A lot of people sending messages to my social media account and also to my other online blog/forum platform inboxes.

As a long-term investor, I always make sure that the company passed my intrinsic value investment valuation. To derived intrinsic value, I always calculated using both qualitative and quantitative fundamental analysis. If the company being evaluated passed the said valuation, I constantly use simple technical analysis for my price entry point.

Now, let’s examine the case of Fruitas Holdings, Inc. (FRUIT) using my valuation approaches below based on the available prospectus data.

1. Asset Valuation

All figures are for the period ending December 31, 2018.

Cash & cash equivalents: 260.498 million

Trade & other receivable: 55.638 million

Total current assets: 500.635 million

Total intangible assets: 214.309 million

Total assets: 904.399 million

Total current liabilities: 497.442 million

Total liabilities: 530.668 million

Total equity: 373.731 million

Total net asset value: 159.422 million (total assets 904.399 million – total intangible assets 214.309 million – total liabilities 530.668 million)

Net Asset Ratio: 1:0.1763 (17.63%) [159.422/904.399]

Cash Asset Ratio: 1:0.5203 (52.03%) [260.498/500.635]

Acid Test Ratio: 1:0.6355 (63.55%) [(260.498+55.638)/497.442]

Generally, the minimum benchmark for these ratios should be greater than 1 or 100%. But companies in different industries have different needs, so acceptable ratios differ from one industry to another. For food and beverages, if said ratios fall below 1:0.75 or 75% are not acceptable.

Current Ratio: 1:1.01 (101%) [500.635/497.442]

A minimum benchmark for the current ratio is 1:2 or 200%. This means that a firm has the ability to cover its current liabilities in the short term. But then again, companies in different industries have different needs for liquidity. So acceptable ratios differ from one industry to another. Any current ratios of less than 1:1.75 or 175% for any industry is below standard.

2. Relative Valuation (also known as Base Multiples)

In this approach, most common are earnings base, sales base, asset base, and debt base. There are other multiple bases, for simplicity reason, I used the basics as enumerated above.

Fruitas Holdings, Inc. IPO priced at 1.68 per share. The basic and diluted EPS as of December 31, 2018 at P0.0627 per share. This company have 2,133,680,000 outstanding common shares with total market capitalization of PHP 3,584,582,400. The audited sales revenue for the year ended December 31, 2018 is PHP 1,579,206,000.

Earnings Base – Price-to-Earnings (P/E) Ratio: 26.79x (1.68/0.0627). This extremely overpriced. Most common P/E for any industry as follows: Below 12x is cheap, 12x-25x is standard and above 25x is very expensive.

Sales Base – Price-to-Sales (P/S) Ratio: 1.35x (2,133,680,000/1,579,206,000). The lower the P/S ratio, the more attractive the investment. Price-to-sales provides a useful measure for sizing up stocks. Since no peer to compare with, this P/S level will require a long period to recover your investment.

Asset Base – Price-to-Book Ratio (P/B): This usually computed by taking the total net asset value then divide by outstanding shares to derived book value per share. To finally get price-to-book, market price per share to be divided by book value per share.

Book value per share = 0.08 (159,422,000/2,133,680,000)

Price-to-Book = 21x (1.68/0.08)

A lower price-to-book ratio could indicate that a stock is undervalued. Again, these vary from industry to industry. However, most value investors may often consider stocks with a P/B value under 3x as their benchmark.

Deb Base – Debt-to-Equity (D/E) Ratio: 1:1.42 (142%) [530.668/373.731]. This ratio is calculated by dividing a company’s total liabilities by its shareholder equity. The leverage ratio category is important because companies rely on a mixture of equity and debt to finance their operations, and knowing the amount of debt held by a company is useful in evaluating whether it can pay its debts off as they come due.

Although acid test ratio measures the ability to pay short term liabilities, D/E ratio measures for the long-term leverage. Higher leverage ratios tend to indicate a company or stock with higher risk to shareholders. Investors will often modify the D/E ratio to focus on long-term debt only because the risk of long-term liabilities are different than for short-term debt and payables. Capital-intensive industries such as manufacturing, and telecom tend to have a debt/equity ratio above 2, while tech or services firms could have a typical debt/equity ratio under 0.5.

3. Discounted Cash Flow (DCF) Valuation

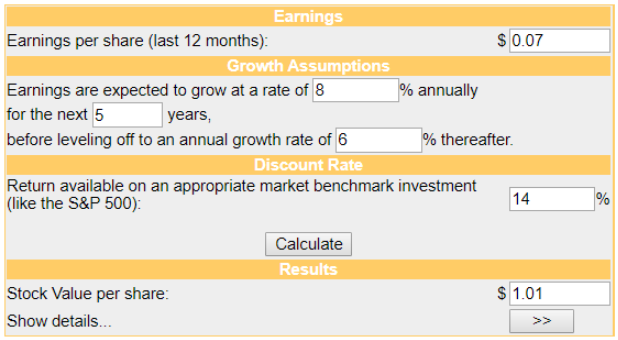

Based on the DCF calculator, my stock price of FRUIT is only PHP 1.01. My DCF assumption here is very conservative at the least. EPS of 0.07, income growth of 8% for 5 years and 6% thereafter and a discount rate of 14%. Why discount rate at 14%? The global discount rate for blue chips or high market capitalization is at 10-11% while 12-15% for medium-capitalization and above 15% for small capitalization.

According to FRUIT’s prospectus, EPS is at PHP 0.0627 and income growth at 6.4% for 2018.

My conclusion:

Asset Valuation = Failed

Relative Valuation = Failed

DCF Valuation = Failed

All failed based on my valuation approaches. It’s highly leveraged at 4 fold and 15.2% of the IPO proceeds will be used to finance debt repayments. This connotes that the company has no ability to decently earn to pay its due obligations.

On its listing date 29-Nov-2019, FRUIT open price at 1.82, flies as high as 2.45 then low and close at 1.71! At this very unstable price movement, I'm expecting the price to correct at my DCF conservative price at 1.01 in the near term.

After 3 years, I will re-evaluate this stock, maybe by that time, we can see improvements and hopefully, all of its plans have been fully implemented like network expansion and store improvements of which according to its disclosures 150 to 250 annually, a whopping 450-750 stores until 2022 of merely 59.4% of IPO proceeds. I want to see farm acquisition to sustain the main materials for their core business.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.

Congratulations @php-ph! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!