This is my first post on Steemit and hope you like it .There are some bad trades and mistakes learnt from stock trading from my experience. I have included all the things that can make someone better with trading stocks and investing. This is the easy method that I use with stocks trading or investing daily as well as on monthly timeframe.

Why is that most traders lose money? The answer would be that stock market is a place of random activity. Each one has their own set of beliefs and trading style. I want to teach others and teaching is the best profession in the world. I want to help fellow traders to make more money.

Each one has their own ambition to achieve their financial dreams. One wants to make 2 percent of their investment while another wants to make 20 percent of the total money. The money gets transferred from the hands of weak trader with less money investment to the hands of strong trader who has the buying power counting to ten times than an average trader.

Is stock trading gambling?

No, definitely not!

If you read the financial news and knew what is resistance level, support level and volume, you aren’t gambling. That’s all you need to know with stock trading. However there are numerous methods of technical analysis out there but these three are the basics (Resistance, Support and volume).

You might have learnt a 1000 times probably what is a resistance, support and volume. There is no technical software that can rightly predict the buy and sell signal, if it had then the software coders would have become the richest people by now. But the probability of success would be 70 percent and if you have traded only 30 percent of the calls generated by the technical software, then you will end with losses. We want financial freedom in 5 years from now; we want our investment to grow every year.

What you must know is how to make money work for you? Make money with ease, that happens when you understand psychology and develop money management skills. Have a budget and spend effectively on things that you require. Make recurring income with stocks and only way is to read more and pick the right stocks at the right time.

A decision to buy or sell can cost you a lot of money; you will find how to be in the safer side. Learn about the myths of long term investing and when to cash out your money.

Understand about the saving and how to keep your accounts active avoiding debts. If you don’t have debts, it’s a blessing and you don’t need to be answerable to the authorities of the bank. Understand the popular saving tricks and when to save your money and how! Savings can really help you for a rainy day, what if you make 30000$ in a year but end of the year you are empty and asking your friends for help.

Investing for long term would make you feel secure. How to do savings hassle free and maintain a balanced portfolio?

How much do I earn after reading this book?

It depends on how quick you learn and take efforts. Someone can run 2 miles a day and another person who is starting would run only 0.5 mile, so it depends. Understand the basics of trading, investing, saving and spending.

Imagine you make 60k$ and never had the feeling of spending your money effectively. Spending your money wisely is another chapter in this book. Learn to save money than from burning it on fire for things that you don’t require. Investing in yourself is the best investment that you can make. It’s improving your wisdom by challenging yourself, learning new things, doing it hard way and learning from mistakes. The goal to achieve anything you want is within your mind. The way you believe at things gives you richness.

Money Management

Are you a trader or Investor?

Are you stock bull or a stock bear?

Do you sell stocks mostly or buy stocks mostly?

Don’t worry about the market trends, you can be a bull or bear relative to the market direction.

Learn how to find opportunities with trading every day; never have a rigid plan to make money. Divide your total money into parts which is the old school method to save money for the future. If you have a static idea to keep buying the stocks, you will miss the best shorting opportunities or if you keep on shorting stocks, you will miss the investment opportunities.

The initial step is to get money month after month with less effort. The best known ways are to invest in dividend paying stocks, renting your apartment, starting an online business and first of all to reduce debts from your life. If you have more debts then no matter how much you earn it goes for paying debts.

Make long term investment for 15 years to 20 years, this would be your backup plan in times of emergency. It’s available under different names for several countries.

Australia's superannuation system

Belgium's pensioensparen

Brazil's and Portugal's Fundo de pensão

Canada's Registered Retirement Savings Plan

France's special retirement plan

Germany Betriebliche Altersversorgung

India's Public Provident Fund

Malaysia's Kumpulan Wang Simpanan Pekerja

Mexico's Retirement Funds Administrators

New Zealand's KiwiSaver system

Philippines Social Security System

Singapore's Central Provident Fund

South Africa's Government Employees' Pension Fund and the Financial Services Board

Spain Plan de pensiones

The United Kingdom's pension provision and individual savings account

United States’ 401(k) system

I always recommend my friends and stock traders to have a backup plan…first you need to save then you must start investing…

Many people argue that the amount you get after 20 years wouldn’t be enough as the inflation would be increased higher than it is now. But have a systematic approach to investing for emergency needs and attain your financial goal. This is the base for all other investments that you make. We don’t know about the future but we are trying our best to save for future.

