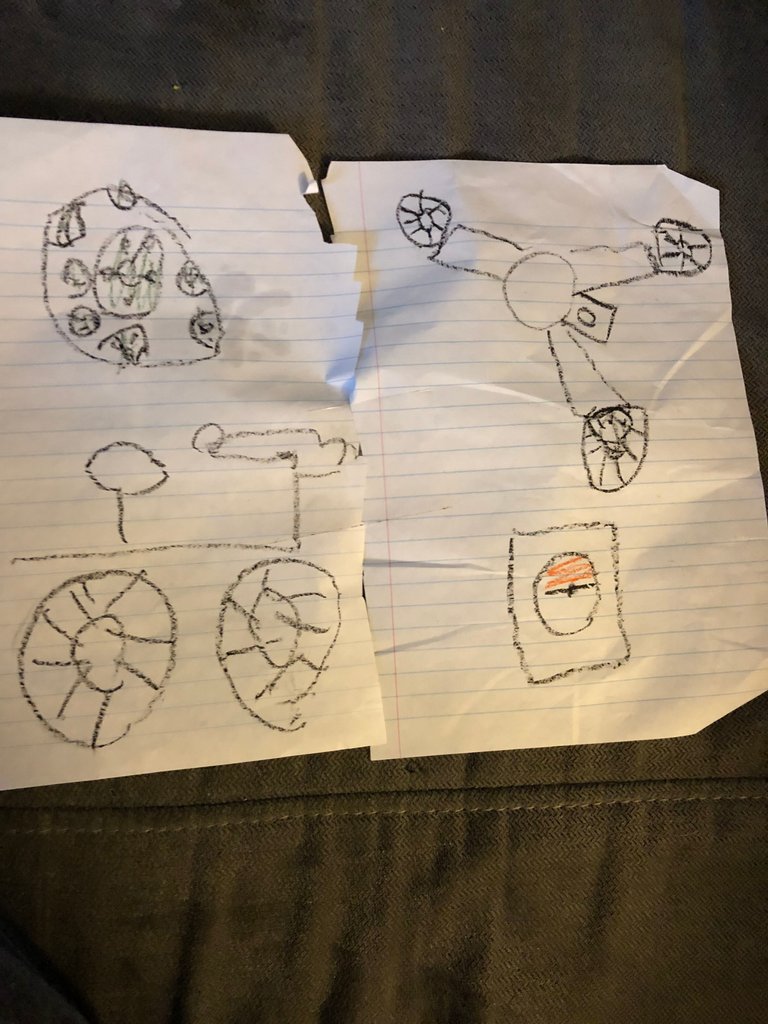

An interesting phenomena is happening in my house. Christmas lists are being created...usually a joyous occasion, my youngest two can not spell/write yet and so I have a series of pictures, scribbles and arrows letting me know what they actually are. Deciphering them requires a truly seasoned parent...

The phenomena is the influence of the older two on the younger two. While I still have pictures of a bow and arrow, race cars, and pokemon cards - I also have a square.

I ask Ben (my 5 year old) "What's that?"

He says nonchalantly "A Tablet."

"Why do you want that?" I ask.

"So I can play pokemon online"

The dialogue took 2 seconds. Ben did not see the confusion in my face, or all the questions whirling around in my head. Obviously a tablet is just a normal part of life for a 5 year old...at least in his brain. My younger two have been listening to the older two make their Christmas list and I am finding the cost of the items on the list are going way up. The list's are becoming increasingly complex, and expensive...

Teach Your Kids Financial Literacy

To be clear we are not going to buy our kids tablets or phones. However, my wife and I are realizing that our kids increased exposure to these things are highlighting our need to teach our kids a level of responsibility. In our elementary school, teachers have had to create policy not to have a phone in class. Seems pretty obvious. Apparently not obvious enough, the school actually had to create policy and communicate it.

So how do we teach our kids financial literacy?

crap...I dont even know what that means...

This unfortunately has been my wife and I's realization.

We have minimal financial literacy, because nobody ever taught us! Looking back to my education, it was all built around get a job. My parents taught me to be generous...and told me i should live on a budget...but thats about it. What are your financial habits? If we don't have any clear financial habits then how the heck are we going to teach our kids financial habits?

No Thanks.Our kids generation is becoming increasingly skilled and comfortable with technology. Their worldviews are being developed with an idea of instant immediate access to whatever they want #theinternet. We are not seeing a culturally disciplined, focused generation, being raised. With no financial literacy their ditch will be early debt, un needed use of credit, entitlement, and ultimately dependent on a bigger and bigger government.

Teach your kids financial literacy...even if your learning with them!

My wife and I are in full on learning mode. We are realizing our need to get on the same page as our kids are asking for gifts and technological devices into the hundreds of $$. We have lived on a budget but until just recently we have for the most part lived pay check to pay check, hoping that our house will appreciate it and help us get an upper hand financially.

One of the the things we have looked into adopting is living off 70%. Every month take 30%, save 10 give 10 and invest 10.

While we know very little about investing, and have nothing we are currently saving for we are trying to implement the discipline and include our children. To include them, we are giving them a monthly allowance at the rate of $1 per year per month. So my 9 year old gets $9/month. We have been allowing them to spend their 70% on whatever they want (cringing as the youngest still buys a hot wheel every time he sees one) after putting the other 30% away.

