume of more than 15 million shares per day, typically, but spikes to more than 70 million when the S&P 500 sees a significant decline and traders pile into VXX pushing it higher.

Yesterday I noticed unusual options activity in VXX. The Smart Money bought over 22,000 of the VXX November 15 call options with a strike price of $37.

Again the VIX is quoted in percentage points and is the expected annualized change in the S&P 500 index over the following 30 days, with a 68% probability. VIX values greater than 30 represent investor fear or uncertainty, while values below 20 represent complacent in the Markets.

Today, I want to talk about Contango and Backwardation. Contango and backwardation are two concepts related to futures contracts that need to be understood in VIX trading. Contango means that futures contracts that are farther out in time are more expensive than the current price of the index and backwardation means that future months are cheaper than current prices.

Because I use intermarket analysis in my trading,

Intermarket analysis is a powerful tool that gives traders/investors a macro predictive direction of stocks, bonds, commodities and currencies. Intermarket analysis states that all asset classes are interrelated and that you can’t definitively determine the direction of one asset class without examining the other asset classes.

I’m not getting a good feeling about the equity markets. And what I’m feeling is being supported by the VIX futures curve and pricing on the shorted dated VIX futures vs the long dated VIX futures.

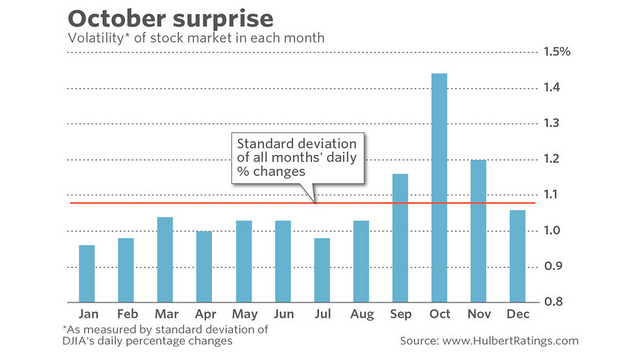

There is roughly 20 more days in October. From a historical standpoint, October is the most volatile month for equity markets.

Case in point was last week. The ISM index is a good leading indicator of the economy and is useful in gauging turning points in the business cycle because the difference between new orders and inventories equates to future production or lack of future production.

The ISM is released monthly by the Institute for Supply Management, but based on surveys of 300 purchasing managers throughout the United States in 20 industries in the manufacturing area.

On Monday the numbers for September were released and came in at 47.8%, the lowest since June of 2009.

Then that Wednesday, the ISM Non-Manufacturing numbers were released for September. Index fell to 52.6% last month from 56.4% in August, weakest growth in September in three years.

The combination of these two announcements, along with some additional dismal news caused the DOW to fall 1200 point decline, followed by a 500+ rally in a week’s time.

Things are crazy out there, but the VIX futures curve is saying we haven’t seen anything yet. Buckle your seat belts because it’s going to be a bumpy ride moving forward.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Thank you for posting from the https://steemleo.com interface 🦁

Some are predicting that Q4 will see a liquidity crisis hitting that takes the markets down. The Repo market, according to them, was just a taste.

With the Fed already expanding its balance sheet, it appears they are very worried about this.

If your analysis is correct, this volatility could cause a lot of investors to pull money out. Uncertainty and markets tend not to go well together.

I have a tough time believing this market is anything but a fluff job due to the easy money central banks handed out.

When will it all pop? Who knows. I am surprised it lasted this long.

I have been trying to short the Markets since the beginning of 2018, but the Markets told me it wasn't my time yet, so now I just have to trade what is real and not what I feel.