In Australia we have compulsory Superannuation. In the US they have the 401k which is conceptually very similar. The idea is that when you are working and earning a wage, you put away some funds to pay for your retirement so that you don’t become reliant on state-funded welfare in your old age. The state gives some tax incentives along the way but you really don’t have a lot of say in it. I’m just going to call it Forced Savings for the purpose of this post because that’s what it is.

Source

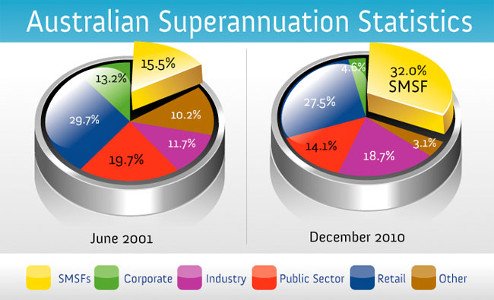

I won’t go into whether I think this is right or not and while it is tempting to delve into the rorts and commissions you pay to a bunch of bean-counters in the process, I will resist. Up until recently you only really got to choose which fund you were going to use for your Forced Savings, then some of these funds started offering you different products like “High Growth” or “Diversified” or “Fixed Interest” which gave you a bit more choice as to how much risk you were taking with your Forced Savings. But when the GFC hit in 2008 they pretty much all got decimated because the people making the decisions were all crowded into the same investments (as they do) and they all went down together. A lot of people lost 40-50% of their Forced Savings in Australia. While the US Stockmarket has recovered, over here in the magical Land of Oz we still haven’t got back to our 2007 highs.

Source

After the GFC a lot more people in Australia started setting up their own Self-Managed-Super-Funds, which although they are still heavily regulated they give a bit more freedom to invest directly in things like Precious Metals that might be a more effective way to hedge against crisis like the GFC in 2008. But SMSF can be expensive to set up, cumbersome to manage and painful to report on at tax time.

Source

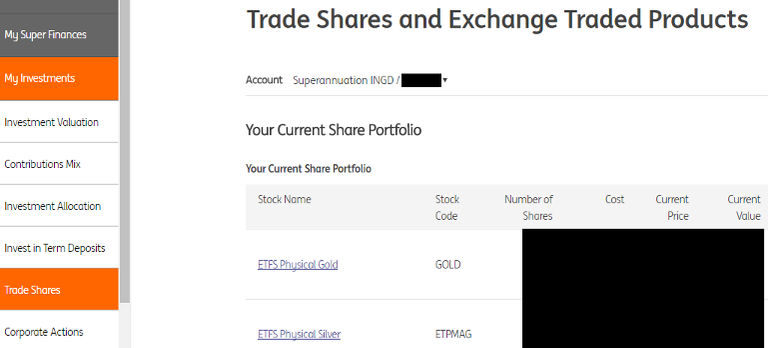

In recent years I’ve come across an option somewhere in the middle. Some of these Superfunds now let you choose specific shares and investments from an “Approved List”. While they still take their fees, they look after all the compliance issues and tax reporting so you can just focus on picking your investments. This is what I have done and among other things, my Superfund lets me choose from the ASX300 as well as several Exchange Traded Funds (ETFs).

Here is a way for me to allocate some of my Forced Savings into Paper Precious Metals and hedge against future problems with the financial system like a repeat of the GFC. Not only can I invest directly in the big Gold Mining shares (which are effectively a leveraged Gold investment) but there are some ETFs which are specific to Precious Metals and are tied to the respective Spot Prices.

Source

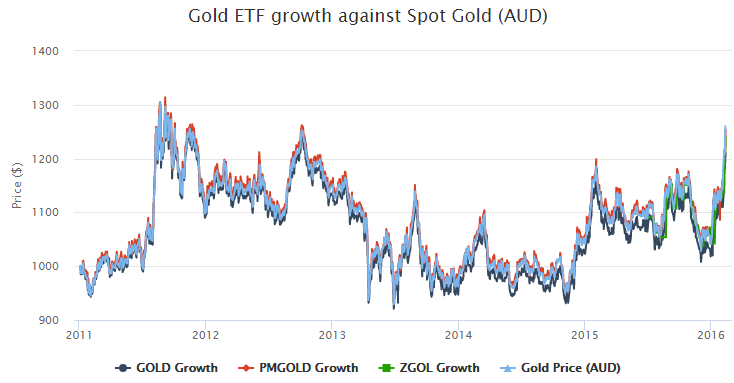

Here are some of the ETFs on offer (listed by ASX code) :-

GOLD and PMGOLD – 100% Gold

- PMGOLD is managed by the Perth Mint and has slightly lower management fees. It also is supposed to facilitate conversion of ETF holdings into physical metal if you show up at the Perth Mint vault and want to redeem your holdings.

