We're at the Verge of a MAJOR Stock Market Crash and Global Currency Collapse

.....With the US dollar is at its lowest value in 10 years, predictions of a major stock market crash and currency collapse are blooming relentlessly. Take a look at the graph below.

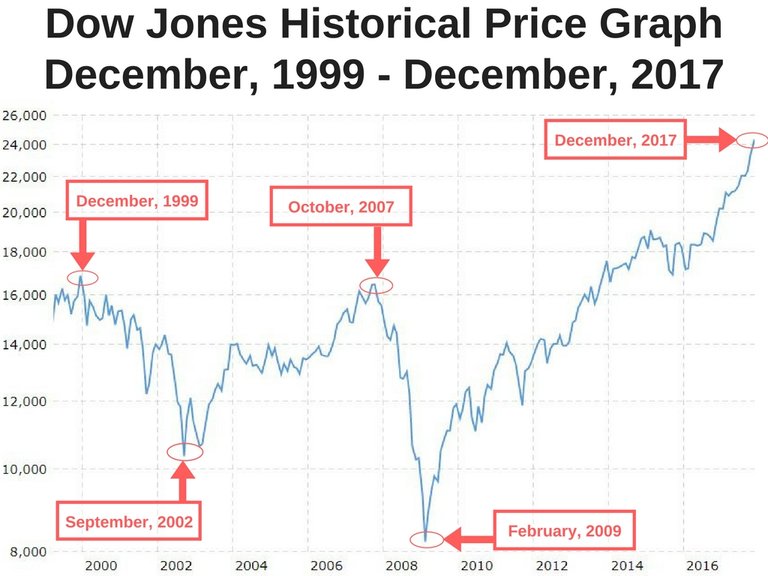

It shows historical data from stock market performance over the past 18 years. Do you see a recurring pattern?

As you can see on this Dow Jones graph, current economic conditions are eerily similar to how they were just before the financial crisis of 2007-2008, and also the dot-com collapse in 1999.

Market trends occur in patterns and cycles. You can trace back to the beginning of record keeping and see the same patterns repeating over and over again. Just remember… what goes up, MUST come down!

MUST READ:

How to Prepare for the Worst Stock Market Crash in History

When the US Dollar Nosedives, Gold Skyrockets!

On a brighter note, this is great news for the price of gold.

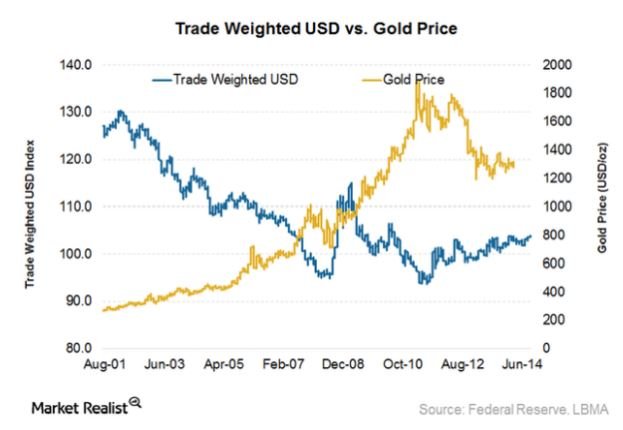

Because of the mirrored relationship between the price of gold and US dollar decline, we could see a significant increase in the price of gold in 2018. Take a look at the chart below…

Image Source: Market Realist

There’s an inverse correlation between the price of gold and the value of the US dollar. Basically, when the US dollar declines, the price of gold skyrockets.

Therefore, buying and storing gold can provide a significant hedge against an ever declining value of paper currency.

This helps diversify your investment portfolio while reducing the risk of investments that rely on the health of a declining US dollar

The price of gold increased at the end of 2017 because the US dollar decreased in value. Further US dollar decline is... continue reading article...

The markets can go higher longer than you can stay solvent, I have been fighting this melt=up for 4 years now, I can see how people are giving up and joining the party. I have used this opportunity to stack, instead of joining the rising DOW. I believe it will pay off in the long run.

To add: If you look at the gold price here in Europe it does not go up. So only expressed in USD it goes up because the USD is worth less relative to other currencies. You are perfectly right that gold protects against inflation of whatever currency you measure in. That is why I started investing big in gold years ago.

Gold miners are looking better now also!