Financial statement or record is considered the heart of all businesses and financial institutions. Before the advent of technology, financial statements are processed manually, which is time-consuming, difficult to process, prone to various data errors, low efficiency, poor update, poor data logging, untimely, poor representation and lack of adequate communication. To avert the stated problems faced by financial expatriates, it is of most importance to integrate information technology into financial accounting so that the desired financial statements are produced with great efficiency and accuracy.

By Nick Youngson CC BY-SA 3.0 Alpha Stock Images

Information technology has impacted business organizations and financial institutions in the ability to use a computerized system to track and record all financial transaction made and to produce adequate and correct financial statements that could be saved on the company database. The powerful integration of information technology, computer processing, and communication in financial accounting gave rise to new models and better business opportunities.

Such advances have made organizations to engage in various forms of activities which have given rise for the need to provide qualitative financial statements. A statement is said to be qualitative if it provides the required financial information that could aid decision making of an organization.

There are some criteria to be considered in choosing the type of information technology to be adopted in any economic unit. Such information technology to be adopted must pass the system integration and network capability test and must also support effective database. The intended system should also be able to possess some specifications such as high speed data processing ability (sending of information from the database to individuals users, and retrieval of information from individual users to the database).

By Marko Puusaar - Own work, CC BY-SA 3.0, Software development Lab.

Compatibility, completeness, reliability, improve accuracy, credibility, increase functionality, flexibility, clarity and precision, high attention, appropriateness, better external reporting, up to date and timely. All these specifications are known as characteristics of accounting information. Some of these characteristics shall be discussed in the latter part of this post.

Be that as it may, any variable of information technology to be adopted by any financial institution must be in compliance with the generally accepted accounting principles and standards and principle of accounting information system. Such principle includes; the cost-benefit principle, the control principle, and the compatibility principle.

An information system can be described as a group of associated reactants and elements components such as input, processor, output, system boundary and feedback that work together to collect useful data, operate on the date, store the data and distributes the processed data inform of information to the end user. Such information is also available for an organization's future use and for decision making.

Accounting information system comprises of many parts and sub-systems of components that are highly integrated together with one another and with the surrounding environment. such system takes cognizance of accounting information principles and procedures to produce financial information or statements from sets of individually collected data (from many users) which must be a true financial representation of an organization, useful for future decision making.

By User:Mattes - Own work, Public Domain, ATM

Impacts of application of Information Technology in some aspects of Financial Accounting

Information Technology has been found very useful in the following aspects of financial accounting; software tools for accounting processes, correct estimation of income, revenue and losses, Financial auditing, income taxation, word and graphics processing, electronic fund transfer, image processing, and electronic data interchange.

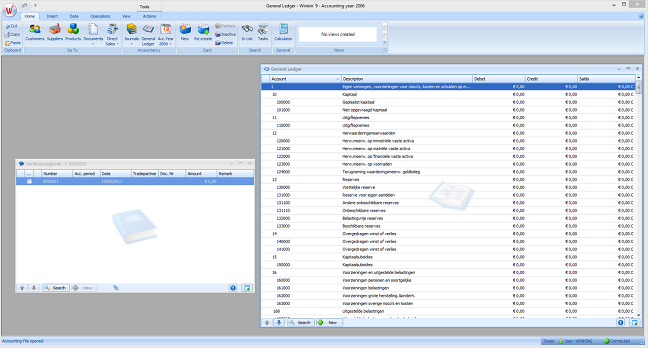

over the year accounting procedures are dependent on traditional ledgers and account paper before any transaction could be made possible. The advent of technology gave a stop to this mess and confusing practice. The traditional ledgers and account books are now replaced by accounting software packages. These software packages consist of generic programs with special features that have forever transformed and improved traditional operations and service provision processes.

By JuFo - Own work, CC BY-SA 4.0, Accounting Software

The size of the operation and the number of accessible end users to a system is to be considered in determining the form of accounting software suitable for an organization. The software or program could be low-end software or high-end software. Small companies adopt low-end software because it is a software package that is programmed to perform the major accounting procedures. But for the purpose of division of labour, this all-in-one software is divided into different categories and stages to form a high-end software with improved functions and efficiencies so that each category could be undertaken by a worker. Large companies subscribe for high-end software.

Auditing firms make use of various hardware and software such as EtQs Enterprise Audit Management Software, ERP Software made by companies like Oracle and SAP, ProcessGene GRC Software Suite, GnuCash, MasterControl Audit Management, QuickBooks or Sage's Peachtree, ADAudit Plus, SaaS Accounting software, Optial SmartStart, e.t.c, to achieve their auditing functions easily and efficiently. These above-listed auditing software perform similar functions, though their scope may be different significantly. Automation of auditing procedures such as trial balance to handle all entry adjustments and produce adjusted trial balance automatically is made possible by the significance of information technology.

By Travelarz - Own work, CC BY-SA 3.0, POS Interface

Electronic Funds Transfer eliminates the usual long queue encounter in the banking hall. The long queue can be frustrating most time because it is time-consuming and stressful. Thanks to information technology, you can now make sorts of fund transactions from the comfort corner of your room, it is very simple, fast and reliable. Instant financial statements are produced for such transaction automatically. Banking transaction made easy through online banking and computerized banking made companies depend on electronic fund transfer. Deduction of fund and credit of funds occur immediately when transactions such as purchase and selling are made.

Conclusion

Automation of accounting procedures and financial statements deal with computation of numbers and it involves making several operators act on functions. The accuracy of such operations must be 100%, there should be no room for error what so ever. Any error in accounting is considered as fraud, so, all automation and accounting processes must be done with zero error, great efficiency, and better accuracy.

In addition to the said accounting information specifications and characteristics, information technology to be adopted in financial institutions must be flexible. Financial accounting procedures are dynamic and not static, therefore, accounting system must be able to adapt to any change in business and transaction practices. Such system must be designed with update feature. When designing flexible accounting system, an effective and prompt security system must be put in place to detect and prevent any fraud. A good firewall must be provided for financial accounting systems, especially to systems involving cloud technology.

Thanks for reading this post

All Images are from free sources

References

https://bizfluent.com/about-5471307-impact-information-technology-accounting.html

https://www.techfunnel.com/fintech/information-technology-impacts-financial-reporting/

http://thebusinesstimes.com/information-technology-affects-financial-statements/

http://smallbusiness.chron.com/information-technology-used-accounting-2101.html

https://blogs.cfainstitute.org/marketintegrity/2016/09/01/the-role-of-data-and-technology-in-transforming-financial-reporting/

Technology is already and almost applicable in all field

Just knowing about accounting... It's cool I hope the downsides are favorable because there is always a downside of everything

Thanks for this comment @osariemen. The downsides of technology on accounting are not always favorable because it is prone to fraud, but the joy about it is that through the same technology, most frauds are traceable but the fact is that the deed has already been done. I think I should discuss the downsides of technology on accounting in my next post. Watch out for it.

Alright

Would be expecting it

The application of computer can never be overlooked in this modern era. From medical field to music industry, banking sector, academics . e.t.c. Your username seems to be similar to RUBY ON RAILS, any correlation?

Technology is applicable in all field you can think about. If not for technology, creation of this platform won't be possibe. Thanks to God that I withness this evolution lol

Technology advancement as really helped various field of life. Financial reporting system has become easier because information technology has experienced quantum leap thereby taking other field with itself. Well done @rubies

Thanks for visiting my post @steepup. Technology is all encompassing