Gold is the ultimate measure of wealth. It is for this reason that it is important to look at what things cost, in terms of gold ounces, and not just in terms of dollars, euros , pounds, etc.

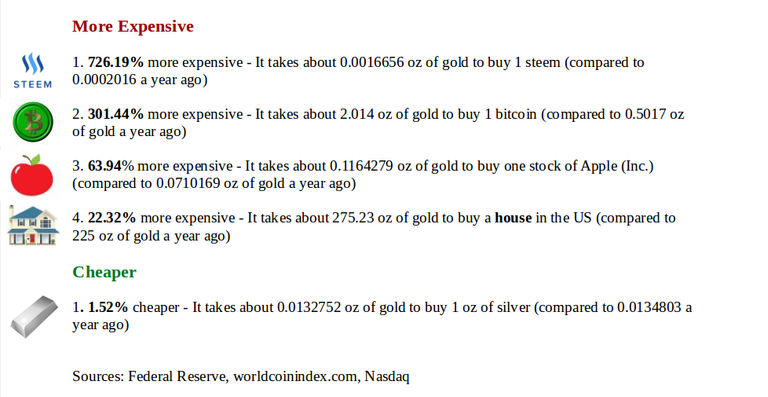

Below, are a few goods priced in gold. Most, are more expensive as compared to what they were a year ago (16 May 2016). So, it has not been such a good year for gold investors.

note: house was based on median US house prices

Please UPVOTE, RESTEEM FOLLOW (for regular updates)

Silver is way under valued here!

for sure, again, a perfect time to swap gold for more silver

.

I will include ethereum in my next report. It is still work in progress.

It is good to think the prices in term of gold. I usually make posts in this direction. A couple of days ago I wrote about gold-silver ratio. Silver is very undervalued in terms of gold. The gold-silver ratio is near its historical maximum.

https://steemit.com/steemsilvergold/@nenio/is-the-gold-silver-ratio-reaching-its-maxium

The largest US bill printed was of $100,000 in 1934. It was worth 5,000 gold ounces, at that time!!!

https://steemit.com/money/@nenio/the-largest-denomination-bills-printed-by-the-us

yes. I saw the gold/silver ratio post. I like long-term charts, they really give a proper perspective. I am just building up for more analysis of these ratios, but for know I just wanted to get things started with the basics. Thanks

Other interesting ratios is gold-platinum and platinum -palladium. Platinum is very undervalued. Some weeks ago. I wrote about it.

I find this type of analysis quite interesting.

I actually don't think platinum is undervalued, but we discuss that further some time.

Gold and Silver are the ULTIMATE insurance policy. Once the markets get out from these suppressed lows, gold and silver will sky rocket with silver leading the way, percentage wise!

fully agree, thanks for visiting