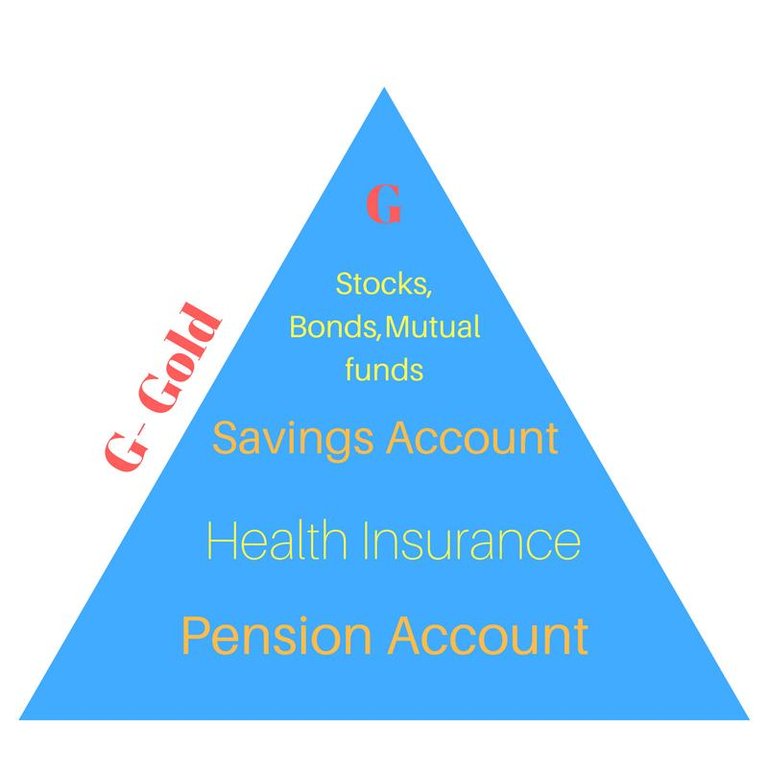

So the base for your triangle of investments would be the Pension account (Long term saving account never touch it for 15 years),

Next is your Health insurance which is compulsory for every individual.

Savings account in your nearby area (Three years or more).

How to start?

If you are a trader and you wanted to earn money from the markets. Then you must be familiar with the fundamental and technical analysis. Just the basics is enough, there are numerous ways by which you can analyze the market. Depending on the country, the habits of the traders differ but the price, volume and time are the best indicators. Any new market indicator is made from the existing price, time or volume.

The eastern countries are familiar with the candlestick patterns and Ichimoku cloud trading, while the western countries make their trade based on news using line chart. Whatever the system one follows, there should be discipline with the trading. Every trader makes bad trades once in a while, never change your stock trading strategy instead pick the right trades intuitively. Yes, trading involves intuition which is chart reading and it’s called common sense. There is no mechanical trading system that can read the chart patterns for you. The idea is to get practiced with the patterns, if you go to the gym your muscles get healthier and just like that if you keep watching stock patterns, your intuition gets improved. It’s by practice; you get wisdom and make the right decision.

In stock market, if you are an investor you should know the latest news and fundamentals of the stock. While if you are an aspiring trader, then you must develop the art of chart reading and keep yourself up to date with the latest happenings in the stock market. There are numerous stock trading techniques and this book is about just four of the major techniques used by many traders. Your ultimate goal is not to get rich overnight but to gain confidence in trading and become financially independent as you travel your journey of life.

For becoming a doctor or engineer, you must study for 4 to 8 years of regular study. But for stock market, most traders are taught in only one month. How can one teach his/her decades of experience in one day? They keep on losing their money and keep changing the trading systems. There is no fancy trading system out there which can make you rich overnight, if it does then why does someone want to sell it to you. I do agree in trading seminars where you can learn something new but I never recommend trading systems which gives instant BUY or SELL signals.

A lot of traders are scammed by fake trading systems, making them ignorant. Some trading systems work because majority of traders are following it. Google Finance along with your stock broker terminal is more than enough to make amazing trades and no need for fancy trading systems. Google is an extra-ordinary resource for traders.

Fund management is a great subject for the traders to learn. Many traders put the profit money again in trading and lose it. Never be greedy with the trades, stock market is not a lottery ticket. Speculation is a bad habit and never to rush to buy a stock. Trading in stocks is a business and you must be serious just like real business. Always take calculated risks, save money for the next day. Set daily targets and never over-trade because it’s not healthy to a trader. Many of them suffer from stress because they get greedy.

Be greedy with the news; make it a habit to read more. It gives you more wisdom; many institutional investors read a lot before making a decision. Have a mind map of the trading day ahead; you will have to make trades only at particular time intervals. As you know, markets goes through bull phase, consolidation phase and bear phase. If you trade when others aren’t trading, you would get caught in the consolidation phase. BUY when others are buying, SELL when others are selling. Look at the volume to make good trades, never put your money in stocks that have below average volume.

