We are hardly half way through 2018, and there is already a slew of articles stating that the markets are going to crash in 2018. What is amusing is that these very same individuals have been making the same prediction for nigh on ten years. You would think that by now they would have had some sense knocked into them; especially since they have taken such a massive drubbing. No such luck, the same experts keep mouthing the same nonsense hoping desperately for a new outcome.

Has anything changed since the last time we penned an article on this subject?

Well, yes, things change on a daily basis, but the underlying trend is still up, and overall sentiment is far from Euphoric. On a technical basis, the markets are extremely overbought and begging for a reason to let out some steam. However, just because they are overbought does not mean they have to pull back. Markets can remain irrational far longer than most traders can remain solvent.

In such a market, one needs to adopt a two-pronged strategy:

Only invest in strong companies that are trading in the oversold ranges.

Secondly, divide your money into two lots and deploy one lot at a time. As the markets are overbought you still have a good chance of establishing a second position at a better price.

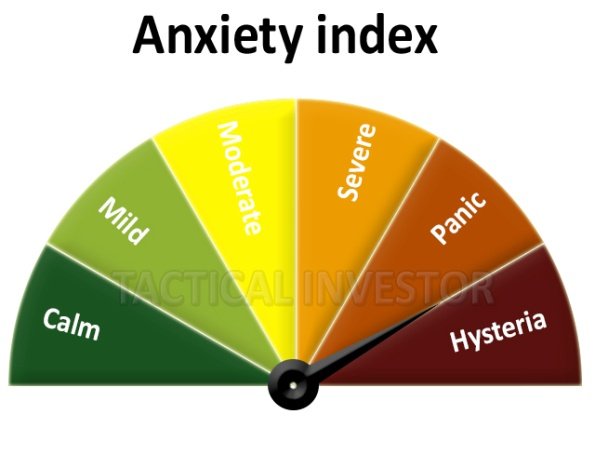

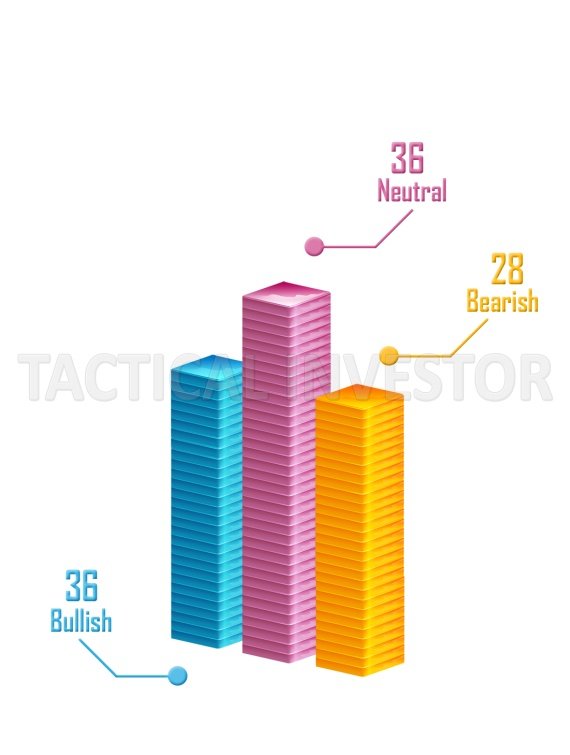

The masses are slightly bullish but sentiment readings indicate that they are not Euphoric

In the last article we made the following comments:

Ask a madman how he is, and he might respond by telling you that “ the road needs to be fixed”. The answer has nothing to do with your question and on the surface has no pattern whatsoever, but if you turned around and looked at the road, maybe you would notice that it is in need of repairs. All you had to do was alter the angle of observance, and in doing so, you spotted something that most would have missed.

Well, nothing has changed since then. This Bull Market is unlike any other market and those that don’t understand the basic concepts of Mass psychology will continue to be left in the dust. Until the mass embraces this market with a passion, the market is unlikely to crash.

The Technical outlook

Without a doubt the markets are overbought, but as we stated before overbought does not mean it's going to crash. A simple rule of thumb; buy when the masses panic, sell when they are euphoric and when they are in between use pullbacks to add to your positions.

A crash at this point in time is highly unlikely, though a sharp pullback (currently in the process) can’t be ruled out. As the trend is up all strong pullbacks have to be viewed through a bullish lens.

Congratulations @sol42! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP