When looking at silver as in investment, you start to see that it is more of a hedge investment than a growth investment. I have been stacking for 4 years and every year silver is going to boom and go to the moon. Every year we see youtubers and bloggers make their case's for $100 silver with the same BS we hear every year. Industrial use is up, people are turning away from banks, eagles had record sales, the gold to silver ratio needs to correct, blah, blah, blah

The very first time i bought silver the spot price in pounds was £12.82 and today the spot price for silver is £12.31. Not a great investment but its very safe as it's tangible. This year so far i am seeing something different, i am seeing people writing and posting about silver being in for a volatile ride in 2018 due to a bunch of complexities my mind is too small to understand, the plan seems to be get more shinny. I understand this.

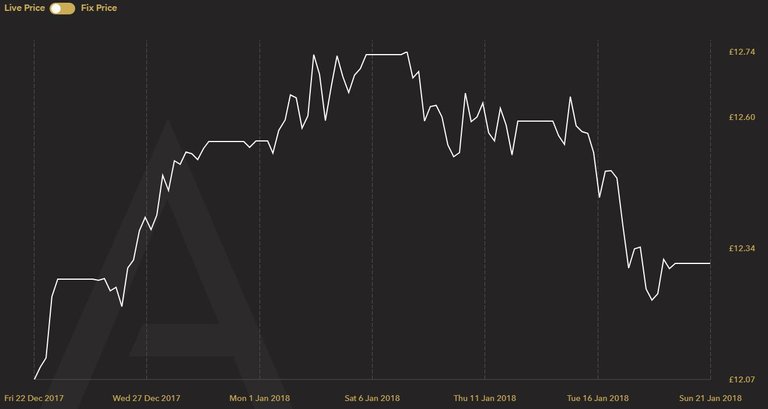

The past month for silver...

We seethe month chart starting out at around £12.07 and then over the course of a few weeks, jumping to £12.73 and holding for a round a week over the start of the new year. Since then we have seen a decline in spot price. The longer i stack the more i see the same things happening over and over It seem that silver always get a run the last 2 weeks of december. It has done the past few years and then drops off at the start of January. Maybe it's just me but i think i this happens every year.

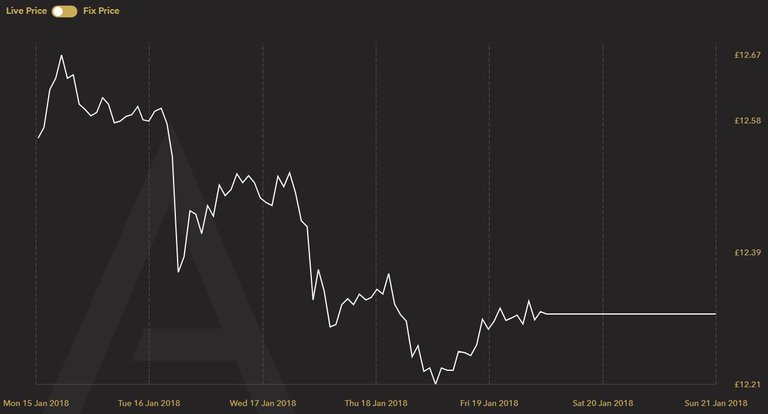

The past week for silver...

Its been a slam down week with silver going down almost everyday. It's another good time to be buying, any number under £14 spot is a super bargain in my mind. I will be taking this chance as i did when silver hit £9 a few years back to do a really big order. I think once it passes £13 this time, it will not go back under even if it is only a few pennies above. I would be surprised to see silver up more than 20% in 2018, i think will continue sideways as new money still pours into crypto's. I think the rush for silver and gold will come when people have made to much interent money and need somewhere safe to store it. There will be a silver and gold craze fueled by stock and crypto money........ Im dreaming again.

CLICK HERE TO ACCEPT YOUR INVITE TO THE GROUPS DISCORD SERVER

Some of my Recent Posts

*** #SteemSilverGold Membership and Voting List UPDATES***

------Bitconnect, Shit hit the fan and my inveswtment------

** A late XMAS gift for myself - New coin Case **

------ Who is on your FOLLOW list ? ------

Silver Sale Continues!

Stack on bro !

More cowbell and MORE silver!

Ding ding

@silverstackeruk, thanks for sharing.

The trading action in silver at the end of a year and the beginning of the year and the price movements could be a result of portfolio rebalancing, profit taking and tax implication selling & buying. I think focusing on the bigger trend and accumulating physical during the dips is a wiser way to invest it the precious metals sector versus following daily and weekly price movements. After following the PM sector and writing about it for over a decade, I have learned to not pay attention to daily market noise. The PM sector will have one more final bull market run, and it looks like 2018 could be the year it starts... if so it could last a few years.

The precious metals pricing does also have some seasonality to it, meaning pricing moves in a specific direction depending on the time of year. I have found the best time of the year to buy gold and silver is in the summer doldrums, then sell in Oct/Nov, buy back in Dec and hold to Feb to May time frame, then sell and buy back in the summer again. This strategy had worked in the past based on seasonality, but PMs can be fickle and it doesn't trade like this all the time. I find using the charts and price action, laying that on top of fundamentals and then making trading decisions help in trying to speculate price directions.

What a great comment, thanks for tasking the time to write it.

I have only been stacking for 4 years so i have a little knowledge but not 10 years worth. I have seen the seasonal treads with silver and they seem to fellow the path you have outlined. I remember working it out by starting with 100oz and trading them this way for 5 years based on the past 5 years. It was when i was starting out and was thinking pie in the sky, haha. Its something i use to roughly guess when to place my bigger orders

@silverstackeruk, Ya, I like writing about precious metals, I did it for about 8 years on my site http://www.goldenfortunes.com/ and in a newsletter for @dollarvigilante , but stopped about 4 years ago and started focusing on the Cannabis Sector. I think we are at the starting of the 3 rd and final phase of the bull market in PM, so I will probably write more about it in the coming years. Great job with the #steemsilvergold group on Steemit, I hope to be a valuable part of the team and contribute my knowledge and expertise. Cheers.

You're so nice for commenting on this post. For that, I gave you a vote! I just ask for a Follow in return!

Thanks for the vote... followed.

Everything sounds great. I am about the post the membership list enrollment post. Get yourself into the comments intereacting with other members to get a nomination :)

Come to think of it, was i talking to you a few weeks back?

@silverstackeruk, yes we spoke about nominating me for membership. I haven't written a blog about PM yet, but I have been commenting on others posts, including yours. I will try and get a gold-related blog out to the PM community on Steemit. Cheers

That actually makes a lot of sense.

I love seeing the extra zeroes on the screen; but the higher they go, the more unnerving it is to have all my eggs in one basket.

I'm looking forward to snatching up a chunk of those 2018 steem coins, and maybe some bars as well.

I like where your head's at.

I cant wait till the 2018 coins come out, will make great presents for people, maybe even make a contest where people can win one too 😀

There were loads of contents last year and they were even selling for up to $60

I heard we will be able to buy with Steem too. Time to HODL as much as possible till then

We will be accepting STEEM as a payment for sure!

That would be a good idea. I think phelimint will accept but im not 100%

The design contests are getting started now by @phelimint. Cant wait to sort the UK buy out this year again.

I agree that Silver and gold is a hedge against the Fiat. Not going to the moon anytime soon. Although see the post I made today. Seems Bank of America is predicting a market major correction which could fair well for metals..

It would be welcome. Living in the UK, we sort it had a bit of correction when the vote for brixit came in. Silver jumped around £2 that day. yeee-haa

A delightful consideration from outside the crypto market, nice to see a post like this. I've wanted to get into metal as long as I've been investing but I've never known how to obtain it.

There are actually some ways of buying metal backed crypto's, or so I've heard. Basically you get a token as a placeholder for your weight purchase in metal. I've had my doubts since if I bought metal I'd like to physically hold it myself, or have an incredible sense of security regarding it's hold. Cough fort Knox.

Do you hold your silver in your home or a bank?

Are crypto's to blame for the prediction of volitility?

If Fiat continues to lose value how will silver investors such as yourself react?

Do you own copper, aluminum or any other metals, would you or why not?

Sorry to bombard you with questions, SteemOn!

If you dont hold it you dont own it. I have heard of metal backed crypto's which to me sound the same as ETF's but unregulated so never looked into them.

1/ I hold my silve rin a safe place only me and the wife know about

2/ The silver market is worth around $18 billion and the cryptomarket is worth $600 billion, i do not think they are related

3/ My silver stacking plan would not change, fiat has been losing value for ever 100 years

4/ I only own silver and small amount of gold. Copper is worthless, $10k in copper would need a truck to move. Silver and gold are easy to buy and resale

Good strategy... everyone should keep their precious metals in their own possession. However, if you have bulk silver and lots of it, you may want to consider storage in a vault. I have written a report on how to internationalize precious metals, it's over 100 pages long and a complete compendium on the topic. In doing so, I have spoken to many of the most reputable private vaulting facilities around the world. But a bird in the hand is worth 2 in the bush, hold the precious metals yourself if you can.

This post has received a 0.47 % upvote from @drotto thanks to: @osirisofthemoon.

Good post my friend, excellent commentary on the week!

Look who the cat dragged in :) Hope all is good with you my friend. Seen your first 2018 pour the other day.