The oldest two are starting to understand their need to be responsible with their money. We have explained to them that we are not going to buy them tablets and phones, rather we want to teach them the responsibility to be able to not only afford that but to be responsible with that. As a result they are starting to save money and say no to trivial toys at the store, in order to purchase something in the future. On top of that, they are starting to ask the question how can I get more money.

Teach them to generate cash

I found that the bulk of my education was about getting a 'good' job. That basically means, make enough money so that you can be 'happy', pay taxes, and ultimately build someone else's dream. No thanks to that as well.

I tend to believe that each of my 4 kids as the potential to make a mark on history that impacts eternity. One of my favorite quotes is from Winston Churchill - it says

"History will be kind to me, for I intend to write it"

I want my kids not to grow up with an worldview of entitlement and dependency on a job, rather with the ability and courage to tap into dreams, desires and ideas to contribute to society. Now all these things will cost money. So financial habits to make money are crucial in these little brains.

Look to empower your kids to make money. Obviously, this needs to be age appropriate, and dependent on where you live. A few of the ventures that are starting to take off in our family are dog dookie pick up and dog walking. My wife and I have not done it for them, but are looking to encourage them and support them in knocking on neighbors doors looking for work.

Do not do it for them

I believe that is the ditch for this generation. It's what they understand watching parents pay with credit cards, watching people use their phones at all hours of the day. They are expecting ease of access. Teach them to work. To go outside and knock on a neighbors door is torture the first time, it requires effort which is new to most of this generation. I charge my 7 year old a quarter for every pile of poop he misses, the first time I took a $1.50 from his paycheck was like I was pulling his teeth out. He is a little more thorough now (he has also conned is 3 yo brother to help him find the poop - on a volunteer basis).

Parents it's our job

This has been a very embarrassing process. Realizing as a parent how little I know about financial literacy is a bummer. However, things are taking off financially and my wife and I are including our kids. It is our job, and I am 100% sure that our education system is only going to sit on their dreams and desires and teach them to get a 'good' job. Most kids learn about finances as they are signing paperwork for thousands of $$ of student debt when they turn 18. What if our kids where signing paperwork to buy their first house when they turned 18 and using it to pay for college...

Parents lets do it - and if you have any financial literacy tips you have used as parents I would love to hear them...

Live big today and Dominate Life!

Kids should definitely learn how much work it takes to earn a certain amount of money, e.g. to be able to buy a tablet. Arithmetics and a sense for the scale of numbers should be taught to them at an early age.

I remember, when I was around seven years old, my Dad would give me a weekly allowance and add a certain percentage on top of it based on the magnitude of my holdings to teach me how interest rates works.

Then I'd save for a lego set, buy it and get back to low absolute interest amounts...

oh snap - love that - teaching my kids about interest...thanks for sharing

This is good Austin. D and I are investing in some kind of tool for Elijah like FPU Jr.

That boy, no matter how much we try to impart financial wisdom, will settle for instant gratification EVERY. SINGLE. TIME.

We tried to teach him the basics of saving for what he REALLY wants, and wait, instead of getting something he doesn't actually want, just to have left the store with something.

His weakness? Legos.

The boy has been wanting an $80.00 Lego box set, and has been so close to being able to afford it time and time again, but settles for 5 $10.00 box sets that he doesn't really want. It makes us cringe every time, and as parents you gotta find the fine line of "Do i let him make this mistake over and over, or do we tell him "No" and hope that he will pick up on the lesson were trying to teach.

So we go home, tell him he has a balance of $0 and he starts over, working hard to earn the almost $80 he had prior to leaving the store. Its a frustrating cycle really.

This is a good post. We can talk more in the future! Thanks for sharing.

haha! that $80 lego set...I feel that...

thanks for reading!

Great post @breakthrough. Our education system has failed to help make financial literacy a common subject. It is up to parents to ensure we send our kids out into the world with that knowledge. @geke has written a book on Home School Economics for Kids. Suggest you check it out - https://steemit.com/steemiteducation/@geke/cbjr-economics-summaries-face-off-section-5

In my opinion, it should be alongside; reading writing and arithmetic ... and Financial Literacy.

thanks for the intro to @geke - looking forward to checking out Cost Benefit Economics Jr

Great post! My parents set up a "family bank" where we could deposit money short term and long term to get interest and also loan money to each other for big purchases (like my brother's first car). It has worked really well. Maybe I'll share the details in a future post...

would love to read about it - @replichara said they did something similar fascinating thought

Congratulations!@breakthrough, your post was Resteemed by @OCD!

Great post @breakthrough you've touched on a much needed discussion. I've believed for quite some time now that financial literacy has to start at a young age.

And like you've stated the first teachers in a kids life is really the parents. It does seem easy to put things on cruise control, but I find this approach to have long term costs that we might not be taking into account.

I hope some parents stumble on your post and feel inspired.

Cheers mate

its gotta start with mom and dad! hope this was hopeful for you - thanks for commenting

Fantastic advice, @breakthrough! Great article.

@steemparents hasn't been very active lately, but December is going to be the month we get put on the Steemit map! Thank you for your continued support and for consistently bringing high quality content to the #steemparents tag

you bet! love interacting with parents

This is awesome! I've already been trying to explain to my 2 1/2 year old. I grew up in house that drilled financial training into our head 😂 And.... I still made some mistakes. I'm glad I knew the basics so they weren't too life changing.

I also think example is here is huge.