Most active scripts by volume

In the world of stock trading, the money moves from the hands of dumb trader to smart trader. A smart trader has complete control of what he/she is doing. He or she is confident to take any trade and confident enough to take stop-loss. When you are in doubt, don’t trade in confusion. Why to find the most active scripts by volume? It is because in trading, you must be with the side that is winning. Volume decides the sentiment of the stock, either buying power or selling power. It is good to trade with the stocks that have good volume, we see many traders trying to put their money in stocks that never move a cent. If you change your approach to trade in the stocks with high volume, then you can certainly make successful trades.

As a trader you must gain confidence with your picks. You will have to be intuitive to tell whether the stock would go down or up. Never short a stock that is above the open and Never sell the stock when is below the open price. We see many traders, randomly short-selling and buy stocks for day trading, if you don’t plan your trades, you will regret later. Buying or selling with high volume stock gives you a lot of opportunity to make money. There are some stocks bought or sold by big market players. If you go against them, you will be at loss for sure. Keep looking for the top volume gainer stocks.

Open high low close analysis

This is one of the easiest methods to find the best stocks for day trading. I recommend to all the traders, because of its simplicity. The idea to find the stocks having open values same as low price, in this scenario which is a strong buy. However you must look at the volumes for day trading.

Open = low (buy)

The reverse condition where the open price is equal to high price will be a strong sell.

Open = high (sell)

You must know to learn about the support and resistance, the day’s high is the resistance and day’s low is the support. But this trading setup works only for the first 45 minutes, after that it’s not worth buying or selling the stock. If the LTP is close to the high price and there is a chance for shorting the stock. You must also look at the chart pattern to decide the trade.

Using Open interest analysis

Change in open interest percentage min and max (10 to 30), which gives you the best stocks to trade for intraday. Open interest can actually be used for making best trades. It can act as the trend decider and give the real meaning for the bulls and bear. Lot of stock analysts recommends this method to choose stocks wisely for day trading.

You had found the stock which has high volumes and you are in the confusion to short-sell or buy, how will you come to a conclusion? The only way to find it is the open interest change percentage. When the price increases with the increase in open interest, then you can buy the stock. When the price decreases with the decrease in the open interest percentage, then it’s a strong bear. We will look out for stocks that have strong bull or strong bear. These are the stocks which you want to target and put your cash, other stocks have less chances.

It is good if you find the open interest real time scanner or open high low finder. Scanning tool gives plenty of trading opportunities. Imagine you have scanner showing stocks that make high or low in day trading. If you have checked the stocks along with the strong bull condition and when the stock makes a high price, you can definitely go for buy.

Strong bull + high price after first hour = BUY for the day

Strong sell + low price after first hour = SELL for the day

Another quick method would be using JSTOCK to scan stocks that have made 7 percent or above in the past two days. The bulls have hold on the stock and there would be very less bears. Once when it moves below the open price and turns negative, the bulls would feel tensed and want to close their position. You can get trades like this every day and you must start to use JSTOCK for scanning purpose.

In stock market, trading psychology works better than levels. Levels are just numbers and when you short-sell a stock below the support, it means that below the support level there would be no buyers. This is one of the best methods to make 3 percent easily. Trading depends on crowd behavior and levels are psychological while you are trading.

Look out for the stocks that are top 5 gainers and look out for the stocks that are top 5 losers, there is a reason behind the stock to gain or fall. Identify the emotions which could be greed or fear behind every trade. If you can read the chart patterns, you are sure to make a lot of money.

Add the stock analyst picks also before starting your day trading, it may work or may not but you get the volumes from the stock. Lot of stock analyst picks which they show in TV doesn’t have the success ratio. One stock analyst was proud to say that the performance of his calls made around 34 percent last year. But if you have reversed the trades, you might have got 66 percent success.

What I recommend is to add all the stocks in your radar

- High volume stocks

- Stock analyst picks

- Open interest percent ( High/Low)

- JSTOCK scanner stock list which made 7 percent or above in the past two consecutive days

- Last hour gainers/ Last hour losers

During the day, I look out for stocks where the total buyers are greater than the total sellers. The chart pattern is bearish/downtrend

Andrew pitchfork downtrend + (total sellers > two times the total buyers) = SHORT-SELL

Andrew pitchfork uptrend + (total buyers > total sellers) = BUY

Time frames in Day trading

When you want to trade in the stock market, you must know the markets will have traders who have their own rules. It would have sellers and buyers trying to take opportunity. It is vital to keep the time-frames in your mind and trade accordingly. The usual time-frames to watch out for would be 10 am to 11 am (After one hour of market open). From 11.30am to 12.30 pm, after you have made the first trade and after 1pm to 2.30 pm.

In day trading, I never hold the positions for more than 90 minutes. When the market opens high, it would be up for one hour or more and the bulls wanted to sell right? So the market would come down from 11 am to 12.30 and again bulls would love to purchase more, this is a cycle here.

