Headlines that bitcoin has gone to $6000 is incredible. Pundits are even calling for $10,000 and to the moon. I am not a big investor in bitcoin because I am lesss into speculation and more into toilet paper (no not the dollar; actual toilet paper); real assets in other words.

I let me explain:

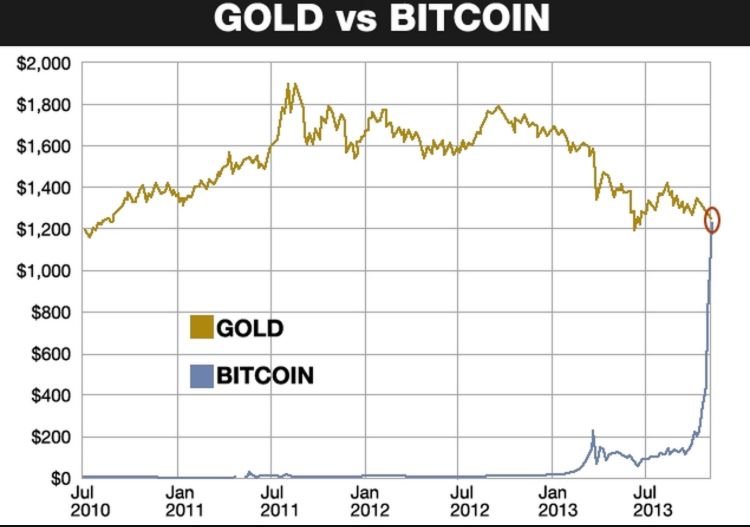

Here is a chart from a few years ago comparing gold vs bitcoin:

We can see the BTC value has surpassed gold for many different reasons. Hot money has flown into bitcoin and made gold look like a shitty investment. Well first off, gold is not an investment it is an asset (it’s not meant for investing).

There are even charts comparing the two which to me are very misleading:

Bitcoin is an avenue to get away from central bank control, as is gold. Gold is manipulated due to the “paper” gold futures. To me paper gold or COMEX gold is not something you have on hand.

If you want to speculate in a controlled market, then you go to the comex. Big institutional buyers change the price at their own whim, and believe me if bitcoin has the same players, the price will be effected as well. In other words if big players who have the money to buy most or all bitcoins can effect the price as well.

In terms of “real money” bitcoin is, and it is not. Due to the reliance on ENERGY (forget the internet for now), physical gold has bitcoin beaten, and it will always be that way. This is the real prime example:

Pictured is Puerto Rico. I read a great blog from @goldenarms and it basically spelled out the scenario where bitcoin is worthless (even more so than cash).

As much as we like to pump bitcoin, it’s reliance on technology and energy make it less likely to be used as money in any emergency. Unless it is

more widely adopted it will never replace cash or even gold.

The psychology is just not even there. When I can go to a local food stand and trade bitcoin for food, then I would say it is more mainstream. Yes I know Japan has made it widely available for use, but many other countries are doing the opposite.

Face facts:

Bitcoin is still relatively new and most people still know nothing about it. Explain electronic wallets how to pay etc..

Gold however will always be traded for something. If there exists a psychological belief that something has worth then it will automatically be worth something. So gold automatically beats BTC in this regard (on mass).

In the event of emergencies or needing something of worth, assets (even toilet paper), will in the end be worth more than gold. Bitcoin would be laughable to trade with (and always will be). We are in a physical world where we need physical things. Perhaps if we ourselves were in a complete virtual world it would be our main currency. This is never going to happen.. because we are physical beings.

So enjoy your profits speculating.. people

make money that way everyday. Bitcoin could go to $10,000-$100,000 thousand, but at the end of the day if you don’t physically own it and can’t trade it without electricity or the internet it is worthless (at the end of the day).

I’m not saying this out of jealousy (although I wish I bought BTC at $5.00). I say this is it of complete logic.

In the event of emergency people would rather trade toilet paper for food. Wealth is only determined by the needs of the moment. Since we live in a relatively artificial world, things that don’t have intrinsic value physically can be made to “look” like they have value.

Just be honest with yourself and view the human experience physically. False Gds are generally things we put faith into that have no real value. We do this with many things in life (including gold, and cash).

Be true to yourself and to others. We need physical things and even if BTC went to $10,000 we would still need to use it to buy something physical.

Very good article. Tangible assets, tangible goods, and just a little bit of Crypto, just in case.

Great article bearbear! I too am a stacker -- and a voracious motherfucker about it. But i also stack cryptos.

