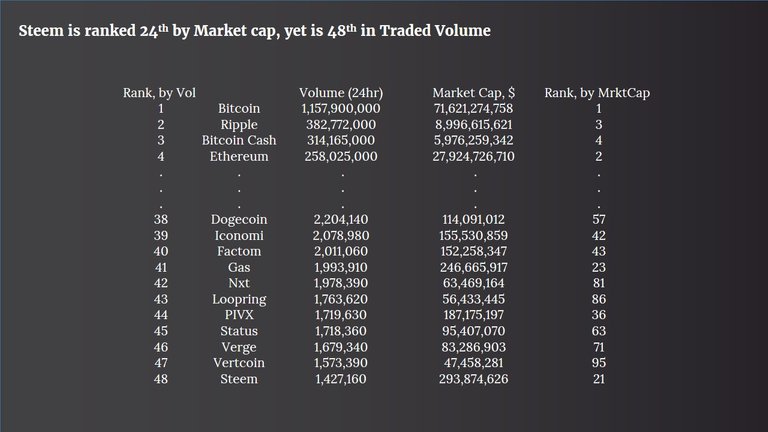

One of the problems with STEEM as a digital currency is it’s lack of adoption outside the Steemit Platform. Despite the obvious advantages of faster execution speeds and zero transaction fees STEEM is ranked 21st by market cap and meagre 48th place by average daily volume on coinmarketcap list. Just to illustrate the state of the matter – Dogecoin has 2x the turnover of Steem.

At the same time, the trading community outside Steemit is being exposed to trading volatility without the reliable way to hedge it versus dollar pair. The demand to hedge the volatility is evidenced in Bancor thunerding ICO, which promises to stabilise the newly minted Ethereum tokens price fluctuations by balancing the liquidity.

While Bancor effectiveness is yet to be proven, Steemit solved the volatility issue by achieving a reasonable dollar peg with SBD. However, market participants seem to ignore the potential (while at the same time being very receptive to the Bancor, which in essence is a workaround)

This leads me to believe that STEEM does not seem to provide enough of an incentive to use it (or SBD) for trading purposes. I.e. they need a catalyst.

One of such catalising asset is proposed by buggedout in form of Steem Gold (I encourage everybody to read it). This would definitely attract more traders to the Steem ecosystem and would be a giant step in blogging and trading community.

Paying a heed to buggedout I believe more is needed to create a critical mass necessary to change the perception of STEEM in the trading community.

Which brings me back full circle to the volatility discussion. Steem can offer hedging instruments in the form of options for major crypto currencies, such as Bitcoin and Ethereum.

A side note – options are contracts between two parties in which one party has an obligation to either sell or buy an asset (called the underlying) at a predetermined price and time in exchange of the premium received. The other party has a right, but not an obligation to exercise the contract, for this flexibility (or optionality, hence the contract name) a premium is paid. Depending on the direction of the trade, the option contract is called either a put ( if it gives a right to sell the underlying) or a call (if to purchase).

Let’s consider an example:

You own 1 bitcoin and are worried that the price might collapse.

I have some spare SBD and would like to buy 1 bitcoin if the price does collapse.

Absent of options we would place limit orders. You - an order to sell if say price dips by 5% (to get into cash and avoid any potential downside) and me - a buy order to buy should the price collapse.

Now with options, I can write a put option with a strike price (the price I am obliged to buy) 5% below current price and sell it to you for a premium of say 1% of the notional. Recall that it gives you as a put holder the right, but not an obligation to sell to me 1 bitcoin at anytime upto the expiration time of the contract.

If price dips below 5% (an event called in-the-money) you can send me your bitcoin and I would be obliged to buy it from you at the fixed contract price, irrespective of the current market price. Thus, by holding the put option you are protected in the event that bitcoin price falls below 5% (say to 10%). In exchange, you paid me a premium of 1%, so you gain if price declines by more than 6%.

If bitcoin price does fall I will receive a bitcoin at 6% off the prevailing market price at contract inception.

Notwithstanding the return profiles, by entering the contract You just shifted the downside risk onto me for the duration of the contract by paying a premium.

In practise, the parties to the contract exchange do not exchange the underlying, but settle by sending or receiving the difference between the strike price and the market price. So in this example I would actually send you the difference between the market price and the strike price (difference being 5%) and you get to keep the bitcoin. This process is called cash settlement.

Note how the name is suggestive – cash assumes a fiat currency in which the contract was concluded. In the old world, this is a prerogative of the almighty dollar. Despite bitcoin dominance, most of crypto traders measure their position against the dollar, not other crypto currencies.

Thus rendering the option contracts against other cryto currencies pairs useless in providing hedging solution. Once bitcoin declines against the dollar, most other crypto currencies nosedive.

To avoid the risks traders of course can liquidate the positions in anticipation of the price collapse, but if enough traders do it at the same time, they create a liquidity squeeze, pushing the prices down and generating handsome income for the exchanges in the form of commission and trading fees.

And that’s where Steemit advantages shine:

- It has a good dollar proxy in the form of SBD

- It has a commission free exchange with fast execution speeds

- It has a pool of witnesses that can provide a reliable price feed for such options

- It would give an opportunity all traders to hedge the risks via options without causing the liquidity squeeze contributing to more predictable price movements

With these solid advantages, I believe Steemit as a platform and STEEM as a crypto currency would experience a growth in popularity it rightfully deserves.

If steen becomes your man peg for crypto trading the value of steem will go up, but wide spread adoption and third party support would be the next giant leap forward.

Thank you @dv8, that was a great read. I agree that there is not enough incentive and adoption of Steem in regards to trading, but I hope this will change as the user base grows. However, I would like to point out that there is a substantial amount of daytraders and crypto-investors who measure their position against bitcoin and not the dollar, myself included.