Align your trade with the world markets, considering the prices of Gold and crude oil. When the crude oil drops, you can see the oil companies benefiting and when the USD drops, there is loss for the export companies. You have to make a mind map of the market ahead. To be ahead with the markets, you must find time to read more news daily. We may not succeed if we don’t know the real path ahead. In day trading, never open too much trades that you can’t handle, always open two to three trades and it’s more than enough.

Print the index chart and read the chart along with different timeframes. I do it every day and that’s the way to read charts. You are seeing a pattern and there is a psychology behind it.Once you identify the stock patterns, you can be sure to succeed. You must read and trade daily to be a successful trader. Many don’t read the news in the market; it would take two hours of your time daily.

Set your monthly target and yearly target that you want to make from the stock markets. Once you achieved your monthly targets, just sit back and relax. When you achieved your yearly target, then you can enjoy vacation with your family. Never over trade with your money or you could be at loss, soon or later.so you need to take one trade (10 am to 11 am) mostly bullish stocks, second trade during (11.30 am to 12.30 pm) and the final trade at (1.30 to 3 pm). This is simple as steps 1, 2 and 3.

News+Levels+ Chart reading

How does the stock market work? There would be small traders, big traders, institutional traders etc., everyone wants to make profit from the stock market during that day or maybe they hold position for two or three days. You have to look for valid news about the stock. Suppose there is positive news about Information Technology sector, then you can see all the tech stocks moving higher. The positive news would be the possibility of acquisition of another company that would benefit in the long term. This might create buzz among the traders and you must have the levels in your hand to make the right decision of picking stocks.

The easiest way to find the buy and sell values would be to enter the yesterday’s close price in the square of nine calculators. This is one of the best methods used by many successful traders. You can make trade with simple 5 day moving average, which is very easy and works 70 percent of the time. There is no confusion to look for the fundamentals of the stock for example like the book value or earnings per share. Some like to be traders while others like to be investors, it depends on how much they learn from the markets.

When there is insider news about a stock, the bulls wanted to make some money out of it. They rush to buy the stock and there is greediness to make more money. Be it intraday or positional trading, every stock makes a stock pattern and it’s called bullish pattern. While the stock makes the bullish patterns which are fueled by the small traders and keep adding. When the last bull sells the stock, the bear takes control of the stock and they keep selling without any stock in their hand.

45 degree works all the time

This is the easiest method to find the bullish or bearish stocks and it works on all charts. But you should be able to spot the early winners and gainers.

After one hour of market open, look out for stocks that are 45 degrees. Chart pattern works all the time and when you practice daily, you will find the right one. We want to buy or short-sell the stocks and you must concentrate the stock with huge volume.

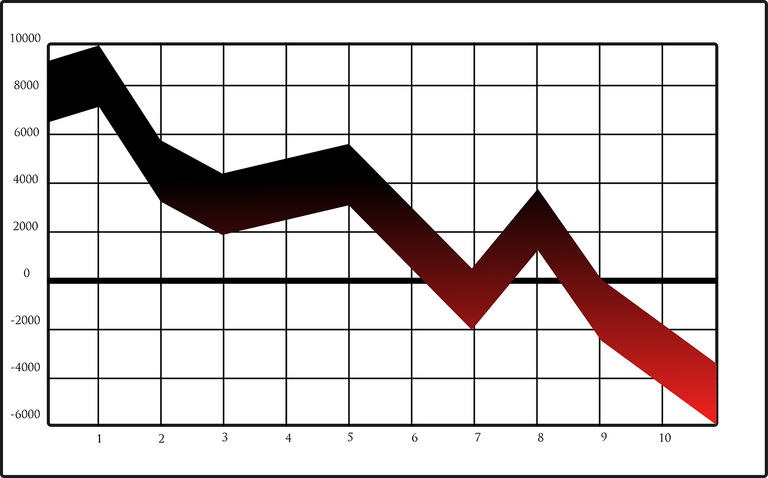

You can see from above chart, if you have purchased around 10 am and hold till end of the day, you would have made 2 to 3 percent. The same works for the stocks that trend down. So that's all for this first post, I will post very catchy informative post on Steemit soon. If you like, please up vote. Thanks

Great article!

"Imagine you make 60k$ and never had the feeling of spending your money effectively. Spending your money wisely is another chapter in this book."--

@ashok22 What's the name of your book?

Hi Lexikon, thanks for the response..you spotted right. I am coming up with a blog or book soon about how to spend and get the best of it. But for now, the blueprint is to invest in 401k, then insurance, fixed deposits and then cryptocurrency, stocks and mutual funds.. Good luck lexikon :)