ETPMAG – 100% Silver

ETPMPT – 100% Platinum

ETPMPD – 100% Palladium

ETPMPM – Mixed Basket

- ETPMPM is a mixed basket of Precious Metals and at time of writing includes approximately Gold 50%, Silver 19%, Platinum 10%, Palladium 21% by valuation.

Source

I am holding a few of these ETFs personally and if the banking system goes kaput they will probably go kaput along with them, but since I can’t really get access to my own Forced Savings these ETFs will at least let me hedge against a few of the financial crisis scenarios. If we get inflation and more money printing with fiat currencies getting trashed then they will hold value as long as the current financial system otherwise remains intact. As things stand I think it’s unlikely I will ever see my Forced Savings because the system needs to hold up for a couple more decades, but at least with these ETFs I have a chance of preserving my wealth long enough to enjoy it during retirement.

https://www.onesmartdollar.com

https://au.finance.yahoo.com

http://dkfp.com.au

https://super.ingdirect.com.au

http://www.etfwatch.com.au

http://www.gannon-scott.com

"Compulsory Superannuation", that's a real fancy word for "putting a gun to your head and making you contribute".

The US version is called "Social Security" which is another way of saying "we take money out of your paycheck or we will kick down your door and kill you".

I'm glad to be living in the land of the free!

Wise move...I've done something similar with my IRA funds here in the US...don't worry, I'm sure governments are going to go on a printing spree again to keep the stock markets up once they start to catch a cold...

In that scenario these ETFs will do well.

A friend of mine runs a super fund.

He and I spent most of 2013 trying to find a way to get my $50K super fund into bitcoin ($50-$200 at the time).

Not permitted. Too risky.

If it's my money, they owe me millions.

If its not my money, they should just admit its another tax, which, thanks to inflation, will buy me a coke and a mars bar by the time I retire.

Nanny State strikes again. It's a bit like our democracy, they want to preserve the illusion that you get to have a say in what happens.

If you can't get Crypto then Precious Metals is the next best thing I reckon. Still, I am waiting for that first Crypto ETF to get listed on the ASX and I'll be all over it. Shouldn't be too long I hope.

You and me both, mate.

I've contemplated moving overseas to access that super, to be honest.

Imagine dropping it into SP now.

I don't give two squirts of duck droppings about my citizenship; but I'd hate to take the kids from their grandparents.

Way to diversify with PM! I would recommend mining companies as well considering they produce an income and could add dividends to your portfolio. These dividends could be used to buy more paper PM or anything you'd like!

Yes, I have got a few of them too. Especially in my regular share portfolio that I wrote about HERE I do find you need to actively study and manage shares due to capital raisings, share splits and all that sort of stuff you need to respond to.

I wanted to write about the ETFs here and I think they are well suited to the passive investment / safety we hope to get with our long term Forced Savings.

If you're worried about managing individual mining stocks, the GDX or SIL are always good options...

Ironic that you have posted this on Paul Keating's birthday!! The Labor party politician who concocted this flawed retirement savings system on unsuspecting Australians.

A system that allows successive politicians (both left and right) to see the forced savings of Australians as a nice honey pot to raid (tax) whenever they please.

The latest absurdity is to limit [lifetime] savings to $1.6 million AUD or face pernicious tax at 49%.

The Australian sheeple have now become so intoxicated and addicted to the welfare state that the National Superannuation, taxation and health care systems are beyond repair.

A very lamentable outlook indeed.

I had no idea it was Paul Keatings birthday. That is funny.

I imagine the politicians will keep chipping away at it over the next decades if a financial system reset doesn't wipe us all out first. Anyway, if there's anything left by the time I retire I will be surprised.

Very informative and helpful post. I appreciate your mentality to help people by your good article. Keep it up man. you are being wise. @buggedout

I think you are being very wise. Diversification into gold and silver etfs will provide good insurance for your future

Aussie is one of the richest countries in the world.

My generation will never go into state-funding retirement and if we ever go the money will be a lot less... btw, interesting, can you exchange cryptocurrency for PMGOLD?

No, I don't believe so. You buy PMGOLD through your share broker and it is priced in Australian Dollars.

you poor bastards. At least you have an option in some way. I would prefer mandatory savings INSTEAD of a welfare state myself. Good luck out there, hope commodity prices increase another few percent for your miners.

Where you from? Whats it like there?

Nice work. It would be great if there was an option to trade off some of your super for precious metals/or anything else the individual would prefer to invest in.

There is currently no pension fund available.

My intake is almost enough for me a month

good post very informative. regards!

yes every country has this kind of system so this is not good ??

hmm, thanks for the insight, Makes me consider other options

You have received an upvote from STAX. Thanks for being a member of the #steemsilvergold community and opting in (if you wish to be removed please follow the link). Please continue to support each other in this great community. To learn more about the #steemsilvergold community and STAX, check this out.