Often people think in black and white terms -- or use the ridiculous gains of bitcoin to argue for the future -- which of course is unknowable. And thus diversification is key.

Buy both. Stack both. Get some palladium, dash, platinum and monero, and don't forget about steem as well. It's all good!

And of course, if you have the space, get a couple of boxes of fancy toilet paper and give your ass a break!

Cheers! from @thedamus

HAHA love it. Don't have as much money to throw around.. life is a bitch (and so is the ex-wife)

To be honest, my main reason for investing in BTC and other cryptos is to accumulate enough USD to purchase a house outright and some other things that will allow me to be more self-sufficient. I don't want to rent for the rest of my life. I trade options sometimes, but they aren't nearly as profitable as cryptos currently...

All the silver and gold I have is something I just plan to hold onto in case I ever need to trade in an emergency.

Hey @cali-girl there is nothing wrong with what you are doing. If you are honest with yourself you are "betting" that the price of BTC will keep going up until you are satisfied to cash out. It's a risk like playing blackjack. The odds may or may not be in your favor depending on the hand you are given. BTC has shown an incredible run. Gold and silver have been manipulated down and steady. Just be careful as it is more for speculation. We speculate it's "value" will go up, we speculate it will be more widely adopted etc.. We don't speculate black swan events or government intervention. One day it's up $500 then next day it's down (or even significantly worse than that).

There are not many fundamentals when it comes to hot money. Greed will always say "What if I could make more" and you risk keeping it in longer. Nobody knows the future, but gravity usually takes effect for everything.

I agree. Currently, I don't actually own any BTC because I spread it out between 4 or 5 other cryptos. The amount I have right now isn't all that much (not even close to getting that house yet, unfortunately) so whatever I have in there I wouldn't sweat if I lost. As it grows, though, I'm sure I'll get more protective of it and pull out quicker. I do the same thing with options; whatever I put in, I make sure I'm ok with losing.

That vet bill really killed my recent influx of investment money...

yes.. always unexpected expenses! Well good luck to you either way and I hope you are successful. The stock market and anything you invest in sometimes feels like a more complicated casino (at least to me). When you risk any loss with anything (even investing), I still look at it like gambling. Some bets are safer than others. Perhaps things go up in value over time, and sometimes they go down.

This is why I also pulled out of alt-coin investing. It's too volatile and I don't have enough volume to help manipulate the market. I just kept on losing. Reading charts here and there is fine, but it's not regulated and pump and dump happens everyday. I haven't seen a coin that "surpasses" bitcoin (although the technologies are there). teem is just the same to me. It could go to being worth only a few cents.. but I don't play the game anymore. I just post and collect now. My payouts are pretty small these day's anyways. When I write out something longer it's more for me or anyone listening. I'm making more money in real life than "trading" or speculating. I'm just not good enough to play the market. I'm also too conservative with risk.

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

i like your post my friend

I keep reading these and I think yall are missing the fact that if it comes back to a time where we're relying on gold and silver as money, that's not a world I want to live in. That means we will basically be back in the dark ages? Is that something you really want?

I understand the value of gold and silver because if our economy collapses it's a store of value that's universally accepted, but I just hope you understand the doomsday scenario in which a bitcoin/fiat goes to $0.

Saying that relying on Gold and Silver as money is like going back to the dark ages is like saying that a government living under a budget is like going back to the dark ages.

Currency used to be backed by gold, and you could only print as much money as you had gold.

The true insanity is having a free floating currency. Perhaps that's why the US dollar has lost 97% of it's purchasing power since the start of the 20th century.

bitcoin has been pumped for various reasons, some legit and some shady. This isn’t about the stone age. This is about reality. For instance, if i go to a regular end of the mill convenience store and I present a BtC wallet vs a gold coin; what do you suppose the person will trade/let you buy with? Tulips..

There were many things that were traded before fiat.

I understand what you're saying, but I'm also saying I'd rather live in a world where bitcoin and gold are worthy investments/store of values.

@originalworks

The @OriginalWorks bot has determined this post by @bearbear613 to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

For more information, Click Here!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

This post has received a 9.13 % upvote from @boomerang thanks to: @bearbear613

@boomerang distributes 100% of the SBD and up to 80% of the Curation Rewards to STEEM POWER Delegators. If you want to bid for votes or want to delegate SP please read the @boomerang whitepaper.

This post has received a 0.74 % upvote from @buildawhale thanks to: @bearbear613. Send at least 0.50 SBD to @buildawhale with a post link in the memo field for a portion of the next vote.

To support our daily curation initiative, please vote on my owner, @themarkymark, as a Steem Witness