Hello Investors!

Commodities will be one of the last bubbles, and its time to consider getting in on the action. Currently, the crypto's are working its way through a bubble (mature?). In addition, the stock market has just started its' melt-up parabolic phase in it's bubble. This has created a basing pattern in commodities. When the stock market bursts (and it will), commodities will start their own bubble phase.

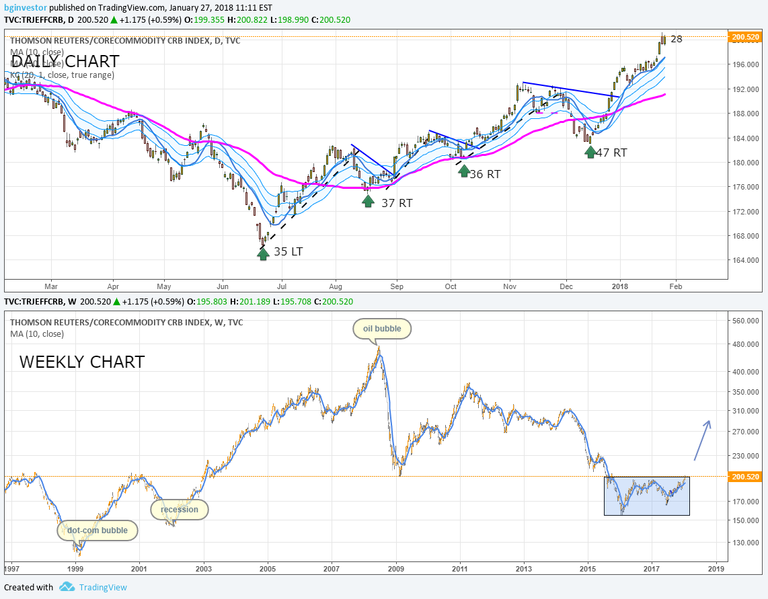

See the CRB chart for the basing pattern on the weekly chart. The CRB is a basket of commodities. The daily chart shows several right translated cycles.

Consider commodities in your portfolio's. I'm 20% commodities (and might consider higher) in my 401k. I bought gold/silver last month the day after the FOMC meeting and doing very well. The intermediate cycle has not topped yet.

If this blog post has entertained or helped you profit, please follow and up vote me. thx.

Note: I am not a financial advisor in any shape or form. The contents in any of my posts are merely opinion alone. I'm simply stating opinions

I have been writing here about commodities for a while. Last time I peeled the onion, I see that base metals have already started the big move; energy following now; precious metals holding ground and agricutlure lagging seriously.

I am especially interested in seeing how your expereince get applied across this segment. I saw the cocoa charts - nice pop coming.

The most recent post looking at all commodities is at http://mymark.mx/TIB166

Hi Carrinm, thanks for posting.

Yup, in general, agree with ur observations.

Still new to STEEMIT, so I haven't posted all my current trades that I entered back in December. My GOLD/SILVER positions are doing quite well; however, they may be under pressure due to the expected DCL in the dollar soon..

Come back, I'm planning to post some real time trades as we go.. Also, I need to make a video to explain my strategy using (Gann type) cycle analysis for swing and position trading.

Good investing.

I force myself to write up the trades as they happen. Every day I make a trade I post. I try to teach while I do it.

Every now and then I step back and write up the method in a post or a specific background post. 178 posts time $3 to $30 per post times the rise in STEEM price gives another portfolio position every now and then.

thumbs up