Gold Bugs are rejoicing as we close in on the Brexit High of July 2016. A lot has been written recently about Gold being just a "Pet Rock" and a "Relic of History" but it continues to defy Central Banker and Crypto Zealot down ramping attempts. It is proving it still is a good store of wealth and has an important role to play as an alternative to Inflationary Fiat Currencies and Volatile Crypto Currencies.

Source

The recent rally in Gold is now into its 7th week and it has been strong enough to convince me that we will break the Brexit high and maybe even take out the high of March 2014 to give us the strongest Gold price in about 5 years. This rally is not quite as spectacular as the Crypto market has been of late, but for our old-world financial system, Gold taking out these highs will be significant.

Source

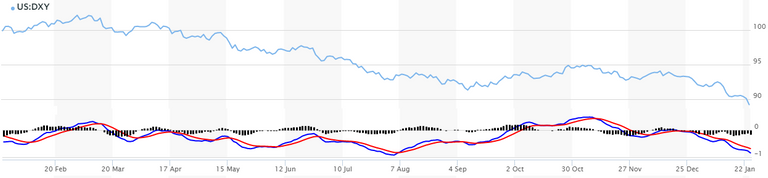

“Why is Gold doing so well?” You ask. Well there are a number of reasons. If you want a bit of a refresher, have a read of my post about the 3 Traditional Gold Price Drivers for some background context. There is obviously ongoing uncertainty around the Trump Presidency, plus we have wavering sentiment in the Crypto Markets, but the main driver seems to be the ongoing decline of the US Dollar. If we have a look at the US Dollar Index (a measure of US Dollar worth) we can see it’s been on the slide for about a year and has just made a new low. This correlates to the fresh rally in Gold and indicates investors are losing faith in the world Reserve Currency (the US Dollar) and are looking for alternative ways to store value. Traditionally this alternative has been Gold.

Source

The most recent sharp dip in the US Dollar (and correlated sharp rally in Gold) has been attributed to the US Treasury Secretary Steven Mnuchin who was seen as advocating that "…a weaker dollar is good for us as it relates to trade and opportunities" while speaking at the World Economic Forum in Davos Switzerland. For those who aren’t aware, this is the big forum every year where the elite Banksters from around the world get together to consipire plan the global economy for the good of us all.

Source

According to THIS ARTICLE this year they seem to be more worried about Cryptos than Gold so maybe they are taking their eye off the ball. I think these old dinosaurs are slowly starting to realise they are losing control of the financial world and their monopolies are under threat.

https://www.slideshare.net

https://www.ig.com

https://www.marketwatch.com

https://www.ccn.com

What did I tell you mate....

STEEM, EOS, GOLD, SILVER or SEGS for short!

With EOS and Steem being rated in the Top 5 Cryptos by Weiss and silver up 3% last night....

FIGJAM!

Faark Yeah! Go SEGS! All 4 heading North.

FYGJAY!

I'm happy with SEGS mate. Got a bit of each :)

Precious Metals will not be on sale forever. If one is considering getting in, now is the time. • SteemSilverGold •

It's not every day where you see a post about gold on Steemit! Just looking at the chart pattern it is looking like there are higher highs - which tends to be a bullish pattern. Of course, this is just our opinion but gold is a great alternative to currency. It will be interesting to see how bitcoin plays out. Even litecoin.

Thank you for the wisdom ❤️

Thanks. I'm not strong on Technical Analysis but it looks pretty good to me. I know how resistance lines work and usually there's a strong move when it breaks through so if it can get through through the Brexit High then a big move would not surprise me.

Lovin It!!! You're on the money with your article.

The only thing is that the AUD in going up in unison against the USD so not much net gain for Aussies.

Thanks. It does amaze me that the AUD is going up considering we have our own problems, but I guess they're just not as bad as others!

Mostly a reaction to the USD going down - it quite often trends the sames as Gold and Silver.

Sometimes I think inflation is a horrible thing and other times I think that I could care less about the dollar because there are so many other assets that are better anyway.

The financial world has really witnessed a lot of upheavals in the last couple of weeks. And it is still not over as gold is currently experiencing a high point while the USD continues a steady decline in world market.

Those who understand the market are currently taking advantage of the occurrence.

@buggedout Thank you for your usually informative and instructive analytic posts.

I’ve been STACKIN metals for over a decade! About time haha...

Well if you started before the GFC then you should be clearly in front. Nice job!

As I am in Europe I look at the gold price in EURO and as you explain the lower dollar is a big factor in the rise of gold. Measured in EUR it does not get up a lot. One EURO is now 1,24 USD .

It is similar in Australia. I normally wouldn't care too much about another nations currency, but the decline of the worlds reserve currency is significant for us all.

People are worried and they put their money where they think it will be safest, gold is a good bet, it hasn't let anyone down for thousands of years, crypto is still young so it is so much more volatile, but you can make more profits with crypto than with gold.

