Yes, we all love to hold ( err, fondle is probably the correct term) gold and silver. Looks nice and shiny, feels smooth and warm. Golum had it spot on. But should physical metals be a major part of your investment portfolio?

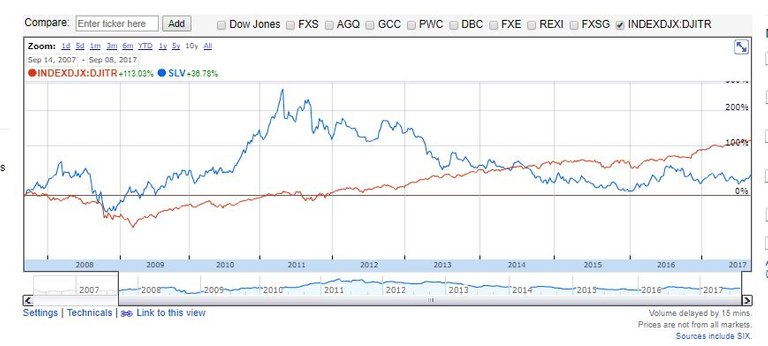

Taking a look at a 10 yr graph vs the the Dow.

As of now the Dow is up 113% and silver up 37%

But silver, for a period, was up over 200% . If you had a trade plan in place, you might have done pretty well

The Dow is a more predictable graph - slow and steady

Shares pay dividends - I nice little earner

You probably are paying insurance on physical silver - if not, it pretty risky.

Both can be liquidated relatively easily. Interesting to see that in 2008 silver also tanked - but recovered quicker and faster than shares.

Personally, find shares can also be very interesting and for me, it's a hobby. Lot's to read, lot's of metric's to compare and hundreds of companies to play with. That said, for those with only a minor interest a share portfolio of a few ETF's would probably be best. In fact, I'll go as far as saying my interest in shares has actually harmed my totally returns and a portfolio of three ETFs for 90% of my investment and then 5 stock picks of 2% each would probably have been a better bet.

Not saying that silver should not be part of a persons portfolio - but balance is important. For me, if I was interested, I would not go more than 5%. I probably would get in through miners though and earn dividends when times were good. Even then, commodities (due to cycles) are more suited for long term trading.

US Student Loan dept = $1.2 Trillion

Total US Debt = $19 Trillion

Global Derivative Value = $1.5 Quadrillion

That could never happen here :)

BAM! Yep. I'll keep stacking my silver thank you very much. The numbers don't lie.

Sure, I also am not a huge fan of FIAT. But stock , although priced in FIAT (as is silver) is not FIAT. Just like silver,

they are asset.

Stocks are nothing more than paper. On top of that, stocks have counter-party risk.

Look at your beloved Silver ETFs (e.g. GLD and SLV). What do you suppose the leverage is on those assets??? Sure it tracks the PM spot prices, and sure they have Gold and Silver on reserve in a warehouse somewhere. But I guaren-damn-tee you is it not a 1:1 correlation. I would guess that it's more like 50:1, so that means 50 people all have claime to one Oz. of Gold in GLD or Silver in SLV.

In my stack, I hold the only side of the trade. It's in my hands therefore I own it.

Well, I am not sure to take this as a bad "looking at you raybrockman or a good. But I am kinda lost on why you would use the #steemsilvergold as your first tag. One thing I do no is the stockmarket is being propped up by the federal reserve. Now you can stay on that train if you want to, but all of us @ steemsilvergold feel different about it. If you where trying to get my attention, you could have done that on steemit chat. Obviously this post did not work out for you, with only 2 comments and one being from me, you should have used steemit chat. But i am there if you would to continue this.

Well, you did ask me what I would buy in your post earlier today. But after looking at some graphs thought that it would be a interesting topic. Obviously not.

Don't get me wrong it is an Interesting topic, but you directed to me. So i wasn't for sure what it was suppose to mean. I believe in a free market, with that being said everyone is free to invest in What they want to. I am not a new stacker I have done tons and tons of research before I decided to start investing in silver. And in my opinion silver will net the largest return, when markets are free. But I am not going to take my opinion to the #stockmarket tag and try to get them to invest in silver.

its all good \o/

i think what most people miss with the silver is this, sure you can watch the paper silver prices and believe that is its true value, but honestly how many of us would ever sell our silver on those exchanges or even know how to, its intrinsic value is more to do with having it to hand and is based on the rarity of the products we hold, what format they take, how they appeal to us and to others, I would say this , if you had a troy ounce of silver as small granules in a bag , or if you had a hand poured ingot from a small mining company that gave added value for its craftmanship and innovation or even an old English pepper pot from the 1800s that had been made by silver craftsman of that time, along with its makers marks and history would we value them the same, even a new silver coin with limited mintage how would we value that certainly not at spot price it seems to me there are 2 seperate worlds here, the world that watches the price that banks and governments tell us what it should be and the world that knows it true value because we own it .\o/

Well, I was just looking at it as a long term investment case - including cost of ownership - and, considering that, what percentage of your portfolio would be prudent.

its all good al thats the beauty of our community we all have opinions and the right to voice them and to be heard , from my point of view thanks for your input :)

Amen!

Interesting Post. I used to think this way a long time ago and was heavily invested in the Markets. I've changed coarse and only have 10% with the miners. I'll take my chances and hold physical silver and gold. Good Luck to you, but I'd consider more than 5% if I were you...

Metals seem to run in cycles so as long as you are prepared to sell at certain levels, sure, could be a very good investment. Another topic, of course would be if holding physical metal or metal ETFs or mining stocks - but seems this part of steemit is a bit of a closed group so will leave it here.

I have 100x as much lead as I do silver. It's pointless to have silver if you do not have enough hot lead to protect it.

I like your style, you speak the truth!

I don't think silver and gold are held to outperform the stock market, they are more like insurance for when external events cause the markets to loose significant value.

Hey @cleverbot, what will @originalworks bot think about this post?

True. But then, in my mind (and if I held) then you must be prepared to sell at a high point to capitalize on your investment. Just holding does not seem (to me) to be a great investment. If the monetary system really does crumble, stocks will just be re-rated to oz's of silver. Even during the great depression, some business did well. I think crypto would be become a fill in currency before silver - in fact, that would be an interesting topic -could that have an impact on metals future prices? But definitely get your point, traditional they have been held as insurance - but for many it's there main investment - I am just questioning if that's wise and what alternatives are there.

If stocks got re-rated in silver, they you could re-evaluate, but no need to sell before that time. Other than that, I agree with you, and it will by interesting to see how crypto will impact silver and gold. I see bitcoin having many of the same attributes of precious metals and think some of the money that goes into metals now will go into bitcoin (moreso than other cryptos).

You may not have gotten many upvotes, but you certainly sparked a more lively discussion than most posts.

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To nominate this post for the daily RESTEEM contest, upvote this comment!

For more information, Click Here!

I don't see silver as an investment but more as a security for when the dollar tanks. There is so much paper out there that is backed by nothing other than only a government promise. No currency lasts forever and it always goes back to being backed by gold and silver. I'll continue to stack physical gold and silver.

I hear you about FIAT. But for you, does that extends to stocks? My view is that both metals and stocks (lets not bring derivatives in here!) are physical things just MARKED in FIAT. And if a currency tanked (as in ZIM or Argentina) they will just be revalue to the next best (and easiest) form of wealth. That has, in the past been the dollar. But if that tanks, may be the Euro? Next, might be crypto or metals. My point being that the stocks will still have value as the means of production and won't just be devalued to zero. If they do, then so could silver and gold - maybe even have a greater chance. IMO of course! :)