This is very true. I like Crypto for Wealth Creation and Gold for Wealth Preservation. It's worth having both :)

With the US dollar is at its lowest value in 10 years, predictions of a catastrophic stock market crash and currency collapse are blooming relentlessly. Market trends occur in patterns and cycles. You can trace back to the beginning of record keeping and see the same patterns repeating over and over again. Because… what goes up, MUST come down! This is a great post. We need more awareness around the failing dollar and it's relationship to gold and precious metals. Because of the mirrored relationship between the price of gold and US dollar decline, we'll likely see a significant increase in the price of gold in 2018.

Thanks and I agree that Gold is getting ready for a break out year. I think the stockmarket is entering a melt-up or blow-off phase but who knows how long it will run for.

you have to feel bad for the guy in the house they built that monstrosity behind.

The USD is in a lot of trouble, expect it to fall as gold silver and bitcoin will inch their ways higher and higher

As I've posted..silver/gold new highs or close on the horizon..that's right..and I urged divirsify two weeks ago from Cryptos.

Congrats. Sounds like a smart move and it's never a bad time to diversify in my opinion.

Not to mention that the demand for gold in industry and electronics will only increase.

actually its Ag - silver that is the major component for electronics. ie. Samsung / Apple / renewable energy / fossil fuel cleaners etc..Per annum Au - gold mined / 3% used for industrial / electronics .. Cheers

sure, but that will only increase, gold makes the best connectors and has other useful properties.

You might be right...but

It is a fact that both China/Russia have been purchasing physical AU by the tonnage for quite some time now. Imo , AU and its "market relevancy future" are more confidence boosters for China like the YUAN/OIL/AU or the Crypto Rubble backed by AU. Lets hope Fort Knox has AU. Canada sold their AU a few years back...North Americans should purchase physical AU for wealth protection. What ever they view wealth to be. Be your own Bank based upon physical assets not paper or polymer. AG can purify my water but it has to be .9999 four nines purity, and a bugger to haul around..

That's both a benefit and a limitation, you can buy smaller increments but then on the other side you have to deal with the size and weight. A half million worth of silver weighs a ton, literally.

Fractional AU has a hefty premium. 10% +++ and will only grow wider as the fractional premium products get gobbled up..I like Combi bars.

I personally think gold is a great buy. All fiat currencies are hyper inflated. I love crpyto currency I think it's the wave of the future. But gold has always been trade able. It's always been the real currency even if these governments have tried to tell us otherwise. If for some reason you can't buy a lot of gold silver is just as good

Absolutely. If you can't afford Gold then Silver is the next best thing. Silver is still trading very cheaply right now.

Yes I'm not a rich person so I invest in silver. I think it will have the same gains as gold if not more

buggedout, now following. please consider following me, I'm into commodity swing trading

Sell at the end of February?

Why?

Seasonality.

There's a season for Gold now? I'm sceptical.

http://www.seasonalcharts.com/classics_gold.html

The fact that the price for physical gold and silver decouples so readily from the paper-traded versions in times of panic is evidence enough to me that they're worth a lot more than they want to let on.

Agreed. The general population don't understand nor value it though, so it's not like we make it hard for them.

Ok, then go and ask the "general public" how, and where to buy AG/AU.. They don't have a clue.

I think Mark Dice has proven this over and over..Only 1%+ own LBMA name brand precious metals.

Go ask the "general public" what Johnson Matthey is or Engelhard or AU/AG maples or Valcambi etc.. It seams wealth is only a perception of ones fruit and labour. Own a Stainless Steel Rolex Submariner? I don't , but there just as liquid as AU. AG is a fantastic Metal , but who's gonna buy it at 100 per oz? All those millennials staring at their phone trading Crytos? Thats Gen Pop.

You're preaching to the choir here. The root of the problem is a basic education about money and financial literacy. We learn to read and write at school but we don't learn to balance a budget properly or how money really works.

A Debt based system will do that.

Yes, I believe Au/Ag are excellent hedges against fiat currency collapse/inflation. 20% is about the right amount for an investment portfolio. But the Au/Ag must be of a physical state , in your hand with no 3rd parties involved. Physical asset is what it is and what it should be to you.

I think this is just the beginning for gold and silver both. They will continue to rise

How much higher would gold be if all of the hedge funds who are pouring money into cryptocurrencies would be investing in gold miners?

If these hedge funds decide to get out of cryptocurrencies then the share value of gold miners would increase by quite a bit.

Have always watched Gold but have never purchased any.

Time to go get ya some...........Start stacking while you can still get above ground precious metals....

I think the days ahead. Good news will be uploaded

Good work dear thanks for sharing keep it up And good luck

Almighty God deals with gold

You have received an upvote from STAX. Thanks for being a member of the #steemsilvergold community and opting in (if you wish to be removed please follow the link). Please continue to support each other in this great community. To learn more about the #steemsilvergold community and STAX, check this out.